Healthcare M&A and Private Equity State of Play

Recently a host of consulting firms have released reports revolving around valuation, private equity, and M&A activity throughout the healthcare landscape. Being the sicko I am, I read through each of these reports and thought it’d be useful for you guys to parse out some of the key trends and things I found interesting. To read them yourself and join the healthcare sicko community, here are the report links:

- Bain’s Healthcare PE report (Link)

- VMG Healthcare M&A report (Link)

- Weaver Healthcare M&A report (Link)

Let’s dive in!

Join 21,000+ executives and investors from leading healthcare organizations including VillageMD, Privia, and HCA Healthcare, health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Cityblock, Oak Street Health, and Turquoise Health by subscribing here!

2023 = Macro Conditions Dominate Investment Narrative

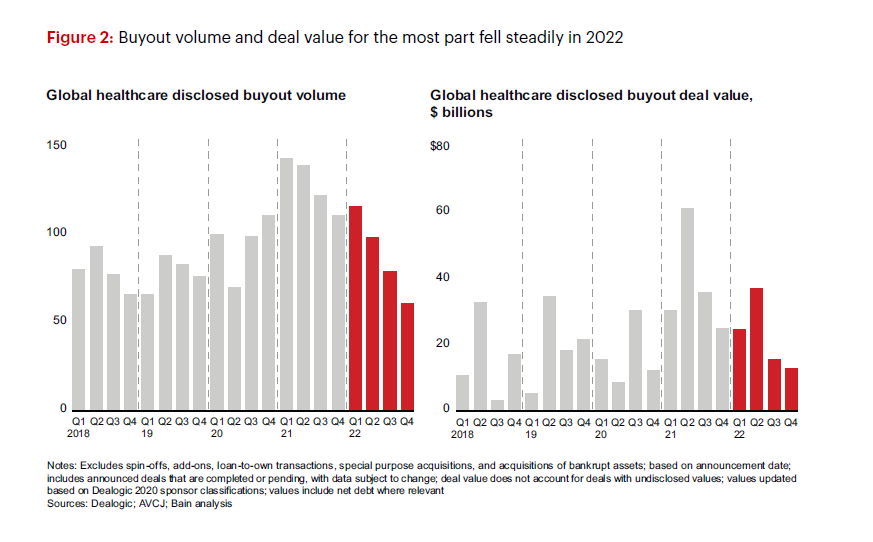

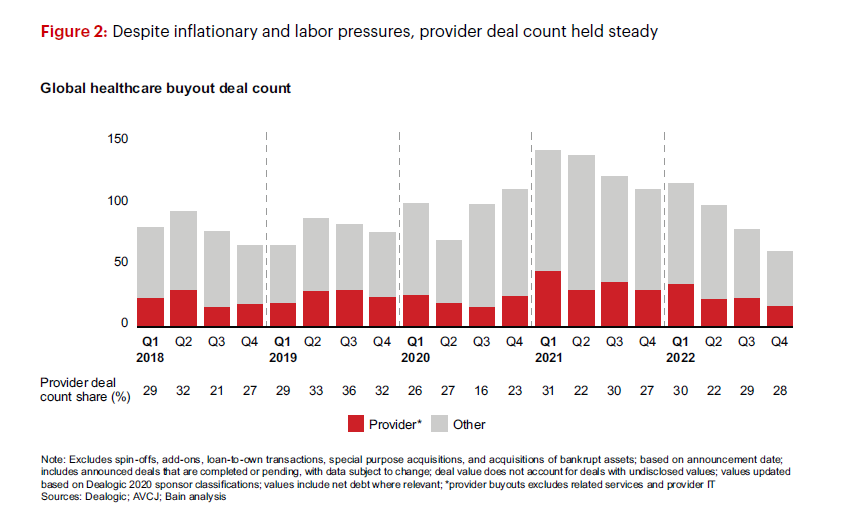

There has been a significant slowdown in investment activity over the course of 2022 and so far into 2023. Deal activity across private equity and venture capital decreased since around the end of the first quarter of 2022.

