Welcome back to another Hospitalogy. We’re nearing the last call on SXSW applications. If you’re in Austin on March 12 evening, come register for the event here: Event Registration

See ya there!

Join 18,800+ executives and investors from leading healthcare organizations including Privia, ApolloMed, and HCA Healthcare, health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Cityblock, Oak Street Health, and Turquoise Health by subscribing here!

North Carolina reaches agreement to Medicaid, Repeal CON Laws

On March 2, North Carolina lawmakers reached an agreement to expand Medicaid to 600,000 additional individuals. According to AP, the agreement won’t be voted on til later in March at the earliest, but if passed, North Carolina would start providing expanded coverage to citizens starting in 2024.

Just as notable is the decision to reverse much of North Carolina’s very stringent Certificate of Need (CON) laws. The state holds some of the strictest restrictions around new healthcare investment and facility development in the state. As part of the bill, much of the CON would be repealed in areas including imaging centers, ASCs and other outpatient facilities (although hospital bed-based CONs will likely remain). Repeal of the CON will result in investment entering North Carolina – renovating outdated facilities and introducing competition to the market. For instance, when Florida lifted its CON on specialty hospitals, post-acute players like Encompass flooded the space with inpatient rehabilitation development plans. Expect a similar gold rush land grab in North Carolina if these changes go through.

Biggest losers in CON repeal are likely to be small to mid-sized health systems situated in rural areas. Expect to see the bigger players move in on previously uncontested territories.

