3 FINTECH NEWS STORIES

#1: Proptech Platypuses

What happened?

An interesting proptech platform raised a seed round:

Roam, the platform for purchasing a home with an assumable low-rate mortgage included, today announced it secured a $1.25 million seed round and has officially launched its service. Roam helps buyers purchase a home with a mortgage as low as 2%, resulting in a monthly payment that is less than half of a traditional mortgage at today’s current rates.

Keith Rabois at Founders Fund led the seed round with additional investment from Eric Wu (Opendoor co-founder), Ryan Johnson (Culdesac CEO), and #ANGELS Founding Partner Jana Messerschmidt. The company welcomes Tim Mayopoulos, former CEO of Fannie Mae, as a senior advisor.

So what?

My favorite thing about the mortgage market is these extraordinarily specific products, which get built to optimize whatever the current rate environment is.

They usually don’t make much sense outside of that environment, which is what makes them so interesting to study.

It’s like, what if I told you there was an aquatic mammal that eats worms and crustaceans found at the bottom of rivers and streams, but it hunts for that food while keeping its eyes, ears, and nose firmly closed at all times?

You probably wouldn’t believe such an animal exists … until I told you that it’s the platypus and that it hunts by using its duckbill snout to detect electric fields as its prey moves around.

You’d reply, “Ohh, it’s an animal from Australia … well then, yeah, I totally believe it exists.”

In this case, what if I told you that I was building a platform to help aspiring homebuyers shop from an extremely small pool of homes (those for sale by homeowners with low-rate FHA or VA mortgages) that come packaged with that home’s existing mortgage and that carry a 1% closing cost fee and that require the buyer to pay the entirety of the owner’s equity in the home, which could be so significant (if the mortgage is almost paid off and/or if the home’s value has meaningfully appreciated) that the buyer needs to take out a second mortgage?

You probably would think I’d lost my mind … until I told you that I was building this platform in 2023.

Then you’d say, “Ohh, it’s a proptech solution for a 7%+ mortgage interest rate environment … well then, yeah, I guess that makes sense.”

#2: Tectonic Shifts in the Small Business Banking Landscape

What happened?

Some exciting stuff!

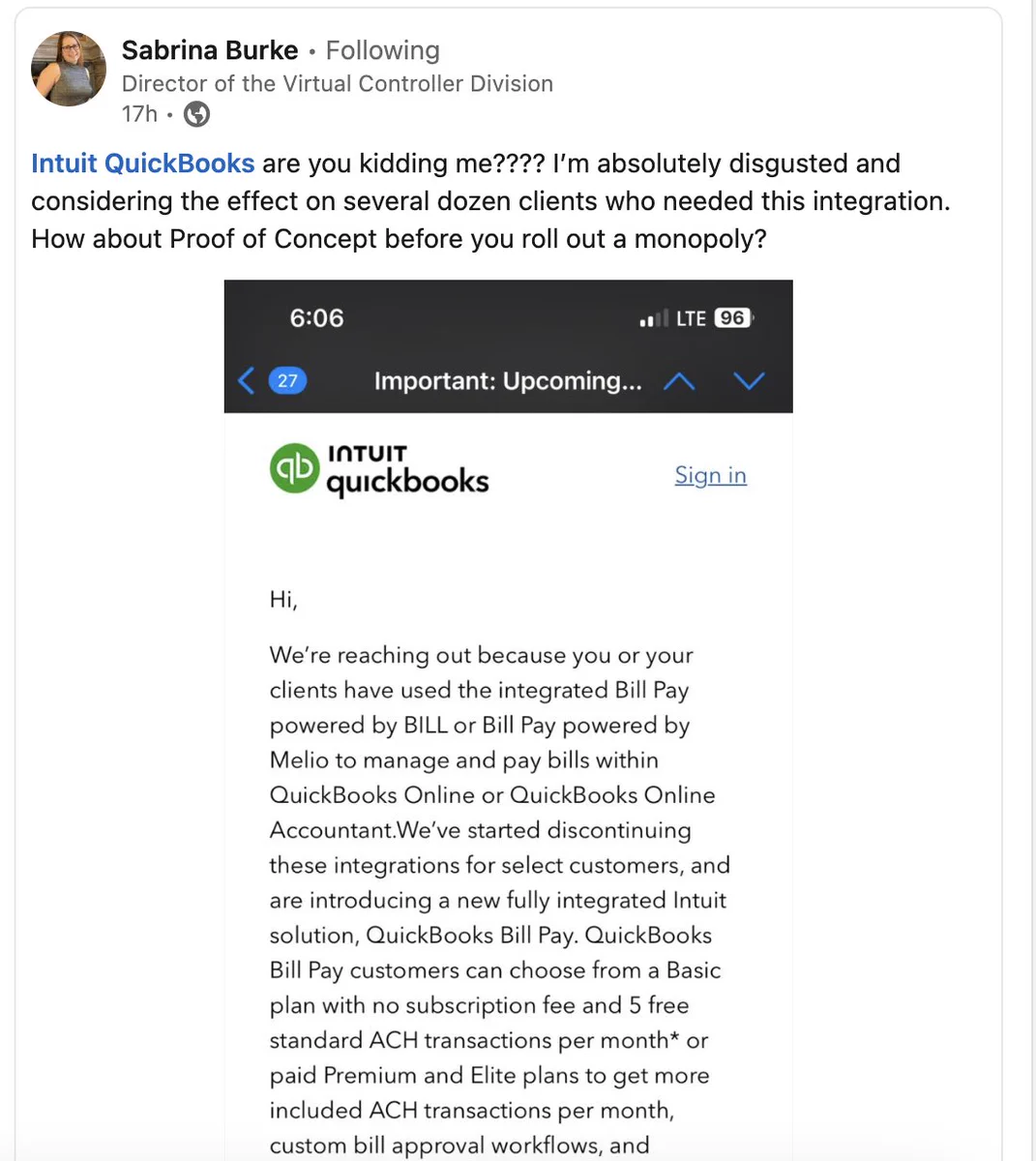

First, it appears that Intuit is building its own bill payment capability for Quickbooks and has preemptively decided to shut down the integrations to its existing partner capabilities (Bill and Melio):

