21 January 2023 | FinTech

How Are Banks Feeling About 2023?

By Alex Johnson

The purpose of today’s essay is to check in on how banks are feeling about the coming year.

I use the term ‘feeling’ intentionally, as the overriding theme of this essay is an incongruity between the apparent reality of the financial industry and the economy at large (in pretty good shape!) and how banks and their investors are feeling about the present and near-term future (apprehensive, to say the least). This distinction matters because, when it comes to the economy and the folks that allocate capital within the economy, reality tends to follow feelings.

To inform my analysis, I read through the Q4 2022 earnings call transcripts and presentations of JP Morgan Chase, Bank of America, Citi, Wells Fargo, PNC, Fifth Third, Citizens Financial, and KeyCorp. And to get a sense of how smaller banks and credit unions are feeling, I’m relying on Cornerstone Advisors’ always-excellent What’s Going on in Banking survey.

Net Interest Income!

We should start here – 2022 was a really strong year for banks. This was largely due to rising net interest income.

Net interest income, or NII, is, very simply, the difference between the amount of money banks earn in interest on the loans they make and the amount of money they pay in interest to depositors.

The biggest driver of NII is the interest rate environment. Think of it like the four seasons. When the Fed sets interest rates at a low level – as it did for basically the last 15 years, and especially during the early days of the pandemic – the costs of borrowing money plummet, and people and businesses take out loans and spend and invest aggressively. Think of this as the Summer – it’s all about growth. Conversely, when the Fed raises interest rates – like it has been doing recently in order to combat inflation – borrowing money becomes expensive, and consumers and businesses pull back on growth and focus on finding safe, high-yield places to park their money. This is Winter, hibernation time. The profitable times for banks are often the transition between low rates and high rates and vice versa. The Fall – when rates are quickly increasing – sees NII expansion as banks rapidly raise loan interest rates but drag their feet on raising interest rates for depositors. The Spring – when rates are quickly falling – sees NII expansion as banks’ deposit rates drop like a brick, with loan interest rates slowly trailing them.

In 2022, banks enjoyed their first Fall in quite some time. The Fed increased interest rates at an unprecedented pace, and banks were able to realize significant increases in revenue from their lending activities without having to mollify depositors with higher rates.

Wells Fargo’s Q4 2022 results were representative of all the big banks:

Fourth-quarter net interest income was 13.4 billion, which was 45% higher than a year ago, as we continue to benefit from the impact of higher rates.

And, as this quote from the CEO of Reading Cooperative Bank (sourced from Cornerstone’s What’s Going On report) indicates, mid-sized banks are feeling similarly positive about the current net interest opportunity:

The increase in the loan rate environment has the potential to allow for an increase in margins we have not been able to achieve in several years.

Now, of course, the party is only going to go on for as long as consumers and businesses are still borrowing money and are willing to tolerate below-market interest rates on their deposits.

Let’s tackle the lending side of the equation first.

Lending: Not Worried (Yet)

After having wrecked my eyes reading through a lot of earnings reports, I can say that banks are feeling cautiously optimistic about their lending businesses going into 2023.

The big banks see credit cards as a growth opportunity, given that spending on cards is up and the percentage of customers revolving balances on credit cards is trending up as well (from JP Morgan Chase’s Q4 2022 results):

Combined credit and debit spend is up 9% year on year … Both discretionary and nondiscretionary spend are up year on year, the strongest growth in discretionary being travel. Retail spend is up 4% on the back of a particularly strong fourth quarter last year. E-commerce spend was up 7%, while in-person spend was roughly flat.

[Consumer card] revenue was up 12% year on year, predominantly driven by higher card services NII on higher revolving balances … Card outstandings were up 19%. Total revolving balances were up 20%, and we are now back to pre-pandemic levels. However, revolving balances per account are still below pre-pandemic levels, which should be a tailwind in 2023.

The super regionals are similarly bullish on credit card, as well as home equity.

