Given how much services organizations are dealing with right now in 2023, I thought it’d be worthwhile to jump into HCA Healthcare’s full year 2022 results as well as what the HCA team expects for 2023. Lots of golden nuggets in this one for fellow hospital operators and provider orgs across:

- Volume & utilization

- Payor mix & reimbursement dynamics

- Expense management

- Capital allocation

- Hospital M&A environment

If you’re a hospital exec or work in a hospital, I’d love to hear your thoughts on the below.

Also, if you’re interested in sponsoring Hospitalogy, shoot me an e-mail directly at [email protected]!

Join 17,300+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!

HCA Healthcare’s expectations for healthcare in 2023: Key Takeaways

Hospitals are focused on two main priorities: Expense mitigation – labor in particular – and revenue diversification.

Labor is still the number one issue affecting hospitals. HCA is investing heavily in its clinical staff.

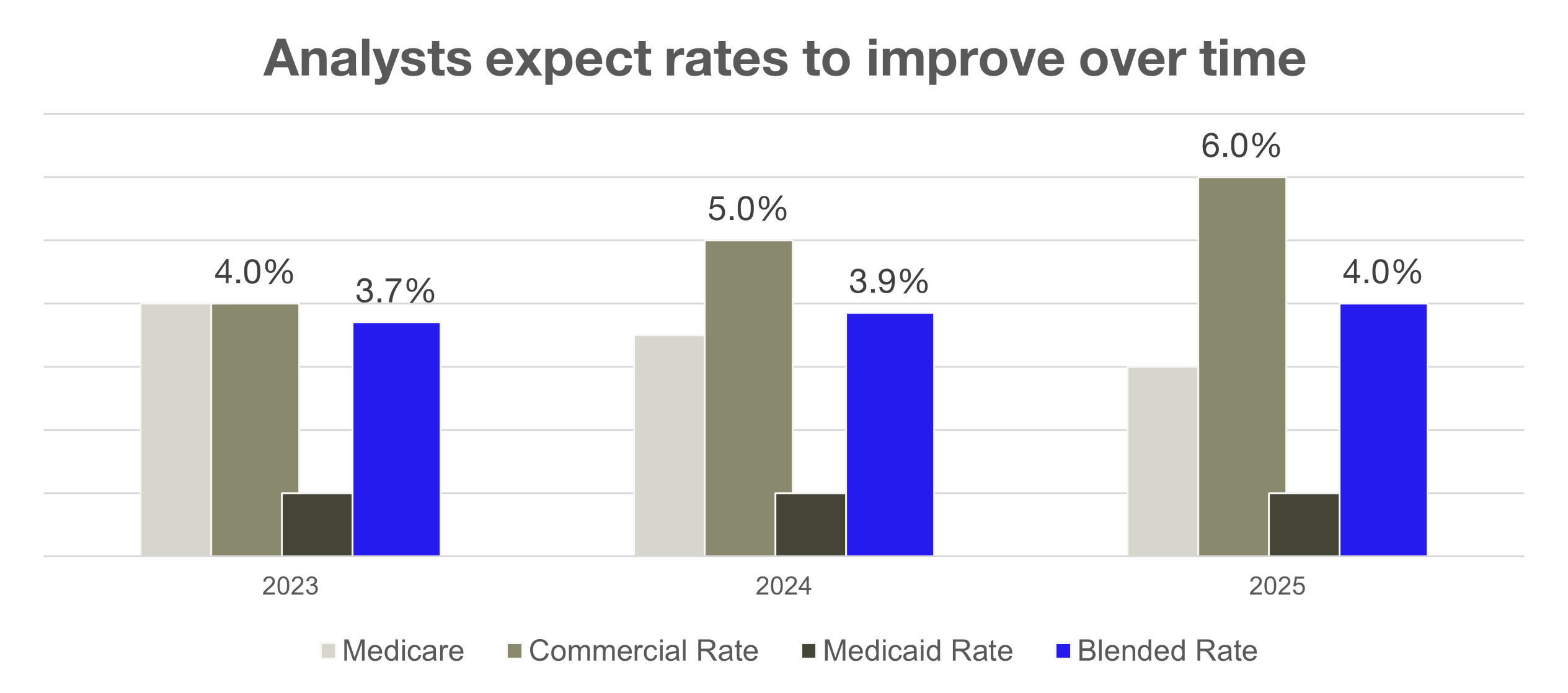

Commercial rate lifts will continue to play out over the course of 2023 and 2024 as new contracts get negotiated. Hospitals shouldn’t expect lifts higher than HCA’s mid-single digits hike.

Hospital M&A is not very feasible in 2023, with HCA execs noting a disappointing pipeline. They’re pivoting to greenfield, or de-novo, development.

Covid is over. The new normal is taking shape in 2023 and utilization returned to HCA hospitals in the fourth quarter of 2023 (with the linchpin being labor capacity). Moving forward, Covid as a % of total admissions will be around 3-4%.

