Today we’re diving back into the world of vertical integration since it’s such a dominant and fascinating strategy amongst the incumbent empires of healthcare. If you enjoy this post, join 20,000 others and subscribe to Hospitalogy here.

Checking in on Vertical Integration: Where are we halfway through 2023?

At the start of 2023, I noted (rather obviously) that vertical integration would be a key area to watch throughout the year and beyond. For payors, the strategy is a no brainer and it’s why we’ve seen UnitedHealth Group triple down on Optum while observing CVS, Humana, and payors even at more local and regional levels set up a payvidor structure. My assertion is that at the right level of scale, with the right assets and market density, the payvidor model is a can’t-lose strategy.

To that end, we’ve seen a number of deals and strategies form around vertical integration in 2023 – not only among payors (Optum <> Amedisys; Humana <> CenterWell; CVS <> Oak Street Health) but also among health systems (Kaiser/Geisinger <> Risant) and even drug distributors (AmerisourceBergen <> OneOncology).

It’s a trend that will continue until someone forces it to stop.

The Vertical Integration Playbook.

When thinking about vertical integration, how exactly does someone like Optum get ahead and generate competitive advantages? What’s the financial component driving the incentive here?

At the end of the day, it’s all about leveraging your scaled assets to lock in margins. Using UnitedHealth Group as a marquee example here, there’s a ying and yang between healthcare services (Optum) and medical spend / medical loss ratios (UnitedHealthcare). But combine these segments into one company, and you create something different entirely.

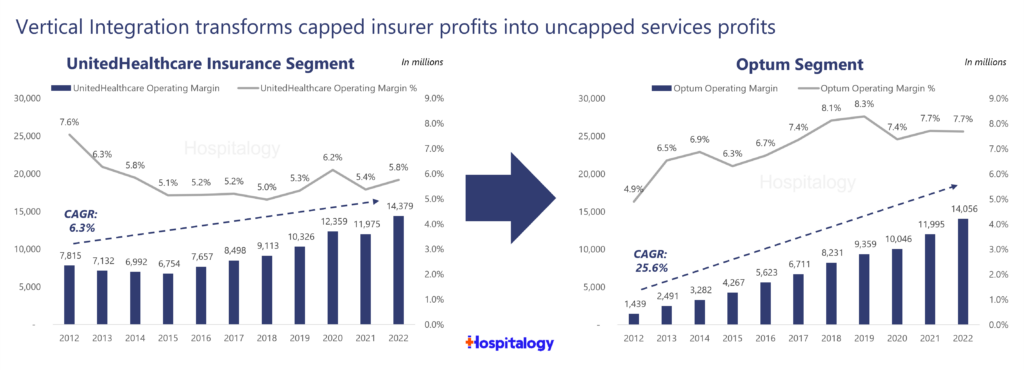

Services unlock profits for insurers. Quarter over quarter, you can see the movement of profit and cash flow to Optum – whose profits are uncapped and unregulated – when compared to UnitedHealthcare – whose profits are capped and regulated under its health insurance segment. It’s an unstoppable machine and an incredible business. And that’s the vertical integration game: the ability to lock in margin on a core business segment, whether that’s a PBM, drug margin, medical loss ratio, or anything in between. Accountants be working overtime.

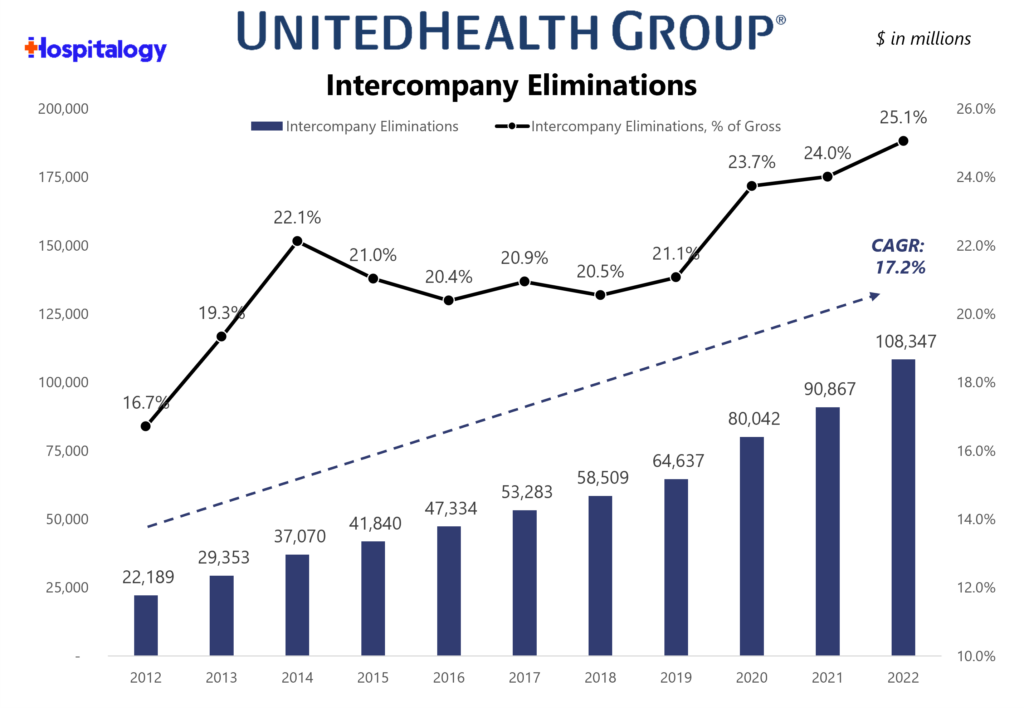

Through intercompany eliminations between UnitedHealthcare (Insurance Co) and Optum (Service Co), UnitedHealth Group’s organizational structure and long-term bet on Optum drives growth in the bottom line for the broader organization.

