Welcome back to another edition of Hospitalogy, where we talk about what’s going on in the business of healthcare!

SPONSORED BY DOCK HEALTH

You’ve heard about Dock Health a few times from me this week. But what’s the quantifiable ROI from using their product?

Stated another way – for my CFOs and finance folks in the audience – ‘how does using Dock Health improve my margin?’

Glad you asked! Dock pushes the needle forward in plenty of ways:

- Reducing staff turnover and identifying top performers

- Maintaining sticky patient relationships to keep them within your network

- Optimizing staff allocation and identifying revenue opportunities internally

In one instance, the Dock team worked with a multi-site mental health firm, helping the group understand how many patients were being referred out due to capacity constraints.

Based on the structured data from Dock, the firm made a data-driven decision to hire another clinician to support revenue goals and expand access to patients.

Make better, data-driven decisions. Learn how Dock drives the bottom line here.

Optum creates a Home Health Bidding War

UnitedHealth Group is once again coming for a major home health player. After Option Health Care in early May announced its intention to merge with Amedisys in a deal valued around $10 billion (Amedisys comprising around $3.6B of the combined enterprise at the time), Optum announced an offer to acquire Amedisys outright in an all-cash deal at $100 / share.

Blake’s Take: The Optum announcement could present an opportunity for both Amedisys and Option Care shareholders to back out of the original offer. For one, analysts were highly skeptical of the original combination here, with lack of payor overlap or other immediate synergies.

There was so much skepticism, in fact, that Option Health Care had to post a follow-up support post along with all of their buddies sharing all of the positive attributes from the announced deal. Has anyone seen anything like this? Is this a normal thing?

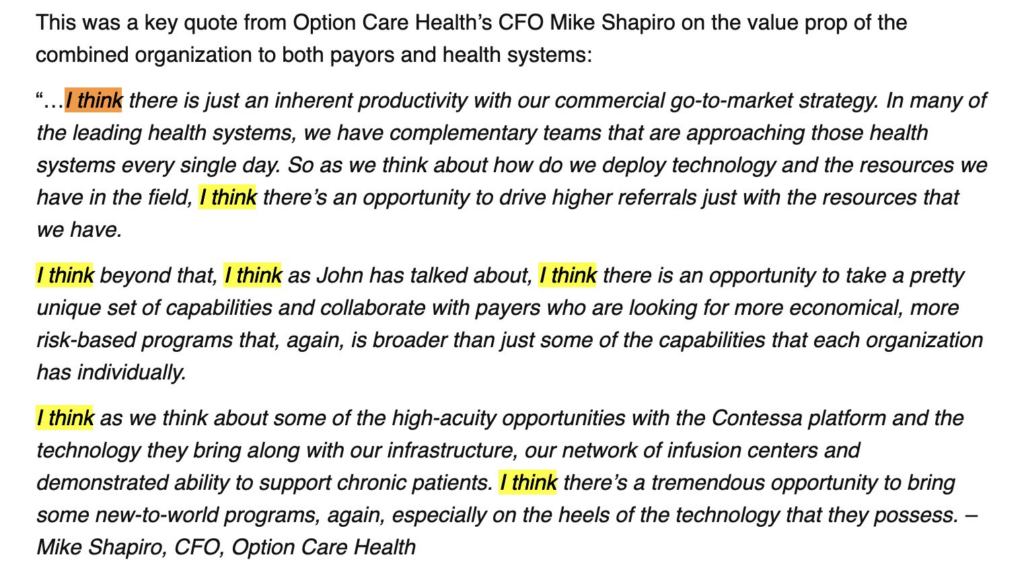

And when the CFO says “I think” 7 times in one quote during the merger call it might be time to rethink the strategy. I’m not picking on the quote but…signals, ya know?

In response to the Optum announcement, Option reiterated its confidence in the merger. All of this to say that shareholders could now vote ‘no’ to the merger and entertain the all-cash offer rather than rolling their equity ownership into Option.

Bigger picture: Payors want home health. Bad. There’s a reason why M&A activity in the post-acute segment is muted, yet payors are jumping hoops for home health assets. As one of the lowest cost post-acute care settings, payors can steer patients into owned home health services as opposed to higher cost facility-based settings. Studies indicate that patients prefer in-home care. These factors and plenty of others prove why Optum wants Amedisys, why Optum bought LHC for $5.4B, and why we’ll continue to see active payor activity across the space. The deal has nothing to do with anything unique about Amedisys despite being a solid operator (e.g., Contessa) and everything to do with payors’ ability to drive down cost of care and expand margin through home health services.

Lots of folks are already speculating as to who’s the next take-out target – AccentCare? Enhabit? In any instance, expect public names to bid up.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

KKR-backed Oncology Player GenesisCare files for Bankruptcy

The second KKR-backed healthcare name in about as many weeks – GenesisCare – is preparing to file for bankruptcy, per the Wall Street Journal.