As the public health emergency ends in May, relief dollars that propped up struggling systems are gone. Medicaid redeterminations aren’t considered a headwind for HCA given ACA subsidies present thru 2025.

Short-term headwinds for HCA include lower reimbursement on Covid DRGs ($280M), 340b Program payment reductions ($50M – $100M), labor investment ($150M), and increased pressure for subsidies from hospitalist physicians, including ER groups and anesthesiologists. Hospitals with higher exposure to Covid, higher Medicare mix, 340b, and contract labor face uphill battles in 2023.

HCA’s primary focus, as always, is investment in higher acuity programs on the inpatient side while expanding its complementary outpatient footprint. HCA operates around 13 or so outpatient sites of service for every hospital it runs. Inpatient demand is nearly flat at this point, so HCA’s main levers to pull here include grabbing existing IP market share from other players, increasing case mix acuity and expanding service lines like NICU, and finally expanding its outpatient footprint (urgent care, freestanding ED, clinic capacity, ASC capacity).

Nonprofit health system losses are HCA’s gain. We will see empirical evidence of this in 2023 and beyond as these systems shutter capital spend and growth – which HCA will take full advantage of. Based on the dynamics at hand, my anecdotal hypothesis for hospitals in 2023 is that large, nimble systems like HCA will flourish (as always), while nonprofits and smaller health systems will disproportionately struggle in the new environment.

How HCA Healthcare Fared in 2022: Intro

If you want to focus on someone making money in healthcare services, HCA is the one. HCA is an absolute machine and is by far the top performing hospital operator when compared to other public and nonprofit players (although lacking info on private for-profit’s like LifePoint, Ardent et al).

HCA’s strategy is well documented and has resulted in phenomenal operational success. 50% of HCA hospitals are located in Florida and Texas, two of the fastest growing states in the U.S. Combine that with their scaled, concentrated market share in those states in growing, strong employer markets, and you have a recipe for success.

HCA’s management is a team of seasoned vets. They know the healthcare system inside and out. So here’s what they had to say on recent transcripts and its year end 2022 earnings call with my commentary plugged in. As an aside, most of the below will be my shorthand notes with key management quotes spread throughout, so let me know what you think of this abbreviated content!

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

High Level Executive Commentary

HCA’s 3 Initiatives for 2023:

- Overcoming labor and capacity challenges

- Countering inflationary pressures

- Doubling down on winning strategies at HCA – including continued investment in outpatient facilities, service line expansions, and clinical equipment for physicians.

4 pillars to HCA’s long-term plan:

- Advancing clinical systems and digital capabilities.

- Transforming care models with innovative solutions

- Expanding HCA’s workforce development programs;

- Investing capital in HCA’s networks to expand their offerings.

- Notable quote: “These efforts are pressuring our results some in the current year, but we believe they are necessary in creating a platform for ultimately optimizing our networks so they can deliver even better patient care in the future.” – Sam Hazen