UnityPoint, Presbyterian announce merger intent

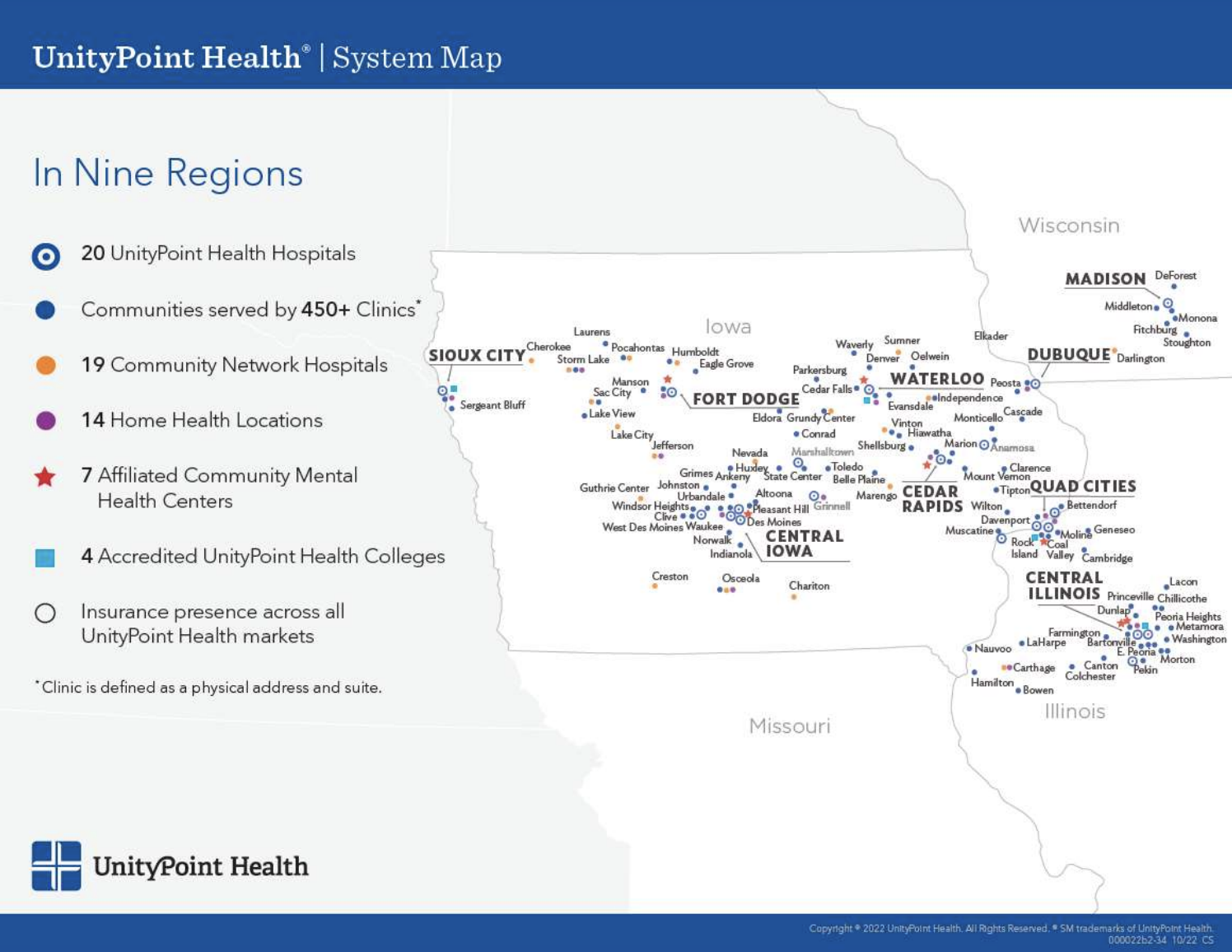

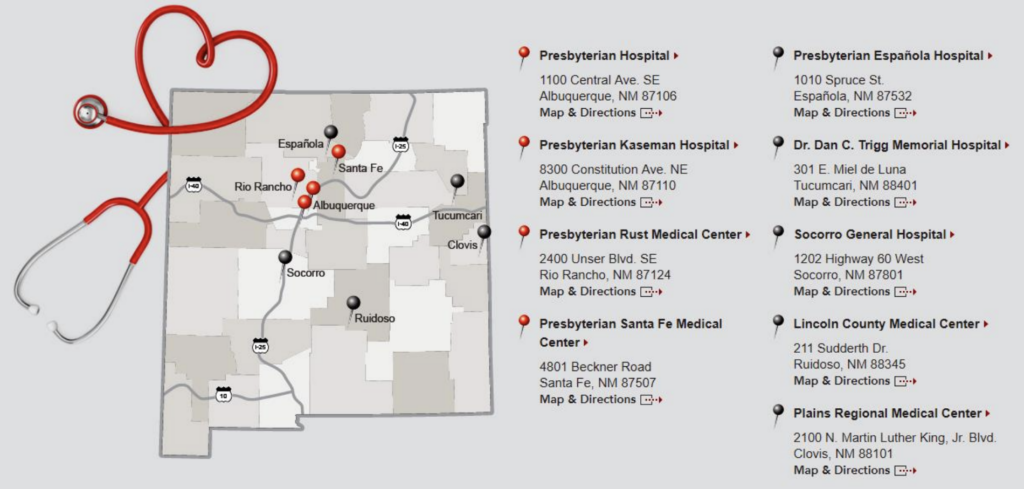

The hospital cross-market mega mergers continue. Des Moines based UnityPoint and New Mexico based Presbyterian Health announced their intention to merge in what would create a system with $11 billion in annual revenue and a footprint including 40 hospitals, hundreds of clinics, 40k FTEs, 3k providers, and more. The structure is similar to Advocate-Atrium in the sense that the two health systems would layer on a joint operating company (JOC) on top of existing operations.