Since first quarter 2022, we have seen steady quarter-over-quarter decreases in growth-equity deals, capital inflows, and corporate strategic acquisitions across the healthcare sector. – William Blair Research, “Private Market Checkup”

This is a global phenomenon as seen by volume and deal value for healthcare assets worldwide:

Source: Bain & Company Global Healthcare Private Equity and M&A Report 2023

William Blair notes this weakness in a recent research report, attributing the slowdown to broader macroeconomic weakness (labor, inflation, geopolitical uncertainty) resulting in lower investor appetite for speculative and growth assets with little to no profitability:

As an example, the top decile of late-stage VC-backed start-ups—most of which received unicorn-level ($1 billion-plus) valuations throughout 2021—saw their average valuations plummet to $680 million in 2022. – William Blair Research, “Private Market Checkup”

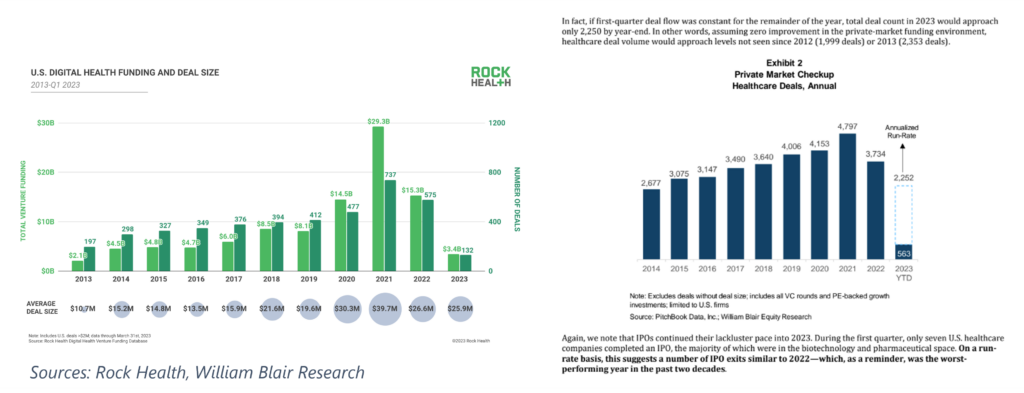

To add to this, the WB team also noted that deal counts for Q1 2023 plummeted – 563 venture capital and PE-backed growth deals in Q1 is the “lowest first quarter deal count since 2011.”

In case you needed any more reinforcement that investors are focused on macro conditions, profitability, and value over speculation and growth: McDonald’s – a recession-resistant staple – just hit its highest valuation ever at 9 times sales. Higher than Google, Tesla, and just shy of Microsoft in terms of valuation. This trend is somewhat counter intuitive. Considering how much emphasis is placed on cash flow in 2023, investors are now valuing McDonald’s like a growth software company. Ironic.

