Welcome back to the latest installment of Hospitalogy, which drops into your inbox every Tuesday and Thursday!

Today’s news round-up: CMS releases Direct Contracting results, Atrium and Advocate complete their merger, and athenahealth might IPO once again.

Join 12,100+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!

Direct Contracting (DCE) savings results – 2021

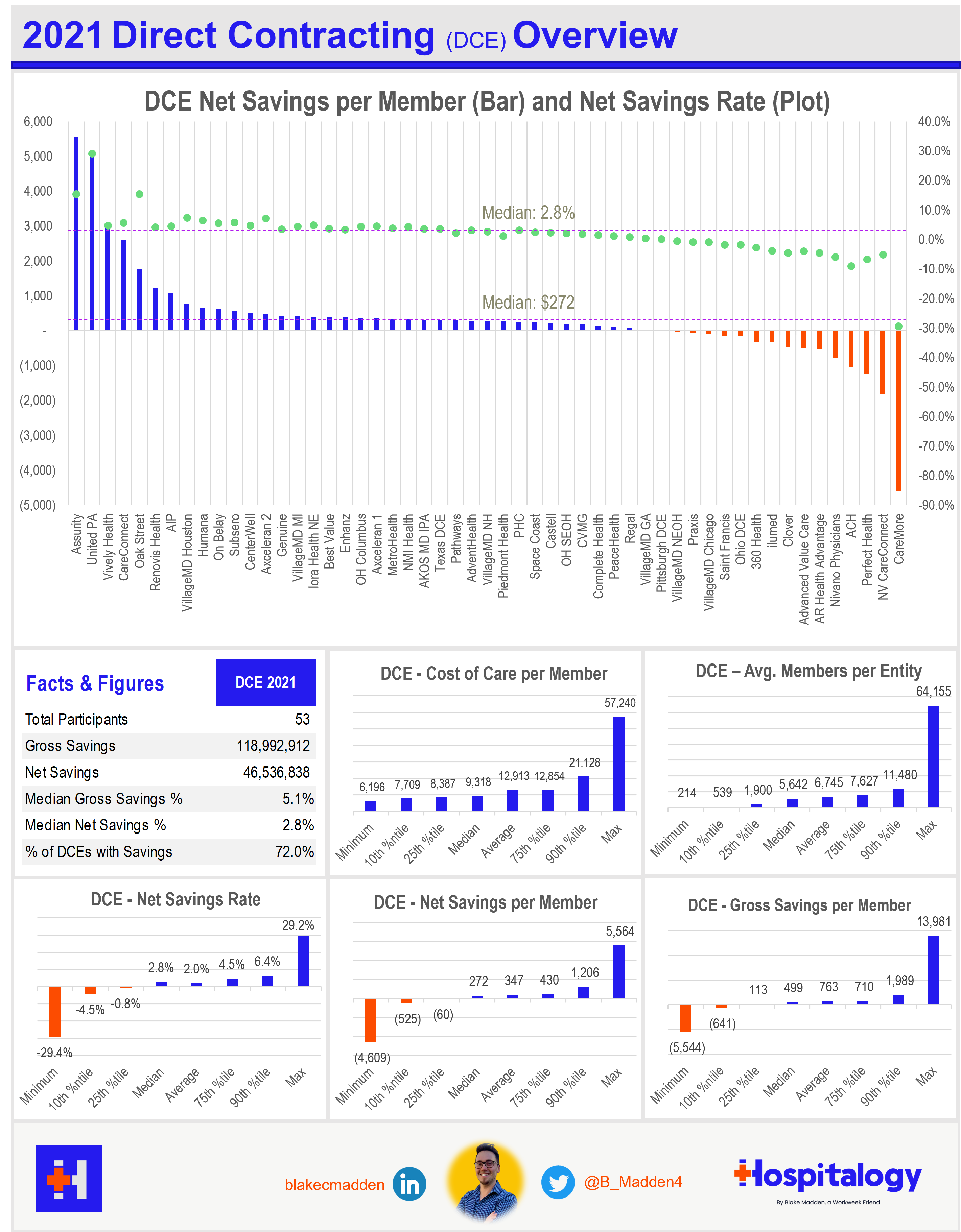

On November 29, CMS published the results for the 53 entities participating in the Global and Professional Direct Contracting (DCE) program. After diving into the results (which you can find at the bottom of that linked page), here are some of the biggest takeaways:

- From a pure dollar perspective, Clover Health performed the worst in the DCE program, at a net savings rate of ($30.4M). That’s quite notable considering Clover was touting DCE growth throughout 2021, expecting its membership to zoom to 125,000 lives in 2022. With the onset of ACO REACH, Clover is, expectedly, dialing back its participation. Interesting considering at one point, according to Health Affairs, Clover attributed 70% of its $3.7B valuation to the DCE program (now sitting at a $600M market cap and $245M enterprise value). It will reduce its total attributed DCE lives by two thirds and gross revenue will hit just north of $1 billion in the program – which is why you shouldn’t value Clover on a revenue multiple, folks. Pretty crazy that Clover almost singlehandedly dragged down this whole program but perhaps there’s a broader strategy I’m unaware of.