Volume and Utilization

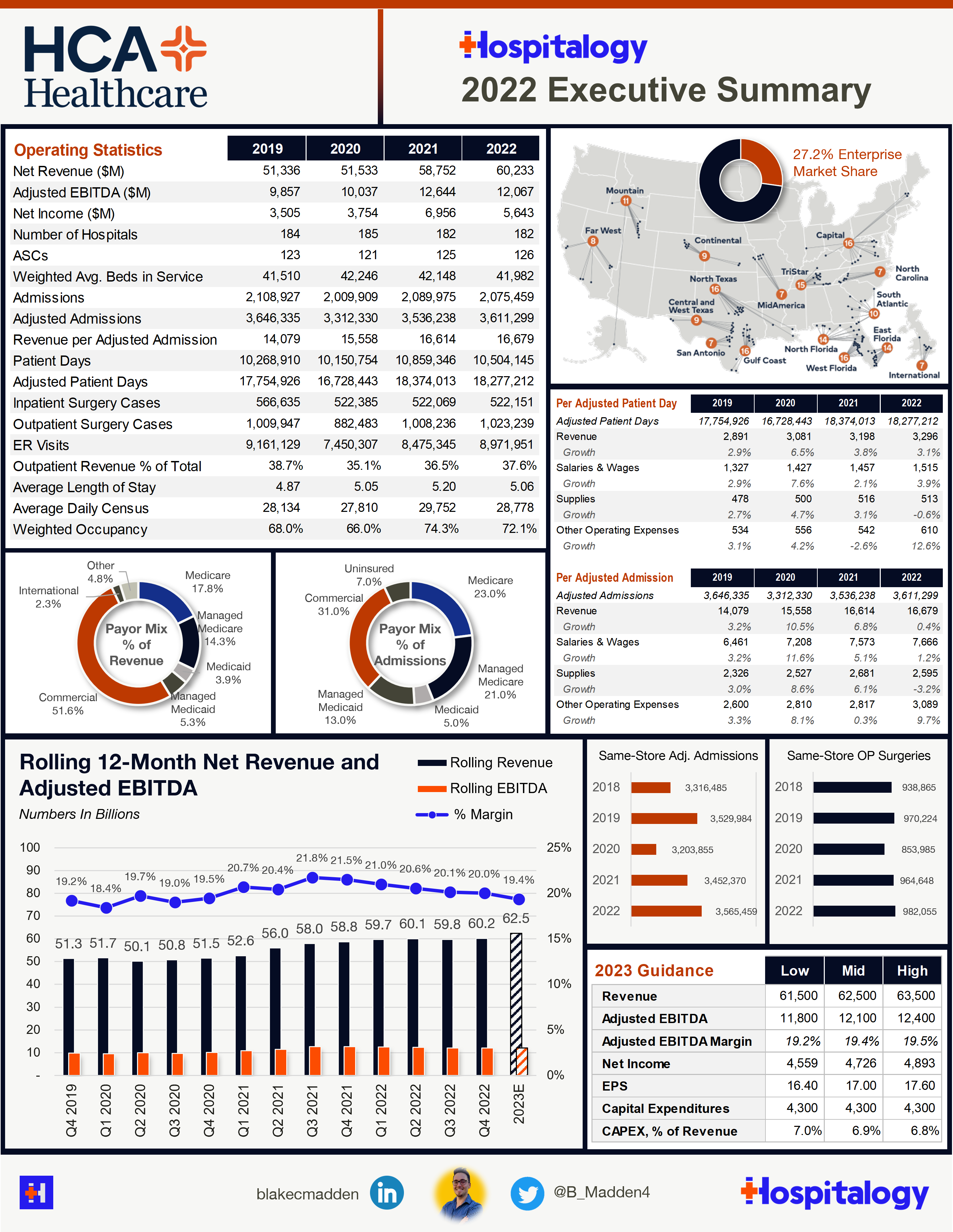

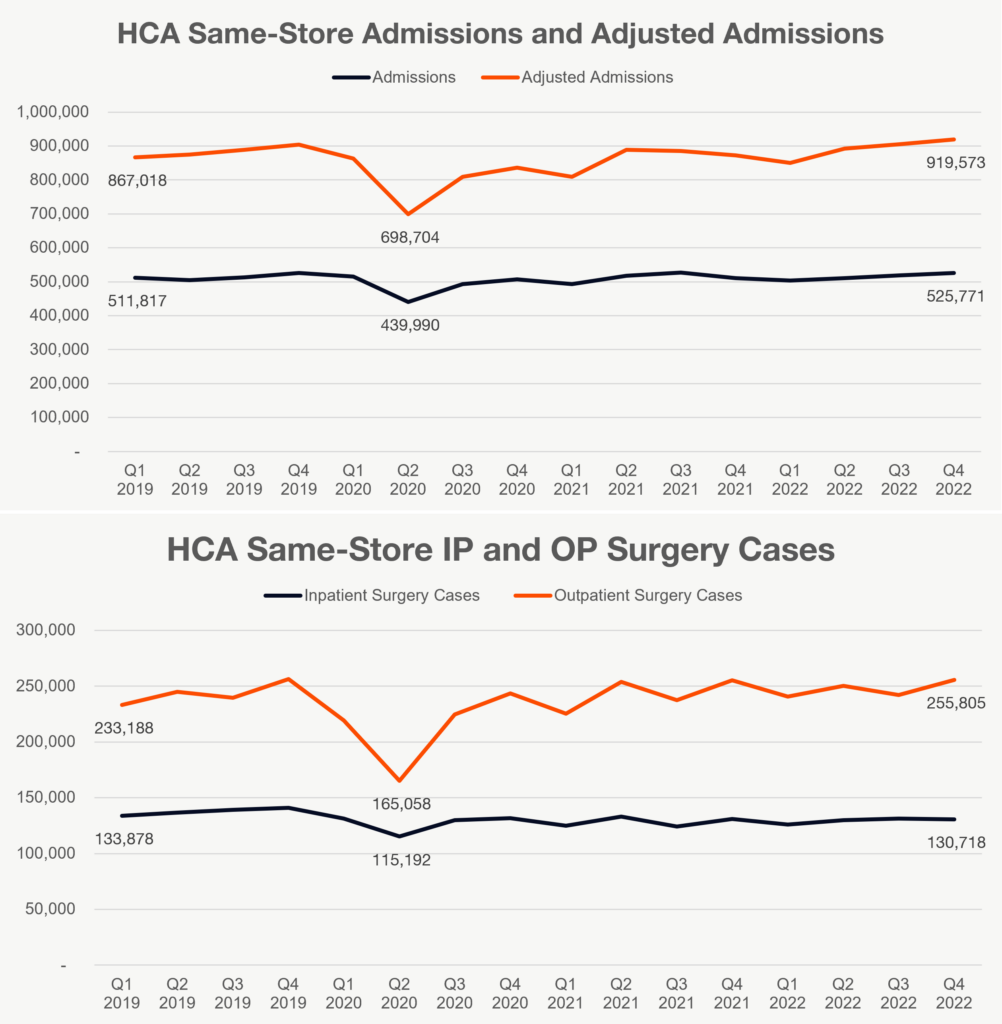

Emergency department (ED) volumes were strong, up 11% YoY – something HCA management was surprised by. Overall, volumes were strong in Q4. Long-term, HCA expects 1-2% growth in inpatient volume and 2-3% in adjusted admissions. Covid admissions as a % of total were 5.2% – this will drop to 3-4% in 2023 pending any surges. Total joint cases were up 6% year over year.

