Welcome back to another edition of Hospitalogy, an industry-leading newsletter that breaks down the business of healthcare written by yours truly, Blake Madden.

Today we’re taking a quick dive into some of the major stories that have emerged so far in healthcare in 2023, visualizing them, and understanding the bigger picture behind why things are happening.

Join 25,000+ executives and professionals from leading healthcare organizations by subscribing here!

This edition of Hospitalogy is sponsored by our friends at DOCK HEALTH

$100 billion in healthcare waste and inefficiency.

The ball has been dropped on the administrative side of healthcare. Complexity causes delays in care, missed referrals, duplicative work and clinician burnout.

Enter Dock Health.

Dock Health acts as the point guard of provider organizations, providing admin decision support and handoffs between admin and clinical teams as simple as Jamal Murray dishing the ball inside to Nikola Jokic for an easy layup.

No more dropped balls, just seamless, HIPAA-compliant task management.

Imagine saving up to 12 hours per week, reducing burnout, and enhancing patient care, all while keeping risks at bay. Sounds like a layup to me!

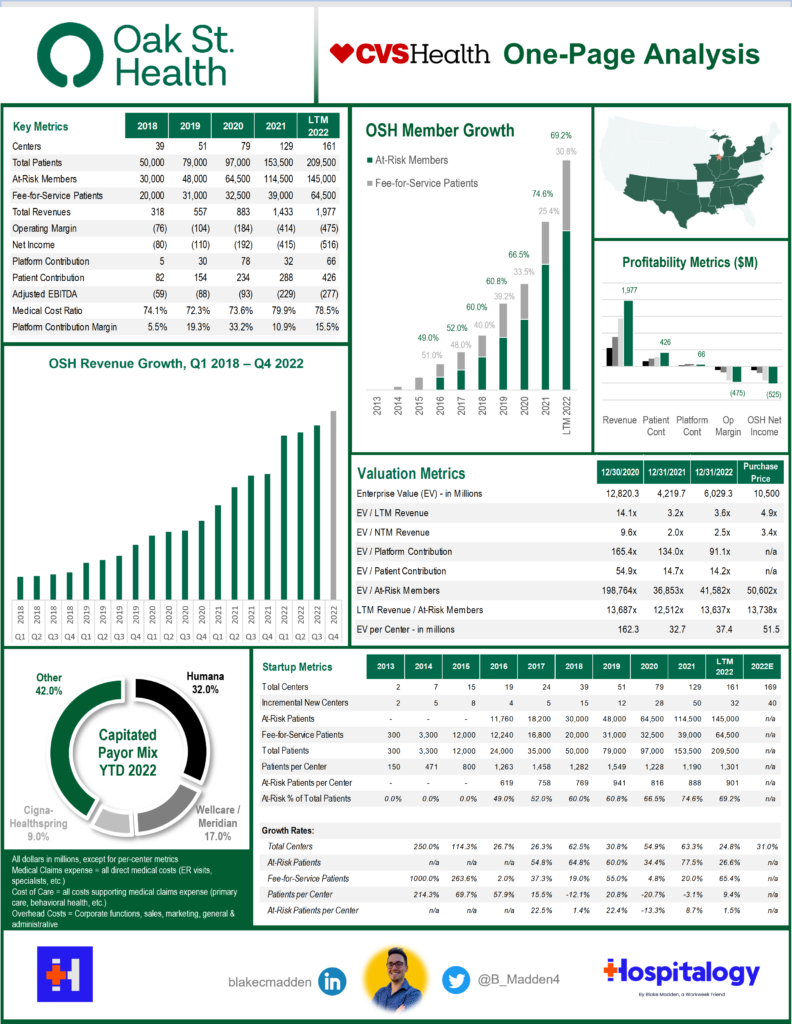

1. CVS finds its National Primary Care Platform in Oak Street Health; Vertical Integration takes Center Stage

Medicare Advantage is a key area of growth for most payors. Market share is up for grabs as the population ages into the entitlement program in a competitive environment. Meanwhile, Medicare Advantage penetration is a rising tide as it overtakes traditional Medicare in 2023.

Payvidors and other strategic players are investing significant capital into primary care. As MA enrollment swells, payors are focused on building out national footprints to attract and retain patients while focusing on managing overall medical spend for an aging population dealing with chronic conditions. Oak Street Health fills many pressing needs for CVS.