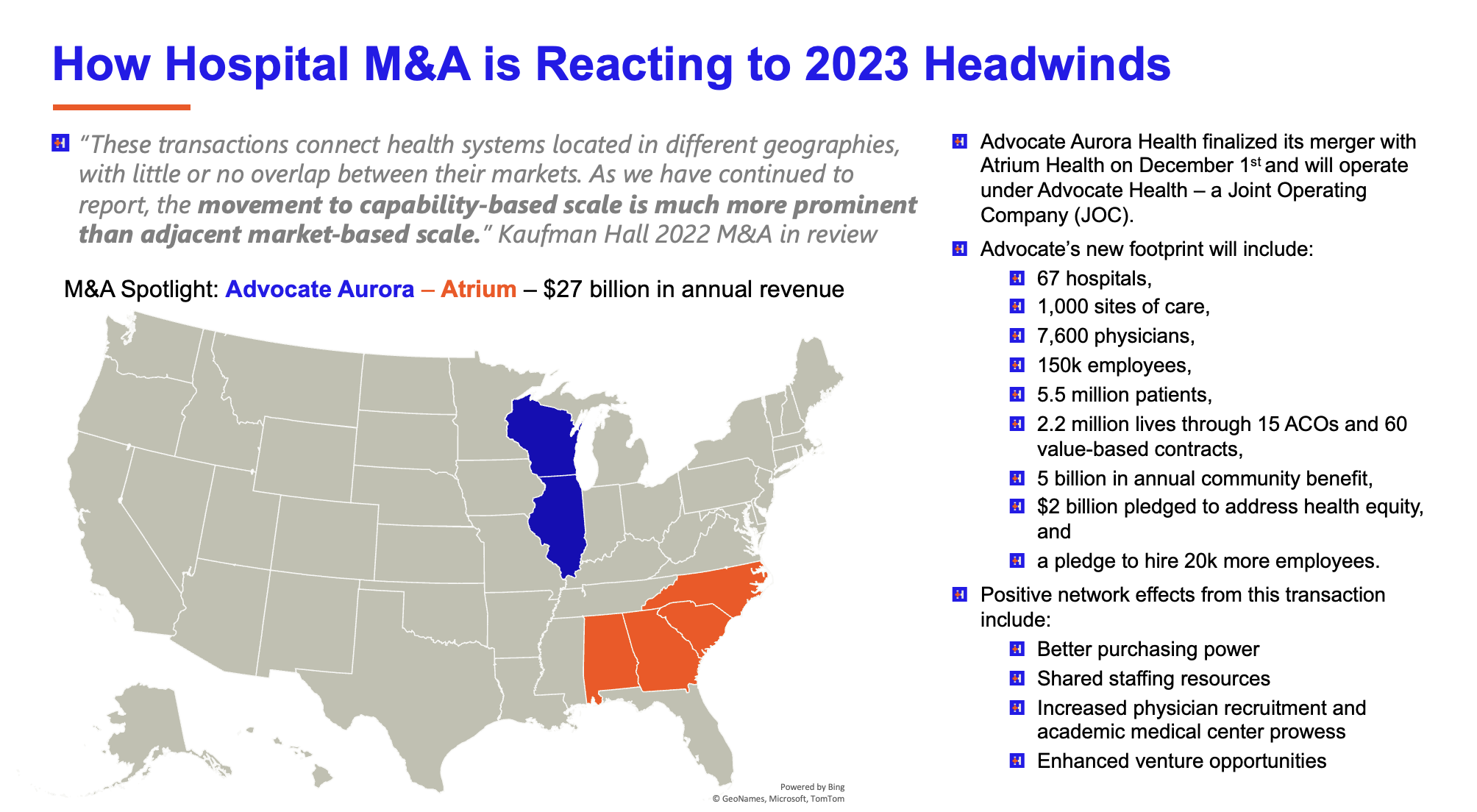

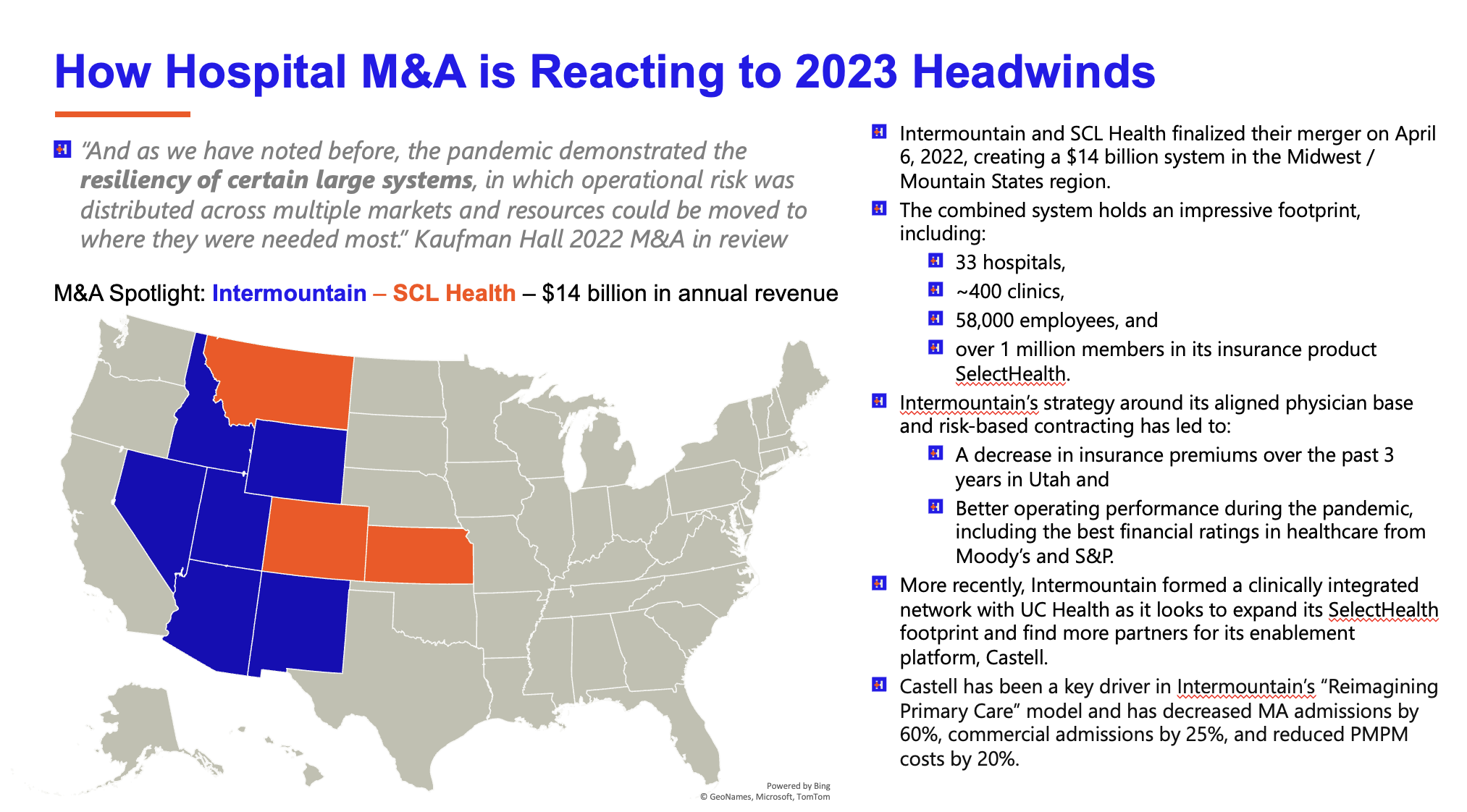

Between Atrium-Advocate, Intermountain-SCL, potentially Fairview-Sanford, and now UnityPoint-Presby, the regional supergiant health systems of tomorrow are forming. Hospitals are coming off their worst financial performance in recent memory in 2022, and labor headwinds are strong. In lieu of more local market power, health systems are pursuing these mergers to capitalize on capability-based scale.

Given general hospital challenges, decline in inpatient discharges, and recent activity from MercyOne in and around the Iowa market (e.g., Trinity acquiring full control of MercyOne, then MercyOne acquiring Genesis Health System in recent weeks), UnityPoint must have been feeling some pressure for a while now. It failed to merge with Sanford in 2019. In November 2022, UnityPoint spun off 3 hospitals and associated clinics from its Central Illinois division to Carle Health. Affiliating with Presbyterian helps UnityPoint diversify further while helping to bolster its labor and supply chain shortfalls. Side note: I have to imagine that cross-market JOC integration is an absolute governance nightmare.