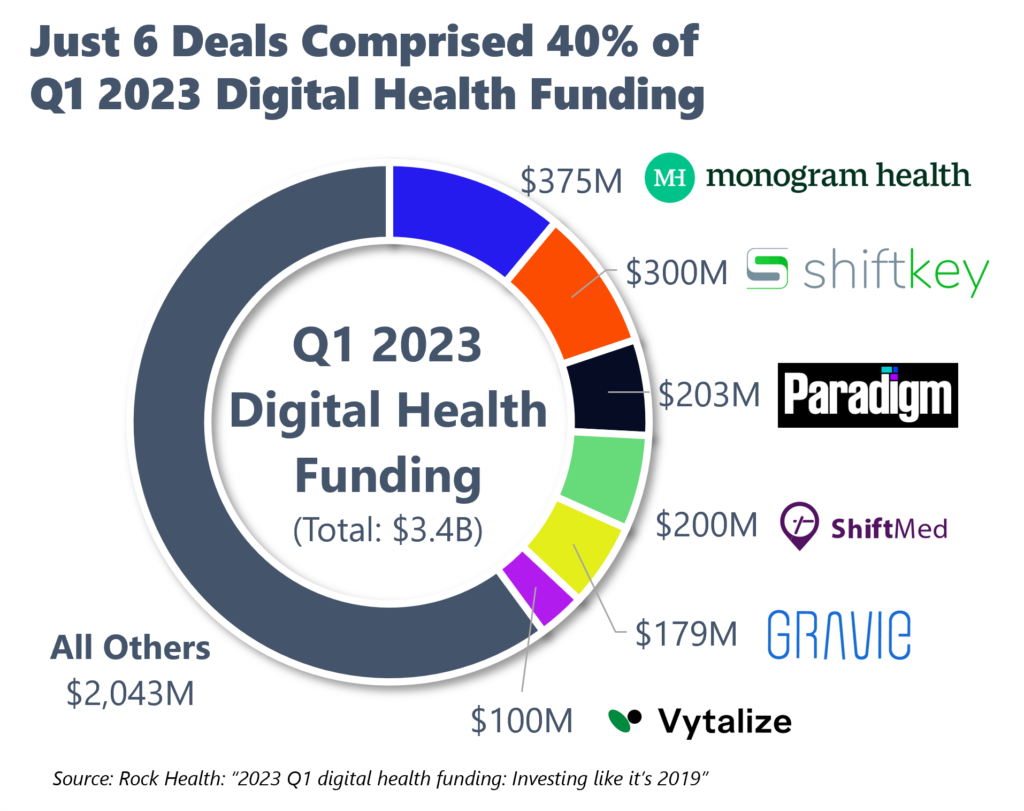

Despite lower total levels of activity, as noted by William Blair and also by Rock Health and others, average deal size has increased. Investors are focused on larger deals, where unit economics make sense and the path to profitability is proven or clear. How will this dynamic play out in healthcare? For one, larger deals dominated Q1 funding as noted in Rock Health’s report:

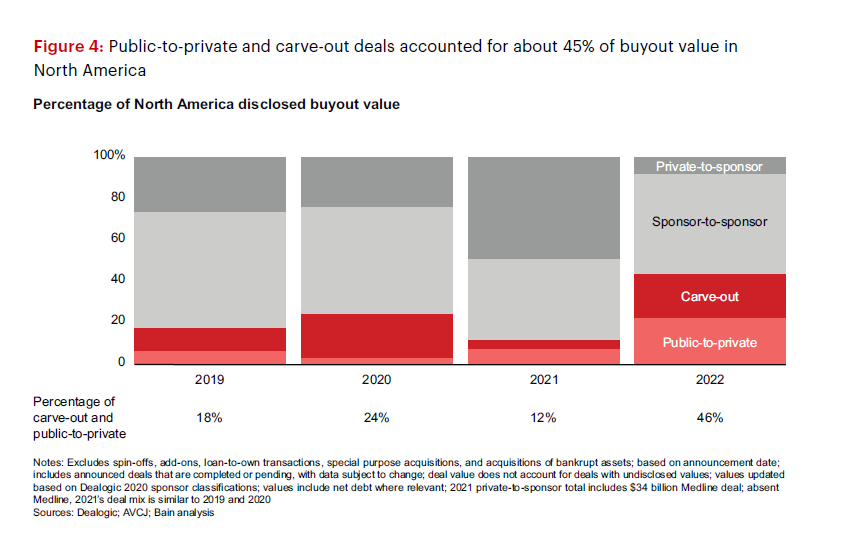

In addition, Bain notes a few interesting shifts in strategy for healthcare private equity investors. including the following:

- More creative deal structures – carve-outs, corporate partnerships, pivot toward smaller deals.

- Focus on what’s working – deploy capital into “category leaders with defendable moats.”

- Performance improvement – identify and improve operational efficiency to improve margins.

- Tuck in acquisitions – “2023 may be the year of tuck-in acquisitions” as PE funds look to enhance the value of their existing portfolio companies.

Funds with conviction in this space, the ability to identify highly differentiated assets, and the expertise to develop a plan for operational excellence will find themselves ahead when favorable economic conditions return. – Bain & Company – “Global Healthcare Private Equity and M&A Report 2023”

We’re in a downturn, but healthcare is recession resistant

So we’ve seen a drop in deal activity. Capital markets are a bit icy. Despite these challenges, healthcare companies will continue to move forward and money will be there for providers:

This is a time where savvy investors with clear theses can separate themselves from the pack. Instead of investing like sheep, funds with strong conviction and focus will find favorable deals and outperform.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Sponsors are seeking out investment themes that play both to long-term trends and are poised to be resilient in a recession.

We’re already seeing this dynamic play out. As Bain notes, funds are much more selective now than they were in the era of free money pre-2022. In particular, investors are moving toward health tech companies that can optimize operations along with innovate various aspects of healthcare delivery & life sciences:

Investors see long-term HCIT opportunity around redefining care delivery and accelerating clinical breakthroughs, and in 2022, there was particular interest in buyouts for businesses that will help optimize operations, especially given the possibility of a recession. – Bain

Since healthcare providers are underinvested in IT in general, there’s a pressing need and opportunity for players in the space. Specific areas of healthcare that Bain called out on the tech side included:

- Workflow management – e.g., patient intake and scheduling, managing labor costs, length of stay management, capacity management, claims resolution, improving EHR integrations, etc.

