15 December 2022 | FinTech

Choose Your Own (Card Issuing) Adventure

By Alex Johnson

Video games used to be simple.

Two players hit a ball back and forth until one of them misses, and the other player scores a point. The first to 11 points wins.

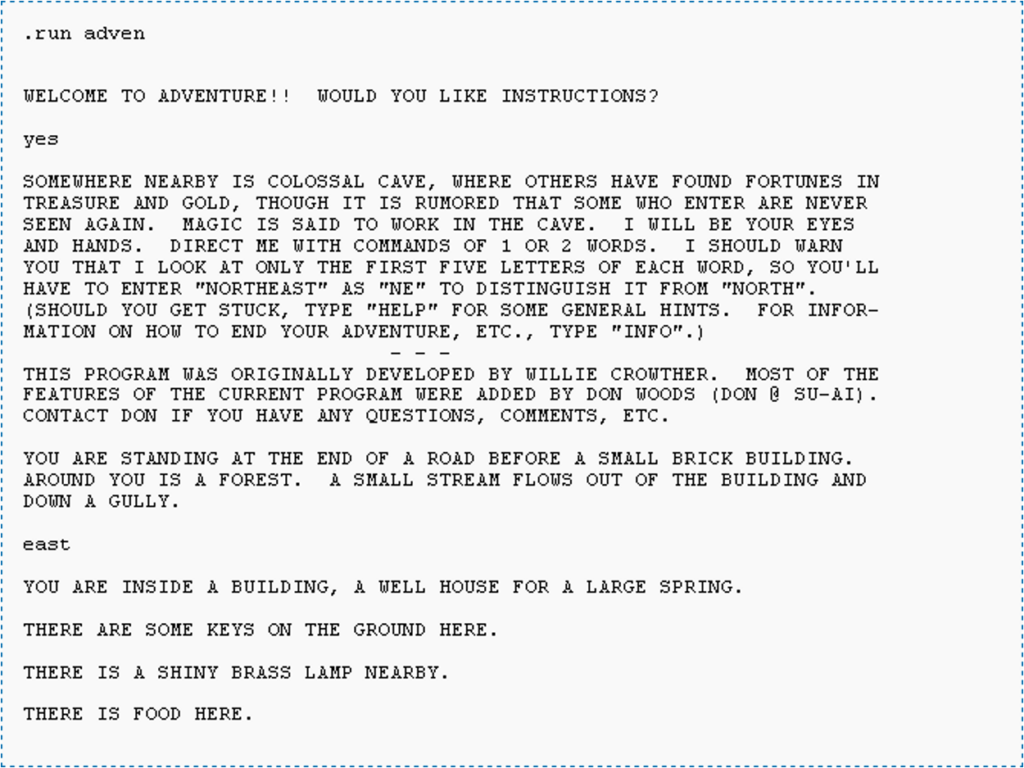

It wasn’t until a few years later (around 1975) that things started to get more complex. That was when a computer programmer and amateur caver (someone who explores caves for fun) named Will Crowther created ADVENT (short for Adventure), the first text-based computer game and the progenitor of an entirely new genre – interactive fiction.

Interactive fiction – software simulating environments in which players use text commands to control characters and influence the environment – represented a major step forward in the evolution of video games and computer games. Until ADVENT, the experience of playing a video game was confined to a small set of player actions within a constrained and unchanging environment (again, think of the paddles and ball in Pong). Interactive fiction, which was built on the emerging natural language parsing capabilities of early computer programming languages like Fortran, opened up the gamer’s experience significantly, giving them vast virtual worlds to explore and the freedom to explore them however they wanted.

The game would narrate what was happening, the player would type in commands, and the game would respond to the player’s commands:

It’s difficult today to fully appreciate how revolutionary this was, how different from anything that existed at the time. Gaming was suddenly complex. It went beyond simple hand-eye coordination. It engaged the imagination. It required creativity and patience and memory.

It was also, often, quite frustrating.

The development of early interactive fiction and text-based computer games led to the emergence of ‘illogical spaces’ – flaws in the internal mechanics of the game (e.g. going north from area A takes you to area B, but going south from area B did not take you back to area A), which would cause most players to get trapped inside a puzzle that they couldn’t escape from.

It took years for both gamers and game designers to master the newly complex mechanics of interactive fiction, but once they did, the computer and video game industry moved into a golden age that, arguably, continues to this day (you can see the DNA of ADVENT in everything from GoldenEye 007 to God of War Ragnarök).

The reason that I bring all of this up is that I think we are at a very similar text-based-computer-games-in-the-late-1970s moment in the world of payment card issuing.

