04 February 2023 | FinTech

The Past, Present, & Future of Big Bank Consortiums

By Alex Johnson

In last week’s essay – Big Banks’ Next Big Bet – I wrote about Early Warning Services’ plans to launch a digital wallet to help its owner banks (EWS is owned by a consortium of seven large U.S. banks) compete with PayPal and Apple.

The focus of the essay was narrow – will Belle (I named EWS’s forthcoming digital wallet Belle) succeed?

But there’s a broader question that I’m even more interested in – what is the future of big bank consortiums?

That question is the focus of today’s essay.

What are consortiums, and why do banks create them?

We should start by trying to understand what consortiums are and why they are such a common sight in banking.

A consortium is an association of two or more organizations brought together for the purpose of achieving a common goal through cooperation and the pooling of resources. A consortium can be a non-profit (like the Five Colleges in Massachusetts), but it doesn’t have to be. It differs from a trade association in that its primary purpose is usually something other than public relations and lobbying.

Put simply; consortiums exist to solve problems through cooperation that individual organizations, in the normal course of competing with each other, would not be able to solve.

Consortiums are an emergent property in financial services.

Take payments as an example.

In the early 1850s (immediately after the California gold rush), the demand for banking and money movement exploded. The number of banks in New York City more than doubled, and the process of moving funds between banks became a tangled mess. Bank employees would walk across the city multiple times per day, carrying boxes of checks to other banks and exchanging them for equivalent boxes of gold coins. The settlement of accounts happened once a week (Fridays), and the settlement process was rife with errors and abuses. In 1853, the New York Clearing House was created to fix the problem. That year, in the basement of a Wall Street bank, 52 banks participated in the first transaction, exchanging checks worth $22.6 million.

Credit cards are another example. Most folks in fintech know the story of Bank of America dropping a pre-approved BankAmericard – the first general-purpose credit card – on 60,000 unsuspecting customers in Fresno, California, in 1958. What you might not know is that the initial BankAmericard could only be used at merchants that had bank accounts with Bank of America. This wasn’t much of an issue in California, where Bank of America was dominant, but it became a big problem when Bank of America started licensing its credit card program to banks and merchants in other states. As part of the licensing agreement, merchants were required to accept all BankAmericard cards. This was good for the utility of the network (consumers didn’t need to worry which bank a merchant banked with and vice versa, as long as that BankAmericard logo was on the card), but it created a couple of big problems, as Joe Nocera notes in his incredible book A Piece of the Action: How the Middle Class Joined the Money Class. The first was authorization:

The merchant had to call his bank, who then put the merchant on hold while they called the cardholder’s bank. The cardholder’s bank then put the merchant’s bank on hold while they pulled out a big printout to look up the customer’s balance to see if the purchase could be approved—all while the customer and merchant stood there in the store, waiting for the reply. And that was when the system was operating smoothly. Sometimes the merchant got a busy signal. Other times his calls went unanswered, something that happened most often when a customer with a card from an East Coast bank tried to buy something late in the day in California. And if the merchant couldn’t get through, they then had to decide whether to accept the card or lose the sale. And if the merchant took the card, and it turned out to be stolen, all hell would break loose as the banks fought over who should absorb the losses.

And the second one was settlement:

It was one thing to settle accounts with five banks or even twenty-five. It was another thing to settle accounts with 150 banks, with millions of cardholders, billions of dollars in sales, and to do it without computer help, with sales drafts flying back and forth across the country every day, and with balances that didn’t add up correctly half the time. Back rooms filled with unprocessed transactions, customers went unbilled, and suspense ledgers swelled like a hammered thumb.

By 1968, BankAmericard was in danger of collapsing under the weight of its own success. Bank of America gathered all of its grumpy BankAmericard licensees at a meeting in Columbus, Ohio, to discuss the problems of authorization and settlement, and after a tense few days, it was persuaded by a young guy named Dee Hock to give up control of the program and form a consortium to set operational standards and policies and develop the infrastructure necessary to scale it up. The resulting company – National BankAmericard Inc. – succeeded, reducing the time to authorize a transaction from 5 minutes to 50 seconds and reducing the postage and labor costs from transaction settlement by $17 million in the first year. Today, National BankAmericard Inc. has (mercifully) a different name – Visa.

There are many more examples I could cite, but the general point is this – consortiums are critical for fostering the coopetition that healthy financial services ecosystems require.

However …

The Eventual Problem with All Big Bank Consortiums

When banks, particularly the biggest ones, decide to cooperate, they can do extraordinary things.

