Welcome back to another edition of Hospitalogy, the best healthcare business newsletter around. Join 26,000 others by subscribing here.

This edition of Hospitalogy is brought to you by PARTICLE HEALTH

Care delivery organizations need a data strategy.

New opportunities are emerging daily around healthcare data exchange – including longitudinal medical records – which can drive great operating results and patient outcomes for your organization.

Particle Health has put together a thoughtful webinar on how tech-enabled providers can take advantage of the emerging trend in Health Information Networks (HINs).

Join Particle’s live event alongside their Founder & Chief Strategy Officer Troy Bannister to learn about everything HINs, including:

- Health Information Network 101;

- Leveraging HIN data to scale your healthcare data strategy;

- Quantitative comparisons of the major HINs; and

- Expected evolution of these networks given TEFCA advancements – and how your organization can take advantage.

If you’ve been looking for a solid perspective on interoperability in healthcare, register below!

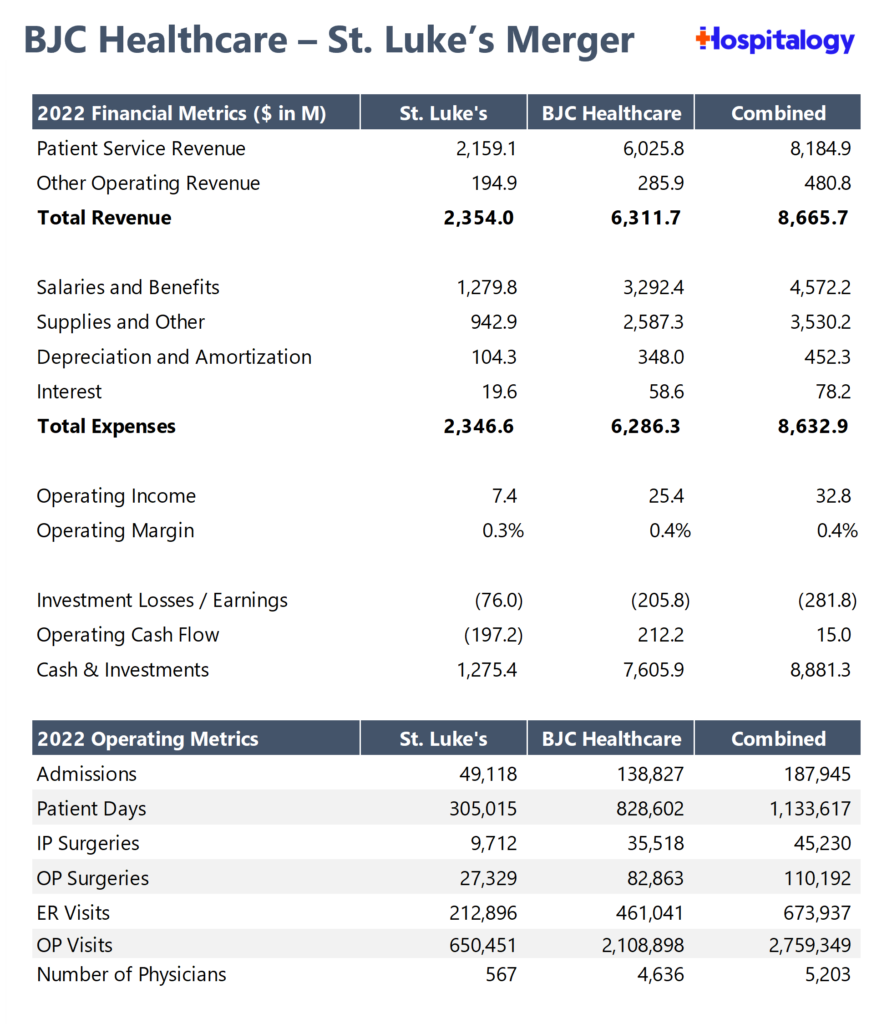

BJC HealthCare, Saint Luke’s Health System plan to merge, forming $9B system

On May 31, St. Louis-based BJC Healthcare and Kansas City-based Saint Luke’s Health System announced their intent to merge into what would create an $8.7B, 24-hospital system. I’d like to say – please don’t quote me on these numbers – as other news outlets and newsletters are reporting revenue figures that vary quite a bit from $8.7B. For instance, the press release itself and ModernHealthcare mentioned a revenue figure of ‘approximately $10B.’ But looking at the audits, I see $8.7B…unless I’m missing an entity or something.