HCA is up to 260 urgent care centers with plans to grow to 300 clinics by the end of 2023.

HCA will continue to focus on and invest in high acuity service areas – e.g., cardiology or trauma units, NICU, etc.

Demand in general is strong – but volumes will continue to be limited by labor capacity. HCA thinks that return to normal historical utilization patterns will happen. In Q3 HCA had to turn away 1.5% of admissions due to staffing constraints*.* But HCA noted that retention is up and turnover is down at their facilities.

The past 12-24 months has seen an acceleration in the shift to outpatient procedures, but HCA notes it was limited to orthopedics and total joint. Around 70%-80% of total joints are conducted in an outpatient setting these days. HCA thinks there may be some other areas that migrate in this fashion, but not to this degree. **

HCA disagrees that inpatient demand is going away, noting they’re at 72% occupancy in 2022, higher than that of 2019. Without proving out this hypothesis, I might wager that this dynamic could be caused by other hospital struggles and service line closures rather than the belief that inpatient demand is stable considering the plethora of data indicating the opposite trend.

2-3% adjusted admissions growth expected for 2023

Madden’s Musing: Looks like HCA is very much so expecting utilization and demand to come back online in 2023. You can see that the trend for same-store volume growth is now at or above where it was in 2019. While margins may stay suppressed in 2023 given short term headwinds, investments that HCA is making today will benefit the hospital operator in 2023 and following years as it uses its massive leverage to double down on successful operations and contract negotiation.

Labor, Inflation, and Expense Mitigation

Labor: Labor remains a top operational priority for HCA. Nurse turnover dropped 26% compared to the average of the last 4 quarters. HCA opened its 8th Galen college of Nursing this year. Hiring was up 6% as compared to 2022, a huge number mostly coming from new grads. You can already see the pipeline that HCA has formed from its Galen investments into new nurses at its facilities, which will greatly impact labor spend over the coming years. Contract labor dropped another 16% sequentially from Q3 to Q4 which comprised about 7.8% of total salaries and wages. Interestingly, HCA expects total labor costs to stay flat on a % of revenue basis with where it sat in 2022. That’s pretty notable considering HCA stated that Q1 contract labor costs reached an ‘all-time high.’ This signals that although HCA will see improvement to contract labor, they’ll use those freed up funds to pay its clinicians on higher bases.

- In reality, a potential recession will likely help with HCA labor pool given that more people will need to work and/or return to work and take what they can get given economic pressure

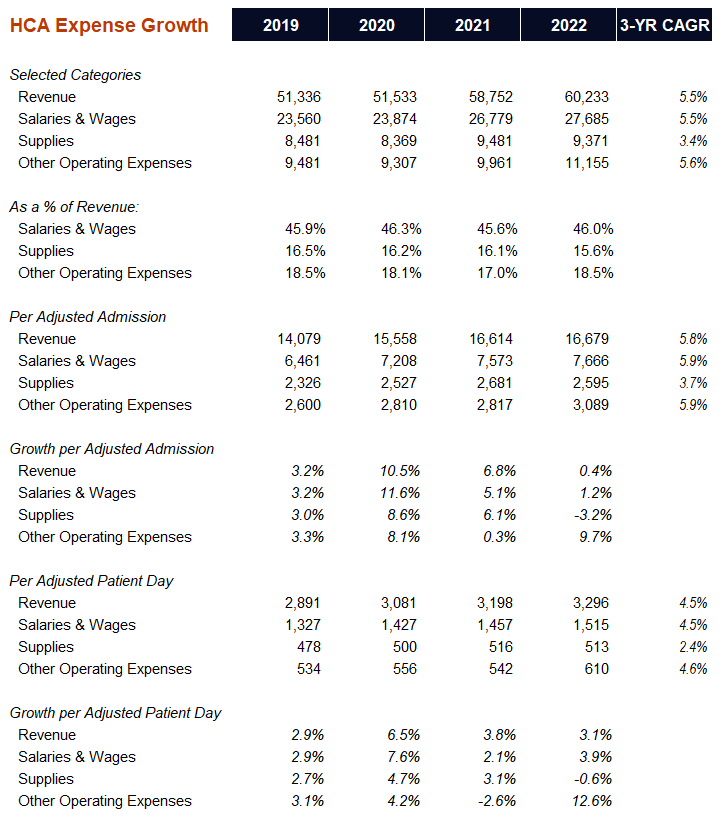

Labor: Labor inflation for HCA in a typical year = 2-3%. This year was closer to 4-5%. Contract labor is trending down & stabilizing. Half of the decrease is from hourly wage cost declines and the other half is from lower utilization of contract labor. Q1 was the max peak. 20% sequential decline QoQ from Q1 to Q3. For 2023, HCA is expecting a base salary increase of around 3-4% for the foreseeable future. HCA is also mitigating this by changing and optimizing the ‘skill mix’ of its clinical labor to match up to acuity.