- All 53 DCEs created north of $119M in gross savings and $47M in net savings, with around $70M in savings generated for Medicare.

- 72% of DCEs generated savings while 15 lost $$$

- Median savings were $775k or 2.8% of the pre-discount benchmark

- Top performers included Oak Street Health, VillageMD’s combined 6 DCEs, OH Columbus, Vively Health (DaVita), and Humana. The top 10 generated $65M in net savings, while the bottom 10 lost $52M, $30M of which was Clover. If you removed Clover from the equation (which is the massive orange negative bar in the graphic below), you likely get a much different picture for the DCE program overall:

What’s next: ACO REACH starts in 2023, which has much more stringent requirements around ACO plan design to address people with traditional Medicare in underserved communities. REACH participants will need to make “measurable changes to address health disparities. This includes greater access to enhanced benefits, such as telehealth visits, home care after leaving the hospital, and help with copays.”

Based on 2021 savings results, the notable players best positioned to perform well in ACO REACH include Oak Street Health, VillageMD (spread across 6 entities and what I expect to be even more participation after the Summit deal), Humana, Iora, and Vively Health, a subsidiary of DaVita.

Advocate-Aurora and Atrium Complete $27B merger

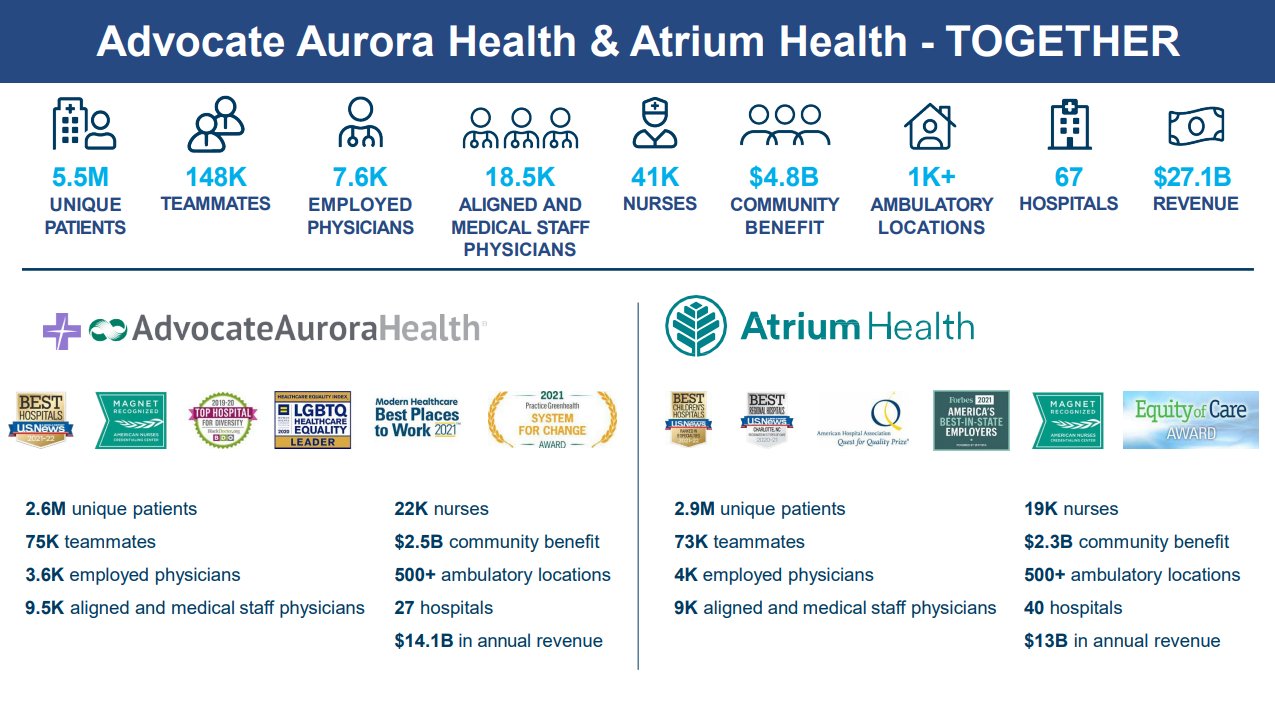

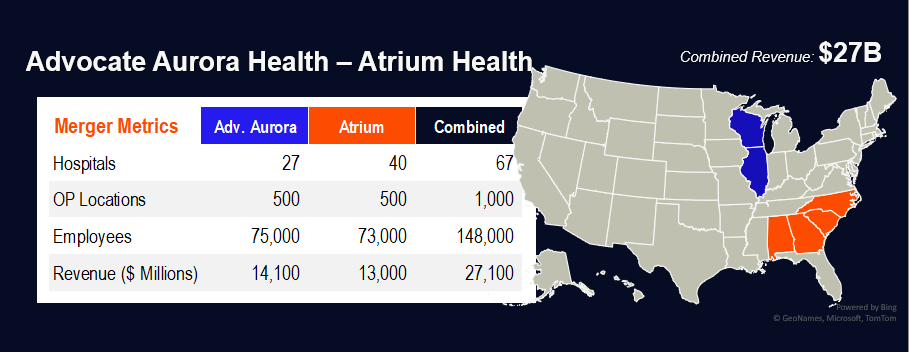

Previously announced earlier this year in May and put on hold by an Illinois board, Atrium and Advocate-Aurora Health received final regulatory approval and announced the completion of their merger.

By the numbers: The transaction creates a $27B in annual revenue giant spread across a diverse geography of 67 hospitals serving around 6M patients, just shy of 150k FTEs, and 7.6k employed physicians. It’ll go by a new-ish name, Advocate Health. Not only will the combined footprint give Advocate vast scale to pursue venture opportunities and population health initiatives, it’ll also entrench their incumbent status even further in their respective communities while also giving a huge lift to its academic center, Wake Forest University School of Medicine (WFUSM). “Since Wake Forest is the academic center of the combined company, this is an incredible boost for medical education in the Triad and eventually Charlotte,” said Tony Plath, a retired finance professor at UNC Charlotte.

“I’d predict this will place Wake’s medical college on par with the likes of the Mayo Clinic, the Cleveland Clinic, and Johns Hopkins in just a few short years.”