From an operating and clinical perspective, acquiring Oak Street Health will afford CVS greater integration in its care delivery model, which will result in better care coordination for patients, more patient satisfaction, increased access for Medicare Advantage (”MA”) members and dual-eligibles, boosts in quality, and reductions in total cost of care.

From a financial and strategy perspective, acquiring Oak Street Health should boost CVS/Aetna’s MA star ratings, enhance member recruitment and retention, enable better risk coding, and unlock a national primary care platform for long-term profitability and future growth.

Oak Street Health’s main business goals are to lower total cost of care by preventing unnecessary acute events and managing chronic disease, all while providing a better patient experience. As a primary care operator working in with Medicare beneficiaries, Oak Street Health has done an incredible job of pushing the value-based care agenda forward.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Payors are chasing UnitedHealth Group and the Optum strategy. The shift toward vertical integration means that insurers are moving profits from regulated, capped insurance segments downstream into higher-margin, unregulated, uncapped services entities.

In isolation, CVS overpaid for Oak Street Health. But CVS will benefit in the long-term – this is a decades-long bet in healthcare and MA. As such, CVS did not value Oak Street Health on its standalone value today, but rather its strategic value to CVS as a whole.

The Oak Street Health, Summit Health, and One Medical transactions by strategic players are huge net-positives for tech-enabled services companies in the risk game. They establish immediate credibility for both at-risk primary care and players dabbling in specialty risk.

Like I stated in the 2023 predictions piece, vertical integration is the dominant trend in 2023. Payors will continue to pursue vertical integration strategy until the FTC someday pries their services arms from their cold, dead hands.

Read my full analysis of why CVS bought Oak Street Health here.

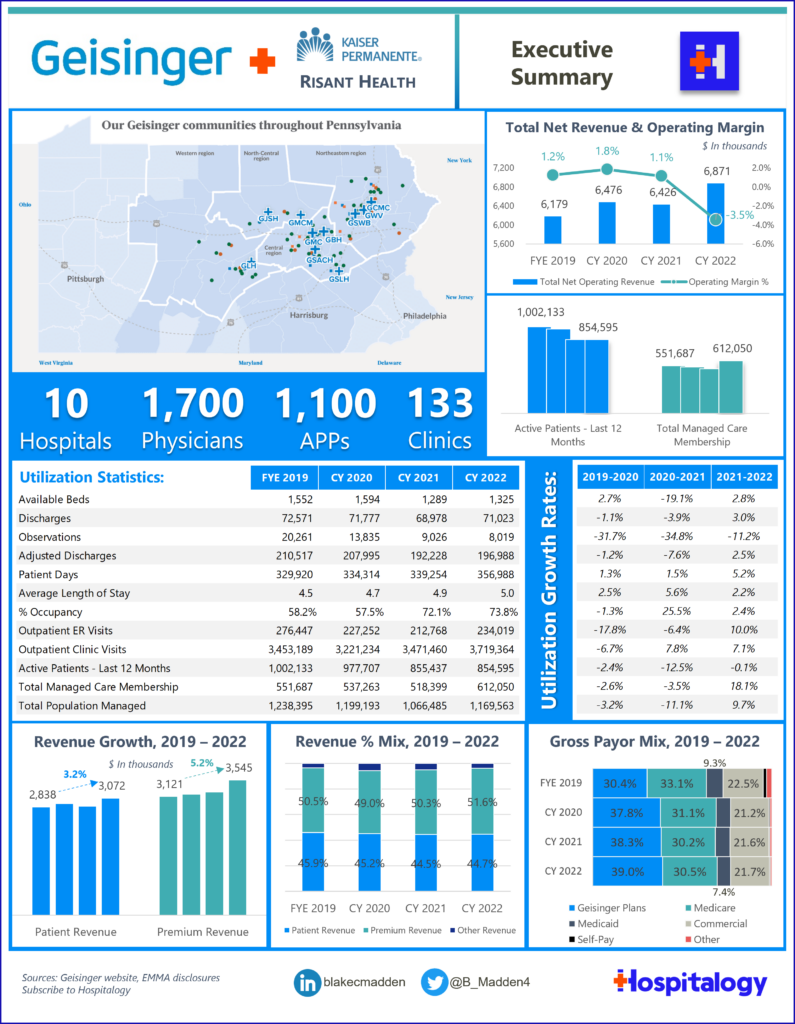

2. Kaiser initiates major growth plan alongside Geisinger, extends lifeline to health systems with launch of Risant Health

Kaiser Permanente formed a new nonprofit health system called Risant Health. Risant Health will have significant financial backing as a subsidiary of Kaiser.