Let’s return to our first example – the New York Clearing House. For the first 60 years of its existence, the New York Clearing House was so effective at managing the flow of payments between banks that it functionally became the central bank of the United States. It managed the safety and soundness of its member banks, requiring weekly audits, minimum reserve levels, and a daily settlement of all balances. During financial panics (which happened every 5-6 years back then), the New York Clearing House would take extraordinary steps, such as issuing its own currency, to help calm the market. In the aftermath of the Panic of 1907, the U.S. Government formed the Federal Reserve System (modeled on the New York Clearing House) in 1913, which took over this central banking role. After that, the New York Clearing House shifted its focus to helping modernize the ways that banks move money between themselves, building the first automated clearing house (ACH) and wire payments infrastructure in the U.S.

This is pretty cool! This is the type of thing that gets advocates of free market capitalism excited – private enterprises cooperating to build the common standards, services, and infrastructure (better and faster than the government) that are necessary for a modern economy.

But what happens once that modern economy has been built?

Well, as a society, we start to see more value in competition and more problems with coopetition. We stop marveling at the wonders of instant, digital authorization and settlement and start wondering why we have to choose between paying a 2-3% tax on every transaction or waiting 2-3 days for money to move from one electronic ledger to another. We take for granted the systems that allow banks to confidently open bank accounts with consumers they’ve never met or worked with before and start asking why banks control consumers’ data rather than the consumers themselves. We forget what it was like to suffer a nationwide financial panic every 5 years and start imagining a world in which any company could safely offer banking services.

As you might imagine, these mindset shifts are alarming to large incumbent banks. So alarming, in fact, that the banks are often tempted to utilize the established tools of intra-bank coopetition to stifle the emergence of new external competitive threats.

This is the modern history of big bank consortiums.

Two examples are particularly relevant – The Clearing House (TCH) and Early Warning Services (EWS).

The Clearing House (TCH)

The Clearing House started out as the New York Clearing House. Yep, the same one that was founded in 1853. The ACH and wire payments networks that it built after the Federal Reserve was created? Those are the same systems that we are using today. They clear and settle nearly $2 trillion in U.S. dollar payments every day.

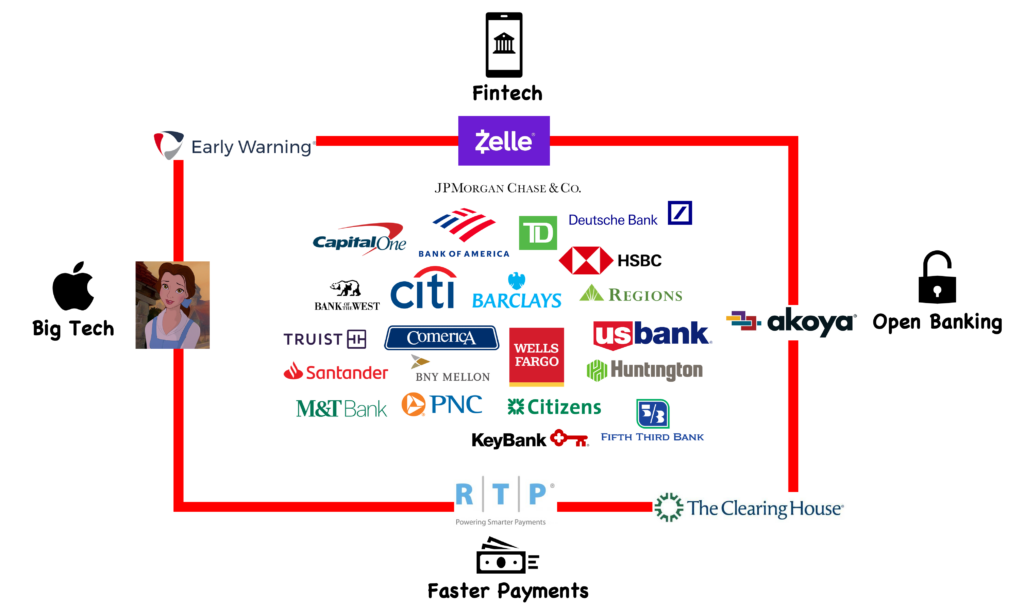

TCH is owned by a consortium of 22 of the largest banks in the U.S. – JPMorgan Chase, Bank of America, Citi, Wells Fargo, Capital One, US Bank, Fifth Third, Truist, KeyBank, Barclays, PNC, M&T Bank, Huntington, Comerica, Deutsche Bank, Citizens, Bank of the West, Regions, BNY Mellon, TD Bank, HSBC, and Santander.

TCH’s owner banks have continued to funnel money into the development of new financial services infrastructure and have been … unamused, let’s say, when competing organizations have encroached on what they perceive to be their turf.

