Before we dive in, I wanted to share the link to the virtual session that Rik Renard, Varun Sawhney and I had covering how to analyze healthcare stocks! You can watch it on Youtube here (first time Youtuber here, go easy on me! and subscribe there for future uploads.)

Today we’re diving into UnitedHealth Group’s (”UHG”) investor day since the $360 billion a year in revenue company can signal a lot to us about what to expect in 2023!

Join 12,000+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!

Key Takeaways

- UnitedHealth Group’s five strategic pillars

- Unitedhealthcare (insurance) investor day highlights

- Optum (services) investor day highlights

- Financial and operating guidance for 2023

- Broader healthcare trends UNH is watching

- What UnitedHealth Group has been up to in 2022

- Key quotes

UnitedHealth Group: by the numbers

Hate em or love em, there is not a more objectively impressive organization in healthcare than UnitedHealth Group. It’s actually incredible by the numbers:

- UHG is a $500 billion company and has a return of ~1,120% since 2012 (~78% since 2020)

- UHG will generate around $320 billion in revenue in 2022 and $20B+ in net income

- UHG employs 380,000 individuals serving 149 million people

- UHG’s health insurance segment UnitedHealthcare serves 26.6M members in commercial plans, 13M members in Medicare, and 8M members in Medicaid and dual eligible plans

- UHG’s Optum Health segment employs / aligns 70k physicians (7% of all physicians in the U.S.) – half of which are primary care physicians and the other half are specialists – at 2.2k sites of care with 100+ payer partners, serving 20M people annually

- UHG’s Optum Insight subsidiary manages $120B+ in annual billings for its revenue cycle management clients

- UHG’s Optum Rx segment manages $124B in annual prescription spend

- I don’t think it has missed on quarterly financial expectations in a decade

UnitedHealth Group’s five strategic pillars for 2023

If you want to dive into everything yourself, there are a ton of resources on UnitedHealth Group’s site – check out the full investor conference page here. There is SO much to unpack and I’m sure plenty I missed here.

Continue transition to value-based care: As of the latest tally, UHG employs or aligns with 70,000 (!!) physicians, around 7% of the entire U.S. physician workforce. A huge avenue of growth for Optum and UHG as a whole exists in transitioning these physicians into value-based care arrangements and integrating care delivery between at-home care, virtual offerings, and behavioral health. In the third quarter, UHG’s revenue per consumer in Optum grew 31%, a chunk of which stemmed from the transition to VBC arrangements. Just under 15% of OptumCare’s 20 million members are in fully capitated contracts, so a long runway left there.

Optimize health benefits: Self explanatory, but UHG wants to continue to deliver solid benefits packages to its 51 million members in commercial and government programs

Invest and expand health tech portfolio: In contrast to a16z’s recent piece on the subject, UHG ironically defines itself as a “payer, provider, and technology company” and will continue to leverage its massive scale to invest in strategic priorities for the company. UHG called out specific investments like improving clinical workflows or simplifying administrative tasks, including tools to improve claims accuracy.

Deliver more seamless payment processes and simplify the patient’s financial experience: Optum has a financial services & tech segment focused on improving healthcare payments infrastructure to enable faster payments for providers with “less administrative burden.” Specifically, UHG wants to integrate Change Healthcare into Optum’s revenue cycle management in order to provide real-time digital cost estimates for services as well as determine eligibility and automate the prior auth process. I’ll believe it when I see it!

Improve pharmacy care services: UHG mentions wanting to strengthen its direct-to-consumer (DTC) pharmacy offerings, ‘capture a greater share’ of the life sciences market, and further integrate pharmacy ops into the rest of its Optum offerings.

Long-term growth expectations: All of this being said, UHG expects long-term earnings per share growth between 13% – 16%.