PNC (Q4 2022 earnings call):

Consumer loans increased $1 billion compared to September 30, driven by higher residential mortgage home equity and credit card balances

Citizens (Q4 2022 earnings call):

When you get into consumer, we’re looking at home equity being a place that we like and [credit] card

On the other hand, these banks have seen (and expect to continue seeing) a softening in demand for residential mortgages and auto loans. Not surprising given that demand for these loans tends to respond very strongly to changes in the Fed fund rate.

A few banks in this category are getting out of the mortgage or auto lending business altogether.

Wells Fargo (Q4 2022 earnings call):

we plan to create a more focused home lending business aimed at serving primarily bank customers as well as individuals and families and minority communities. This includes exiting the correspondent business and reducing the size of our servicing portfolio. I’ve been saying for some time that the mortgage business has changed dramatically since the financial crisis, and we’ve been adjusting our strategy accordingly. We’re focused on our customers, profitability, returns, and serving minority communities, not volume or market share. The mortgage product is important to our customer base and the communities we serve, so it will remain important to us, but we do not need to be one of the biggest originators or servicers in the industry to do this effectively.

Citizens One Auto Finance plans to run off $3 billion on its auto portfolio in 2023 following a pullback in auto lending that began in Q2 2022. Auto outstandings came in at $12.3 billion in Q4, down 6.6% sequentially and 15.5% year over year, according to the bank’s earnings supplement.

Mid-size banks and credit unions are facing similar market dynamics, but their priorities are a bit different than their larger peers. There are a couple of reasons for this. First, mid-size banks tend to have a lot fewer consumer loans on their books. They are predominantly commercial lenders, and demand for commercial lending has been holding up reasonably well (commercial real estate, especially for urban office space, is an exception to this, thanks to the boom in remote work). This is reflected in Cornerstone’s finding on mid-size banks’ lending priorities for 2023 (compared to the prior three years):

