#1: The Three-Body Problem

What happened?

Ramp launched some new capabilities:

As Ramp has continued to move more up market, it has worked to expand its product suite. In response to the needs of Shopify and other large companies, for example, Glyman said Ramp created an additional tier to its flagship product offering, with new capabilities designed for “businesses with complex financial needs.” That new tier is called Ramp Plus.

It is also now offering a new and automated “procure-to-pay solution” within Ramp Plus with the goal of giving large enterprises “a viable alternative to incumbents like Amex, Concur and Coupa.”

And so did Brex:

Brex today revealed Payables, its AI-enabled Accounts Payable (AP) offering

Prior to this launch, [Henrique] Dubugras said that Brex offered a lighter version of bill pay that gave customers the ability to send scheduled and recurring payments. Now, he said they will “have even more advanced spend controls with multi-level approvals.”

And so did Rho:

Rho said it is offering AI-powered invoice and bill processing to its clients. Specifically, invoices sent to a designated AP inbox will “undergo automatic digitization” powered by generative AI technology.

In a statement, the company said the process “transforms the invoice into a bill and creates a corresponding liability in the client’s integrated ERP system. Clients can then authorize bill payments through Rho one by one or in bulk, with liabilities automatically marked as paid in the ERP.”

So what?

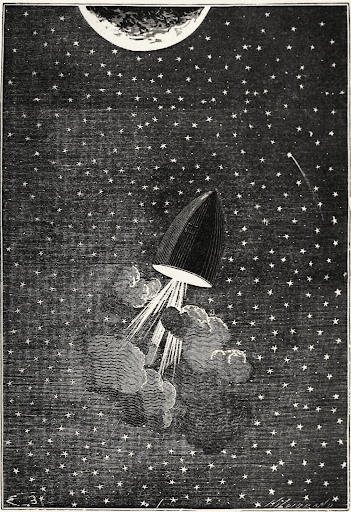

In physics, the three-body problem is the problem of taking the initial positions and velocities of three different bodies and solving for their subsequent motion according to Newton’s laws of motion and gravity.

The basic idea is that when you have three bodies, all acting under their own momentum and simultaneously exerting force on each other, it becomes extremely difficult to predict precisely how each body is going to move. There are just too many variables.

Two-body systems are predictable. Three-body systems are chaos.

This reminds me of the corporate spend management space.

We had a fairly predictable two-body system – Ramp and Brex, both focused on providing corporate cards and (later) expense management to high-growth businesses.

Then Rho, which had started out on the business banking side, jumped into the fray, adding accounts payable functionality, a corporate card, and expense management software. Brex added a business banking product. Ramp and Brex both got into travel. Everybody is doing AI.

And now here we are – with three companies, all extremely well-funded and fast-moving, dynamically swirling around each other.

Join Fintech Takes, Your One-Stop-Shop for Navigating the Fintech Universe.

Over 36,000 professionals get free emails every Monday & Thursday with highly-informed, easy-to-read analysis & insights.

No spam. Unsubscribe any time.

Broadly speaking, we know what’s going to happen in this space. These companies are all going to keep upping the product ante in an attempt to best serve corporate finance teams.

More specifically though, I have no idea what’s going to happen next. Will Ramp get into business banking? Will Brex chase Ramp up market? Will Rho get into travel?

Who knows? It’s chaos!

#2: A New Easy Button

What happened?

Knot, a fintech infrastructure company, raised a Series A:

Knot API, a startup that aims to help fintechs and banks maintain deposits, raised $10 million in Series A funding led by Nava Ventures

Selling to banks and fintechs, Knot’s main product allows customers at those institutions to switch payment methods at merchants like Netflix and Amazon to a new card, all in one go, within the bank’s app.

So what?

I am (through Workweek Capital) a small investor in Knot, so, full disclosure, I am biased. I think Rory and the team at Knot are great and are already far along in executing against a compelling product roadmap.

But allow me to share a bit of my thinking on the problem that they are attacking …

In my past analysis, I have often compared financial services to healthcare. The parallels (the importance of outcomes, the impact of small behavioral changes, the moral responsibilities of providers, etc.) are irresistible.

However, one area in which financial services and healthcare are different is easy buttons.

In healthcare, there aren’t a lot of easy buttons. There is pain relief, but beyond that, if you are looking for better long-term outcomes, you need to put the work in. You can’t deputize an app to eat healthier for you or go to the gym in your place.

In financial services, there are a lot of tasks that are just annoying enough that most folks don’t ever get around to them – moving deposits to the highest-yield accounts, rolling over old 401Ks, updating cards on file, etc.

But unlike your physical health, you can deputize an app to take care of these tasks for you.

We can build easy buttons!

Knot is an important part of a larger trend in financial services (automated account switching) that will lead to better outcomes for consumers.

#3: Start with Happiness

What happened?

A new personal financial management app!

Allo, a new financial app that can be described as Headspace for personal finance, is aiming to help users meaningfully engage with their finances without becoming overwhelmed with numbers and spending. The idea behind Allo is to help users create a mindful money practice that allows them to approach their earnings, spending, saving, investing and giving with a sense of fulfillment.

So what?

As I wrote about a few years ago, the key flaw in most PFM apps and other tools that attempt to provide financial advice is that they don’t have any context for what makes a user happy. And it is impossible to provide useful financial advice without an understanding of what makes someone happy.

Is your daily Starbucks order an unnecessary drain on some larger goal (like a vacation) or an essential component of a joyful day? Without first gathering input from the user on how their daily Starbucks order makes them feel, there is no way to know.

Allo seems to understand this:

the app focuses on two things when encouraging you to be aware of your transactions. First, the app will encourage you to look at the things you appreciate. You can reflect on the transactions that made you happy, such as the money you spent on your family or well-being.

Next, the app will encourage you to reflect on the transactions that you don’t feel great about and may want to follow up on. For instance, you may see a transaction for a subscription that you intended on canceling beforehand and make a note to do so. Or, you may come across a transaction where you spent a lot of money going out, and don’t see it as a good use of your earnings.

This is great! I’m delighted to see someone building this!

A couple of other things I like:

- The app is specifically designed to be used sparingly. It wants you to check in periodically and reflect and then get back to living your life. Yes!

- Allo makes money by charging customers a $6.99 per month subscription fee. I love a straightforward business model with no weird incentives!

- Allo is self-funded and has no plans to raise outside capital. How strange. How marvelous and strange.

2 FINTECH CONTENT RECOMMENDATIONS

#1: How the Recession Doomers Got the U.S. Economy So Wrong (by Derek Thompson, The Atlantic)

Every economic expert predicted that we were headed for a recession. That hasn’t happened (at least, not yet), and the overall economy is doing extraordinarily well right now.

Why? And how did all the experts get it so wrong? And what can we learn from their mistakes?

This is the most useful article I’ve read for trying to answer those questions.

#2: AI and the Structure of Reasoning (by Jerry Neumann, Reaction Wheel)

This one is a super nerdy deep dive, so don’t bite it off until you have sufficient time and are in the right headspace, but this is an incredible explainer on the evolution of AI and the limitations of generative AI when compared to general human intelligence.

1 QUESTION TO PONDER

I’m going to be giving a couple of keynote presentations next month on the most important trends in fintech.

My audience is going to be, for the most part, bank and credit union executives.

What fintech trends and ideas should I highlight in my presentation?