Today we’re diving into Privia Health’s Q1 2023 results which were stellar. As a reminder, Privia is an enablement company that partners with physicians to make their lives easier in fee for service land while transitioning patient panels to value-based care arrangements.

Join 24,000+ executives and investors from leading healthcare organizations including Privia, Optum, and HCA Healthcare, health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Cityblock, Oak Street Health, and Turquoise Health by subscribing here!

Privia Health Q1 Overview

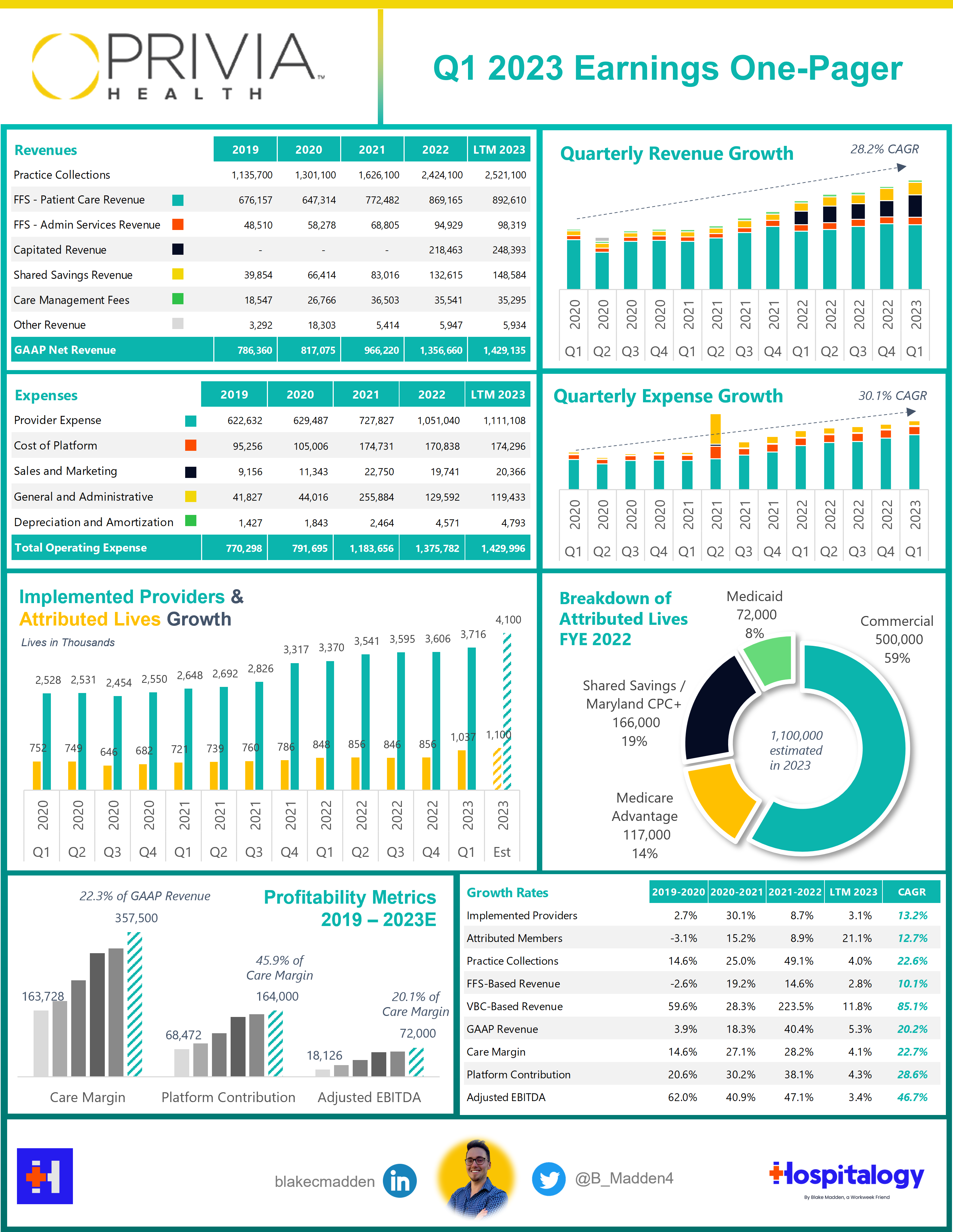

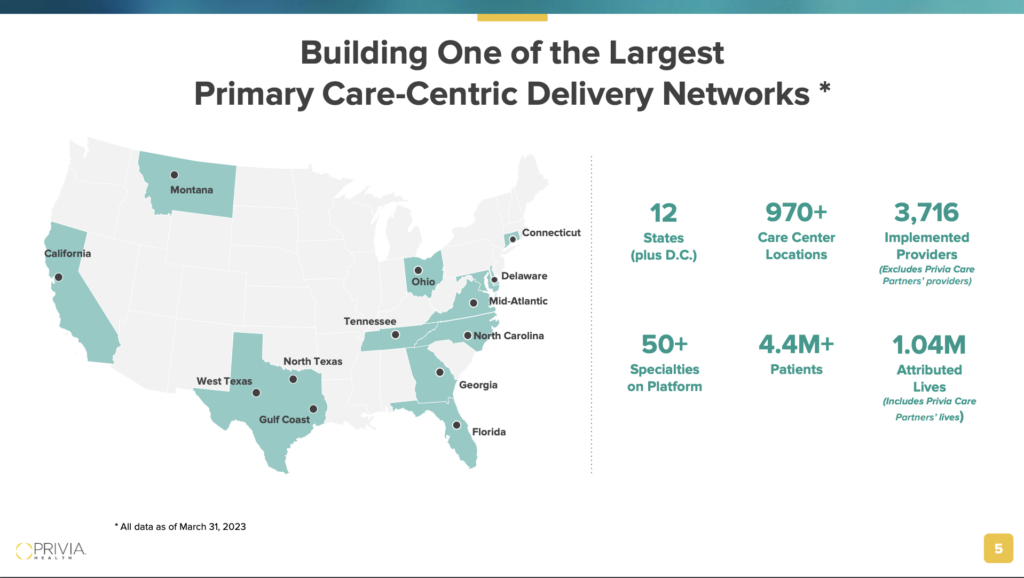

Privia Health reported solid financial and operating results in Q1 as the enablement space continues to perform well. The firm hit over 1 million attributed lives in the first quarter while implementing 3,716 providers to its platform. These results added up to $386.3M in revenue (23.1% growth over Q1 2022) and profitable at $16.9M in adjusted EBITDA.