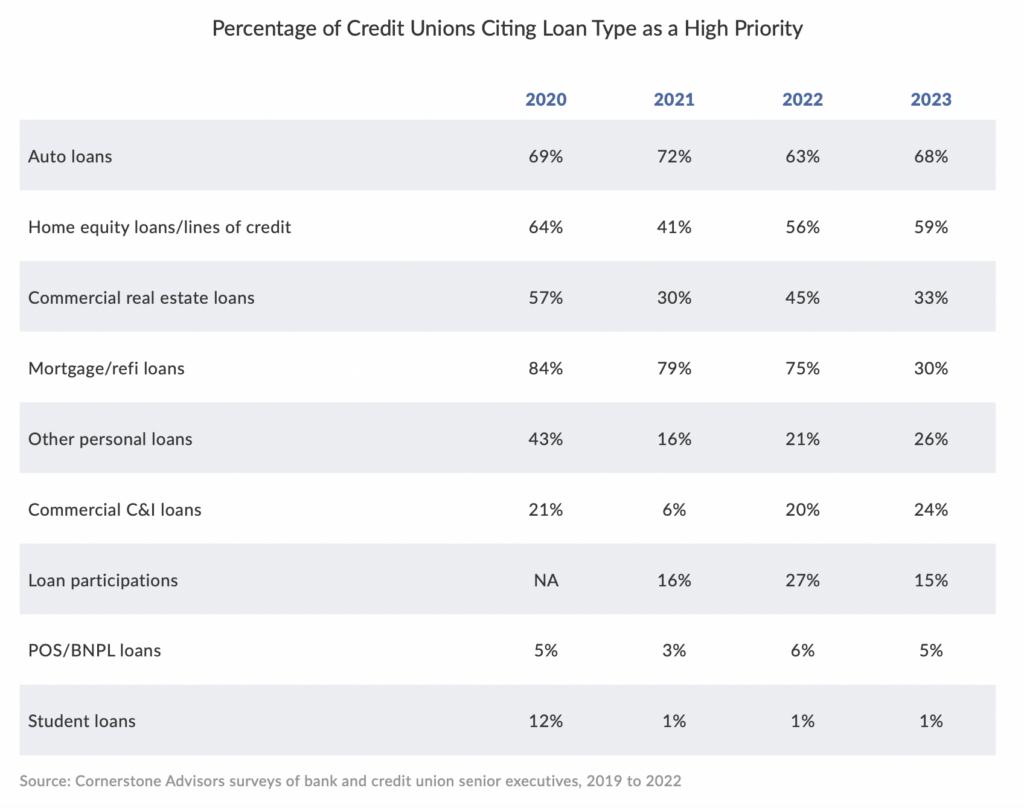

Second, credit unions, being tax-exempt nonprofits, tend to lend money in ways that are a bit out of sync with the rest of the industry. As I recently wrote about, credit unions have been kicking ass in auto lending. They’ve done this by keeping their rates low and eating the loss on the margin. Unsurprisingly, auto lending showed up at the top of the list of lending priorities for credit unions in Cornerstone’s report:

What’s most interesting about financial institutions’ outlook on lending in 2023 is their view on consumers’ credit quality.

Pretty much all banks are reporting that while loan delinquencies and charge-offs are rising, they are still below normal pre-pandemic levels. Here’s what Bank of America said in its Q4 earnings call:

Credit card charge-offs increased in Quarter 4 as a result of the flow through of modest increase in last quarter’s late-stage delinquencies. This should continue as we transition off the historic lows in delinquencies to still very low pre-pandemic levels.

This is how all the banks are looking at it – stimulus checks and forbearance programs during the pandemic held delinquencies down to extraordinarily low levels, and the end of those interventions is bringing loss rates up to where you would expect them to be in a reasonably healthy economy.

Except … the economy might not be healthy?

Increasing Loss Reserves

Bankers, being conservative by nature and even more conservative by regulatory requirement, have all been increasing their reserves to cover increasing loan losses over the next few quarters.

JP Morgan Chase is an illustrative example. It increased its total reserves by $1.4 billion in Q4:

The net reserve build of 1.4 billion was driven by updates to the firm’s macroeconomic outlook, which now reflects a mild recession in the central case

I want to hone in on that phrase, “mild recession”. That’s what all the banks I looked at were talking about, and it’s important to understand exactly what they mean by that and how it impacts their strategy for determining loan loss reserves.

Banks build reserves by mapping out three different economic scenarios for the coming year – a baseline scenario (in which, for 2023, unemployment rises to 4.5%), a downside scenario (say 7.5% unemployment), and an upside scenario (say 3.5% unemployment). They then weight each of those scenarios based on how likely they think they are and how conservative they want to be (wise banks are being very conservative right now given how weird and unpredictable the economy has been), average out the weighted scenarios, and calculate their required reserves based on the projected loss rate for that averaged scenario.

Banks believe that a mild recession (meaning unemployment reaching roughly 4.5%) is most likely in 2023, but that belief is based on their best guess of what Jerome Powell might do in his quest to smash inflation. The consensus view, articulated here by PNC, is that the Fed will chill out by Q4 of 2023:

Our rate path assumption includes a 25 basis point increase in Fed funds in both February and March. Following that, we expect the Fed to pause rate actions until December 2023, when we expect a 25 basis point cut.

The Battle for Beta and the War for Deposits

And now, let us speak about the other side of the net interest equation. And let us speak plainly.

Banks’ profitability in 2022 was mostly due to their success in withholding yield from their depositors without pissing them off too much.

That may sound harsh, but it’s really just the reality of banks’ business model. Thriving in a quickly rising rate environment requires banks to play chicken with their deposit customers. Here’s the way Citizens describes it:

We look at a lot of benchmarking data, and we’re pretty confident that we’re performing in the top quartile of our peer banks in terms of retention of low-cost deposits as well as interest-bearing deposit costs so far in the cycle. It’s sort of midway through the cycle. So we’ve got to stay disciplined and manage it well

All the investments we’ve made in the franchise, whether analytics, new products, the introduction of CitizensPlus in our Private Client Group as well as having Citizens Access to fence off interest-bearing deposits to maintain discipline in the core have all been really big levers for us to manage well.