Inflation, Supplies, and Other Expenses: Inflation hit commodities, utilities, insurance, professional fees, etc. HCA overall was able to mitigate supplies cost per adjusted admission as they extended supply contracts during Covid – but renegotiating these contracts in the coming years may prove tricky. Since Covid, HCA has had 50 to 60% of its supply cost contracts are under ‘firm pricing.’ HCA did specifically call out professional fees as an area where inflation hit them particularly hard. These are small dollars proportionate to HCA’s overall business, though.

Other notable initiatives in purchased services and professional expenses:

- Resiliency actions around certain support areas like laboratory operations, environmental services, plant operations and the like which should mitigate inflationary impacts.

- Advanced analytics and expense benchmarking across its hospital portfolio to hone in on optimizing costs.

Madden’s Musing: If this is the commentary coming from HCA on labor, I have to believe that operators with less leverage will struggle in 2023. HCA had remarkable foresight in negotiating its supplies contracts to lock in contracts during Covid, but there’s some small risk involved with those contracts renewing in the near future. It’s notable to look at expenses per adjusted admission and patient day. On those metrics, you can see that expenses are growing in lockstep with revenue, meaning that HCA struggled to maintain operating leverage in 2022.

Key Management Commentary:

- On nursing and clinical labor investment: “With respect to labor, yes, we have made significant investments in our people. We did that throughout last year, mainly in the late summer, early fall, where we adjusted our wages to deal with movement in the market, resulting from some visibility that we had with our overall competitive positioning. Some of the contract labor reductions that we expect and have already made even will be absorbed a little bit in those decisions, but we think the net of it is what Bill just alluded to, and that is that we can maintain our labor cost as a percent of revenue roughly around what we finished 2022 at. So that’s how we’re thinking about it. And again, we’re seeing positive metrics across the key dimensions of our labor agenda that is encouraging to us. And we believe we have more room to gain with our agenda, and we’re hopeful that, that will continue throughout 2023.”

- On nursing turnover and nationwide turnover & retention averages: We, pre-pandemic, were somewhere around 13% or 14% for nursing turnover. We’re on a run rate now 18%, 18.5%. That’s down from mid-20s. We think the industry average is somewhere in the mid- to upper 20s right now from what we’ve seen with external benchmarks and so forth.

- On other expense inflation: Our other operating expenses, you’re right, are subject to some of the general inflationary increases that we’re seeing across the economy. When we think about utilities and insurance, and in addition, our professional fees areas, we’re seeing some higher single-digit cost growth and other operating expenses.

- On other expense inflation: “Fortunately, if you look across the quarters for 2022, as a percentage of revenue, you’ll see our other operating expenses as a percent of revenue staying relatively flat and pretty consistent throughout the year. As we look forward to 2023, we do believe that’s an area that can continue to see some higher single-digit inflationary pressures, and we factored that in to our guidance going forward. Again, we think labor supplies will keep in line and hopefully below where our revenue growth is. But the other operating cost area is around utilities, insurance pro fees are going to continue to see some pressures, and we factor that into our guidance.”

Payor Mix, Medicare Advantage Dynamics, and Commercial Reimbursement Rate Lifts

Reimbursement and Payor Mix: HCA noted that they’re starting to see better pricing on the commercial side. They were locked into contracts during 2022, and now they’re able to renegotiate those rates for 2023 and beyond. Expecting 40% of contracts to get negotiated in 2023, 100 bps premium to historical escalation (historical escalation being around 3.5-4%) on the low side with upside from there. HCA noted they’re negotiating around the midpoint of range which is likely 5-6%.

HCA has never gone through a recession with the exchanges & Medicaid safety net in place, so they’re not sure how things will shake out, but noted that expanded subsidies over the next 3 years and COBRA should help alleviate payor mix concerns.

Over the past few months, analysts asked quite a few questions about evolving care delivery models, the prevalence of Medicare Advantage, and HCA’s associated physician strategy. I wouldn’t be surprised to see them announce some sort of initiative or new project in an area related to population health in the near future – maybe even an acquisition in this space.

Regarding Medicare Advantage penetration, HCA isn’t on the effects on utilization patterns in markets where MA penetration is higher. Reimbursement is the same for HCA, and HCA doesn’t view MA trend as a negative at this point despite MA plans overtaking traditional Medicare in prevalence.