Risant’s first member is Geisinger, based in Pennsylvania. Geisinger’s CEO Jaewon Ryu will lead Risant.

Over the next 5 years, Risant will target smaller integrated care delivery organizations (e.g., nonprofit health systems with a health insurance offering) with the goal of hitting $35 billion in system revenue. The nonprofit health system members will operate independently but hold affiliation with Risant.

Risant provides a potential lifeline for health systems struggling in the 2023 operating environment to provide population health expertise, capital needs, and capability-based scale.

Read my full analysis of what Risant Health means here.

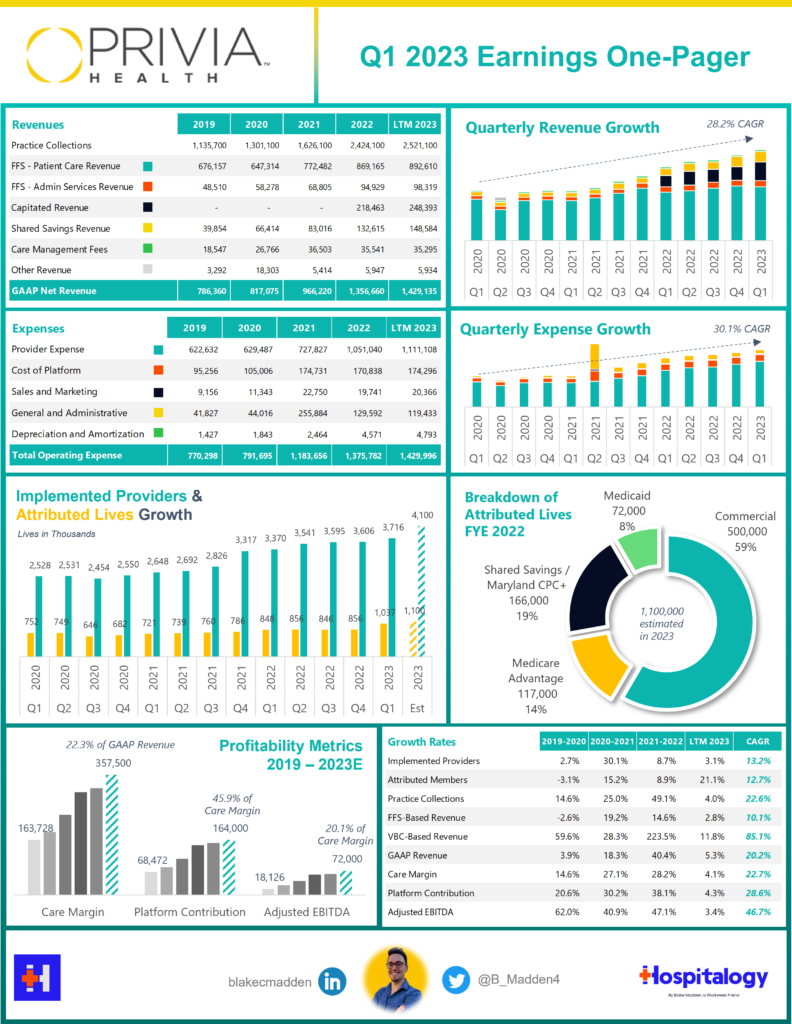

3. Riding Value-Based Tailwinds, Enablement Players Continue to Outperform

Although I focused on Privia in Q1, all of the enablement players continue to attract physicians to their platform and execute on the value-based care playbook – moving patient panels down the risk continuum and generating shared savings for payors and physician partners.

Privia in particular continues to notch successful partnerships all the while transitioning both its CEO and major institutional investors.

Over the next few quarters – and coming years (it is healthcare, after all) I’m watching Privia and other emerging enablement players, performance in the ACO REACH arena (for those participating) and their appetite for risk in specialty care, which will initially take place in narrow, disease/specialty-specific arenas including oncology and nephrology.

Read my full breakdown of Privia’s Q1 here.