What they’re actually saying here is that they’ve been successful at hanging on to checking account customers and funds (“retention of low-cost deposits”), increasing interest rates on savings accounts, CDs, and money market accounts by the absolute bare minimum required (“interest-bearing deposit costs”), and creating a new, digital-only spin-off brand to capture new, yield-hungry depositors without letting their existing customers know that they’re willing to pay out higher rates (“having Citizens Access to fence off interest-bearing deposits to maintain discipline in the core”).

The metric that matters here is deposit beta, which is the portion of the change in the Fed fund rate that a bank passes on to their customers in their deposit interest rates. In this most recent rising rate environment, banks have been unusually successful at keeping their deposit betas low (a good beta in a rising rate environment is 35%-40%, but most banks have been keeping their betas in the 20%-30% range this time around). However, all the banks are now cautioning investors that pressure from customers for higher rates is going to catch up to them this year, and the result will be higher funding costs and lower net interest incomes.

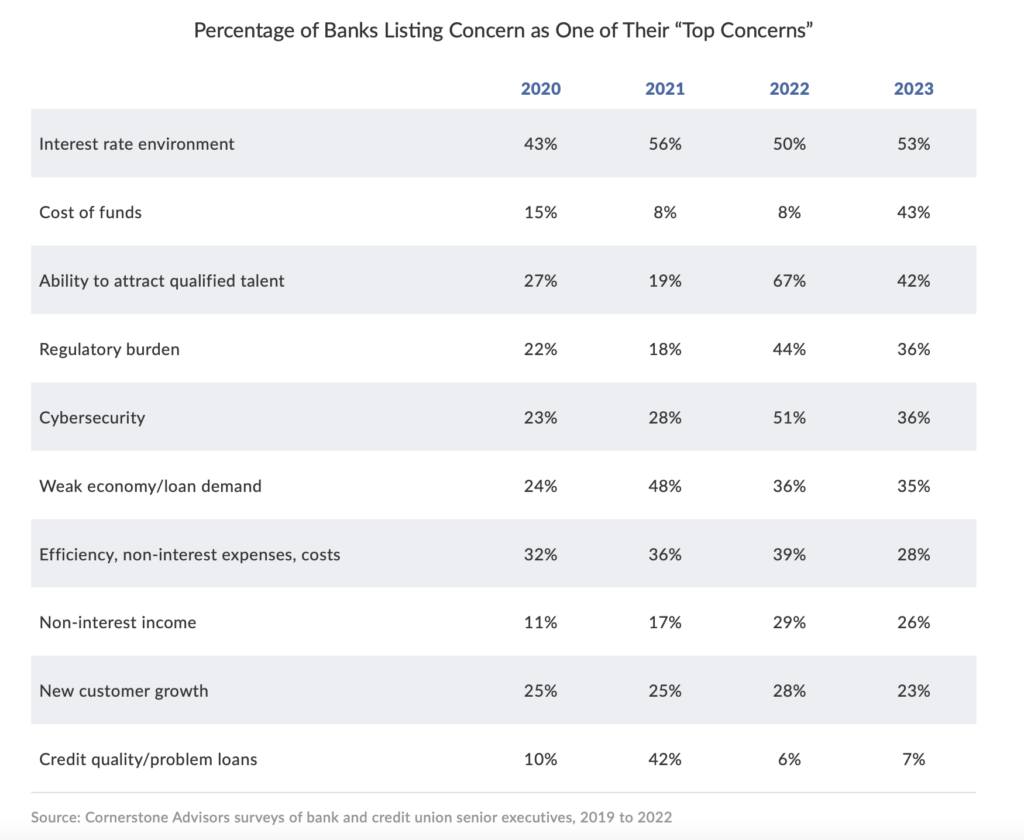

Mid-size financial institutions share this concern about rising rates on the deposit side of the business, according to Cornerstone Advisors, with 43% of banks listing “cost of funds” as a top concern in 2023 (up from 8% in 2022) and 47% of credit unions concurring (up from 9% in 2022).