Maybe I’m looking at the wrong health system audits or old information, but this is what I put together on the merger details:

Anyway, numbers aside, I digress. The bigger story here is yet another ‘cross market’ merger between two non-profit health systems in which both systems maintain their own headquarters and operate independently, yet try to realize some expense/capability-based synergy. The merger follows in the footsteps of Advocate-Atrium, Intermountain-SCL, UnityPoint-Presbyterian, and Kaiser-Geisinger.

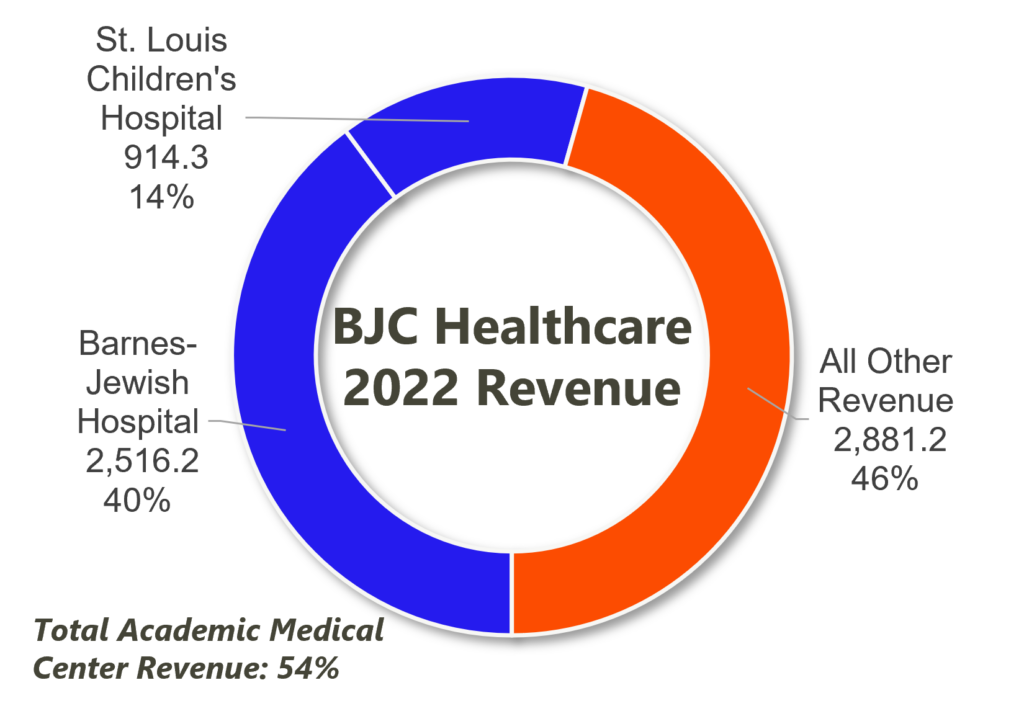

BJC and Saint Luke’s makes a bit more sense than those, though. Both of these health systems have been a part of the BJC Collaborative – a multi-system alliance – since 2012. And the merger paints an even clearer if we take a peek at BJC’s impressive facility base and academic medical center footprint.

BJC holds a 40+% market share in its core market and generates 54% of its revenue from its formidable academic medical center footprint:

BJC needed an expansion story, and the merger with Saint Luke’s grants that. According to credit agency reports, about a quarter of BJC’s admissions come from outside of its 11-county primary service area. To me, the signal here is that BJC can leverage Saint Luke’s operating footprint to push more patients to its facilities outside of the core market. BJC was already in a healthy financial position, expecting margin recovery this year and holding a nice credit rating from the agencies. If anything, this merger will continue to push that margin further upward after a bad 2022 stemming from labor and inflation issues for hospitals.

The merger also opens the door to potential population health initiatives. The BJC Collaborative combined touches around 11 million residents in the Midwest. You have to think that operating some of the premier institutions across that population as well as leading market share puts Saint Luke’s and BJC NewCo in the driver’s seat.