Of course, the mega-merger doesn’t come without controversy. We all know the drill: potential for increased prices, market power dominance, etc. The merger finalization comes at a time of one of the worst financial years on record for hospitals.

athenahealth to go public again

Just around a year after selling, athenahealth, the EHR vendor, is looking to go public once again. athenahealth has changed hands often. Back in 2007, athenahealth debuted on the public markets. In 2018, PE firm Veritas Capital and hedge fund Elliott Management acquired athenahealth for $135/share at a $5.7B valuation. Bain Capital and others then bought athenahealth in November 2021 for $17B. Over the timeframe of private life, athenahealth has focused on the outpatient business, a growing section of healthcare, and strategically pivoted away from hospital EHRs. Now athenahealth powers newer players like Privia and at the time of sale to Bain, partnered with more than 140,000 ambulatory surgery centers across the U.S. The EHR vendor has added 2,000 physician practices over the past year and the runway is likely there for continued growth in the outpatient environment.

- Chilmark Research provided a nice concise research note on athenahealth’s 2022 analyst day here

Market Movers

Partnerships and Strategy Updates:

- Specialties driving ASC growth include orthopedics and cardiology, both of which have been called out for growth from players like Tenet and UnitedHealth (Read more)

- Quest Diagnostics and Premier Health signed a group purchasing agreement for use of Quest’s laboratory stewardship solution. (Read more)

- VillageMD and Point32Health partnered to expand access to primary care to its Harvard Pilgrim Health Care members in Massachusetts. (Read more)

- This WSJ feature (paywalled) was a nice overview of how deferred patient care may be a major headwind to insurance giants in 2023. This theory was half-confirmed by UnitedHealth’s medical loss ratio guidance for 2023, which came in higher than expected. (Read more)

- Oscar Health announced in-network status with Vanderbilt University Medical Center. (Read more)

Finance and M&A Updates:

- This article from MedCity News had some good, varying perspectives on the Amwell-Talkspace potential merger. I am also quoted!! (Read more)

- US Physical Therapy snagged a 13-clinic physical therapy practice, buying 80% of the equity for $25M on $12M in revenue and 120k visits. (Read more)

- Stonebridge Healthcare, a hospital turnaround firm, has offered to buy 3 Pennsylvania-based hospitals from Tower Health for $675M. (Read more)

- Enhabit acquired a home health agency from Southwest Florida Home care. (Read more)

- P3 Health Partners announced the appointment of a new CFO, Atul Kavthekar. (Read more)