The pace at which banks raise their deposit interest rates in 2023 will vary, but multiple banks that I analyzed warned that they wouldn’t drag their feet if it meant putting valuable customer relationships at risk. Here’s what KeyBank said in its Q4 earnings call:

we’re not going to win the beta battle and lose the deposit war because it’s very important that we serve our clients and we keep them here at Key.

The Rise of Wealth Management

Non-interest income is slumping at most banks. Mortgage production has slowed (as we talked about above), dragging down origination and servicing fee revenue. Investment banking ended 2022 on a bad note, with a slowdown in corporate activity (like M&A) leading to a significant dip in advisory and underwriting fee revenue. And then, of course, there was the hit that most banks signed up to take on overdraft and non-sufficient funds fee revenue, as KeyBank explained in its Q4 earnings call:

The largest decline for us will be in the deposit service charges category. We mentioned that this quarter was the first full quarter of the implementation of NSF OD fee. There’s about another $70 million impact in Q123 compared to Q122 for that.

How are banks going to replace this fee revenue?

One emerging answer seems to be wealth management.

I was surprised to see new wealth management platforms, products, and initiatives being discussed in the Q4 earnings calls of many of the banks I analyzed for this essay.

Bank of America, which has been in the wealth management and private banking business for a while, is seeing strong growth:

Our talented group of wealth advisors, coupled with powerful digital capabilities, generated 8,500 net new households in Merrill in the fourth quarter, while the Private Bank gained an impressive 550 net new high-net-worth relationships in the quarter. Both were up nicely from net household generation in 2021.

Wells Fargo is expanding its focus on wealth management:

We launched Wells Fargo Premier, our new offering dedicated to the financial needs of affluent clients by bringing together our branch-based and wealth-based businesses, to provide a more comprehensive, relevant and integrated offering for our clients.

So is Citi, which launched a new niche wealth management franchise focused on junior staff working in private equity, consulting, and accounting:

We’ve been bringing in different parts of that business together. The Wealth at Work franchise is one that’s had particularly pleasing growth in it, and we’ve also been seeing some good growth as we put a comprehensive offering together for our customers.

Even Citizens is getting in on the fun, recognizing that it has an untapped opportunity within its core markets:

Moving to wealth. We’ve launched a number of exciting initiatives with Citizens Private Client and CitizensPlus as we orient the business towards financial planning led advice. These should really help us penetrate the opportunity with our existing customer base.

This feels like the convergence of banks’ increasing comfort with digital transformation (we can build a scalable new platform to facilitate growth outside the reach of our branches) and an interesting attitudinal shift (screw Goldman Sachs, we can carve out a nice wealth management side business for ourselves).

It’ll be interesting to see how this trend progresses this year and how it intersects with fintech’s ongoing focus on the wealth management space.

Tech Spending and Adoption (mostly) Keep Rolling

The Q4 earnings calls were also an opportunity for banks to do a little bragging about the rate of digital adoption within their customer bases:

Bank of America said in its earnings presentation and commentary that digital “sales” made through the company’s online channels were up 22% year over year and now account for 49% of that activity. Active mobile banking users was up more than 7% year on year, to 35.5 million individuals. … there were 146 million interactions with Erica, Bank of America’s virtual financial assistant, in the most recent quarter, up from about 123 million a year ago, or 18.7%. Erica users were 33.5 million in the fourth quarter, versus 24.6 million last year.

J.P. Morgan’s active mobile customers gained 9% to 49.7 million consumers.

Wells reported that it had 28.3 million mobile active customers, up 4% year on year, and mobile logins stood at 6.6 billion.

Citi’s active digital users were up 6% to 25 million; its active mobile users outpaced that growth at 10% to 18 million

(Editor’s note – multiple banks also bragged about growing Zelle adoption, which, as I recently explained, might not be the unequivocally good thing that they think it is, but I digress.)