Privia Health also launched three new ACOs in the first quarter of 2023, expanding the total number of Privia-owned ACOs to ten. The firm now serves beneficiaries across the District of Columbia and eleven states, including California, Connecticut, Delaware, Florida, Georgia, Maryland, Montana, North Carolina, Tennessee, Texas, and Virginia. Through those ACOs, Privia serves over 2,500 providers and around 200,000 Medicare beneficiaries.

Notable Partnerships: Community Health Group, Novant, Beebe Health, and OhioHealth

Privia’s business development team has been busy, notching several new partnerships across multiple states.

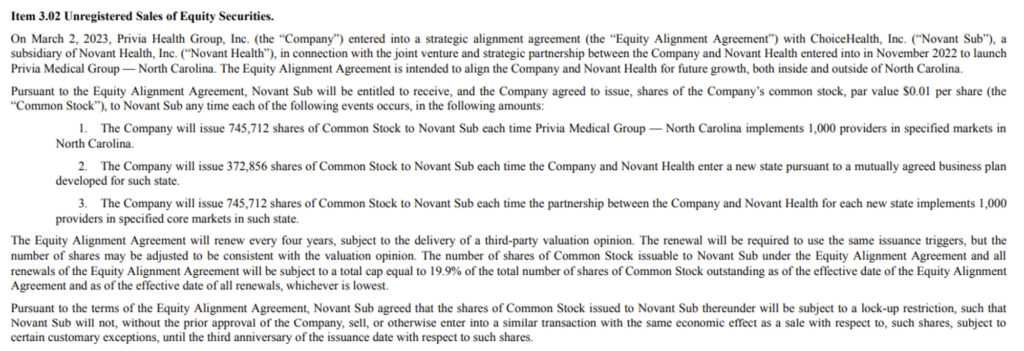

Privia – Novant Health Partnership: in late November 2022, Privia Health announced a robust partnership with Novant Health, in which it’ll create a clinically integrated network, launch Privia Medical Group – North Carolina, and joint venture with Novant Health’s professional corporation Choice Health.

Privia also disclosed some interesting agreement terms related to its joint venture with Novant Health in a recent 8-k filed on March 7. For every 1,000 providers that Novant brings onto the Privia platform, they will be awarded 745,712 shares of Privia’s stock.