A Quick Primer on Card Issuing

Before we get into that, though, we should spend a few minutes defining, as clearly and succinctly as we can, what card issuing is and how it works.

(Editor’s note – the content from this section was largely drawn from the incredible library of content that Lithic has put together on all things cards and payments. This is an intentionally oversimplified summary of a vastly complex and multilayered set of processes that make up card issuing and processing. If you are interested in digging deeper, dive into Lithic’s content library as well as this excellent primer on payment cards from my fintech friend Eduardo Lopez. After that, if you still want to go deeper, let me know, and I will connect you with the right payments nerds for the furtherance of your education.)

There are three basic types of payment cards – credit/charge cards, prepaid cards, and debit cards.

Credit cards allow cardholders to borrow money from their bank up to a predetermined limit and either repay or revolve that balance (and pay interest). Charge cards are a type of credit card that needs to be paid off in full at the end of each billing cycle. Charge cards are a popular product within certain fintech segments, like corporate expense management. Prepaid cards allow cardholders to access funds that have been pre-loaded onto the card. And debit cards allow cardholders to access funds in their bank account and use them to make purchases or withdraw cash from an ATM.

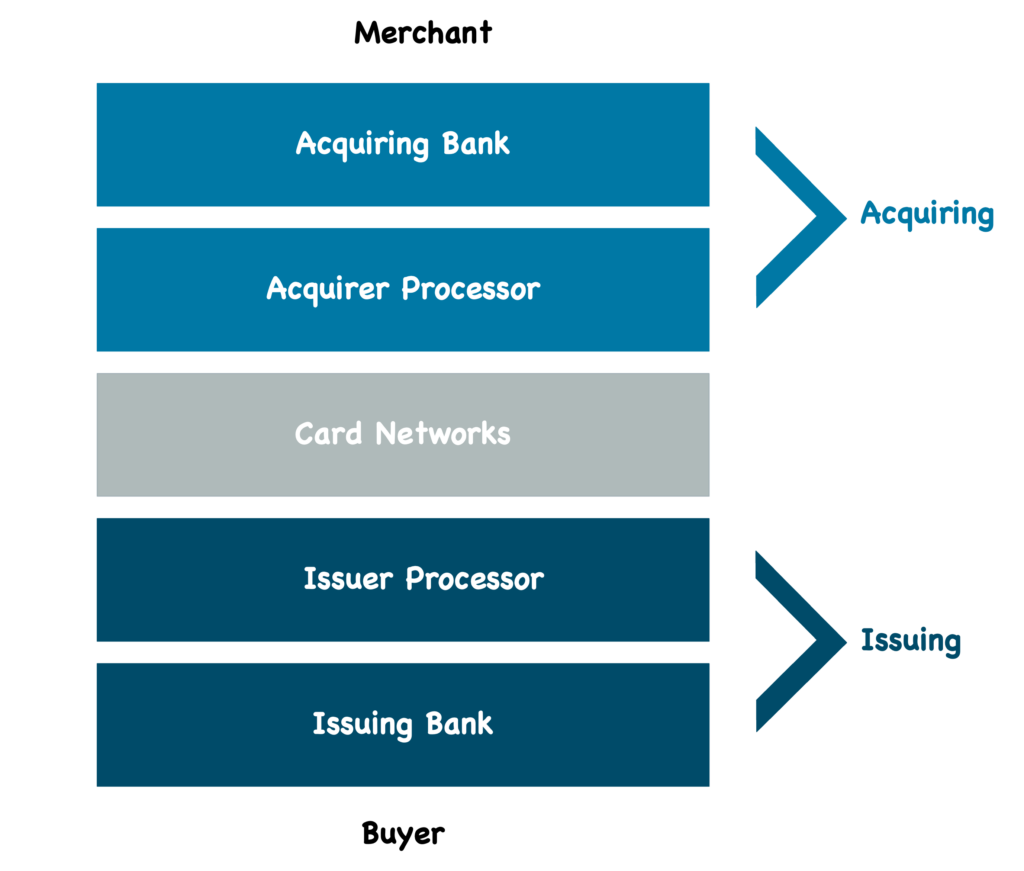

Regardless of the card type, all payment card transactions have two sides: acquiring and issuing. The acquiring side accepts the payment on behalf of the merchant, and the issuing side makes the payment on behalf of the buyer. On each side of the transaction, there’s a bank and a processor, although in some cases, the bank and processor are the same.

Here’s a simple visual:

Mechanically, if we were to think about the card issuing half of this graphic as a set of jobs to be done, here would be the big ones:

- Providing the payment rails. This is what the card networks (Visa and Mastercard) do. Their infrastructure facilitates the flow of payments between the parties engaged in the transaction. The networks also set and enforce the rules for how those transactions are conducted and how any problems are resolved.