Partnerships and Strategy Updates:

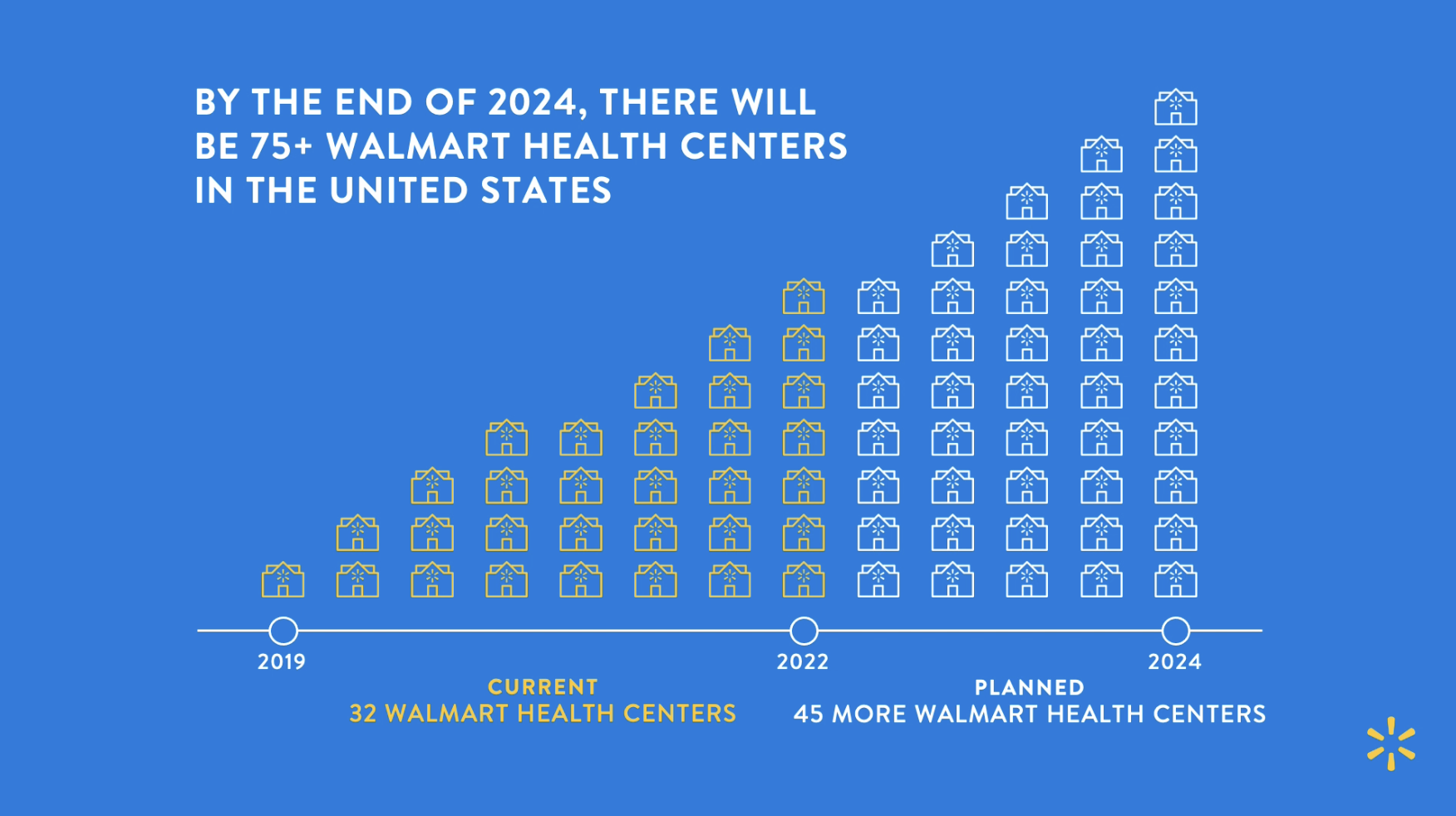

Walmart Health announced a significant expansion of its centers. By 2024, Walmart aims to have more than 75 clinics and will tack on two more states – Missouri and Arizona. New center composition and location (Walmart):

