09 December 2022 | FinTech

Make it Dumber

By Alex Johnson

Let’s say it’s 2019, and you’ve decided you want to build a neobank.

What kind of neobank might you build?

Well, you’d probably focus on the youngest cohort of available customers – Gen Z. The ones you feel like incumbents are probably least able to understand and serve well.

You might look for some way of simplifying the banking experience for these consumers, taking advantage of some new technology that they are inherently comfortable with, like mobile chat apps.

Ideally, you’d want to be able to sell your vision for your product as being part of a larger, global trend that just hasn’t become fully distributed yet. If you went with a mobile chat-based banking product, you might link it to the emergence of super apps like Alipay and WeChat in China.

You might launch something like Zelf:

Initially launched in 2020, Zelf aspired to be a light-touch, convenient, communication-centric neobank for Gen Z consumers in Europe:

Europe’s youngsters are getting a “messenger bank” — an encrypted chatbot that manages users’ finances and sends money via Facebook, WhatsApp, Telegram and Viber.

The fintech behind the venture is called Zelf and is on the cusp of launching, having signed up 350,000 users to its waiting list across France and Spain since April.

Unlike its fellow neobanks, Zelf has no app and no physical card. It also has no “offboarding” — meaning users can’t withdraw funds once inside. Instead, users will be able to transfer money to other ‘Zelfers’ or shop via a virtual Mastercard, which integrates with Apple Pay and Google Pay (allowing both online and offline shopping).

Its main selling points were speed:

It takes seconds — literally — to open an account. After clicking on a launch link, a new conversation with Zelf pop opens on WhatsApp or Facebook and promptly issues users their own IBAN account number and virtual card, which they can transfer money to and ‘top up’.

Users don’t even need to prove their identities until they’ve spent or received over £150, in what the company calls a “light KYC [know you customer]” approach. Zelfers can, therefore, get up and running almost immediately — even if they aren’t over 18 — without leaving their favoured app.

And an ability to facilitate P2P payments without requiring the sender and the recipient to download yet another new mobile app:

“These [social media] apps are where people spend 65%-84% of their screen time… so we haven’t built our own app by design. We want to make it more frictionless, just like sending a message,” Zelf founder Elliot Goykhman told Sifted in an interview, speaking from his native Russia.

“Let’s say you were talking to your sister on Facebook, you can send the money you owe her straight on there… She can even sign up directly on Facebook,” he notes. Even modern banking apps like France’s Lydia create new pain-points by prompting a download and a lengthy signup process, he argues.

And, of course, Zelf’s roadmap had a plethora of additional features, including the ability for customers to manage their side hustles more easily:

By year-end, it hopes to offer full-use virtual cards, loans and ready-made invoices for Premium users — a nod to the younger generation’s financial drive and ability to earn money as influencers or online.

All in all, not a bad concept.

It was certainly ambitious (a neobank without a mobile app), but you can understand the reasoning, and you can appreciate the initial execution. I mean, look at this website. They certainly nailed the Gen Z brand aesthetic:

You can understand how Zelf raised a $2 million seed round in 2021 (especially considering that the founding team at Zelf has an extensive history working at some of the largest banks in Europe).

It was a decent bet.

However, since its initial launch, Zelf doesn’t appear to have been flying off the shelf (I’m so sorry … I couldn’t help myself).

It’s hard to say why that is. I’m not terribly well versed in the competitive dynamics of the European retail banking market, but maybe 19-year-olds in France and Spain don’t actually mind downloading new apps onto their smartphones? Or maybe the fact that Zelf’s “light KYC” approach (read: not doing KYC) limited its customers to payments of £150 or less (yes, really), reduced the service’s overall utility and appeal?

The reasons aren’t really important for the purposes of this essay.

What is important is how Zelf responded.

Did it beef up its KYC process and figure out a way to compliantly handle more than £150 at a time? Did it create a mobile app as an alternative point of interaction to the messaging service? Did it refine its customer acquisition strategy?

No.

I mean, it did a few of those things (sort of), but no. The big change that it made was doing the thing that the year 2021 taught most new financial technology companies to do.

It made the product dumber.