- Remote & home care – telehealth, hospital at home, remote patient monitoring, readmission prevention

- Revenue cycle management

- Clinical and Life Sciences data

On the services side, Bain noted we should expect to see investments in areas including:

- Specialties that are ‘nondiscretionary’ with solid payor mixes, that include strong commercial and self-pay mix

- Specialties with a secular shift to outpatient and value-based care, including ortho and cardiology

- Medicaid-based services as enrollment in Medicaid increases during a recession (although redeterminations may mess with this thesis)

- Emerging areas including generative AI (and you guys know I love the ambient documentation space as an initial use case for AI)

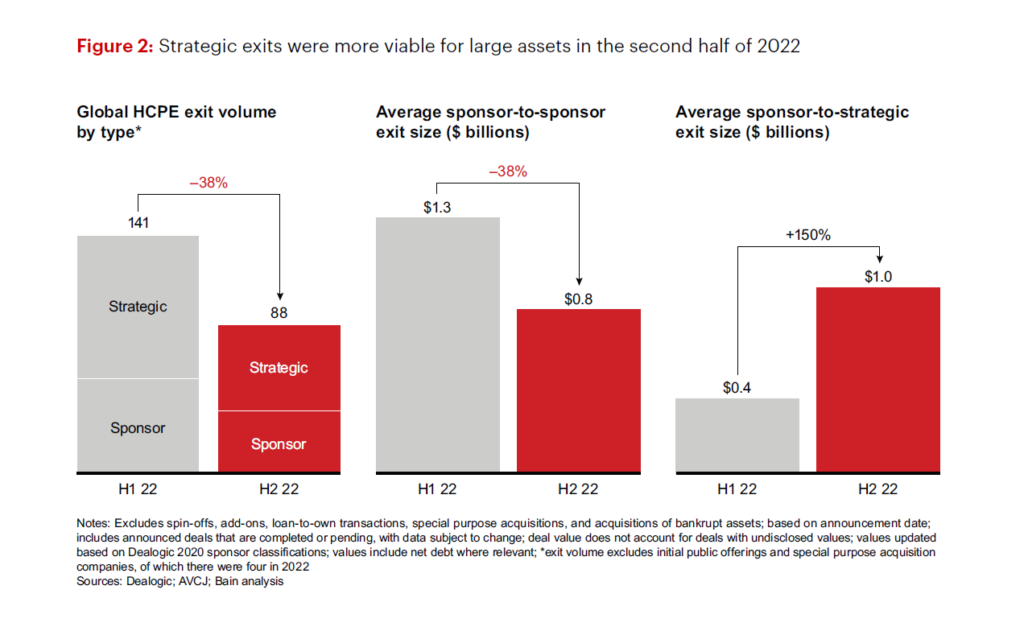

Rise in Strategic Buyers creates more exits for PE, VC

It’s no secret that payors are vertically integrating. I’ve covered it at length in Hospitalogy here, and Bain touches on it as well in its report this year. But because payors are diversifying into healthcare services, administrative services, and IT, this creates more exit opportunities for private equity and venture backed firms.

Within the payer space in 2022, corporate buyers made 3.7 acquisitions for every sponsor buyout. This represents a significant jump from 2021, when corporate buyers made just under 1.6 acquisitions for every sponsor buyout. – Bain

Bain notes an interesting dynamic with the increased involvement of payors in the services industry. It’s a double-edged sword – increased strategic activity creates competition for acquiring assets and therefore bidding wars. But on the other hand, investor-backed players with these assets in hand probably have an easier time of selling or exiting their investments with more buyers in the market. As payvidors form into diversified healthcare behemoths, they’re looking to gobble up everything from physician practice rollups, to behavioral health footprints, to health IT like revenue cycle management or prior auth automation.