Andrew Mok from UBS asked Privia about the equity included in the Novant deal and if this would be the norm for health system JVs moving forward. Privia’s CEO Parth Mehrotra noted that it’d vary by system, but with a significant partnership like the one closed with Novant and the number of providers involved, it made sense to align with equity.

Privia – Beebe Healthcare Partnership: In January 2023, Privia partnered with Beebe in Delaware to launch Privia’s then-ninth ACO with around 12,400 lives and 200 providers – through Privia Care Partners, which is Privia’s ‘lite’ version of its core offering.

Privia – Community Health Group Partnership: In February 2023, Privia announced a partnership with Connecticut based Community Medical Group, the largest clinically integrated network in CT with around 1,100 multi-specialty providers (430 PCPs, 450 clinics), and formed an ACO in conjunction with the partnership. Total patient attribution here included 29,000 Medicare beneficiaries – also through Privia Care Partners.

Privia – OhioHealth Partnership: Finally, in March 2023, Privia partnered with OHHS to launch a medical group for independent physicians throughout the state of Ohio within OHHS’ clinically integrated network and ACO.

Another analyst asked how Privia’s partnership with Surgery Partners in Montana was going. Privia noted that there are expansion talks underway and that the combined partnership provides a compelling value prop to payors: “So I think we’re going to look forward to as we both…bring a very unique offering to our payer partners from a value perspective and how we construct these networks in a multi-specialty medical group with an outpatient facility attached to it. And you can — as you know, you can reduce total cost of care in a pretty meaningful way with those strategies.”

Parth Mehrotra takes the helm as CEO

In early April, Privia also announced a CEO transition from Shawn Morris to President and COO Parth Mehrotra. Fun fact, Parth was one of the first execs I talked to in early June after starting Hospitalogy. He’s been at Privia since 2018 and knows the space like the back of his hand.

Goldman sells its entire Privia stake; Pamplona Capital reduces its stake

Along with the earnings release, Privia also announced a secondary stock offering:

- “Separately, we are very excited and have launched and priced this morning a large secondary offering of the company’s total diluted shares outstanding. This transaction substantially reduces or eliminates Goldman Sachs and Pamplona Capital’s ownership. We are also very excited to welcome a number of new long-term oriented investors, including Durable Capital Partners and Rubicon Founders among others who purchased shares in this transaction.” PRVA Q1 2023 earnings call

Both Pamplona (owning 15.3%) and Goldman (owning 21.5%) were pre-IPO, longstanding Privia investors. Goldman and Pamplona are exiting their investments entirely, paving the way for other institutional funds and mutual funds to build positions in Privia Health, a signal I view as a net positive. To clarify, Privia Health just flipped 35% of its ownership overnight, meaning that investor appetite for the enablement firm is strong.

To add to this, Durable and Rubicon Founders are coming in to the fold, buying up $335M worth of the secondary offering, and I presume the rest will be up for grabs from various other financial players wanting to build stakes in a growing healthcare name. Rubicon Founders also recently invested in Cano Health’s 14% interest loan and partnered with cardiology group U.S. Heart & Vascular to “expand USHV’s capabilities and build the premier, cardiovascular focused, value-based model in the United States.”

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Is Privia thinking about Specialty Care?

On that cardiology note, one of the more interesting analyst questions came from William Blair’s Ryan Daniels who asked Privia about how they’re thinking about specialty care – particularly when it comes to oncology or nephrology. Parth noted that integrated, multi-specialty care is a pointed Privia strategy and prepares the firm well for the next phase of VBC:

- “80% of the cost is downstream from the PCP.”

- “But I think going forward, as we both organically internally as well as through partnerships, you should expect us to look at some of these specialty specific strategies. It will be, again, very disease-specific or specialty specific as you outlined, so — and then geography specific where we have density in lives, and we can make a big impact. But I think it’s a big part of our strategy going forward.”

Bottom line: There’s a reason why we’ll continue to see dense multi-specialty groups form. Healthcare is headed in this direction – just ask Privia, Optum, or VillageMD. Specialty care is where the bulk of the spend sits, and the more that VBC penetrates this area, the more opportunity to lower cost of care and generate big savings returns.

Parting Thoughts: Business as Usual

Privia continues to hit singles in publicly traded healthcare arena. It’s exhibiting solid growth, implementing and retaining providers, succeeding in MSSP and MA capitated arrangements, and has a solid balance sheet in a capital-efficient business model. I’m excited to see which areas Privia chooses to focus with growth, and who partners with Privia in 2023 as the space heats up. More competition enters the arena by the day.