- Knowing the customer. You can’t open up a new card account without satisfying regulatory KYC requirements (for the most part, there are some limited exceptions). This responsibility falls on the issuing bank but is often accomplished using technology and data provided by third-party vendors.

- Evaluating the risk and potential profitability of the customer. Once you have established the customer’s identity and confirmed that you are legally allowed to do business with them, you have to determine whether you want to do business with them. This process can include a credit risk evaluation if the product being applied for is a credit card. Or it can be a simpler risk screen to weed out potential first-party fraud risks (which is an especially relevant problem these days). This responsibility falls on the issuing bank as well, although if the card is being issued on behalf of a non-bank company (like a retailer or airline), that company will have some say here as well. And again, technology and data from outside vendors are commonly employed for this job.

- Creating and funding the card account. Once the customer has been approved, the card account needs to be created and funded. The mechanism for funding obviously depends on the type of card account being created. The issuer processor typically works in conjunction with the core banking system and/or loan servicing system to do this job.

- Generating the actual card(s). The issuer processor is also responsible for issuing the cards, which historically has meant coordinating with card manufacturers to print and ship physical cards to customers. However, in recent years, virtual cards and digital wallet cards (cards that are pushed to your Apple Pay or Google Pay wallet on your mobile device) have become much more common, as a supplement to or (in some cases) a full replacement for physical cards.

- Authorizing transactions. This is the only job that happens in real-time, during the payment transaction. The acquirer processor will pass a message through to the card network to check with the issuer processor to confirm that the card is valid and that the cardholder has sufficient funds or credit available to complete the transaction.

- Settling the transactions. After the transactions are completed, they are batched up and sent from the merchant (through the acquirer processor) to the card networks and on to the issuer, so that they can be settled and the funds transferred back to the merchant (minus the fees). The issuer processor helps orchestrate the necessary communication between the issuer and the network for settlement.

- Keeping track of everything. All card issuing and payment processing activity is tracked in a centralized ledger, which acts as the single source of truth for the issuer. This ledger is sometimes provided by the issuer processor and is sometimes provided by a separate third-party vendor or by the issuing bank itself. Different card types require different ledgering and account servicing capabilities (i.e. credit cards require the ability to track payments and calculate outstanding balances and interest).

- Watching out for fraud and money laundering. The issuing bank is responsible for monitoring their cardholders’ transactions in order to spot any signs of money laundering. They also monitor transactions and account activity for signs of post-onboarding fraud. They will frequently leverage third-party data and technology to assist with this.

- Providing ongoing customer support. The issuing bank (or the non-bank company working with the issuing bank) provides ongoing support to cardholders, including dealing with any disputes or chargebacks.

- Collecting payments and chasing down delinquent customers. This one is only relevant to credit cards, as they are loans that require customers to make regular payments on outstanding balances. If customers don’t pay in a timely manner, the issuing bank will often attempt to collect on the delinquent balances by contacting the customer and encouraging them to pay. The collections process is often messy and unfun, which is why non-bank companies that are providing cards may choose to outsource this activity back to their issuing bank partner.

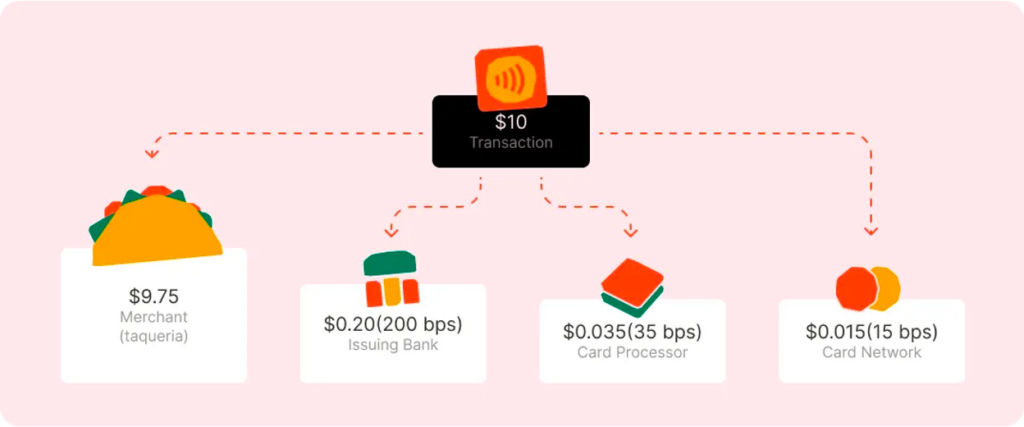

The primary source of revenue for the companies on the issuing side are interchange fees, which are a percentage of each transaction amount paid by the merchant to the issuing side and the card network as compensation for the risk and cost of providing the card to the cardholder, as well as to cover the cost of processing the transaction, providing ongoing cardholder support and protections, etc. Here’s a handy illustration from Lithic:

OK, I think that gives us a good grounding. Now let’s jump back in.