- Trinity Health posted a quarterly loss of $550.9M. (Read more)

- Cleveland Clinic posted a wide quarterly loss of $469.2M. (Read more)

Digital Health and Startup Updates:

- I feel like these announcements are somewhat flying under the radar, but Amazon’s AWS is doing some work, pushing into the healthcare cloud space at a rapid clip. This week, AWS announced the launch of Amazon Omics, a cloud-based service to process bio-heavy workflows, hold genomic storage, and other perform specialized infrastructure capabilities. (Read more)

- Oh yeah, and AWS also partnered with UNC’s Eshelman Institute to help launch up to 25 startups over the next 3 years. (Read more)

- Instacart co-founder Apoorva Mehta is moving on from the food delivery company onto Cloud Health Systems, a ‘new healthcare startup aiming to offer consumers medical consultations and other health-related services’ – sounds perfectly vague but I’m sure the details will pan out over time! (Read more)

- Citron published another agilon short report today. While there are major questions raised about risk adjustment and compelling bear case presented related to management growth expectations & valuation, I’m rooting for success for companies like agilon. (Read more)

- Carbon Health published nice results from its diabetes program as part of its Connective Care primary care platform. There was a good Twitter thread here on the results as well. (Read more)

- Upward Health was selected by San Francisco Health Plan to deliver Enhanced Care Management (ECM) services to a high-complexity cohort of SFHP’s membership. (Read more)

- Counslr partnered with Allstar Children’s Center to offer its services and support mental health of the faculty. (Read more)

- Not to be confused with Upward Health, Upstream Health raised a whopping $140M Series B, co-led by Coatue and Dragoneer. (Read more)

Policy and Payment Updates:

- Here’s a good summary from Wilson Sonsini on new reimbursement rules for telehealth, remote patient monitoring, and behavioral health. (Read more)

- There are talks of the Hospital at Home program getting sunset, but I find this unlikely given the level of investment and amount of hospitals participating in the waiver. (Read more)

- The Texas Medical Association filed another lawsuit challenging the No Surprises Act. Where does this end? Probably in the Supreme Court. (Read more)

Costs, Data, and Other Updates:

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

- 15,000 nurses at 15 or so facilities are striking in Minnesota. Death, taxes, payor-provider disputes, and nurse strikes. Healthcare nature is healing. (Read more)

- UnitedHealth lost a lawsuit to PE-backed TeamHealth. A judge awarded $10.8M in damages to TH after TH alleged that UnitedHealth underpaid TH from 2017-2020. This is just one of a string of lawsuits between UHG and PE-backed emergency providers. The news comes in conjunction with the No Surprises Act being challenged in Texas. (Read more)

- Forbes released its 30 under 30 with several notable healthcare individuals – Advisory Board broke them down here. (Read more)

- Private equity firms have recently been investing in clinical trial businesses, which have increased the cost of conducting clinical trials and made them less accessible to smaller companies. However, they have also helped to streamline the process of conducting clinical trials, making them faster and more efficient. This KHN article did a nice job explaining the pros and cons of private equity activity and increased investment in the clinical trials space. (Read more)

- Humana released its 2022 value-based care MA propaga- er, report on the state of its programs and beneficiaries. (Read more)

- Hospitalizations for the flu were at the highest levels seen in almost a decade. Yikes. Get your flu shot? (Read more)

Miscellaneous Maddenings

- Somebody gifted a female streamer $70,000 in cash in a briefcase. I mean..what are we doing here?!

- Dallas put in WORK against Indy on Sunday, and it turns out that the score was Scorigami!!

- I recently changed up my putting stance and stroke after a lesson and man..it has made a huge difference in how I’m rolling the putter. This weekend I shot a 79 at Ridgeview Ranch in Plano and had 28 putts with several eight footers as one-putts. My buddy Travis would be proud.

Hospitalogy Top Reads

- Owen Willis wrote a really nice essay on venture investing in health tech, finding high conviction investments, and frameworks you can use. (Read more)

- This was a fantastic dive from Business Insider into the trends driving mental healthcare and their startups, including skyrocketing customer acquisition costs leading to poor DTC results. (Read more – paywall)

- Private Equity healthcare services companies – roll-up plays (Read more)

- Jan-Felix wrote the first part of a series on risk taking in employer sponsored health insurance and benefits. (Read more)

- This Health Affairs read on value based payment systems in the U.S. was a good update on the state of things, and a reminder that there’s a long way to go to align incentives. (Read more)

- I enjoyed this read from Fast Company on the problems that health tech faces and why much of it is not recession resistant unlike traditional healthcare services. (Read more)

That’s it for this week! Join 12,100+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!