Happy Tuesday,

As I’m prepping for the Hospitalogy webinar at 11 today, here’s a light overview of one of the topics we’re covering – the state of hospitals in 2023.

See you at 11!

Join 18,000+ executives and investors from leading healthcare organizations including Privia, ApolloMed, and HCA Healthcare, health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Cityblock, Oak Street Health, and Turquoise Health by subscribing here!

| Join the first ever Hospitalogy Virtual Panel Thursday 2/16 at 11am CT |

| The first Hospitalogy panel is this week on Thursday – history in the making! Join the panel to hear from Herd Midkiff and Kyle Kirkpatrick, healthcare experts and partners at JTaylor with a combined 40+ years of experience. It’s gonna be a fun discussion! During the panel, we’ll cover interesting topics like: – Vertical integration emerging as the dominant payor strategy; – Hospital headwinds and current dynamics facing providers; and – How hospital M&A is changing in light of the above trends Sign up below – the panel is in 2 days, on February 16th at 11am CT! Save your Seat |

1. Health System M&A is evolving.

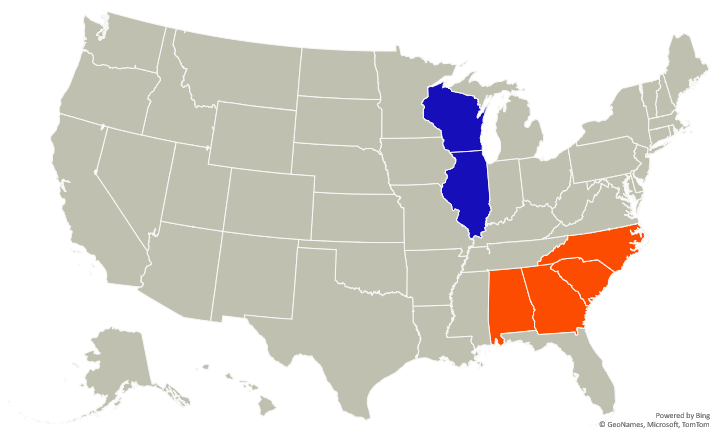

Health system M&A is evolving in the face of increased cost pressures and revenue headwinds. The above graph represents Atrium Health’s 2022 merger with Advocate-Aurora. You might be asking yourself “how the heck is this thing gonna work? There’s no geographic overlap or real rate play here.”

Like I touched on in new-age health system M&A in June 2022, health system merger strategy is shifting. Kaufman Hall repeated this sentiment in its 2022 hospital M&A year in review. Strategy is shifting to capability-based scales, including shared resources and labor, better purchasing power, and expanded academic medical center services across new markets:

“These transactions connect health systems located in different geographies, with little or no overlap between their markets. As we have continued to report, the movement to capability-based scale is much more prominent than adjacent market based scale. A key element of these mergers is geographic diversity, spreading the combined organization’s operating risks across multiple markets and different market types (e.g., urban vs. rural). But other strategies can come into play: expanding access to an academic medical center’s specialty services to new markets, for example, or creating a mixture of diverse market “laboratories” in which new innovations can be tested against different demographics.” Kaufman Hall

Importantly, these mergers escape antitrust scrutiny as well. North Carolina said its hands were tied – e.g., no legal basis – when it came to merger review.

“A benefit of cross-market mergers is that they do not actually change the competitive structure of the markets involved in the merger—there is no increase in the concentration of local hospitals or health systems, an increasingly important feature considering the current regulatory landscape.” Kaufman Hall

Resources on hospital M&A:

- Kaufman Hall 2022 Hospital M&A Year in Review (KF)

- Characteristics of Hospitals Undergoing Mergers and Acquisitions (Avalere)

- 2022: Year of the Cross-Market Mega Merger (Hospitalogy)

- New-age Health System mergers (Hospitalogy)

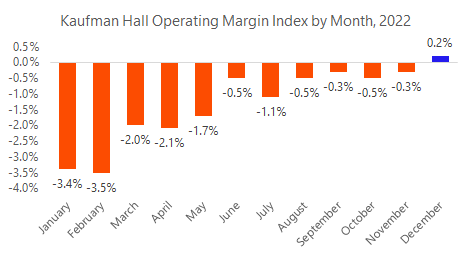

2. Health systems had a bad financial year 2022

While well-capitalized, top performers will fare better and bounce back in 2023, small to mid-sized health systems – especially rural hospital operators – will struggle with the same labor & supply chain issues from 2022. If you’re not named HCA with 50% of your hospital portfolio in growing populations and strong employer markets – Florida and Texas – you are likely still dealing with reimbursement challenges, feeling the squeeze on physician subsidies, and struggling to staff beds. Will we see hospitals unroll and ‘de-consolidate’ physician employment this year?