This growing adoption is motivating continued investment, with all the big banks that I looked at noting that tech spending in 2023 would remain at or above what it was in 2022. The same can’t be said for mid-size banks and credit unions, however, as Cornerstone notes:

In 2022, just 3% of banks and credit unions said their IT budget would be lower in 2022 than it was in 2021. For 2023, 9% of banks and 7% of credit unions expect their IT spending to be lower than in 2022. Not a big number, but the percentage of banks expecting a greater than 10% increase in their IT budget drops from 23% in 2022 to 14% in 2023, and among credit unions, that percentage drops from 25% to 16% from 2022 to 2023.

Burned by Crypto

There was a funny moment in the Q4 earnings call for PNC when an analyst asked the executive team to clarify some of the elevated expenses that quarter, and the CFO explained that it included a few impairments on some failed investments but that there wasn’t any one thing that really stood out and the CEO immediately jumped in and said:

Yes, there was. We wrote off everything we had to do with crypto.

😂😂😂

The analyst that asked the question didn’t follow up, but I’m guessing the CEO was referring to this:

Crypto exchange Coinbase said Tuesday it’s working with PNC Bank, the fifth-largest commercial bank in the U.S. by assets, on a crypto project.

The service would give the Pittsburgh-based national bank more seamless access to cryptocurrency investments for its customers, the source said. It’s just one facet of PNC’s broader digital assets and blockchain strategy.

I guess that project and all the other facets of PNC’s digital assets and blockchain strategy are pretty much dead. Can’t say I’m surprised.

And on the mid-size bank and credit union front, Cornerstone reports:

In the 2022 What’s Going On In Banking study, we found that 10% of financial institutions were planning to offer cryptocurrency trading and investment services in 2022, with another 13% expecting to offer these services in 2023 or later.

In the new study, just 1% of banks said they’re offering crypto investing services, and just 1% said they will offer it in 2023. On the credit union side, 5% of respondents currently offer crypto investing to their members and another 5% said they will launch a crypto service in 2023.

Get in Loser, We’re Going BaaSing

We can’t talk about banks’ outlook for 2023 without talking about banking as a service.

Should we get into BaaS?

That is the existential question for mid-size banks this year. It can be a path to fabulous riches and an escape from the inevitable M&A maw that gobbles up community FIs … or it can be its own black hole, sucking you down into a crushing vortex of deeply unfun compliance problems.

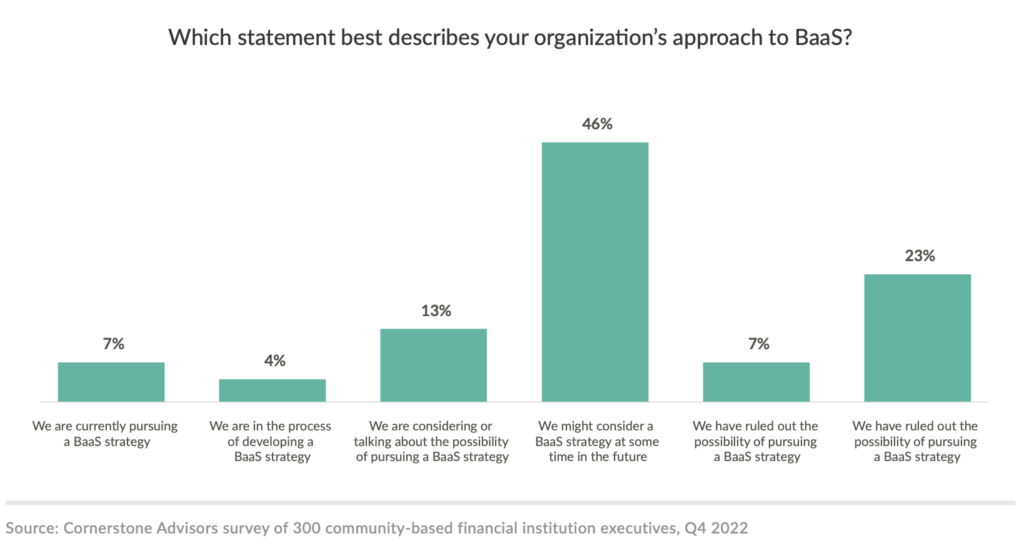

So, what are mid-size banks going to do? Well, according to Cornerstone’s survey, a decent number of them are considering (or might someday consider) BaaS:

(Editor’s note – I’m assuming the rightmost two columns are basically trying to say the same thing – we’re not getting into BaaS.)