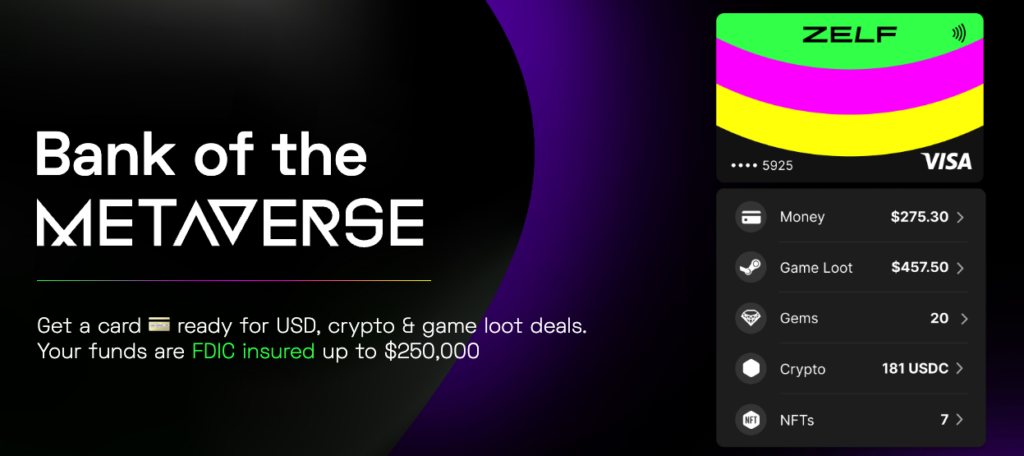

Here’s what the new Zelf, relaunched just this week, looks like:

I am now going to do my best to fairly describe what the newly relaunched Zelf is trying to do and how it appears to work:

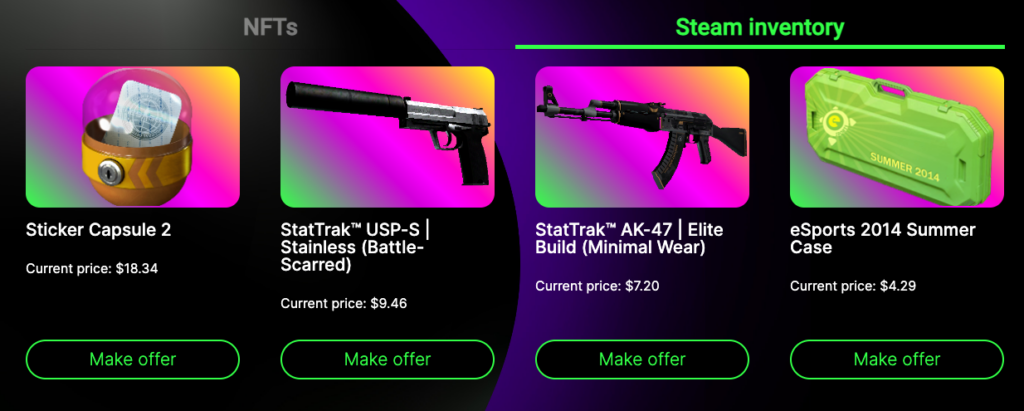

Zelf is the “Bank of the Metaverse.” Its mission is to “turn digital loot into real money and vice versa. Simple and fast.” It allows users to anonymously open a deposit account and charge card (issued by Evolve Bank and Trust), via whichever messaging app they prefer. The user’s Zelf account generates a virtual card, which can be used online or through a mobile wallet such as Apple Pay or Google Pay. Zelf allows users to transfer and sell USDT, USDC, ETH, and more than 20 other crypto tokens. Users can buy NFTs from Opensea through Zelf, list and sell NFTs on Zelf’s proprietary marketplace, and earn free NFTs and rewards towards the purchase of new NFTs by referring new users to Zelf. And finally, Zelf allows users to connect their Steam accounts (Steam is a digital video game distribution and streaming service) and keep track of their in-game inventory of loot (weapons, skins, crates, etc.), and sell their play-to-earn assets for cash within the Zelf marketplace.

OK, now let’s break that down.

1.) I have no idea what “Bank of the Metaverse” means. What is the metaverse? I tried to define it in a piece I wrote a while back as ‘a more immersive version of the internet, enabled by technologies like virtual reality.’ What is Zelf’s definition? Does it even have one? I certainly couldn’t find one on its website. Maybe Zelf believes that everyone born after 1995 just instinctively knows what the metaverse is and all they need to do is just invite them to join it?