- 10 locations in Dallas metro area

- 8 locations in Houston metro area

- 6 locations in Phoenix metro area

- 4 locations in Kansas City, MO, metro area

Signify Health partnered with Cardinal Health, allowing Signify clinicians performing in-home assessments to use Cardinal Health’s OutcomesOne platform to check and see whether Medicare patients are adhering to their medications. (Signify)

agilon affiliated with Family Practice Center, Central Pennsylvania’s largest independent primary care group including 160+ providers, 200k patients, and 42 locations across the state. Starting in 2024, agilon will work with FPC to transition the primary care providers to full risk models. (agilon)

GE Healthcare and Advantus Health partners announced a 10-year, $760M contract to provide GE’s health tech management services to Advantus clients. (Press Release)

Finance and M&A Updates:

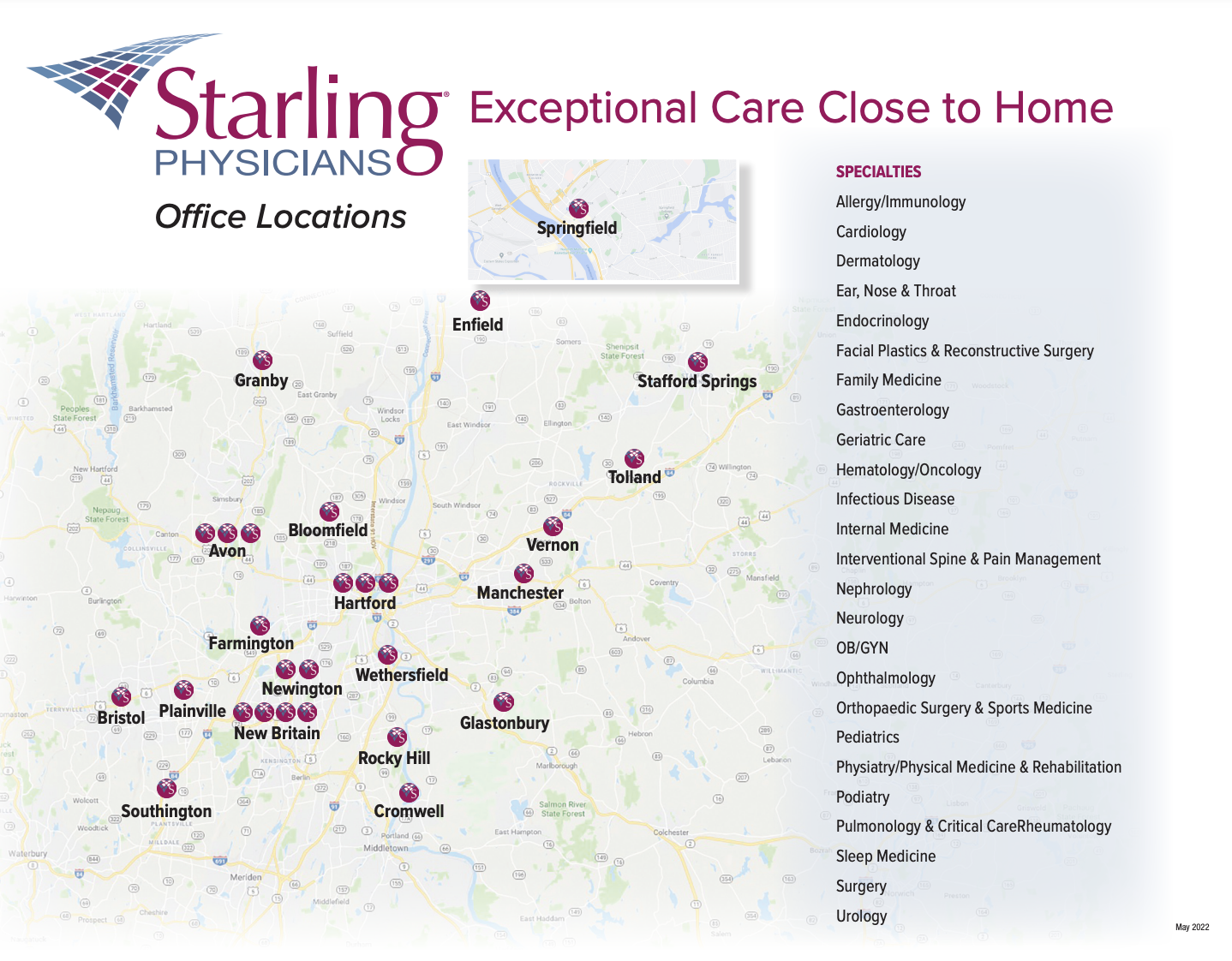

VillageMD acquired a substantial platform, multispecialty physician group in Connecticut. Starling Physicians operates over 30 locations with ~30 specialties, 150+ physicians, 60+ APPs, and delivers care to 200,000+ patients annually along with lab and infusion centers. Along with the Summit acquisition, VillageMD is developing a formidable footprint throughout the Northeast – New York, New Jersey, Connecticut. (Press Release)