The Evolution of Card Issuing

Card issuing used to be simple.

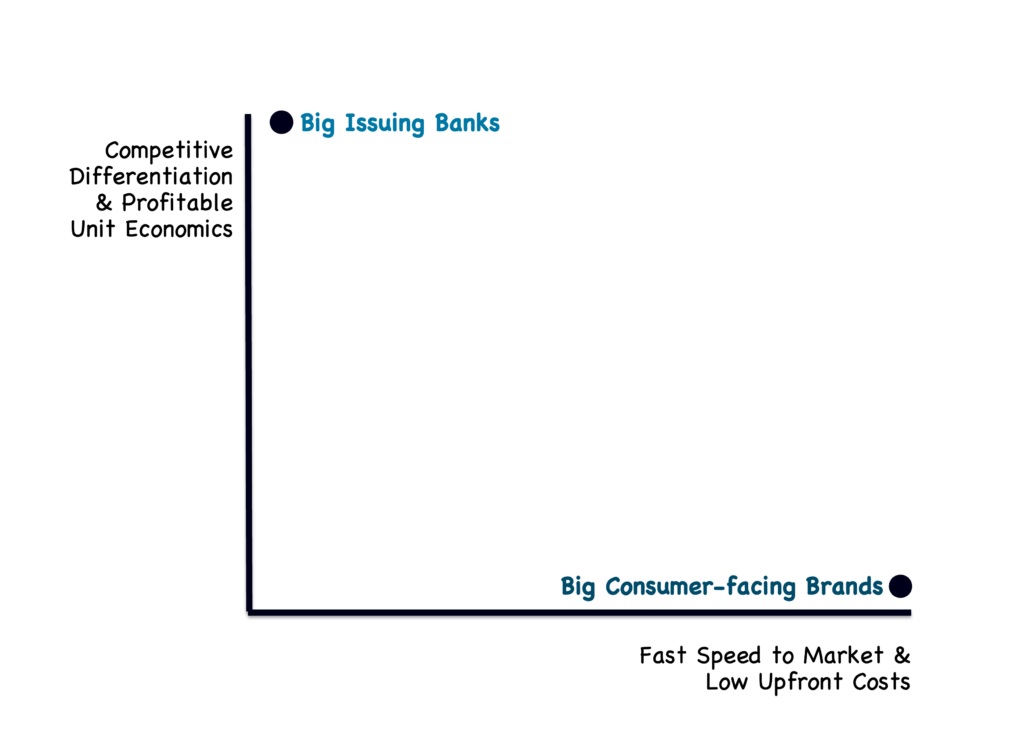

There were basically two paths you could choose to go down, depending on what outcomes you wanted to optimize for.

If you wanted to issue a payment card that would help differentiate your company in the market and directly produce the most profit possible over the long term, you would issue your own card. This was the path of the large banks (think Bank of America and JPMorgan Chase).

If you wanted to issue a payment card quickly and with very little upfront work or expense, you would partner with an issuing bank and launch a co-branded or private-label card. This was the path of large retailers and other consumer-facing brands (think L.L. Bean and Delta).