…healthcare may be one of the first industries where IPOs return. Sponsor-to-sponsor and sponsor-to-strategic exits remain common. For strategic exits, sponsors should think early about how to best position assets for exit and consider partnering with corporations as coinvestors. – Bain

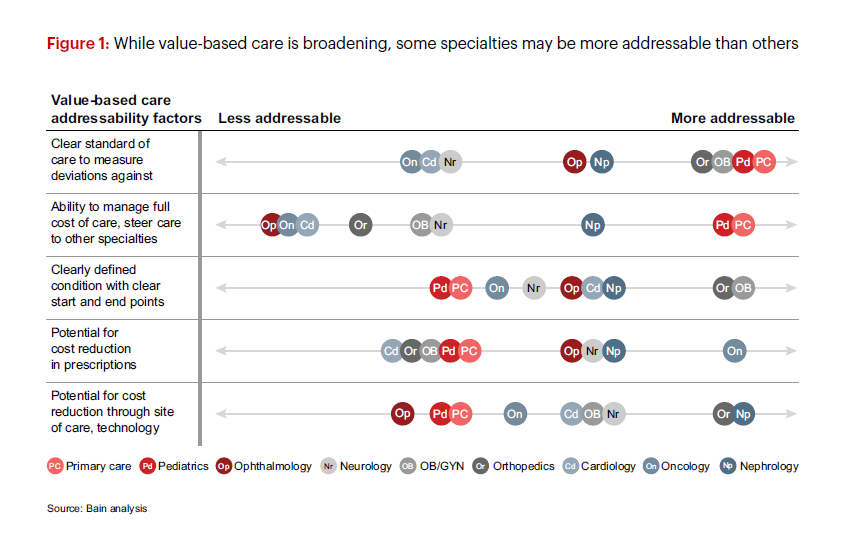

Value-Based Care: Lots of growth available

There is still ample headroom for growth in value-based care adoption in the PCP space. As of 2021, nearly 60% of healthcare payments had at least some linkage to quality and value, but less than 20% incorporated two-sided risk (and capitated models are still under 8% of spending). – Bain

So far, the focus on value-based care (VBC) has been in primary care and Medicare populations, but the next iteration of VBC extends to specialty care. We’ll continue to see growth in specialties with “standardized and time-bound interventions” including orthopedics, cardiology, and OB/GYN. Why do you think there’s so much interest in these areas? And I can recall several specific mentions of these specialties in HCA and Tenet earnings calls over the past couple of years. Keep an eye out also for oncology (and the enhanced oncology model) and nephrology, given that Monogram Health raised $375M in Q1 and there’s been plenty of other activity here.

The main takeaway here is that specialty care holds a ton of investor interest ACROSS all types of investors. Specialists hold a ton of healthcare spend and the opportunity to drive down costs by aligning with physicians in a multispecialty setting is enticing. That being said, there is, and will continue to be, nuance to parse out. As Bain points out in its analysis, there is no one size fits all model for specialty VBC, and investors should allocate dollars toward specialties and models with repeatable, sustainable performance. Not all business models will succeed. Plenty of enablement firms or VBC entrants will fizzle out based on unproven models, but experimentation in general is good for healthcare to drive down total cost of care and improve patient outcomes.

Not only is the VBC machine itself interesting from an investment standpoint, but the VBC infrastructure – the oil required to run population health successfully – will continue to pique investor curiosity.

Investors interested in provider assets that participate directly in VBC models will need to ensure that the businesses they acquire have the right data infrastructure and the appropriate risk models for the population they serve. – Bain

Data players focused on predictive analytics, contract pricing, or patient care management will thrive as the VBC space receives continued investment and policy support.