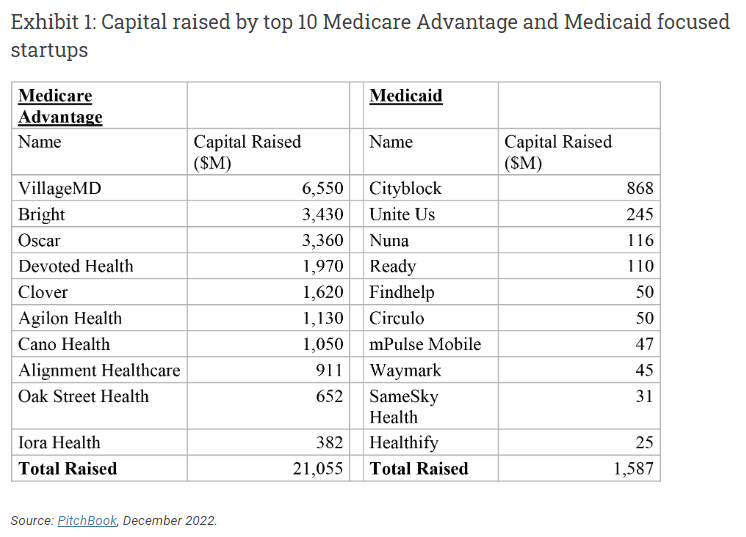

This was a good read from Health Affairs on capital (I believe private capital) raised from MA and Medicaid startups, and ways to change care delivery in Medicaid to improve patient outcomes. (Health Affairs)

CD&R-backed Gentiva acquired ProMedica’s home care and hospice assets for $710M (HHCN)

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

LifePoint Health acquired four inpatient rehabilitation facilities from Everest Rehabilitation in Texas, Arkansas, and Ohio. (Press Release)

Bright Health noted severe liquidity concerns in its full year 2022 earnings release. “Bright’s Q4 financial report was full of bad news. I would go into specifics but it is indecipherable. We do know they lost $1.5 billion for the year, ended last week with only $150 million of parent cash, and are in breach of their credit facility, even after raising $175 million in October.” – Ari Gottlieb (Bright)

Digital Health and Startup Updates:

Mental health startup Headway is expected to raise $100M in a new funding round valuing the company at over $1B. (Bloomberg)