For example, in 2017, TCH launched Real Time Payments (RTP), an instant payments platform designed to modernize the revolutionary-but-now-kinda-antiquated ACH payment rails that it developed in the late 1970s. When TCH’s old frienemy, the Federal Reserve, announced that it was thinking about building a competing faster payments platform, TCH freaked out:

The banks say an updated Fed system could delay widespread adoption of instant payments because thousands of financial institutions might wait for the central bank to roll out its new technology instead of connecting to the existing private option now. The Fed has been exploring the question of speeding up the payments system since at least 2013.

“We have a real-time payments network. It’s operating,” said Steve Ledford, senior vice president for product and strategy at the company that operates the bank’s network. “If the Federal Reserve decides to launch its own network, it’s just delaying the access to faster payments to everybody.”

Their objections were transparently motivated by self-interest, as the same Wall Street Journal article notes:

Banks behind the private payments system are worried about a big, public-sector rival. The Fed, by law, doesn’t seek to make a profit but has to cover its costs by charging banks for the services it provides. In this case, it would have to show it can break even on creating and running the updated system. The big banks fear this would cause the Fed to compete for customers by offering volume discounts to users, which would force them to follow suit.

Another example of TCH attempting to flex its anti-competitive muscles is open banking.

As I’ve written about before, banks don’t like open banking. While most of them are too smart to say so out loud anymore, they all believe, to at least some degree, that banking data belongs to them, not their customers, and they shouldn’t be forced to share it with their competitors. This belief is not shared by the rest of the market, as the growth of open banking data aggregators like Plaid, MX, and Finicity and the CFPB’s assertive rulemaking on Dodd-Frank Section 1033 demonstrates.

So, if they can’t stop open banking, maybe they can at least slow it down?

One month after Visa announced that it was acquiring Plaid – which, at the time, seemed to presage a major acceleration in the adoption of open banking in the U.S. – TCH announced that it was acquiring a controlling interest in Akoya, an open banking data aggregation service built by Fidelity:

The strategy behind the acquisition is to have Akoya stand at the door when customers want to link their accounts to third-party applications from fintechs, as well as data aggregators. Third-party financial apps are booming as personal-financial management programs, online banks, other fintechs, and data aggregators seek access to raw banking data to carry out their functions. Under the usual practice, consumers simply give their login credentials to third-party apps.

But with Akoya, which has created an application programming interface-based (API) network, acting as the go-between for its user banks, third parties will not have direct access to credentials.

“This removes that from the process,” a spokesperson for New York City-based TCH tells Digital Transactions News. “That’s a huge concern for the financial institutions.”

Hmmm …

Early Warning Services (EWS)

Early Warning Services – which is owned by JPMorgan Chase, Bank of America, Wells Fargo, Capital One, US Bank, PNC, and Truist – was founded in 1990 to help banks identify and mitigate deposit fraud. Its first flagship product was a closed-for-cause database that allowed participating banks to share intel with each other on consumers who had previously misused deposit accounts, thus enabling them to avoid opening new deposit accounts with those same consumers. Basically, credit reports for deposit products.

Much like the early inventions of TCH, this innovation provided value to the entire ecosystem. However, also much like TCH, EWS has not been idle in the years since. Its owner banks have utilized it as a vehicle for responding to outside competitive threats.

One example is Zelle. As I wrote about recently, Zelle is the manifestation of many of banks’ fears and ambitions when it comes to fintech. Regardless of how rational these fears and ambitions are (I personally find them mostly irrational), Zelle’s success – $490 billion in total payments volume in 2021 – can’t be argued. And I don’t think it’s a coincidence Zelle was originally born out of a cooperative effort between Bank of America, Wells Fargo, and JPMorgan Chase in 2011, nor that it really started to hit its stride after being sold to EWS in 2016.

Another example is the digital wallet that EWS is reportedly working on, which, in the absence of an official name, I have christened Belle. According to the Wall Street Journal, EWS’s owner banks are very intentionally trying to use this new digital wallet to stymie the progress of non-bank competitors (Apple, most notably) by leveraging the built-in network effect they have across their collective customer bases:

The banks expect to enable 150 million debit and credit cards for use within the wallet when it rolls out. U.S. consumers who are up-to-date on payments, have used their card online in recent years and have provided an email address and phone number will be eligible.

The banks are still ironing out the details of the customer experience. It likely will involve consumers’ typing their email on a merchant’s checkout page. The merchant would ping EWS, which would use its back-end connections to banks to identify which of the consumer’s cards can be loaded onto the wallet. Consumers would then choose which card to use or could opt out.

The Future of Big Bank Consortiums

So, if the past of big bank consortiums was about solving for industry-wide infrastructure gaps and the present of big bank consortiums is about blunting the progress of big banks’ competitors, what does the future look like for big bank consortiums?

I have a few guesses.