GenesisCare, based in Australia, holds a sizable footprint of radiation oncology and medical oncology operations in the U.S. Normally, radiation oncology is fairly profitable and a stable book of business since, as you can imagine, cancer is such a large industry.

But the post-Covid drop in utilization for healthcare services combined with not-so-great tuck-in acquisitions of medical oncologists led to financial deterioration for the cancer care business.

Then in 2019, KKR combined forces with GenesisCare to buy a distressed cancer care operator, 21s Century Oncology in a $1.1B deal according to PE Hub.

That deal was likely a big contributor to the collapse – 21st Century Oncology (21C), its legacy operating struggles, and of course, debt problems. Agencies cut GenesisCare’s credit rating twice in the past 6 months and its liquidity deteriorated over time.

But here’s the big picture happening right now: debt-saddled, highly levered players are going belly-up in current capital environment, with high interest rates and jumpy banks. Major fat is getting trimmed in healthcare right now, and more is yet to come.

Partnerships and Strategy Updates:

Evernorth has entered a strategic partnership with CarepathRx, aiming to leverage the latter’s health system footprint to provide integrated specialty pharmacy solutions. As part of the partnership, Evernorth is making a significant minority investment into CarepathRx. (Link)

Minnesota is expected to pass a public option health insurance plan, following in the likes of Colorado and Washington state. Interestingly, it seems as if both payors and providers dislike the bill, with insurers stating that residents would switch off more lucrative private commercial plans while service providers would face a hit to revenue (side note – assuming they’re forced to stay in network with the public option). Definitely a dynamic to watch. (Link)

UPMC is expanding its in-house travel program by adding a regional option, aiming to meet its staffing needs more flexibly. As of June 1, UPMC has hired more than 700 staff into the in-house travel staffing agency, with 60 percent of those workers being external hires. (Link)

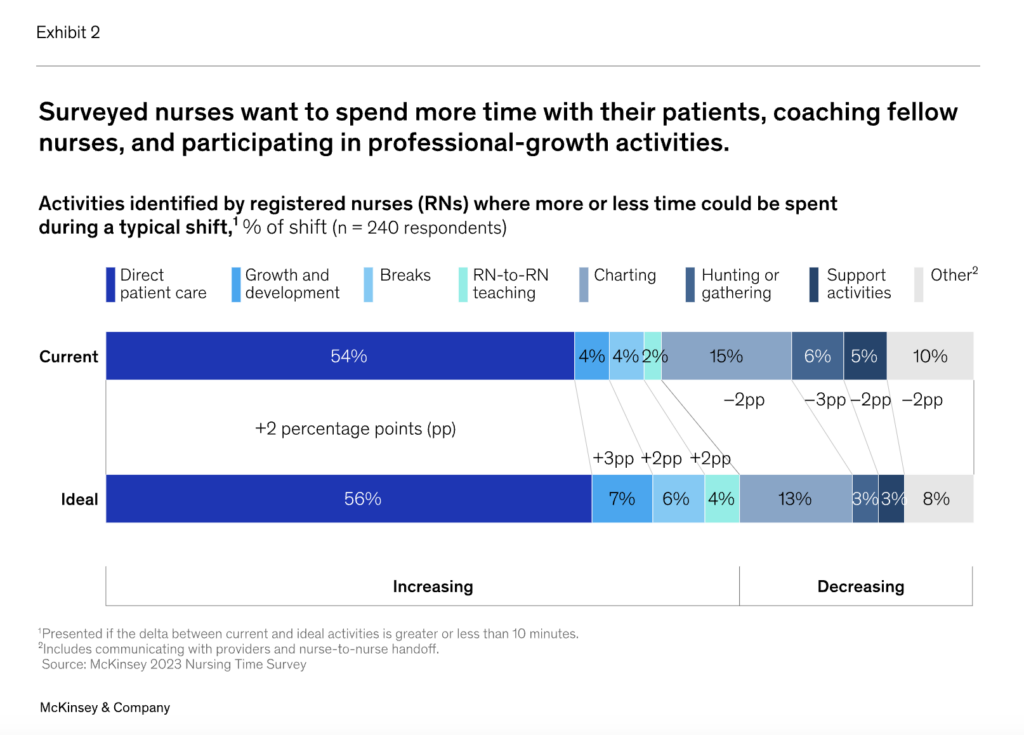

McKinsey continued its series on the nursing workforce with interesting insights for healthcare operators, including a survey of nurses that identifies gaps between what nurses perceive as ideal use of time versus what they actually spend their time on, and where tech can fill in the gaps to help with burnout and admin tasks. (Link)

Finance and M&A Updates:

A couple of CVS updates – CVS expects the hit to its Medicare Advantage star ratings drop to amount to around $1 billion in lost revenues. Its new subsidiary Oak Street Health is also expanding into 4 additional states in 2024 – Arkansas, Iowa, Kansas, and Virginia.