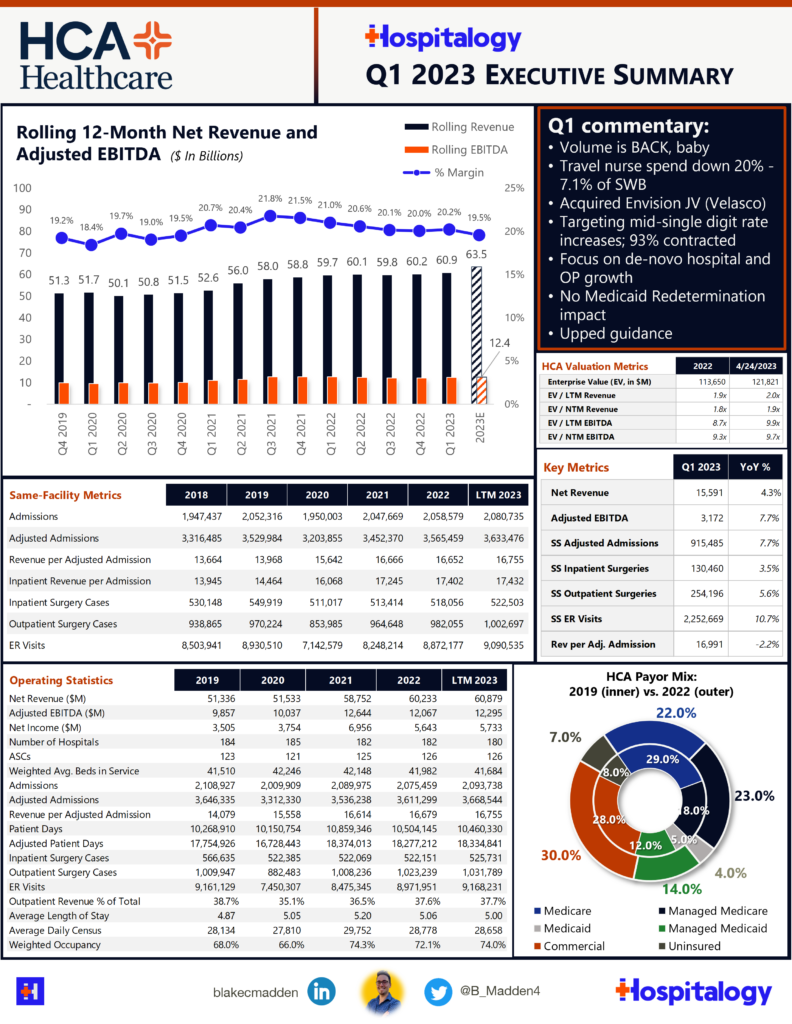

4. HCA’s Rebound Signals the Return of Utilization

HCA continues to show signs of life and outperformance as compared to its nonprofit peers after a resurgence in utilization, a reduction in labor costs, and consequently, an increase in the hospital operator’s guidance/expectations for 2023 after reporting Q1.

Going into 2023, systems like HCA were dealing with a plethora of dynamics:

Hospitals are focused on two main priorities: Expense mitigation – labor in particular – and revenue diversification.

Labor is still the number one issue affecting hospitals. HCA is investing heavily in its clinical staff.

Commercial rate lifts will continue to play out over the course of 2023 and 2024 as new contracts get negotiated. Hospitals shouldn’t expect lifts higher than HCA’s mid-single digits hike.

Hospital M&A is not very feasible in 2023, with HCA execs noting a disappointing pipeline. They’re pivoting to greenfield, or de-novo, development.

Covid is over. The new normal is taking shape in 2023 and utilization returned to HCA hospitals in the fourth quarter of 2023 (with the linchpin being labor capacity). Moving forward, Covid as a % of total admissions will be around 3-4%.

As the public health emergency ends in May, relief dollars that propped up struggling systems are gone. Medicaid redeterminations aren’t considered a headwind for HCA given ACA subsidies present thru 2025.

Short-term headwinds for HCA include lower reimbursement on Covid DRGs ($280M), 340b Program payment reductions ($50M – $100M), labor investment ($150M), and increased pressure for subsidies from hospitalist physicians, including ER groups and anesthesiologists. Hospitals with higher exposure to Covid, higher Medicare mix, 340b, and contract labor face uphill battles in 2023.

HCA’s primary focus, as always, is investment in higher acuity programs on the inpatient side while expanding its complementary outpatient footprint. HCA operates around 13 or so outpatient sites of service for every hospital it runs. Inpatient demand is nearly flat at this point, so HCA’s main levers to pull here include grabbing existing IP market share from other players, increasing case mix acuity and expanding service lines like NICU, and finally expanding its outpatient footprint (urgent care, freestanding ED, clinic capacity, ASC capacity).