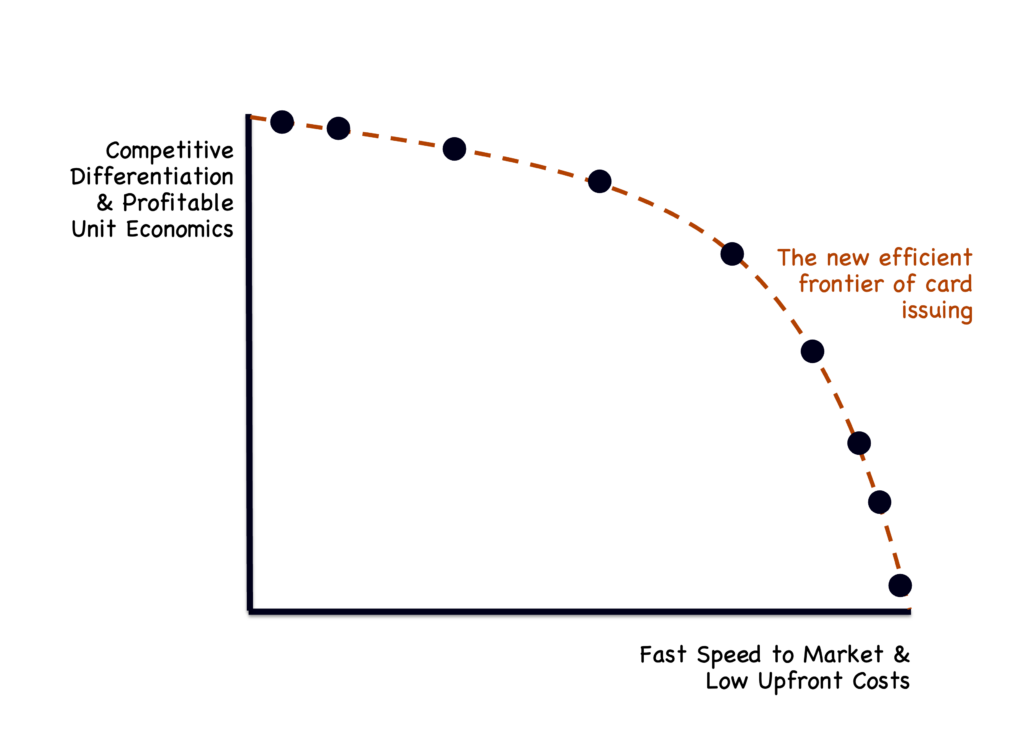

If you were to plot this out on a graph, it might look something like this:

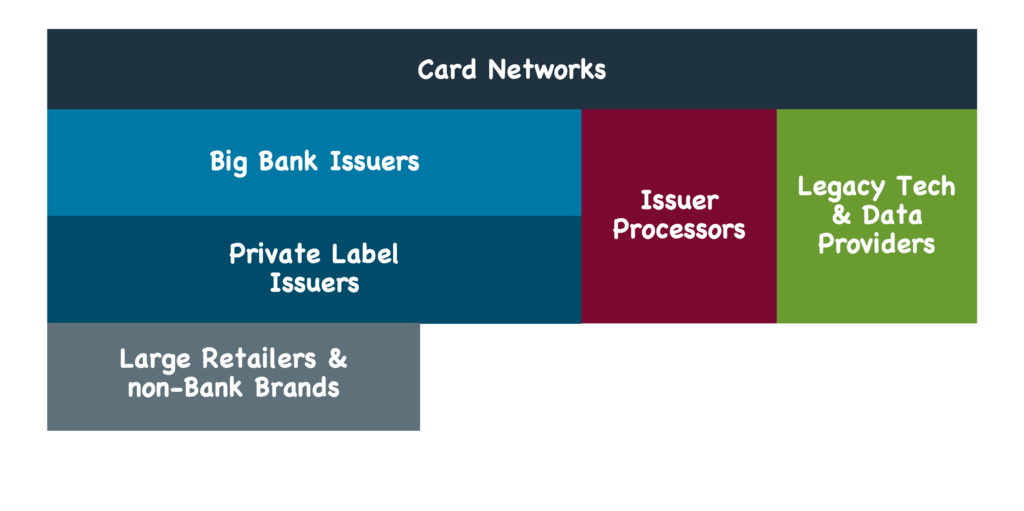

The number of companies involved in this market was relatively small. You had the big issuing banks, which had the resources and scale to justify building out their own tailored card programs (and supporting co-brand programs). You had a couple of dominant private label card issuers (Synchrony, Alliance Data), which enabled a few large retailers and other non-bank brands to quickly and inexpensively launch their own card programs. You had a few big issuer processors like TSYS, which helped enable all of these banks to run their card programs. You had a small set of legacy technology and data vendors (Equifax, FICO, LexisNexis) that helped with the ancillary jobs to be done. And, of course, you had the card networks.