(“Join Metaverse!” doesn’t even sound grammatically correct to me, let alone a compelling call to action, but I’m not Gen Z, so …)

2.) I also take issue with the word ‘bank’. Zelf isn’t a bank in the same way that Chime isn’t a bank (although Zelf is much less clear about this distinction on its website than Chime is). However, it’s also not a bank in a more important way.

The underlying product here is a deposit account and a charge card linked to a line of credit. That line of credit is set based on the funds available in the deposit account, so, functionally, the card operates like a debit card, but with a slightly higher interchange rate (I’m guessing) and the ability to report the “payments” to the credit bureaus (this is something that Zelf says in its terms of service that it has the legal right to do, but it doesn’t tout it as a credit building benefit the way that some other neobanks do).

Here’s where it gets weird.

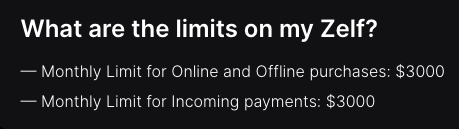

Users can only deposit up to $3,000 per month in their account, and they can only spend up to $3,000 per month from their account.

Why?

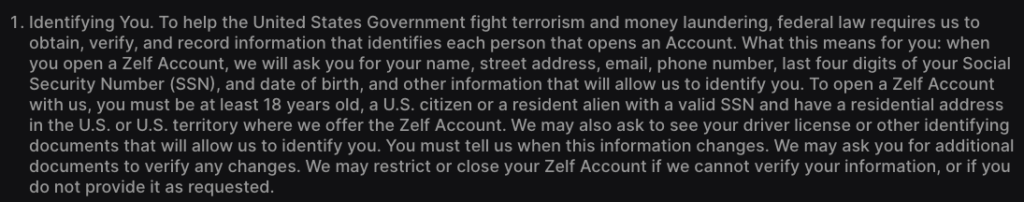

I don’t know, but I’m guessing it has something to do with Zelf’s insistence on being “best in privacy” by offering an “anonymous” debit card that users can sign up for with “no SSN, ID, document scans or selfies required.”

This is for real. You can sign up for a Zelf account by simply texting Zelf your name and phone number. The “light KYC” approach makes for a crazy fast account opening experience and a just plain crazy approach to compliance.

As Jason Mikula at Fintech Business Weekly pointed out on Twitter, this onboarding process directly contradicts Zelf’s own terms of service, which state that it will collect user information (including the usual stuff like address and a partial SSN):

Evolve Bank and Trust has been the subject of some unpleasant rumors over the last couple of weeks, stemming from their partnerships with crypto companies like FTX and BlockFI. Some of that speculation is unfair and rather illogical (crypto contagion isn’t going to cause a solvency problem at Evolve). On the other hand, some of that speculation is entirely fair based on the types of companies and business models Evolve is helping to enable. I mean, really? Anonymous debit cards? Is anyone at Evolve even checking their partners’ marketing materials?

And, on a related note, I just love this FAQ from Zelf’s website:

3.) The crypto piece of this is weird, even for crypto. Users can “top up” their Zelf accounts with crypto by sending 25+ different tokens from one of their other wallets to their Zelf wallet (enabled by ZeroHash). Those tokens are then automatically liquidated by Zelf (which charges a 1% fee each time you do this), and the resulting USD balance (minus the 1% fee) is added to your Zelf account balance.

Most neobanks enable their customers to buy and sell crypto tokens directly within their app. I have my concerns with that, but at least the value prop makes sense. It makes the neobank app a convenient one-stop shop. How is Zelf’s manual crypto deposit and liquidation feature at all useful?

4.) The NFT play here is awful. If a friend refers you to Zelf and you sign up, you get a free NFT from Zelf. However, you only own that NFT for 30 days, which is the window in which you want to pump up and promote your NFT and try to convince someone you know to buy it on the Zelf marketplace. If you succeed, you get paid, and your friend who initially referred you gets paid, and your other friend who just bought the NFT gets screwed.