WeightWatchers acquired Sequence, a telehealth platform designed for clinical weight management. Excluding $26M in cash, it’s a $106M purchase price and a 4.24x multiple on Sequence ARR of $25 million, or 4,400 per member assuming 24,000 members. Sequence offers a $99/year subscription for its services and just started operating in 2021 which makes me question whether WW could’ve saved the hundred mil and spun up its own telehealth offering with how easy it seems to be these days and WW’s 3.5M members. That being said, it appears Sequence was cash-flow positive after 2 short years, so there must be some secret sauce here. Obesity as a complex chronic disease is quickly becoming the latest emerging market in DTC healthcare. And with these weight loss drugs coming online, it’s turning into the wild west of healthcare. Meanwhile the Chief Clinical Officer of Ro is penning an op-ed on weight loss medication because of course. Continue to keep an eye on DTC telehealth and obesity medication in the news cycle because it’s for sure not gonna end well. There is, of course, way more nuance going on in this issue than I have space for in a Tuesday newsletter. (WW)

Transcarent acquired assets from 98point6 including an ‘AI enabled’ virtual care platform, associated medical group, and the self-insured employer business. The deal is valued at or around $100M according to the report, and Transcarent will now employ around 150 physicians and was valued at $1.6B in early 2022. Transcarent now holds contracts with around 200 employers. (Forbes)

A long, eye popping read about Leda Health – Leda Hell — How A $9 Mill.+ Survivor Led Company Became More Traumatizing For Me Than Sexual Assault Itself (Medium)(Thread)

BetterHelp settled with the FTC for $7.8M over patient data sharing practices. BetterHelp is now banned from sharing consumer data with firms like Snapchat and Facebook. This news comes on the heels of a $1.5M fine for GoodRx and its data sharing practices with third parties and continues the trend of regulatory authorities cracking down on patient data usage in healthcare. Health tech operators need to tighten up those privacy policies fam. (HCD)

Policy and Payment Updates:

So here’s an interesting development in retail pharmacy. Governor Newsom said that the state of California ‘won’t do business’ with Walgreens after the company stated it would not sell abortion pills in 21 states due to restrictions on the drug. (CNBC)

Costs, Data, and Other Updates:

Same patient, same drug, same insurer — coverage denied (Stat)

Trust in the US healthcare system is decaying – “Of all health economy stakeholders, health insurance companies have long engendered the least amount of trust from consumers, with fewer than 20% of Americans trusting health plans. However, consumer trust in physicians and hospitals deteriorated more than any other part of the healthcare system during the pandemic, declining 23% and 21%, respectively, from April 2020 to December 2021.” (Trilliant)

Eli Lilly lowered the price of its insulin to match the Medicare part D cap of $35/month. (Axios)

Whitepapers and Resources

Rock Health posted its excellent overview of consumer adoption of digital health in 2022. “In our 2022 Survey, 80% of all respondents reported having accessed care via telemedicine at some point in their lives, up 8pp from 72% in 2021. While telemedicine use continues to vary across demographic segments, 2022 saw notable adoption increases among groups that have long been underserved within healthcare.” (Rockhealth)

Pitchbook released an update for subscribers on Healthcare IT trends including a snapshot of the changing funding environment and of the light at the end of the bear market tunnel. (Pitchbook)

Here’s an interesting read from JLL on the growth in demand for outpatient services and how this sets the stage for the stability of medical office assets. (JLL)

Value-Based Health Care at an Inflection Point: A Global Agenda for the Next Decade (NEJM)

Hospitalogy Top Reads

- Woodside Capital Partners released its excellent quarterly overview of health tech capital markets. Download it here.

- ICYMI: I wrote an essay on the physician-owned hospital debate. On Thursday, I’ll be sharing opinions from subscribers on the issue including a full guest post from Dr. Benjamin Schwartz. If you have any thoughts or opinions on the piece feel free to respond to this e-mail or shoot me a message at [email protected]. (Hospitalogy)

- Hal Andrews shared a great read on pricing opacity – It’s All About the Rate (Trilliant)

- Everything you think you know about homelessness is wrong (Noahpinion)

That’s it for this week! Join 18,800+ executives and investors from leading healthcare organizations including Privia, ApolloMed, and HCA Healthcare, health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Cityblock, Oak Street Health, and Turquoise Health by subscribing here!