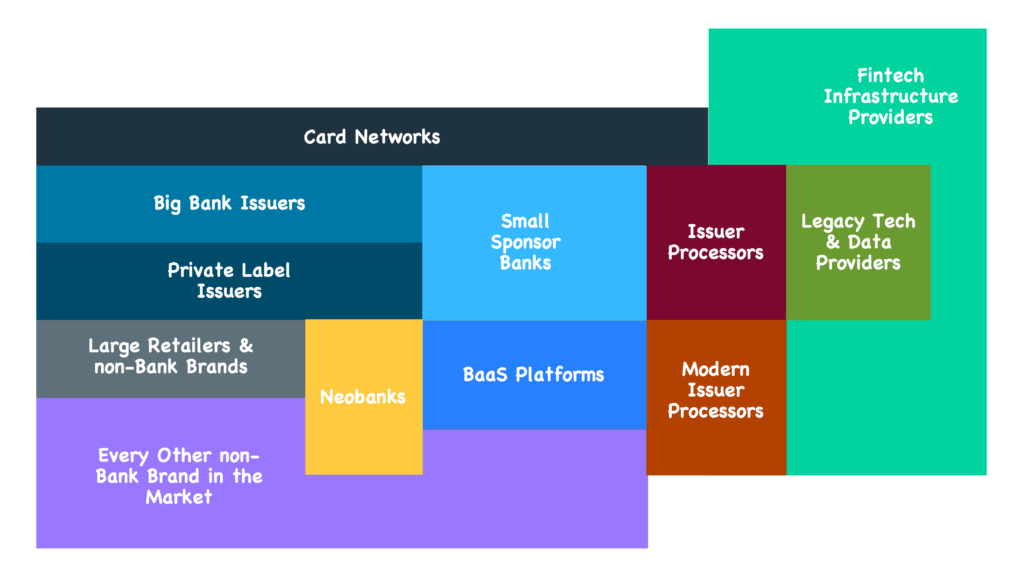

Then things started to get more complex.

Entrepreneurs and VC dollars started flowing into fintech, and that, combined with some timely regulation, led to a proliferation of new companies in and around the card issuing space. Smaller banks, taking advantage of their Durbin-exempt interchange status, built out sponsor bank programs for smaller non-bank brands to take advantage of. Neobanks leveraged those sponsor banks to launch innovative debit card products. BaaS platforms and newer issuer processors popped up to help neobanks, and other smaller non-bank brands streamline the process of working with sponsor banks and give them more granular control over the design of their card products. And an entirely new universe of fintech infrastructure providers appeared, offering no-code tools and APIs for every job to be done, from KYC and AML to ledgers and servicing.

It’s worth pausing and reflecting for a minute on the issuer processor portion of the fintech infrastructure landscape (the orange and red boxes) because, even when you account for the rapid pace of innovation in financial technology over the last couple of decades, issuer processing as a category stands out.

A lot of providers in the issuer processor space like to use the word ‘modern’ to describe themselves – we’re the modern card issuing platform. The reason for this is that the issuer processor market has evolved unusually fast.

The first wave of issuer processors – FIS, Comdata, Jack Henry, Wex, and Fiserv – were founded in the 1970s and 1980s. They focused on serving companies in specific verticals (banking, healthcare, fleet/logistics), and, as with most technology providers from the time, their services really only made sense for large companies that could afford the time (12+ months) and money ($1+ million) needed to launch a card program.

The second wave of providers – Galileo, Corecard, i2c – appeared within the last 20 years. The newest of them, Marqeta, was founded in 2010. These providers leveraged APIs and bundled program management with their platforms in order to cut the time and money needed to launch a card program in half, which helped open the market up to mid-size and enterprise companies across a wide variety of verticals. Many of the most successful fintech card programs from the last 10-15 years were built on these platforms.

And yet, the march of technological progress continues, relentlessly.

In the last couple of years, a third generation of issuer processors has emerged. The focus of these companies – Lithic, Highnote, Stripe – is to fully leverage APIs and cloud-native platforms to enable new use cases and streamline the process of launching a card program. Card programs built on these players can be launched in as little as one month, which opens up these services to companies across a wide range of verticals.

The net result of all of this innovation has been to dramatically expand the number of options for companies looking to launch a card program. No longer are we reducing card issuing down to a single choice: profitability & product differentiation or speed-to-market & low setup costs.

Today, companies are empowered to pick the optimal spot anywhere along that continuum:

That’s great.

However, much like the early days of text-based computer games, it can be easy for companies interested in launching card programs to get lost in the ‘illogical spaces’ created by this abundance of choice.

What’s needed is a guide for navigating the new world of modern card issuing.

A Starter’s Guide

I’m not sure it’s possible to write a single, fully comprehensive guide for navigating all of the choices that one would need to make when building out a new payment card program. However, I have done my best to distill down a few of the more important ‘decision points’ within that process and provide some advice for how to navigate those decisions, keeping in mind the main decision drivers outlined above (profitability, differentiation, speed to market, and cost).

A couple of notes:

- Because I’m a dork, I have written some of this starter’s guide in the style of an early-1980s interactive fiction computer adventure game. Each decision point starts off with a ‘narrative’ that sets up the decision. Please don’t stuff me into my locker.

- The advice for how to navigate each decision point was provided by Nikil Konduru. Nikil works on GTM strategy at Lithic and has forgotten more about this stuff than I’ll ever know.

OK, ready?