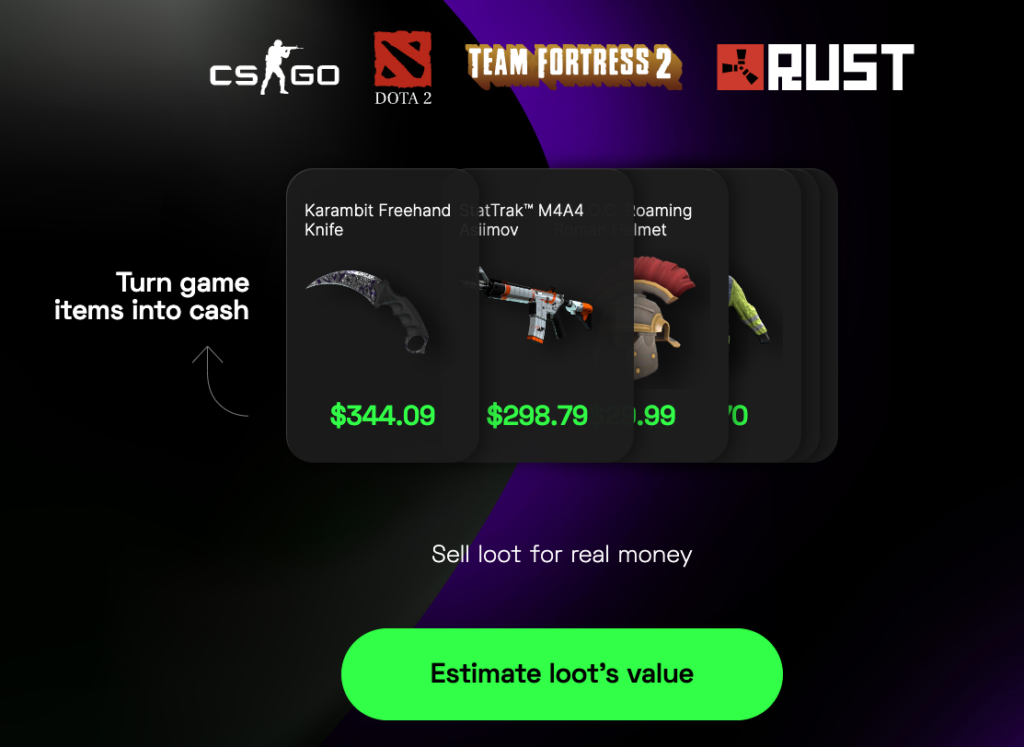

5.) As if all of this wasn’t enough, there’s also play-to-earn gaming (Zelf uses this term all over its website).

The promise is that gamers who play CS:GO, Dota 2, Team Fortress, Rust, and PUBG and have a Steam account with inventory from those games can link that inventory to their Zelf account, list the items in Zelf’s marketplace, and sell them for REAL MONEY.

Here’s how they sell this value prop on their homepage:

And here’s a screenshot from their loot marketplace:

I don’t know what’s worse; that Zelf believes that someone would pay $344.09 for a virtual knife, or that the listed prices for weapons and gear that is currently listed in Zelf’s marketplace are all a fraction of that.

6.) Zelf claims that its card can be issued to users in over 150 countries worldwide, and given the company’s general approach to compliance, I’m sure it believes that claim is true!

7.) I have no idea who this card is for. Who is the target market? 18-year-old, privacy-obsessed digital nomads wandering from country to country playing video games and buying and flipping NFTs and loot for a living while never spending more than $3,000 per month?

Bad Timing

It’s easy to make fun of this today, but if we’re being honest, the only thing Zelf really got wrong here is the timing.

This is a 2021 fintech product being launched at the end of 2022.

In December 2022:

- Meta’s stock price is down by a catastrophic amount because public market investors think that Mark Zuckerberg has lost his mind trying to build the metaverse.

- NFT sales have collapsed into a black hole, and Bored Apes can now be purchased for less than $60,000 (I still feel incredibly stupid typing that but whatever).

- Axie Infinity, once the darling of the emerging play-to-earn phenomenon, is being criticized as digital sharecropping masquerading as an unfun video game.

However, in 2021:

- Meta had the most popular app in Apple’s App Store on Christmas: the Oculus VR app.

- A picture of a dog was sold for $4 million, fractionalized into billions of tokens representing tiny portions of that picture, and resold at a total valuation of more than $300 million.

- Sky Mavis, the creator of Axie Infinity, raised $152 million at a $3 billion valuation (led, of course, by a16z).

If the new Zelf – the privacy-preserving, digital asset ownership-enabling, bank of the metaverse – had hit the market in early 2021, it would have raised an absurdly large Series A round, and most of us wouldn’t have even blinked.