And Cornerstone’s Chief Research Officer, Ron Shevlin, makes a persuasive case that bigger banks will jump into BaaS as well:

Conventional wisdom holds that BaaS is a small bank’s game because of the favorable interchange rates sub $10 billion (in assets) banks have. Durbin II is going to hammer on those interchange rates, as are other consumer behavior trends. For large banks, making a 70/30 revenue share deal (fintech to bank, versus the 50/50 offered by smaller banks) is just a margin decision for a big bank like Chase or Bank of America. If the potential partner—which is more likely to be a major retailer or merchant than a startup fintech—promises a high volume of payments or, better yet, loan volume, the large banks will be more than willing to take the hit on the interchange margin.

Scooping Up Fintech

And finally, outside of BaaS, I think it’s worth considering how banks might interact with fintech companies in 2023.

Let’s start with the story that caught everyone’s attention a few weeks ago – the lawsuits between JP Morgan Chase and the former CEO of Frank, the student lending fintech that Chase acquired in 2021 for $175 million. Mike Mayo (the best bank analyst in the biz) asked Jaimie Dimon about that acquisition and what it indicated about Chase’s acquisition abilities in the bank’s Q4 earnings call. Dimon admitted that it was a huge mistake, but he also had this to say:

when you’re getting up to bat 300 times a year, you are going to have errors. And we don’t want our company to be terrified of errors so we don’t do anything

This seems to align with the thinking, more broadly in the industry, that banks can’t be scared of making mistakes in dealing with fintech if they want to survive this most recent wave of disruption.

Take Fifth Third as an example. The bank has acquired two fintech companies in the last couple of years – Provide (lending to doctors and healthcare practices) and Dividend Finance (lending for solar panels and other sustainability-focused home improvements). These acquisitions haven’t been all smooth sailing (it sounds like Fifth Third isn’t in love with the home equity portion of Dividend’s business, for example), but they have given the bank a wider array of options for generating net interest income, even if interest rates hold steady or start to fall towards the end of this year.

KeyBank – Fifth Third’s Midwest mortal enemy – provides another example. It acquired Laurel Road (a student loan refinance provider focused on healthcare professionals) in 2019 and GradFin (a fintech focused on student loan forgiveness counseling) in 2022. As KeyBank explained in its Q4 earnings call, student lending hasn’t been the best business to be in recently, but it’s sticking to its long-term conviction that these bets will position it to seize a bigger opportunity down the road:

So Laurel Road, obviously, from a straight origination outlook perspective, has been challenged. It’s been challenged really by three things. One is the federal loan student payment holiday, that’s a challenge. I think that’s been extended several times. The next is just the rising interest rates, which are a challenge. And the third challenge that we’ve had there is all the discussion around student loan debt forgiveness, obviously, I think, has some borrowers wanting to stay on the sidelines to preserve optionality. Having said all of that, I was impressed that we were able to originate last year, $1.5 billion of refinance loans. But even a bigger picture is that we are trying to create a national digital affinity bank that has a full suite of products for doctors, a whole suite of products for nurses. We’re getting a 30% cross-sell on the business that we do. So, there’s no question that originations have been challenged, and they’ll continue to be challenged in the very near term. But what we’re trying to do there is a lot broader. This GradFin business that we bought is really interesting because they’re a leader in public service loan forgiveness and where you’re going to see a lot of discussion going forward is around this income-based repayments. And we’re kind of uniquely qualified to be in their advising on that. Any time we advise people, obviously, we’ll bring them on as full customers.

My feeling is that banks will continue to approach the task of investing in, partnering with, and acquiring fintech companies with optimism in 2023 (perhaps a more opportunistic optimism given the challenging financial straits that many early-stage fintech companies find themselves in these days). And this will not be limited to the big banks. According to Cornerstone, roughly 70% of financial institutions said partnerships will be important to their business strategies for the upcoming year.