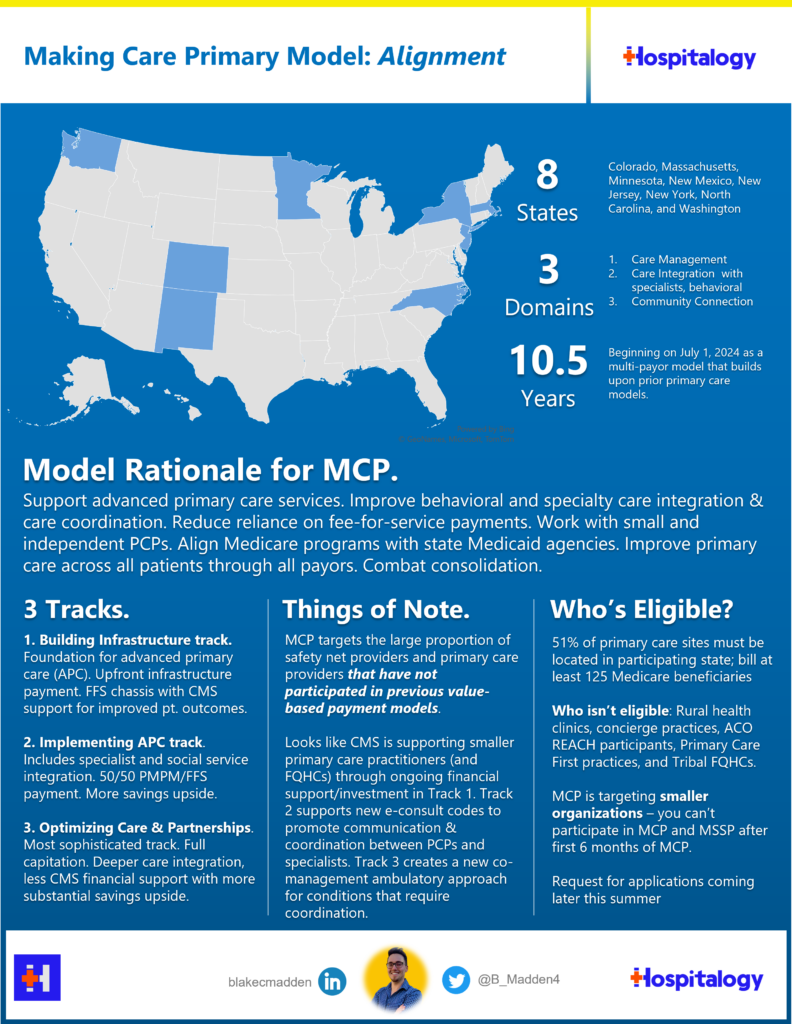

CMS Launches Making Care Primary

On June 8, CMS announced the latest and greatest model in value-based care: the Making Care Primary model.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

The reimbursement model builds on past iterations of primary care and CMS seems to be targeting anti-consolidation with this one. CMMI is trying to incentivize clinicians who have never participated in advanced primary care, including Federally Qualified Health Centers, supporting these clinicians with boosted infrastructure payments, more hand holding/financial support and 3 tracks that move progressively down toward full risk.

Along with incentivizing the little guys, CMS is harping hard on care coordination, specifically calling out the integration of specialty care and behavioral health with primary care to promote team-based care. To that end, the agency is adding new e-consult CPT codes and other financial incentives when a chronic condition requires coordination between a specialist and PCP. And of course, CMS continues to reinforce health equity measures in every VBC program.

All this to say that integrated care delivery across primary care and specialists, but also across payors (Medicare, state Medicaid agencies, and potentially commercial) is the future CMS wants to push toward.

If you have any thoughts about the implications of this model, I’m all ears – feel free to respond to this e-mail!