MA plans are not capped by statutory constraints like traditional Medicare FFS is since MA is ‘managed.’ Hazen and HCA thinks this could change soon, given healthcare cost pressures on the Medicare trust fund in the near future. How does this affect players in the MA space? Agilon comes to mind as a name with exposure here.

Medicare reimbursement in general will lag inflation and won’t recognize full brunt of inflation because it’s based on statutory updates and historical data. MedPAC will advise CMS on rates using labor as a leading indicator, though

Madden’s Musing: Commercial reimbursement negotiation is a key tailwind for HCA and other hospitals in 2023 and 2024. Pricing lags other input costs for services firms, so if HCA is able to successfully negotiate its commercial contracts to the tune of 5-7% per year over the next few years, and commercial payors comprise around 52% of its total net revenue, then we should see some strong revenue growth (assuming no capacity issues).

Key Management Commentary:

- On payor mix dynamics during Covid: “we were also benefited during COVID a very favorable payer mix. A couple of reasons that potentially drove that. Number one, is the Medicare population that may have stayed away from a health care setting vulnerability, but we saw a significant — reasonably good increases in the health insurance marketplace. And we’re very encouraged now with the enhanced subsidies continuing for the foreign car that, that becomes a support structure for people going forward on there. So those 2 have been positive. So again, we went this year aiming to maintain both the acuity and payer mix, and we’ve mostly been able to do that this year. So those are positive forces.”

- On Medicaid Redeterminations and the PHE expiry: “We haven’t fully assessed that Medicaid redetermination process. But right now, I’m thinking of maybe best case it’s a push that if people are losing Medicaid coverage is maybe people who have income that would be eligible for coverage in the health insurance exchanges. And just for illustrative purposes for — and generally, on average, for every 3 members that lose Medicaid coverage, if only one of those finds coverage in the [ health care ] exchange is basically net-net even for us. If 2 of those 3 find coverage in the [ health care ] Exchange, it could be a positive trend force. So again, we haven’t finished our ’23 assessment on there, but those are — that’s kind of the analysis that we’re thinking about right now that I think right on Medicaid redeterminations likely a push, maybe there’s some upside with it. But I don’t know if I see a scenario where there’s downside necessarily yet. But we’ll need a little bit more time to see how states, one when the PHE expires. And then two, states will have some time to kind of enact the process. So we have a little bit of time to kind of further assess that.”

- On looming potential for Medicare Advantage headwinds: “It’s difficult to predict. Obviously, what the government is going to do on that front. I mean, there’s concerns. There’s been concerns around the Medicare trust fund. My sense is it’s moderated in some respects around how poorly the rest of the hospital industry is doing. And that creates a bit of a buffer around what they can do because of the disruptive force that it could have for others. So I don’t really have an opinion on it at this point. I think inflation will be reflected in some of the reimbursement down the road, how they deal with the trust fund, could be more on the Medicare Advantage side than it is on the provider side. And I say that simply because that part of the equation maybe isn’t fully embraced as an opportunity for impacting the trust fund. So I don’t know that it will be as much on the providers. And so we’re not anticipating anything radical at this point.”

M&A and Partnerships

HCA exercised its call option on its existing JV with Envision in January, expected to close sometime in the spring, to buy out Envision. Very notable – the inpatient acquisition pipeline for HCA is nonexistent given the current antitrust environment

Key Management Commentary:

- On recent partnerships: “Also in the quarter, we saw value from our portfolio optimization plan and closed 2 joint ventures with strategic partners, one was with our Sarah Cannon Research Institute, which we combined with McKesson’s Cancer Research entity. We believe the combination of these 2 entities will produce better cancer research and more clinical trials across the country, providing even more community-based resources for physicians and patients to fight this disease. The second co-venture is with our core trust purchasing organization. We closed on a new partnership with Blackstone. We believe this new relationship can expand our ability to offer commercial purchasing and services solutions to a broader variety of customers. We believe both of these deals achieved our strategic objectives, and connected us with a better platforms for success in the future. We are excited to partner with both entities.

- On outpatient M&A: “For M&A, we have been fairly active in market with outpatient acquisitions again when they come available, whether it’s urgent care, some freestanding emergency room, some ASC, some physician clinics and so forth. And those are very complementary, synergistic to our network acquisitions, and we will continue to pursue those as they develop.

- On inpatient and hospital M&A slowdown: “We have not had too many opportunities on hospital acquisitions, although, recently there was an announced LOI on a hospital just outside of the Dallas-Fort Worth market that we think is synergistic with respect to clinical services and so forth with our system in Dallas-Fort Worth. So we’ll continue to look for those. We do have a pipeline of greenfield hospitals because the acquisition environment is not as robust end market as maybe we would have hoped. So we need to consider greenfield projects, and we do have a number of those that are in the works. We have one under construction currently in San Antonio. And I want to say we have 7 or 8 parcels of land, maybe 10, that are designed for future hospital development when the time is right for us to make those investments.”