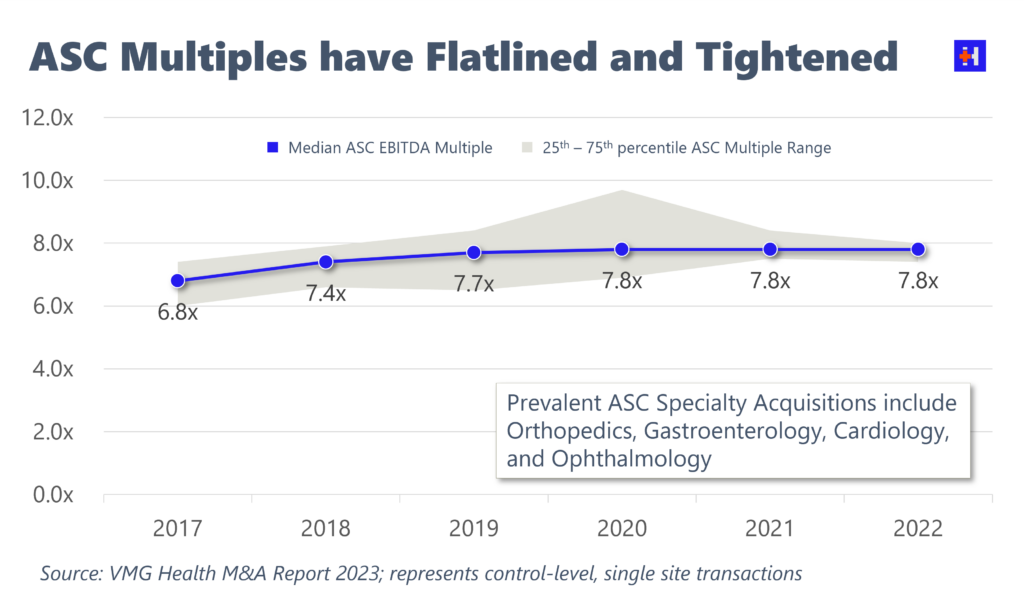

Despite increased demand, ASC multiples have flatlined. However, platforms still command a premium.

Outside of ASC platform acquisitions (e.g., a large ASC management company that holds stakes in several ASCs), VMG Health noted in its report a flatlining of ASC multiples, and a narrowing of multiple ranges:

This dynamic surprised me. All tailwinds in healthcare favor continued use of ASC. For that reason, we’ll continue to see investment and transaction interest from both financial and strategic players. Because of that sustained demand, I would’ve expected to see ASCs creep up a turn or two in multiple. I can think of a few reasons why this isn’t the case, though:

- Labor pressures post-Covid are hamstringing volume growth; ASC capacity and productivity is limited

- Tighter interest rate environment is suppressing valuation (higher discount rate)

- Elective surgeries continue to unwind post-Covid

- Harder to recruit / retain physicians at ASCs given the level of demand and competing forces bidding for physicians

VMG also noted an ongoing shift in private equity (PE) to pursue investment in ASCs outside of a physician practice portfolio company. In years past, PE firms would co-invest a fund in both the physician practice management company AND the ASC. It’s a synergistic investment to own both in the portfolio and capture value through aligning physicians in an owned ASC. (E.g., TPG’s minority investment into Kelsey Seybold, which was subsequently bought by Optum). Now, we’re seeing a divergence where PE firms may be opting to invest in JUST the ASC operations, management company, etc.

Weaver also had some interesting intel on the ASC front. While single-site, control-level ASCs are holding steady on the multiples front, platform-level acquisitions command a significant premium. As Weaver points out, Tenet’s acquisition of SurgCenter Development commanded a 10.8x EBITDA multiple, three turns higher than observed by a single site ASC.

Expect the shift to outpatient surgeries to accelerate. Weaver noted that Surgery Partners has estimated that of the $230B spent on surgical inpatient procedures, $58B (25%) have the potential to shift to outpatient settings. This number is likely to increase as surgical innovations advance. Outmigration of services to the outpatient setting is inevitable. This secular move is a big reason why we’re seeing such demand for physician services M&A. ASCs are stable cash cows.

“The outmigration trend is an extraordinary future growth opportunity for the ASC industry. This trend will lead to higher volume, revenue, and profits for the industry and helps justify elevated transaction multiples in the space.” – Weaver

The need for physician alignment, a fancy way of saying retaining physicians, treating them well, and making sure they’re on the same page has never been more pressing for healthcare organizations’ outpatient ASC strategy.