Here’s the overarching narrative for this exercise:

You have burned the boats that brought you here. Nothing remains behind. Ahead of you is a journey that will define the rest of your life. The choices you make now will determine the path you tread, the rewards you reap, and the perils you encounter. Choose wisely.

The Card Network

Narrative: In front of you sits a vast and impenetrable-looking wall. It appears to stretch, without end, to either side of you. You gaze up, but you cannot see its top. Directly in front of you, embedded within the wall, are two doors. The doors each have a symbol above them, but otherwise, they are unmarked.

Possible Actions:

> VISA

> MASTERCARD

Advice: American Express and Discover mostly operate a three-party model, which means that they are the only issuing banks on their networks. So we are excluding them here. When choosing between Visa and Mastercard, you ideally want one of the networks to offer you financial incentives in order to win your business. This can be extremely difficult for most startups unless they have an experienced founding team with deep relationships in the payments space and/or an especially compelling use case that one of the card networks sees a lot of potential in for new network growth.

The Product Type

Narrative: You approach a long wooden table. On the table are three weapons, each with its own unique characteristics. You may pick up any of the three weapons, but you may only take one with you.

Possible Actions:

> PREPAID CARD

> DEBIT CARD

> CREDIT/CHARGE CARD

Advice: All three of these card product types can facilitate payments. Prepaid tends to be the most flexible and quick-to-market option. It can be used in a one-time capacity (with little-to-no KYC required), or it can be reloadable. It has a demonstrated track record of helping to facilitate merchant loyalty programs, but can also be used, functionally, like a bank account. And it usually comes with interchange rates that are slightly higher than debit cards (to offset increased fraud risks). Debit cards are generally the lowest interchange option, but they are also the most broadly useful for consumers. They are tied to a bank account, which means the card is connected to an account that is consistently getting replenished with fresh funds, meaning the card is more likely to get used for spending. They don’t allow users to take on debt. And they, uniquely, facilitate access to cash (via ATMs). Credit cards are high risk, high reward. They are the most complex to service. They come with a lot of compliance requirements. They require the issuing company to provide the funding, which obviously subjects the issuer to credit risk. Because of this, they aren’t usually accessible to all consumers and businesses (unless the issuer is focused on credit invisible customers). However, credit cards also generate the most interchange. They have the potential to generate revenue through interest on revolving balances. And they tend to be popular among older and more wealthy customer segments as well as segments that are drawn to cash-flow smoothing as a value proposition.

The Sponsor Bank

Narrative: You enter a room filled with dozens of warriors. Some of them are well-armored and reputable looking. Some are … less so. Some attempt to speak with you, while others ignore you. A few will actively avoid you if you try to interact with them. One of these warriors will be your teacher, protector, and companion on the road. Choose well.

Possible Actions:

> ANY ONE OF THE DOZENS OF DIFFERENT SPONSOR BANKS IN THE U.S.

Advice: Some sponsor banks will be immediately off the table for you, depending on the card network that you pick (if that’s important to you) and the product type that you pick (prepaid and debit are much more commonly supported than credit). You want to find a sponsor bank that believes in your vision for your product and your likelihood of being successful (it’s really very similar to pitching a VC, except that you can be sure the bank is actually going to dig through your data room). Ideally, you want to work with the most established and respected sponsor banks because they tend to have the best relationships with regulators and thus carry the least risk of regulator-induced disruption (which we have seen recently with a number of sponsor banks and the OCC). However, these sponsor banks are low risk because they are extremely picky about the partners they work with and are thus hard to land. You want to find a sponsor bank that is a good fit personality-wise (do the people at your company get along well with the people at the bank?) and that has an approach to compliance and risk management that is compatible with your level of sophistication and operational rigor (i.e. you don’t want to be constantly getting requests for reports that you’ve never heard of and have no ability to produce). You can work with a sponsor bank through a third-party program manager (some issuer processors and BaaS platforms provide this service), which can make the technology integration and compliance management with your partner bank easier, but going this route will require you to work with a sponsor bank that the program manager already has a partnership with (which could be a bank with a not-so-good reputation with regulators), keep you one layer removed from having a direct line of communication with the sponsor bank – perhaps the most critical partner in your supply chain, and it will likely cost you more at scale than a direct relationship with a sponsor bank would. If your product or use case deals with a high-risk vertical or customer segment (cannabis, gambling, adult entertainment, etc.), you will be picking from a much smaller list of sponsor banks, and you will likely be paying more for the privilege of working with one of them.

(Editor’s note – I would be remiss if I didn’t point out the great resources that Lithic has for helping fintech companies work with sponsor banks. There’s a great guide and two podcasts from Matt Janiga and Reggie Young that you should check out.)