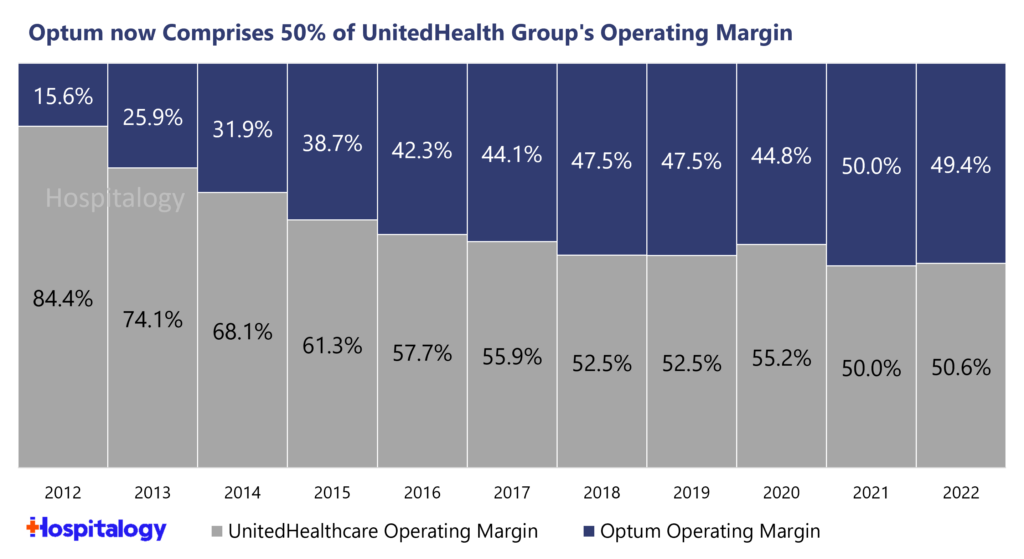

For UnitedHealth Group, the hyper-focus on Optum as its future growth engine has been working like a charm. In fact, Optum now comprises 50% of UNH’s total operating margin, up from a mere 15.6% 10 years ago:

The Imitation Game

Given Optum’s massive success over the past decade, growth in Medicare Advantage lives, CMS policy pushing healthcare toward accountable care, and increasing sophistication of value-based care arrangements, copycats have finally emerged.

As a CVS or Humana, seeing business results like these and doing nothing would be akin to witnessing your favorite college football program getting steamrolled by Alabama year in and year out and not trying to copy their best practices. Their training sessions, the players they recruit, the coaching scheme, etc.. No – these payors are catching up quick and want to build the next Georgia (or…hear me out…Texas?…alright…bad joke yall).

The strategy is there for the taking, and healthcare is plenty fragmented still. Throw the weight of your organization, all the resources you can muster, and your entire bag at the problem until you reach critical mass for the flywheel to take effect. And because they’re playing from behind (most people are when playing against ‘Bama), panic set in. Which is why we witnessed the very juicy multiple that we did for Oak Street Health. But beyond that acquisition, the general demand for services along with the competitive and financial forces at play are why we’re seeing so much activity across primary care, behavioral health, home health, and virtual care.

The economics of risk work way better in a fully integrated care delivery model as opposed to a standalone primary care player. Look for payors to continue to make strategic acquisitions across their portfolios (Humana-CenterWell, United-Optum, CVS-CVS Care, Cigna-Evernorth).

Antitrust and Local Market Considerations

The final point I’d like to cover, and one where I don’t really have a conclusion, is the FTC’s ability to regulate vertical M&A activity. Historically, there has been no ability to do this. It’s something to keep an eye on as the FTC continues to ramp up scrutiny in mergers – but at the end of the day, what power does the agency have? The burden of proof is on them to prove out that these deals are anticompetitive. It’s a tall task.

To this end, and perhaps an exercise I’ll dive into one day, is thinking about how markets might shift or change when they are dominated by a vertically integrated player, or when a market is heavily influenced by Medicare Advantage penetration (similarly to how highly concentrated hospital markets are studied) Most notably:

- How are clinician wages affected?

- How do clinical / quality outcomes differ?

- What is the quality of provider networks and ability to access care?

- How do referral patterns differ between a heavy-MA market versus a ‘normal’ healthcare market? E.g., are we seeing a higher level of patient steerage, discharging to the home rather than a SNF or IRF, etc.

I’m sure there’s plenty more to consider and plenty of nuance to be had in the above conversation, but my whole goal is to get more people to talk and think about these interesting dynamics.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Great Thoughts from Arlo’s Jan-Felix Schneider

Hi Blake – great thoughts. A few points of my own on this:

* Vertical integration is not just a strategy to expand profits but to increase market share. By vertically integrating the companies can put more price pressure on their competition and in a market that is highly price sensitive (individual insurance, small group insurance) this can give you the edge over the competition.

* vertical integration may also be an indication that the current model of provider contracting is failing – when there is no competition in a market I guess the only thing to do is to combine forces. Wondering though what the anti-trust impact of this is, I.e. if UHG owned providers are allowed to give them lower rates compare to other payers, especially when they are the dominant provider.

* from a welfare perspective I wish we would find alternatives to the brokers provider-payer contracting game, like a one payer price and the right for payers to determine in-Network providers independent from health system ownership.

* one way to get there may be through radically simplified payment methodologies, ie cut out the overhead of contract negotiation, claims, collection losses, by setting more reasonable prices that get paid OR by differentiating prices based on quality (better doctors should be paid more). IMO reference-based pricing & cash pay can be the way forward here.