Partnerships and Strategy Updates:

S&P continues to downgrade RadPartners’ credit, and the radiology rollup is reportedly on a downward trajectory. Critics suggest the company is struggling with operational issues and high physician turnover. (Link)

Friday Health Plans has been forced into receivership across multiple states, signaling the end for the once high-flying insurtech. What’s worse, though, is that Friday’s insolvency holds ripple effects for other players on the exchange who could be exposed from not receiving Friday’s risk adjustment transfer payments. I hope this isn’t the case, but I’ve heard – unverified – rumors that Sendero in Texas could have exposure here. (Link)

Morgan Health released an agenda stating its desire for policy reform and continued support for value-based care, especially in the commercial realm of healthcare. (Link)

CenterWell continues its expansion with the addition of its 250th primary care center as it stays on track to open 30-50 senior clinics a year. (Link)

Finance and M&A Updates:

Walgreens sold its remaining stake in post-acute care and infusion services company Option Care Health for $330 million. More money for VillageMD and other healthcare stuff, eh? (Link)

Beckers put together a nice list of the financial results of 30 health systems, including the major for-profits, through Q1 2023. (Link)

Intermountain had its ‘AA+’ credit rating affirmed, boasting the highest rating among healthcare nonprofits. (Link)

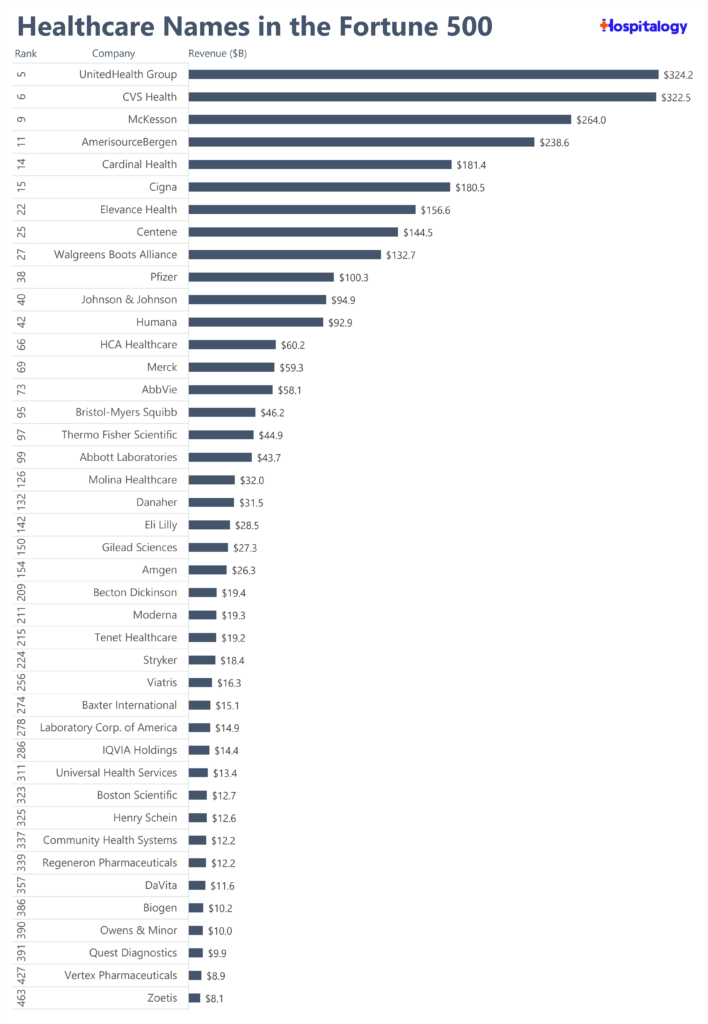

Top 25 healthcare companies in the 69th annual Fortune 500.

Digital Health and Innovation Updates:

SmithRx – a next-gen PBM – announced this morning (just an hour ago!) that it’ll begin to offer Yusimry, a biosimilar of Humira, to its members at a steep, 90%+ discount to the cost of Humira. And take a wild guess who they’re working with? Mark Cuban Cost Plus Drugs. Hell yes, fam. This is a gamechanger for one of the highest-cost drugs in the game, with over 300,000 patients in the U.S. and the top-selling pharmaceutical in the world. SmithRx will cover Yusimry when it launches in July. Recall that MCCPD partnered with Coherus BioSciences to offer Yusimry to MCCPD customers starting in July. (Link)

Google Cloud and Mayo Clinic are expanding their partnership to develop new generative AI models aimed at improving patient care, including models for predicting patient outcomes and helping clinicians make more informed treatment decisions. (Link)