Nonprofit health system losses are HCA’s gain. We will see empirical evidence of this in 2023 and beyond as these systems shutter capital spend and growth – which HCA will take full advantage of. Based on the dynamics at hand, my anecdotal hypothesis for hospitals in 2023 is that large, nimble systems like HCA will flourish (as always), while nonprofits and smaller health systems will disproportionately struggle in the new environment.

Read my HCA full-year 2022 analysis here.

5. Option Health Care’s Merger with Amedisys Raises Eyebrows

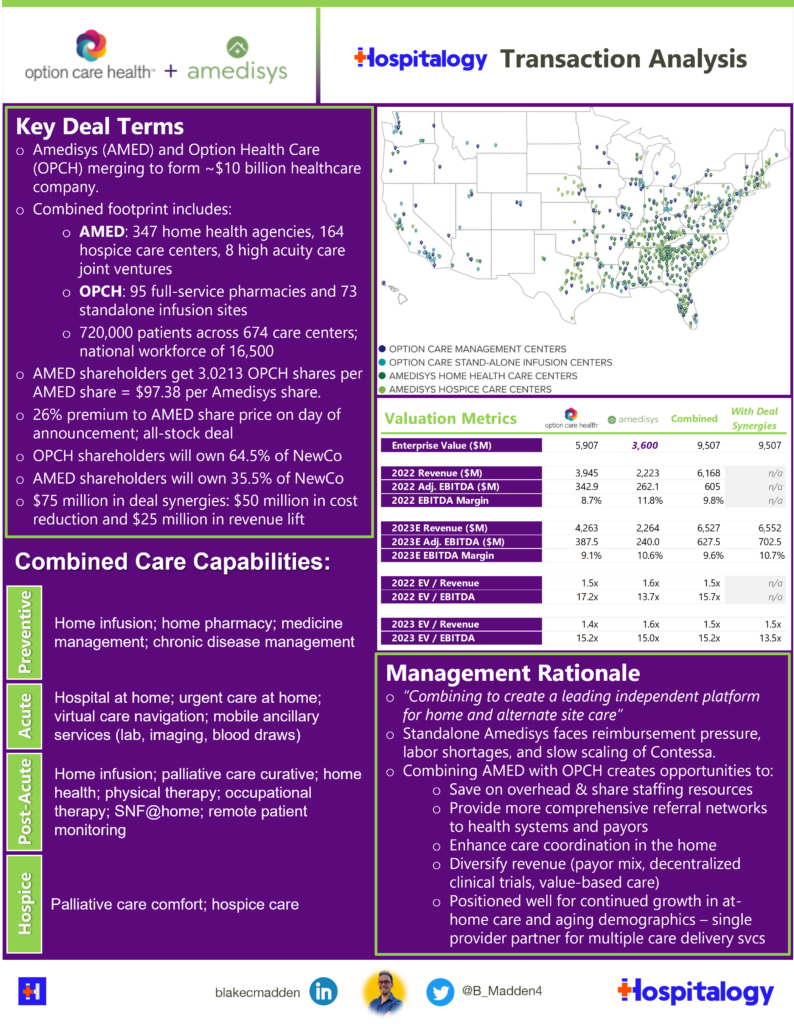

Option Care Health is acquiring Amedisys in an all-stock deal valued at $3.6B or 15.0x forward adjusted EBITDA guidance as provided by Amedisys during its first quarter earnings release.

The merger took analysts by surprise – a dynamic that was painfully obvious on the merger Q&A call. It’s never a good sign when you hear analysts openly questioning the logic, timing, and overall strategy of your multi-billion dollar transaction.

Most outsiders are questioning the realizable synergies and strategy behind the merger, which seemed to come out of left field.

“The deal makes no sense,” a healthcare executive lampooned after I asked them for thoughts on the Amedisys-Option Health Care Deal at a recent conference.

Still, the deal hits on a common theme in healthcare post-ACA. Bigger is better, no matter how you get there. Although the identified synergies aren’t there today, maybe they will be tomorrow.

Read my thoughts on the Amedisys-Option Health Care Merger.

That’s it for this week. Join 25,000+ executives and professionals from leading healthcare organizations by subscribing here!