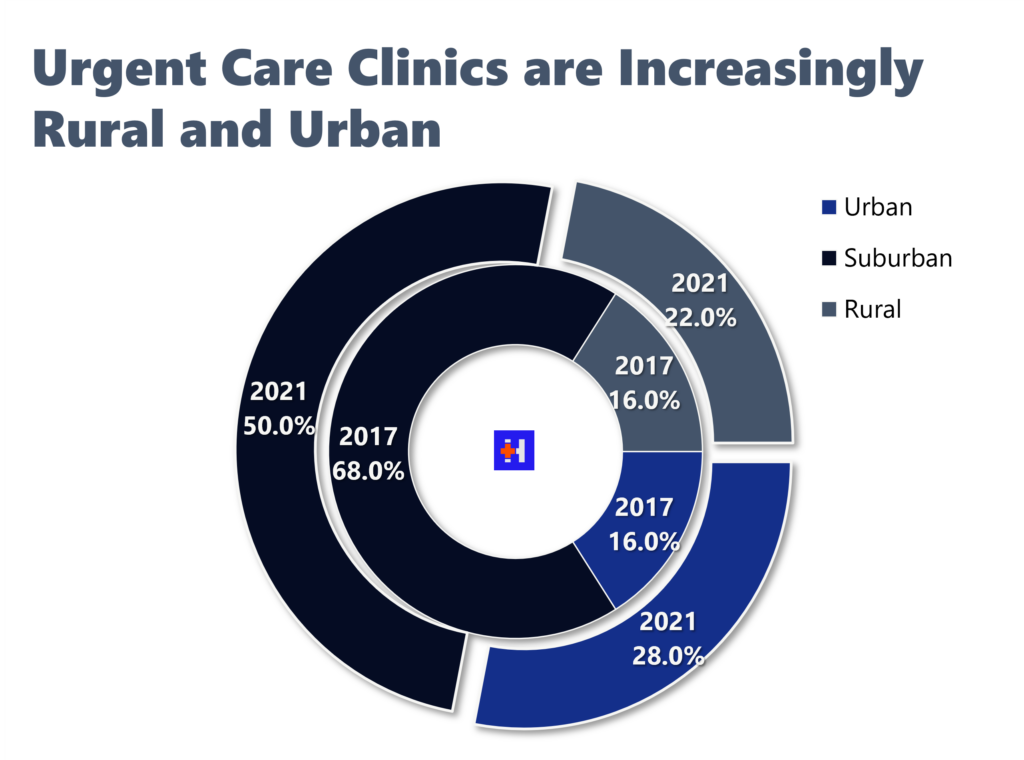

Urgent Care Centers are shifting toward rural and urban markets as suburban landscape faces increased competition

From the VMG report, there’s a clear shift in locations moving toward more urban and rural areas. Historically urgent cares dominated in the suburbs. They still do, but that’s changing as urgent care operators increasingly focus on rural markets.

This shift highlights two potential trends:

- As rural hospitals struggle, there’s an opportunity for urgent cares to fill in the primary care gap for local communities.

- Perhaps suburban markets at this point are saturated with competition. That competition includes other urgent cares, encroachment of emerging retail players, virtual care, and other primary care offerings. As a result, many operators likely looked to other market segments for growth. The 4-year shift from 2017 to 2021 in the location distribution of urgent care centers is substantial:

Urgent cares received outsized benefit from Covid in the form of increased volume and operating as testing sites (free marketing + revenue). As this dynamic unwinds in 2023, how will urgent care operators react? I agree with VMG’s take here: “UCC operators with sophisticated telemedicine capabilities, COVID-19 testing and treatment capabilities, and the ability to adapt to changes in patient visit types will be popular acquisition targets in the future.” CVS’ deal with Carbon Health comes to mind as an operator poised to adapt to near-term trends in consumerism.

Parting Thoughts: When will the Dry Powder ignite?

I think I’ve seen it in every consulting and investor deck out there…”There’s still $x trillion in dry powder out there, Blake! Just waiting to be deployed!” And to add to this, investors still have no problem raising billions of dollars for healthcare funds.

Data from Preqin suggests that firms raised more than $15 billion in new buyout capital for funds where healthcare is the exclusive or core focus, which has happened in only two other years in the last two decades—2019 and 2021. – Bain

Funding and use of capital likely boils down to the banks. Once the interest rate environment stabilizes and banks feel more comfortable to free up liquidity, we should expect to see a more robust deal environment and more activity. That being said, this is the first recession in the era of the Affordable Care Act. How will healthcare react? What will shift? Will we see more willingness for healthcare to evolve more quickly given expense pressures? It’ll be interesting to see how tectonic plates move in healthcare assuming that a sustained recession plays out.

What areas of healthcare are you watching? If you’re an investor, what are you paying attention to? What did you take away from these reports that I didn’t?

Feel free to reach out to me with your thoughts!

That’s it for this week! Join 21,000+ executives and investors from leading healthcare organizations including VillageMD, Privia, and HCA Healthcare, health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Cityblock, Oak Street Health, and Turquoise Health by subscribing here!