Regulators are going to keep targeting them. One of the modern challenges for big bank consortiums is that they can’t help but look collusion-y and anti-competitive, and this tends to draw the scrutiny and intervention of regulators and lawmakers. Senators tend to say things like, “it’s a mistake to entrust this system to the biggest banks.” And regulators say things like:

in telecommunications, the open internet, powered by protocols, like the hypertext transfer protocol, helped to create a new worldwide web. No one “owned” this internet. Of course, many actors have sought to obtain, and in some cases successfully grabbed, more control. Threats to openness have come from browsers, operating systems, app stores, infrastructure providers, and others that already have scale or provide a must-have component.

There will undoubtedly be similar efforts when it comes to open banking and finance, potentially from Big Tech firms or a consortium of incumbents. We’re thinking through how standard setting could be rigged in favor of some players over others, where an intermediary or other platform could undermine an open and neutral ecosystem.

FedNow is supposedly coming to the market this spring. Rules for 1033 will be finalized and in effect by the end of 2024. Regulatory scrutiny will, I’m guessing, continue to be heaped on Zelle and Belle and whatever EWS dreams up next. It will, in short, be tough sledding for big bank consortiums on Capital Hill.

Internal disagreements will hamstring them. Another challenge for big bank consortiums is the need for consensus. When product and strategy decisions are made by committee, you end up with camels instead of horses.

The description of how EWS’s digital wallet will work – plug in your email address and select from a list of eligible cards – sounds, to me, like a camel. As does the decision to leak the discussions about potentially reimbursing Zelle customers for fraud to the Wall Street Journal and the absence of any notable fintech companies or data aggregators in the Akoya network.

Big bank consortiums have massive built-in network effects. That’s a tremendous advantage. But you still need to build great products and have great execution if you want to succeed in pushing back the barbarians besieging your walls. My guess is that big banks, who don’t all seem to be on the same page when it comes to hot-button issues like faster payments and open banking, will struggle to collaboratively out-execute fintech and big tech competitors.

Small banks won’t cooperate with them. If you’re bullish on the future of big bank consortiums, Zelle is the example you’d want to build your argument around. You’d point out that EWS has grown Zelle well beyond the footprint of its big bank owners to more than 2,400 financial institutions (90% of which are institutions with less than $10 billion in assets).

Of course, if you made this argument, then I (the skeptic of big bank consortiums) would rebut by pointing out that small banks are not all that happy with Zelle at the moment:

Putting financial institutions on the hook to repay scammed customers will disproportionately affect smaller banks, which operate with thinner margins compared with the large banks that own Zelle, said Rebecca Kruse, chief operating officer at ICBA Bancard, a subsidiary of the Independent Community Bankers of America, a trade association representing roughly 5,000 community banks.

“When utilizing Zelle and other [peer-to-peer] applications, community banks have little room or ability to customize the applications, including fraud warnings and alerts to end users,” she said. The new proposed playbook “may threaten their ability to offer these services.”

I would point out that many small banks felt like they had no choice but to join Zelle and that competitors to EWS, like Alloy Labs and Jack Henry, are now jumping into the market with P2P payments solutions tailored to the needs of smaller banks.

I would argue that other big bank-led initiatives, like RTP, have failed to gain any significant traction with small banks specifically because of the suspicion that small banks have for their larger peers.

And I would close by speculating that this problem is unlikely to get better for big bank consortiums in the future.

If you love something, set it free.

One last thing.

I’ve noticed that a lot of the angst in and around big bank consortiums tends to revolve around one company – Visa.

They rarely say it out loud, but you get the sense that everything Visa does – striking a special deal with Apple on Apple Pay, attempting to acquire Plaid, resolving their differences with Amazon, arguing against faster payments – absolutely pisses off the big banks.

And I get it. A lot of these things would frustrate me too, if I were in their shoes. But I think there’s something more to it. I think one of the animating emotions behind big banks’ continued investments in consortiums is their regret at letting Visa (and Mastercard) go.

Remember, until 2006, Visa and Mastercard were private companies owned by the banks. They only went public because of a combination of employee pressure, the need for capital (big banks were starting to feel the heat from the brewing financial crisis), and a desire to get some legal distance from mounting antitrust complaints from merchants about interchange fees.

However, once they went public, Visa and Mastercard were free to operate themselves as they saw fit. They were free to treat banks as just one constituent in their multi-party networks rather than as their all-important corporate overlords. This has, I think, angered the banks, who probably can’t help but think about how competitively useful it would be to have the card networks more firmly under their thumbs.

That said, I also think that Visa and Mastercard going public was one of the best things to happen to the financial services industry in the last couple of decades. The card networks aren’t perfect by any means, but they are much more responsive to the needs of the ecosystem as a whole, and that has had a positive, balancing effect that I don’t believe would have been possible had they remained private, bank-owned entities.

As hard as it may be for the big banks to hear, I think the lesson of Visa is clear – if you love something, set it free.