Resources on hospital financial performance:

- National Hospital Flash Report: January 2023 (KF)

- What HCA Healthcare is telling us about healthcare in 2023. (Hospitalogy)

- The sobering state of hospital finances (KF)

- The Weekly Gist: The Catch the Superb Owl Edition (Gist)

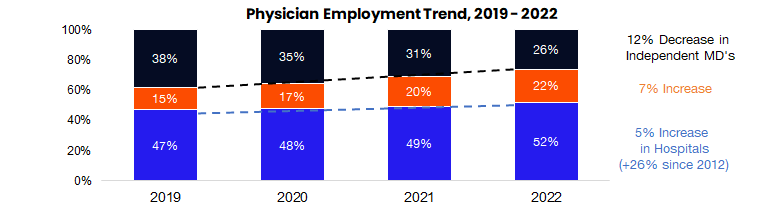

3. Physician Employment seems to be nearing max hospital capacity

The graphic above depicts the growth of hospital-employed physicians (blue), corporate-employed physicians (orange), and the remaining independent physician base (black). In addition to Gist Healthcare’s commentary in its latest newsletter, I’ve had several conversations lately with industry folks asking about physician employment dynamics in hospitals. Bottom line, the hospital subsidy for physicians seems to be on increasingly shaky ground as reimbursements decline relative to inflation, payor mix deteriorates, things move outpatient, and costs squeeze margin.

My hypothesis from this point is that, while there won’t be a collapse like the 90s PPMs, the pendulum will gradually swing back to private practice and other forms of partnerships. Of course, young physicians will still likely want to stay in hospitals early in their career. But a comment from someone I met with this week stuck with me related to physician employment dynamics: “There’s something magical about private practice and the entrepreneurial spirit of the physician.” In my view, we should be doing everything we can to push that dynamic forward and that means supporting business models that lift up physician independence, a model that is proven to be commercially viable.

Resources on physician market dynamics:

- PAI-Avalere Health Report on Trends in Physician Employment and Acquisitions of Medical Practices: 2019-2021 (PAI)

- The death and life of the private practice physician (Healthcare Huddle)

- The future of physician employment and the physician practice (Hospitalogy)

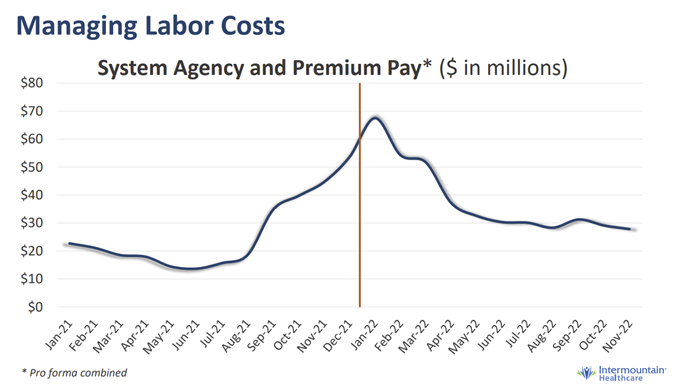

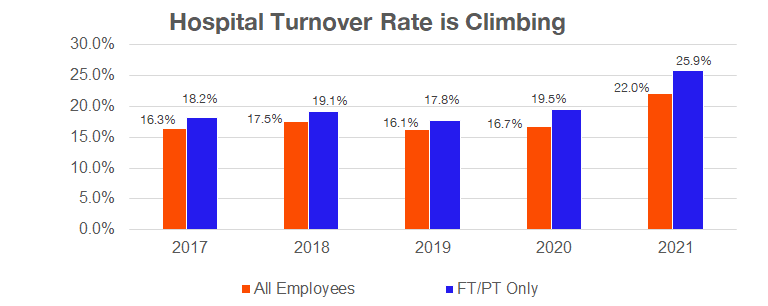

4. Labor dynamics are health system leaders’ top concern in 2023

According to the American College of Healthcare Executives (very on-brand name), hospital exec’s top concerns for 2023 are once again workforce challenges and personnel shortages. It’s no secret at this point that clinical recruitment and retention efforts are of utmost importance to hospital strategy, along with listening to clinicians, bumps in pay, and burnout prevention measures. Many states are also considering implementing mandatory nurse-to-bed staffing ratios, while recent nursing strikes agreements have items like guaranteed PTO and mandatory ratios baked in as table stakes.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Also notable – travel nursing and contract nursing costs, as illustrated by Intermountain’s agency & premium pay trend seen above, is above historical norms and looks to be stuck there for good. Given the ever-present conflict here between clinical personnel and hospital admin – coupled with increased investment in staffing agencies across the country – will we see a more pronounced shift to agency pay over the coming years? Just an interesting trend to keep an eye on.

Resources on hospital labor dynamics:

- Survey: Workforce Challenges Cited by CEOs as Top Issue Confronting Hospitals in 2022 (ACHE)

That’s it for this week! Join 18,000+ executives and investors from leading healthcare organizations including HCA, CVS, and OneOncology, nonprofit health systems including Providence, CommonSpirit, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!