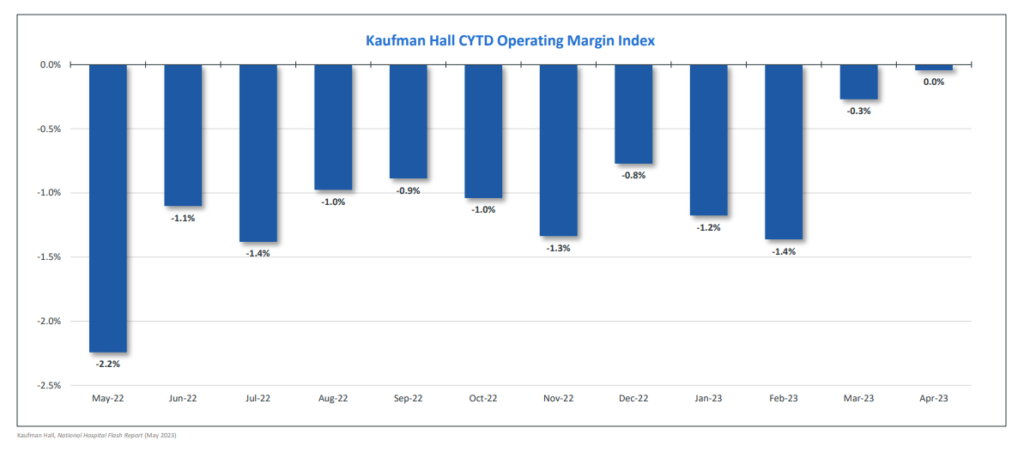

Kaufman Hall’s latest flash report presented another uptick in margin for hospitals in May. KH also noted drops in volume, stable ER volumes, Medicaid redetermination effects, and inflationary pressures continuing to make its presence known. (Link)

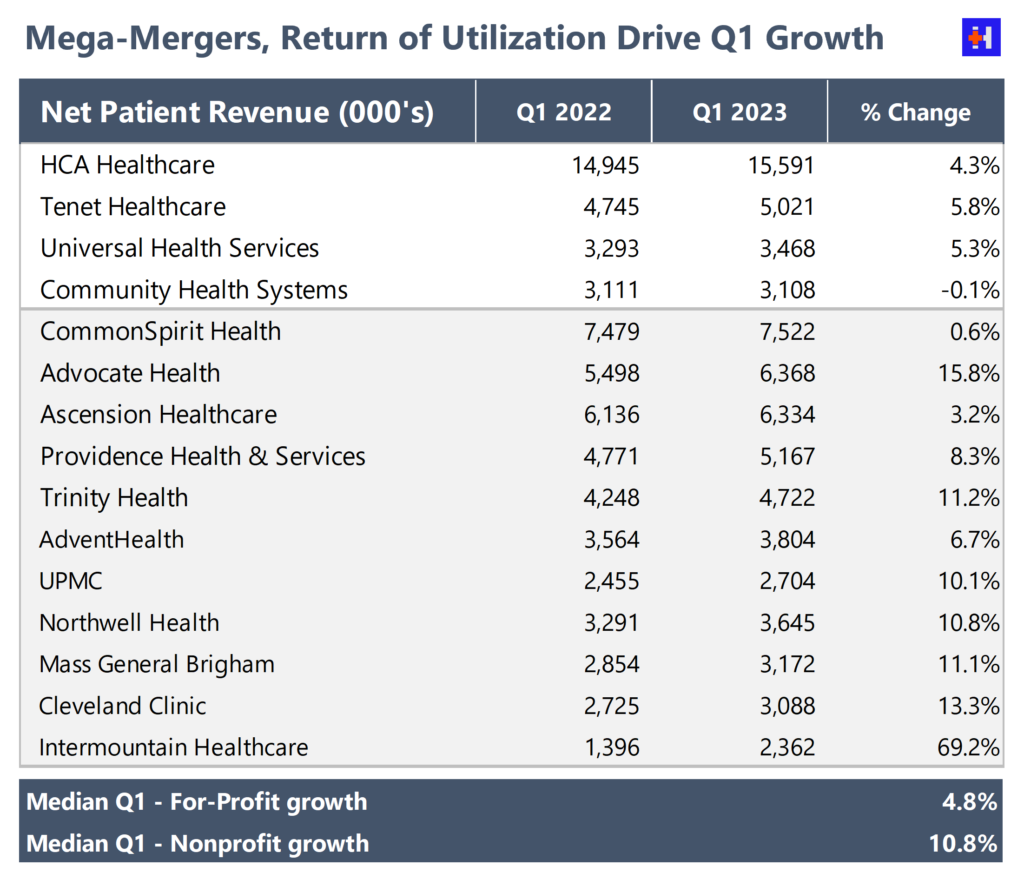

To continue with hospital financial data, I took a quick look at hospital Q1 net patient revenue growth. The below table compares Q1 ‘22 to Q1 ‘32 direct patient revenue growth for some of the largest health systems. Based on the below in addition to public commentary from HCA and Tenet, the biggest players seem to be signaling increased utilization and growth headed into the back half of the year.