The Issuer Processor

Narrative: You come to a stable. It contains a number of magnificent horses, of varying ages, temperaments, and capabilities. They all appear fairly similar, but they react very differently when you approach them. They also react very differently to the presence of your warrior companion. You may choose one horse (and one horse only) to carry you and your companion on your journey.

Possible Actions:

> ANY ONE OF THE GROWING LIST OF ISSUER PROCESSORS IN THE U.S., FROM ANY OF THE THREE GENERATIONS OF COMPANIES DISCUSSED ABOVE

Advice: If you are planning to build a card product with some unique features, you will want to work with an issuer processor that is API-first, developer-friendly, and innovative. Not all issuer processors support all card types (credit is the least likely to be supported). Some offer program management services and have established relationships with sponsor banks that they can easily onboard you onto, while some issuer processors require you to bring your own sponsor bank. You want to work with an issuer processor that is not only reliable, and capable of responding quickly to your needs, but also continually reinvesting in its platform and capabilities, including keeping up with the latest updates from the card issuers (Visa’s Fleet 2.0 initiative and Mastercard Installments are fairly recent examples).

The Fintech Infrastructure Providers

Narrative: You enter a massive emporium, which sells everything from food to clothing to navigation equipment. You glance down one of the aisles, and you can’t see the end of it. Your purse is heavy with gold, but you remind yourself that its contents are not unlimited nor likely to be replenished anytime soon. You also notice, in the front corner of the emporium, a couple of vendors offering ‘all-in-one’ travel planning services, which offer to assemble everything you need for your trip and plan the entire thing out for you. These services cost almost all the gold you have, and they require you to give up the warrior companion and horse you selected earlier (they will be choosing for you).

Possible Actions:

> A MYRIAD OF DIFFERENT FINTECH INFRASTRUCTURE PROVIDERS, FOR ALL THE REMAINING JOBS TO BE DONE WITHIN CARD ISSUING

> A FULL-SERVICE BAAS OR CCAAS (CREDIT CARD-AS-A-SERVICE) PLATFORM PROVIDER

Advice: Use a BaaS or CCaaS platform provider if your primary goal is getting off the ground quickly and you are less concerned with flexibility or unit economics at scale. (maybe the primary goal is loyalty and retention, not revenue). If you choose not to go the BaaS/CCaaS platform route, choose the individual fintech infrastructure providers that you integrate into your card issuing ‘stack’ with care. Focus on the providers that help enable your competitive differentiation (e.g. if you are offering a crypto-backed debit or credit card, you will want to find a strong partner to enable crypto on-ramping and buying and selling, and you’ll want to agonize over picking the right KYC and AML providers). Try to save money on everything else (remember, each additional fintech infrastructure provider you add to your stack eats into your unit economics). Don’t ever pick fintech infrastructure providers because you think they’re cool.

Where Is This Journey Taking Us?

We are in the very early innings of a monumental shift in the ability for companies to quickly and inexpensively stand up payment card programs and start issuing cards.

Not every company will issue its own payment card (I’m not a huge believer in the “every company will be a fintech company” orthodoxy, at least not literally). Indeed, I think it’s unlikely that we will see the same widespread adoption of this modern payments infrastructure on the issuing side as we have (and will continue to see) on the acquiring side. Practically every merchant has to accept payment cards in order to be in business. It’s a prerequisite. Thus the value prop of an optimized payment card acceptance solution will always have more widespread appeal than a comparable solution on the issuing side.

Having said that, I think that we are nowhere near the optimal level of issuance and use of payment cards in the U.S. and certainly not internationally (that sound you hear is every executive at Visa and Mastercard simultaneously high-fiving). Something like 40% of B2B payments are still made using checks for crying out loud.

There is significant room to run, and companies will be increasingly able to explore the opportunities provided by card issuing … however they want.

> END

About Fintech Takes’ Sponsored Deep Dives

Sponsored Deep Dives are essays sponsored by a very-carefully-curated list of companies (selected by me), in which I write about topics that are of mutual interest to me, the sponsoring company, and (most importantly) you, the audience. If you have any questions or feedback on these sponsored deep dives, please DM me on Twitter or LinkedIn.

Today’s Sponsored Deep Dive was brought to you by Lithic.

A Little Bit About Lithic

Lithic builds card issuing infrastructure for developers. Software companies use Lithic’s APIs to move money, build card programs, and issue debit, credit, and prepaid cards to consumers and businesses. Today, Lithic powers a variety of use cases, such as bill pay and expense management solutions, corporate incentive programs, and co-branded cards for companies. Unlike other solutions, Lithic allows for a faster, more flexible go-to-market process with hands-on support from experts across implementation, partnerships, and legal and compliance.