HCA’s 2023 Guidance and Commentary on 2023 Hospital Environment

Guidance: Lots of dynamics and uncertainties heading into 2023. Like I mentioned in the key takeaways, hospitals that have more exposure to Covid, HRSA reimbursement, and have a higher mix of Medicare will likely face more revenue pressure. 340B headwinds are present as well given the scrutiny of the drug reimbursement program. Reductions to the 340B program will result in between 50-100m headwind for HCA specifically. Plus, HCA is facing increased pressure for subsidies from hospitalist physicians, including ER groups and anesthesiologists.

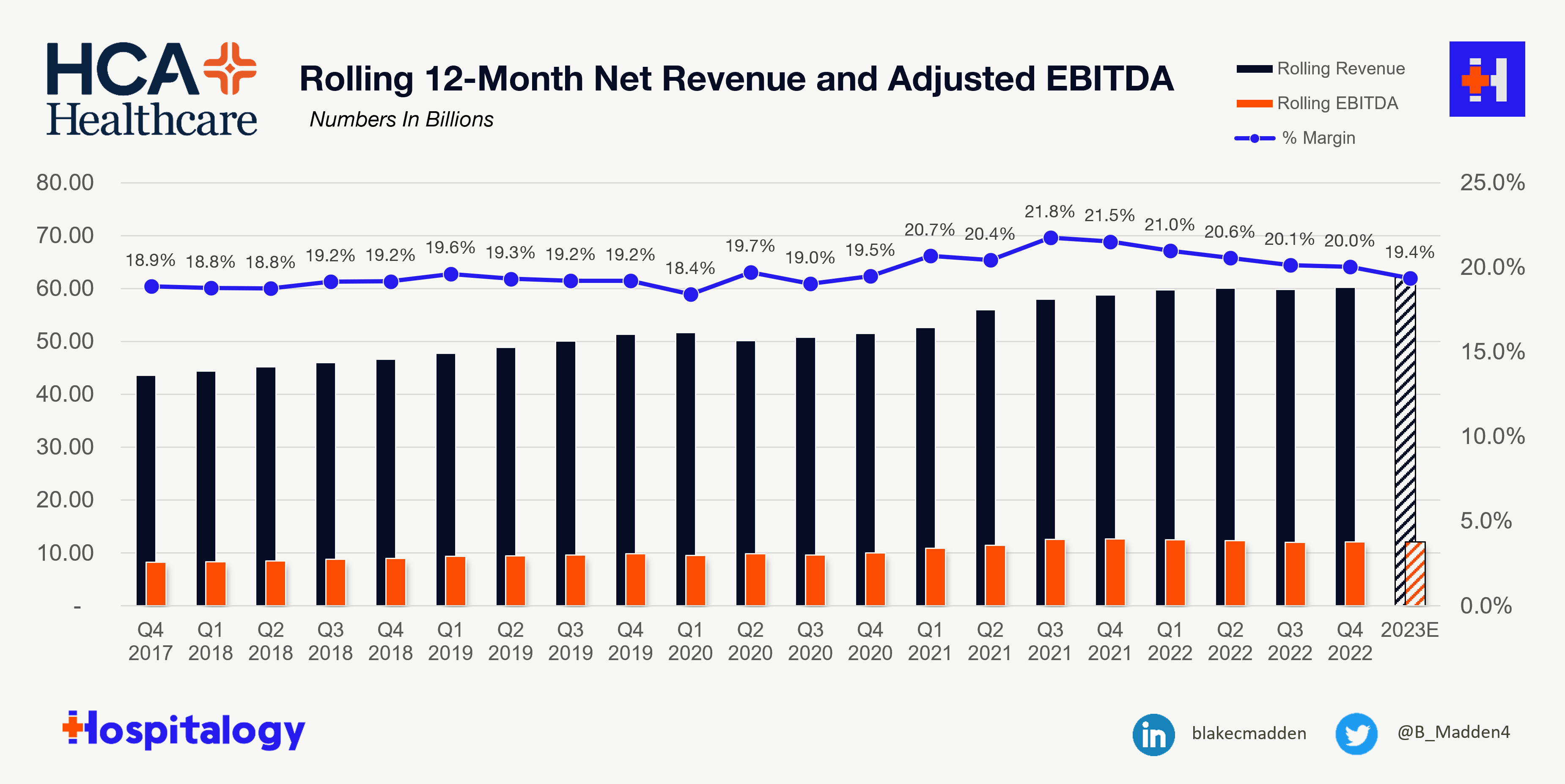

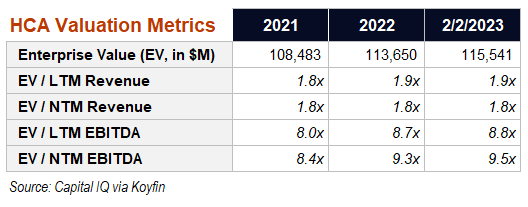

All of this was baked into HCA’s midpoint revenue guidance of $62.5B and Adjusted EBITDA guidance of $12.1B, or a 19.4% margin, notably lower than historical norms over the past few years. This margin compression speaks to current labor dynamics and the wind-down of the public health emergency. No more free lunches for hospitals, so while HCA will be just fine, I suspect others will see margins compress further.

