Today will be an abbreviated newsletter with some tidbits I’m picking up at ViVE combined with interesting news stories this week. I’ll be back to regular scheduling next week!

If you’re around ViVE, let’s connect.

Join 20,000+ executives and investors from leading healthcare organizations including VillageMD, Privia, and HCA Healthcare, health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Cityblock, Oak Street Health, and Turquoise Health by subscribing here!

Headlines this week

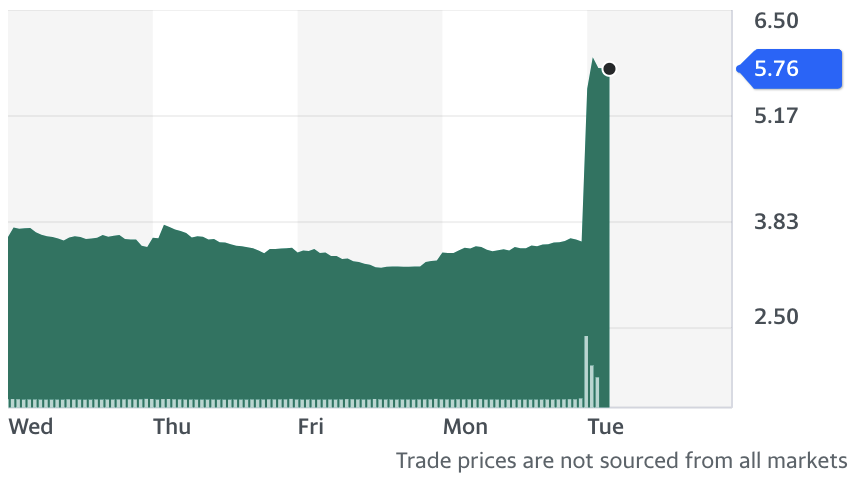

Oscar goes old school CEO: Today Oscar Health announced that Mario Schlosser is transitioning to President of Technology at Oscar. Who’s replacing him as CEO? Mark Bertolini. If that name sounds familiar, it’s because he’s the former CEO of Aetna, which sold to CVS for $69B in 2018 which begs the question…might we see Oscar prep for a sale? Something to keep an eye on, especially as Oscar shares skyrocketed 60+% as of this writing. Can’t wait to write about Oscar’s sale in 12-18 months! (Oscar)

Mindstrong sells off for parts: Sondermind has acquired Mindstrong’s remaining tech assets for an undisclosed sum. The deal comes after 6 years of operation for the mental health player. From the Modern Healthcare exclusive:

- Mindstrong was founded in 2017 by Dr. Tom Insel, former director of the National Institute of Mental Health, and in its six years received $160 million in funding from venture capital firms such as General Catalyst and ARCH Venture Partners. Started as a company that would use biomarkers to detect mental health conditions, it evolved to treat mental health through smartphone-based therapy and other services. (Modern Healthcare)

Oak Street Health partners with InterWell: Oak Street and InterWell are forming a JV, officially launching OakWell. The partnership plans to integrate primary care to end-stage renal disease patients directly in the dialysis clinic. This deal makes a lot of sense when you consider that dialysis patients on average spend around 12 hours in the clinic and very often have other chronic, complex conditions that Oak Street can leverage to improve patient care while boosting the bottom line. Looks like InterWell has contributed centers in Chicago, DFW, and Houston.

- “When patients have urgent needs and aren’t currently in a dialysis center, providers will conduct video visits and provide other support to make sure patients stay healthy and out of the hospital. Additional services such as behavioral health and renal pharmacy support will provide complete, wraparound care. OakWell care teams will also support coordination of kidney transplants when possible.” (Press Release)

North Carolina officially expands Medicaid: Along with expanding Medicaid to 600,000 new North Carolina residents, North Carolina also repealed parts of its Certificate of Need program including CON requirements for ambulatory surgery centers, behavioral beds, and capital expenditures up to $3 million in equipment replacement value. After North Carolina, there are 10 states left who have not expanded Medicaid. The North Carolina bill goes into effect starting in 2024, at which point the federal government will foot 90% of the expansion bill with hospitals forking over the other 10% to fund the program. Interestingly, to muddy the waters a bit more, the CON repeal only applies for the 23 largest counties likely to preserve & bolster rural hospital operations. Regardless, expect to see investment flood into ASCs and mental health facilities with the CON lift.

ViVE updates

AI is the new Web3: ViVE is absolutely buzzing about artificial intelligence use cases in healthcare. First it was web3; now it’s A.I. The only difference being that A.I. is actually useful and real tools are being developed across a smorgasbord of use cases (revenue cycle management automation, prior auth automation,

B2B dominating the booths: From what I’ve heard from folks, not too many DTC players at ViVE this year. Many players here and talk in general seems to be focused on hospital cost containment solutions and revenue generation, in line with my newsletter a couple weeks ago on this subject. Some examples of random companies I talked to:

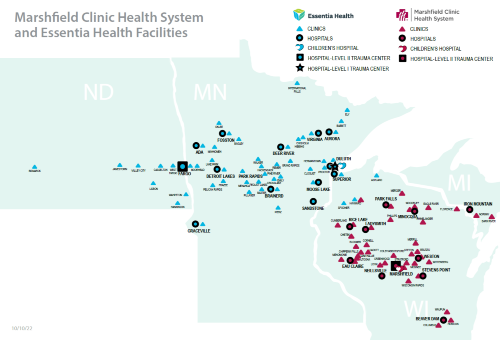

- Medical scribes are getting a ton of buzz (Abridge, Augmedix, Ambience, Nuance, Notable) and are competing in competitive bid processes across the hospital landscape. In fact, Notable just won a bid to deploy its solution system wide at Marshfield Clinic Health System, which announced a potential merger with Essentia in late 2022 – that’s 3,800 providers potentially powered by Notable).

- Virtual nursing assistants like AvaSure that works with over 1,000 hospitals and reduces burden on nurses from a documentation and observation perspective

- Call center infrastructure like Parlance that uses AI and improved call experience for patients while alleviating burnout and churn for call center agents

- Specialized operators like Biofourmis who are helping enable hospital at home, SNF at home, and optimize reduction of readmissions in hospitals

From my perspective, I was expecting to see more health systems on the floor. I know it’s not necessarily their cup of tea, but I would’ve loved to have more conversations with health system folks considering there seems to be a lot of need for outsourcing and expense management. I had a great conversation with the Intermountain folks here. All in all, this first conference experience has been great so far and I’m looking forward to the conversations, panels, and networking today. There are conversations and inside baseball dynamics you learn through in person discussions are better than any intel I might get over Zoom.

That’s it for this week! Join 20,000+ executives and investors from leading healthcare organizations including VillageMD, Privia, and HCA Healthcare, health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Cityblock, Oak Street Health, and Turquoise Health by subscribing here!