Shit, it wouldn’t have even had to make any actual changes to its products or build these integrations with ZeroHash, Opensea, and Steam! It could have just updated its website and pitch deck (Metaverse! NFTs! Play-to-Earn Gaming!), and VCs would have been dropping term sheets on its head.

When the Search for Product-Market Fit Goes Off the Rails

The changes that Zelf has made to its product and positioning over the last couple of years are entirely logical and aligned with the incentives that the fintech and crypto ecosystems have provided, until very recently.

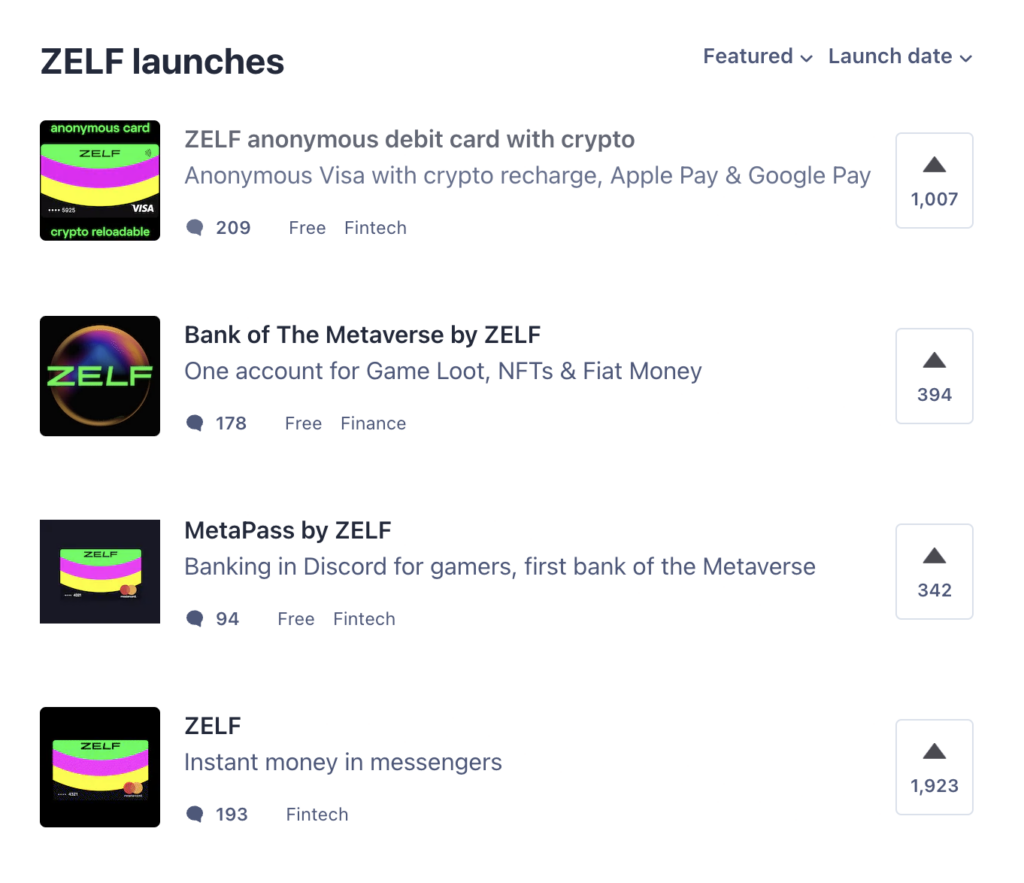

Just look at Zelf’s history on Product Hunt! It’s been trying to find product-market fit by iteratively making its product dumber:

Building a new, better way for consumers to interact with their money is hard.

Even under the best circumstances, founders are still battling against behavioral inertia, powerful market incumbents, and a regulatory superstructure that casts an incredibly long and intimidating shadow over everything they are trying to do.

Iteratively building a product that customers will love and that VCs will understand and invest in is insanely difficult, and the circumstances today are far from ideal.

I think the least that us non-builders (investors, journalists, analysts, etc.) can do is not derail founders’ search for product-market fit by overhyping immature, untested technologies and obviously stupid trends.

Fintech should never again be an industry where making your product dumber is somehow the best and/or easiest way to generate value for stakeholders.