Digital Health and Startup Updates:

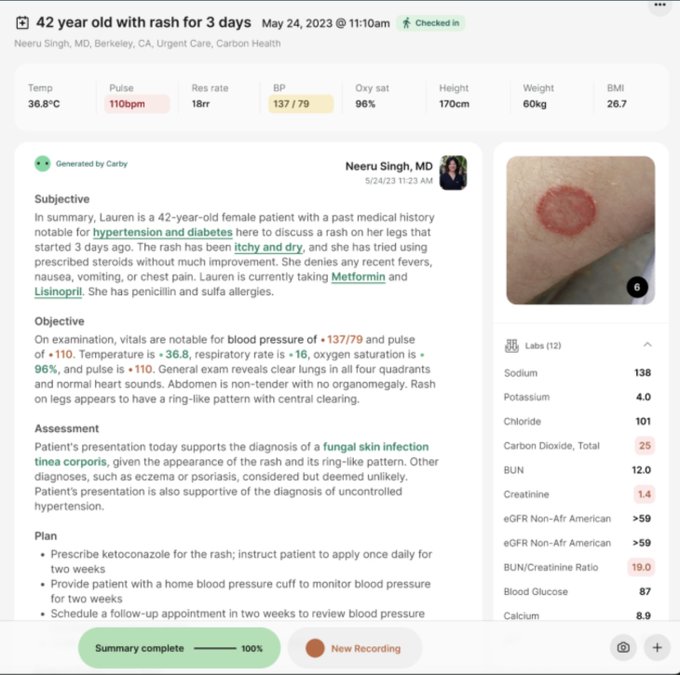

Carbon Health has introduced a new AI-enabled feature for hands-free charting, designed to streamline documentation and enhance patient-provider interactions during healthcare visits. (Link)

- Alex Cohen from Carbon shared an example of the generative output in a tweet which looks like most other generative AI interfaces I’ve seen out in the wild, but I’ll be interested to see the effects of it on an organization as large as Carbon and implemented across the organization immediately.

This Stat article on Nuance’s DAX and AI-powered medical scribe tools was a good read on the pricing dynamics at play with the new tools coming online. One thing is clear: physicians love documentation solutions. (Link)

GE Healthcare has unveiled Sonic DL, an AI tool now FDA-cleared to expedite cardiovascular ultrasound exams, potentially halving the exam time by auto-tracking and measuring cardiovascular structures. (Link)

Omada’s strategy with weight loss and GLP-1s was revealed by CEO Sean Duffy in a tweet thread, making it known that Omada would not prescribe GLP-1s as part of its programs but rather support those prescribed through sustainable virtual programs. (Link)

Miscellaneous Maddenings

- So, I’m not sure if every golfer feels this way…but for my buddy Travis and me, there are a couple of golf courses that absolutely rock our world. No matter how we’re playing headed into these courses, we just cannot play them well. Well, we played one of those courses this past weekend. Duck Creek. It’s an extremely short municipal (in rough shape) northwest of Dallas that SHOULD be an easy course but it ate my lunch and makes me reconsider my decision to be a golfer. I shot an 86 with quite a few penalties and couldn’t get the driver going. We’ll try to bounce back this weekend as I’m headed down to Austin with my wife to play one of the Omni courses out in the hill country!

Hospitalogy Top Reads

- A new startup Ezra, which provides full-body preventive scans in an effort to prevent cancer, was featured in a recent Not Boring sponsored piece. I really enjoy Packy’s writing and thought the piece (despite being sponsored) prompted an interesting discussion on the value of preventive screening and pushing the needle forward with more efficient scanning, innovation in medical imaging. Of course, these potential benefits contrast against scan access (it’s all out of pocket, thousands of dollars) and downstream over-utilization problems that a startup like Ezra is bound to create at scale. Nikhil’s piece on over-utilization of diagnostic testing and screening healthy people is a good counterbalance to the discussion. (Link)

- Nikhil Krishnan wrote a nice overview on CPT Codes – their origins, what they incentivize, and challenging dynamics that an evolving healthcare world faces given the system. (Link)

- Chrissy Farr did a great deep dive into the obesity market, peeling back the layers of a complex chronic condition. (Link)

That’s it for this week! Join 25,000+ executives and professionals from leading healthcare organizations by subscribing here!