Valtruis has launched TailorCare, a value-based care option specifically designed for musculoskeletal patients, marking a significant step forward in providing more personalized and cost-effective care. Keep this name on your radar. (Link)

Transcarent is partnering with ViewFi, an ortho and MSK company, to provide members with an orthopedic consult via Transcarent’s platform. Even cooler – ViewFi was cofounded by former tennis player Andy Roddick. My grandma would love to hear that. (Link)

Yuvo Health announced a $20.2M Series A to expand their partnership model with Federally Qualified Health Centers. According to the presser, Yuvo now helps FQHCs with over 150k patients. Don’t forget that we had a virtual event with the Yuvo Health team just a few weeks ago!! (Link)

Healthcare management platform, Laudio, has raised $13 million in funding to expand its offerings aimed at improving the healthcare workforce’s operational efficiency. (Link)

Nutromics has secured $7 million in pre-series A funding, aiming to advance the development and commercialization of its wearable health monitoring platform. (Link)

Carbon Health is looking to make its entire, custom-build EHR AI-driven. (Link)

Cityblock cut 12% of its workforce. (Link)

Miscellaneous Maddenings

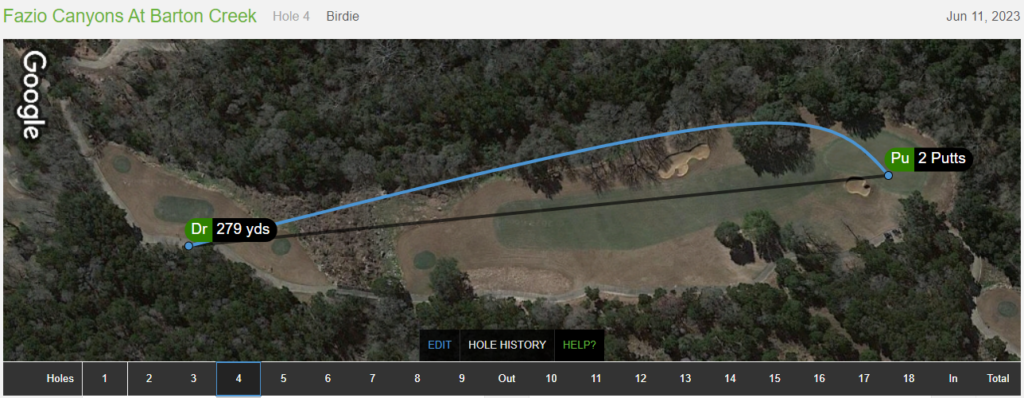

- We had a great weekend in the hill country of Austin relaxing at the Omni pool, spa, and golf course. I played Fazio Canyons, which was a spectacularly beautiful course – but obscenely difficult. Even though the tee shots were tight, I drove the ball well and squeaked out an 82, though it could have been better if my putter were cooperating. Highlight of the round for me was hitting it onto the green on a short par 4 into the wind, then 2-putting from 50+ feet for the birdie! Here’s the hole in question:

Hospitalogy Top Reads

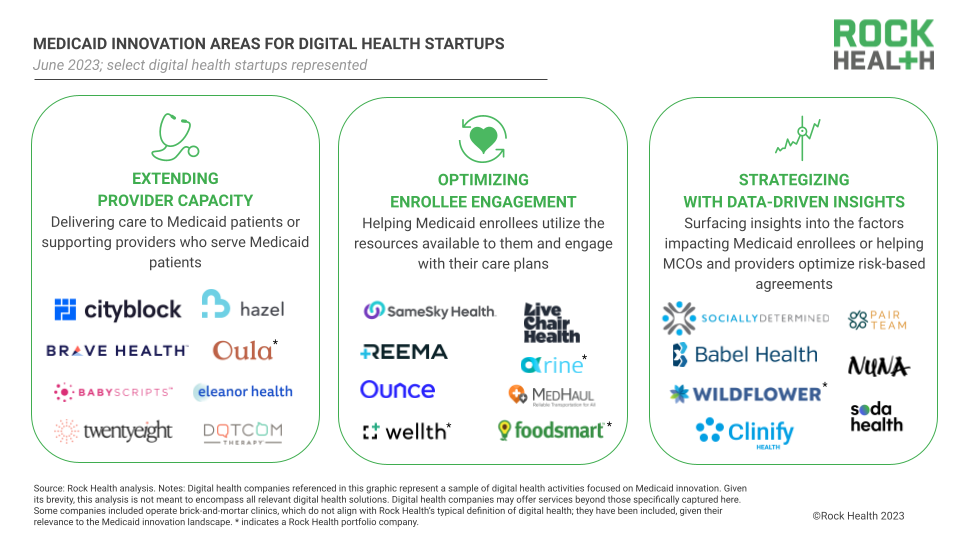

- Rock Health wrote a wonderful dive into the world of Medicaid and the abundant, underrated opportunity in the space. (Link)

Two Docs and a Substack released a nice overview of the behavioral health space, including some spicy takes on consolidation and specialization vs. generalization over time. (Link)

- Ultimately, we predict that the hyper-specialized behavioral health platforms will become acquisition targets for the generalist providers of care, which is when their true power will be unlocked as they will be available to increasingly broader swaths of the population.

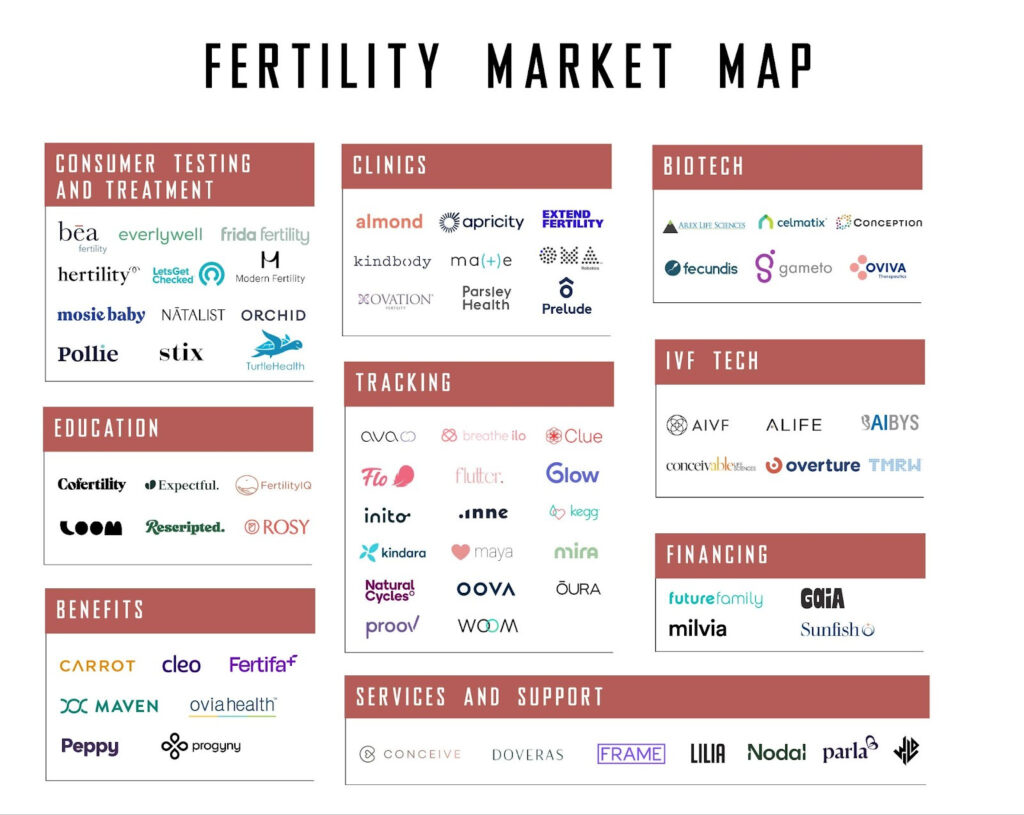

Chrissy Farr and Leslie Schrock wrote an excellent essay on the state of the fertility market. (Link)

I had the good fortune to join the Healthcare Rap podcast recently to chat about what’s going on in healthcare M&A, my journey to becoming a healthcare creator, and more! It was a lot of fun – go listen here.

That’s it for this week! Join leading healthcare organizations and 26,000+ others by subscribing here.