Key Management Commentary:

- On 2023 Guidance: So let me speak to our 2023 guidance for a moment. As noted in our release this morning, we are providing full year ’23 guidance as follows: we expect revenues to range between $61.5 billion and $63.5 billion. We expect net income attributable to HCA Healthcare to range between $4.525 billion and $4.895 billion. We expect full year adjusted EBITDA to range between $11.8 billion and $12.4 billion. We expect full year diluted earnings per share to range between $16.40 and $17.60. And we expect capital spending to approximate $4.3 billion during the year. So let me provide some additional commentary on our guidance.

- On Inputs to Guidance: Our 2023 adjusted EBITDA guidance is impacted by several governmental and policy changes. In 2022, we recognized approximately $280 million in COVID support mainly from DRG add-ons, removal of sequestration cuts and HRSA reimbursement for uninsured COVID patients. We expect very little revenue from these programs in 2023. Also, as discussed in our first quarter release, we recognized $244 million of revenues and $90 million of expenses related to the Texas directed payment program that was for the last 4 months of 2021. This program that started on September 1, ’21 was not improved until the first quarter of 2022. In addition, we estimate the impact of the 340B related payment reductions to be between $50 million and $100 million. Adjusted for these items, the midpoint of our 2023 adjusted EBITDA guidance would be in the middle of our historical 4% to 6% growth expectations that we have had over time. Within our guidance, we expect our same facility equivalent admissions to grow approximately 2% to 3%, and our revenue per equivalent admission to grow approximately 2%.

Capital and Investment

Capital: Cash flow from ops between $8.5B and $9B. Investments in nursing schools, clinical transformation initiatives, and new technology equipment, incremental investment up $150 from 2022-2023.

HCA is operating at a low point in leverage – 3x to 4x EBITDA. It repurchased around $7 billion in stock in 2022. HCA has very low exposure to floating interest and has about $2-3B in debt that comes to maturity each year. HCA was upgraded to investment grade this year. Blended borrowing rate at under 4%.

Key management commentary:

- On cash flow allocation: “We paid dividends of about $650 million, and we repurchased $7 billion of our outstanding stock during the year. Our debt to adjusted EBITDA leverage ratio was near the low end of our stated leverage range of 3 to 4x. For full year 2022, we realized approximately $1.2 billion in proceeds from sales of facilities and health care entities. Also noted in our release this morning, our Board of Directors has authorized a new $3 billion share repurchase program. This will be in addition to the approximate $1.5 billion remaining authorization we had under the previous program at the end of the year. In addition, our Board has declared an increase in our quarterly dividend from $0.56 to $0.60 per share.”

- On future innovation and growth: “First and foremost, we think we have just an incredible portfolio of communities that we serve. They are growing in and out themselves. So we have opportunities to invest in that growth. We think demand is going to grow in our markets. Aging baby boomers population growth, chronic conditions, all those things unfortunately produce demand in some respect. And we think our portfolio is a little better than the national averages on that front. So we’ve got that as a backdrop. So there’s opportunities, I’ll call it, outside the walls of HCA to invest in that natural growth in demand. The second piece that we believe exists is opportunities inside of HCA. We have what we call an economy of opportunities that exist across our 180 hospitals and 2,400 outpatient facilities that we have. And that opportunity is to use big data, use better clinical system capability and better analytics to support better care. And so our technology agenda, coupled with our care transformation agenda, is really about tapping into the economy of opportunity that exist inside our organization. So we think we have 2 sets of opportunities, outside to continue to grow market share and benefit from the growth in our markets, and then continued improvement in care delivery for better patient outcomes, more efficiency, better operational management in our hospitals by infusing machine learning, advanced analytics with our care transformation agenda. So our care transformation team is led by a physician and a clinical team with industrial engineers and other type of people who are big data analysts who are supporting evaluating great performance that we have inside our company and really studying the processes around those, or looking outside the company for better processes, better technologies, and again, weaving that into our overall agenda for our long run. And we’re encouraged by that. We have a major initiative that we’re rolling out this year in our obstetrics unit, and we’re excited about the possibilities around that. On our clinical systems, we’re actually in our alpha pilot on our clinical system upgrades. We’ll have a beta pilot later this year. This is a system that we will be able to push more information, standardized information into the cloud and start to turn that into actionable insights that we believe can help our patient outcomes. So we’re really excited about our long-run agenda. And again, it’s geared toward better patient care, but capitalizing on the opportunities inside the walls of HCA.”

That’s it for this week! Join 17,300+ executives and investors from leading healthcare organizations including Privia, ApolloMed, and HCA Healthcare, health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Cityblock, Oak Street Health, and Turquoise Health by subscribing here!