Intuit also introduced a free, entry-level version of its small business banking product:

Intuit … today unveiled QuickBooks Money, a new all-in-one payments and banking solution with no monthly fees or minimum balance requirements that gives small businesses complete control of their money from anywhere.

And finally, JPMorgan Chase is adding payroll capabilities through a partnership with Gusto:

Join Fintech Takes, Your One-Stop-Shop for Navigating the Fintech Universe.

Over 36,000 professionals get free emails every Monday & Thursday with highly-informed, easy-to-read analysis & insights.

No spam. Unsubscribe any time.

JPMorgan Chase is stepping up its appeal to small business customers by planning to offer digital payroll processing, CNBC has learned.

The bank has picked San Francisco-based fintech player Gusto to provide the underlying technology for the feature, according to Gusto CEO Josh Reeves.

So what?

Phew! Big week for small businesses!

Here are a few thoughts:

- My overall takeaway from all of this news is that scale really matters in small business banking. Quickbooks, which probably has the most market and mindshare among small businesses generally, clearly isn’t afraid to piss off some customers by cutting out its bill payment partners and essentially forcing customers to use its own solution instead. This really speaks to the market power that Intuit has (and isn’t afraid to wield) in the small business space. And JPMorgan Chase, you may be surprised to learn, has a cool 5 million small business customers and more than 200,000 users of its payment solutions. Not too shabby!

- From what I can tell, Quickbooks Money looks like a fairly competitive small business banking product, and this new subscription-free option could do well when combined with Quickbooks’ existing reach.

- I’m impressed that Gusto landed JPMC as a partner. Chase buys fintech companies. It doesn’t often partner with them. Making it through that due diligence process is a feather in Gusto’s cap.

- This is yet more evidence (to me, at least) that the fintech company that Jamie Dimon most admires/finds annoying is Square (the CNBC article mentions PayPal, but PayPal doesn’t offer payroll services to merchants).

- We talk a lot about rebundling in the consumer banking space, but it might be an even more relevant trend in the small business banking space. Small business owners are some of the busiest and most stressed people that you can find. They don’t have time to cut the cord and manage a bunch of streaming apps. They want to pay for cable.

#3: Worth a Little Patience

What happened?

A new neobank emerged from stealth:

Founded in October of 2021, Alza is a startup aimed at helping meet the various banking needs of Latin or Central Americans who have moved to the U.S. Launching publicly today, Alza has spent the past two years building its products, securing partnerships and developing compliant infrastructure.

With Alza, users get an FDIC-insured checking account and debit card. But that’s not really unique. What makes Alza stand out, claims [Arturo] Villanueva [Alza founder and CEO], is that users also get the ability to send cross-border remittances to more than 20 countries in Latin or Central America embedded in its app via three methods, depending on the recipient country: bank transfer, cash pick-up or transfer to a debit card.

So what?

As I’ve written about repeatedly, I’m a big fan of neobanks built to serve specific, underserved customer segments. Especially when the founding team and early employees are members of (or close to) those segments (as is the case with Alza).

Seemingly small problems, like the likelihood of someone with a Latin American name being denied a bank account based on a false positive caused by a bank’s aggressive fuzzy matching against the OFAC list, are actually not small at all if you are the one encountering them.

Niche neobanks are built to solve the thousands of “small” problems that traditional banks don’t have the time, interest, or lived experience to solve for specific customer segments. That’s why I love the concept.

I do worry, as I wrote about a while back, that niche neobanks aren’t super compatible with the expectations and investment patterns of most VC firms. I’m hoping that Alza, which was funded by Thrive Capital back in the salad days of 2021, doesn’t suffer from this mismatch in expectations.

The size and importance of the problem it is trying to solve are certainly worth a little patience.

2 FINTECH CONTENT RECOMMENDATIONS

#1: Solid Faked Revenue Numbers, Special Committee Appointed To Investigate, Sources Reveal (by Jason Mikula, Fintech Business weekly)

Another BaaS scoop from Jason. Perhaps the craziest one yet.

There’s way too much in here for me to even write a decent summary, so just read the full article, please.

One thing I will say – the list in this article of fintech companies (past and present) that indicated that they used Solid for BaaS looks like it was lifted straight out of a bank regulator’s worst nightmare. My god in heaven.

#2: 6 Thoughts on “Elon Musk” by Walter Isaacson (by Trung Phan, SatPost)

I’d love to read Walter Isaacson’s new book on Elon Musk, but, realistically speaking, there’s just no way that I’m going to have time.

Trung provides an excellent book report on the subject.

1 QUESTION TO PONDER

What fintech questions do you have for me?

My next Fintech Office Hours event is happening next week (9/27), and I’d love to spend as much of the 30 minutes answering your questions as possible. So please submit a question (or questions) in advance!