Throughout its presentation, UHG harped on our healthcare system transitioning to become more patient-centric and how important it was for UHG to pivot into a ‘preeminent consumer organization.’ – “In every scenario, the American consumer, the American patient has more influence in the future than today. We need to build and respond to that. That’s why you’ve seen in the last 12 months, enormous steps forward in the company’s stance towards the consumer at every level, our agreements with Walmart, our partnership with Red Ventures Health are both designed to engage us at a level with the American consumer, where we’ve been nowhere close to before.”

UnitedHealthcare commentary and priorities in 2023

As a reminder, UnitedHealthcare is UnitedHealth GROUP’s insurance subsidiary, which includes its commercial and employer insurance segment as well as government funded programs (ACA, Medicaid, Medicare Advantage) and a small international footprint.

UHG’s insurance arm is a mature segment and as such, has long-term revenue growth expectations of 8%-10%, calling out the growth in Medicare Advantage (MA) market in particular as a major tailwind. For 2023, UnitedHealthcare is expanding into 314 new counties. As a market leader, UHG expects to see folks transition from UnitedHealthcare commercial plans into UnitedHealthcare MA plans and capture a bigger piece of the MA market while seniors age into Medicare.

Notably, UHG is predicting strong commercial membership growth for 2023 including a new commercial plan offering called the Surest plan, which will hit the employer market with 15% lower premiums and provides some interesting cost sharing provisions (varying co-pays, some level of outcomes dependent, and better price transparency for members).

On the Medicaid side, apart from potential headwinds from Medicaid redeterminations, in which 5 million up to 14 million individuals could lose Medicaid coverage after the public health emergency ends, UHG expects its membership to grow as states expand managed Medicaid coverage. UHG specifically called out additional coverage for more complex populations, too (risk adjustments!!). Over the past 18 months, UHG has seen record membership growth in the Medicaid space.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Although UHG noted that its operating margin should remain stable, management did mention that additional investment and growth into government programs will cause its medical loss ratio (MLR) to rise (government MLR > commercial MLR). For 2023, United guided for a slight increase in its MLR given the potential for a higher intensity flu season (which hasn’t materialized quite yet) and deferred patient care returning = more healthcare utilization.

Optum commentary and priorities in 2023

The vision that UHG laid out with Optum over the past decade-plus (launching in 2011) may be the best strategic move in healthcare of all time. As a result of the shrewd move, UHG and Optum are a step ahead of every other payor in terms of vertical integration and clinical footprint.

Optum Health / OptumCare: By magnitude of market opportunity, Optum Health’s growth strategy includes further transition to value-based care arrangements (fully capitated arrangements) and increasing revenue per consumer (expected growth of ~25% for 2023 here). Optum is looking to add 750k+ lives into the OptumCare VBC platform after growing by a million or so lives in 2022. From there, Optum will look to organic clinic growth and growth in ASC / specialty case volume through SCA Health – more complex procedures in ortho and cardiovascular in the outpatient setting – then growth in ancillary, integrated downstream offerings like behavioral health (Refresh Mental Health) and at-home care (LHC Group). Optum Financial also low-key has a huge potential market in its financial services and payments segment – for instance, linking health plan info, pharmacy benefits, and supplemental benefits, etc all into one ID and payments card for seniors – payor agnostic.

Optum Insight: Change Healthcare is the obvious one here – Optum will integrate Change’s capabilities to automate certain steps of claims processing. Optum also wants to continue to use Insight to help with chronic disease management and advance AI capabilities.

Optum Rx: Nothing too special here, just continued growth, deeper integration and breadth of pharmacy care service, and further optimization for Rx as a whole. Potential cost savings from biosimilars coming onto the market are a growth factor as well, with an emphasis on providing the patient with more choices.

Optum’s long-term growth rate expectations:

- Optum Health (care delivery): ‘double-digit’ revenue growth with operating margins in the 8%-10% range.

- Optum Insight (data & infrastructure): ‘double-digit’ revenue growth with operating margins in the 18%-22% range.

- Optum Rx (pharmacy & PBM): 5%-8% revenue growth with operating margins in the 3%-5% range.

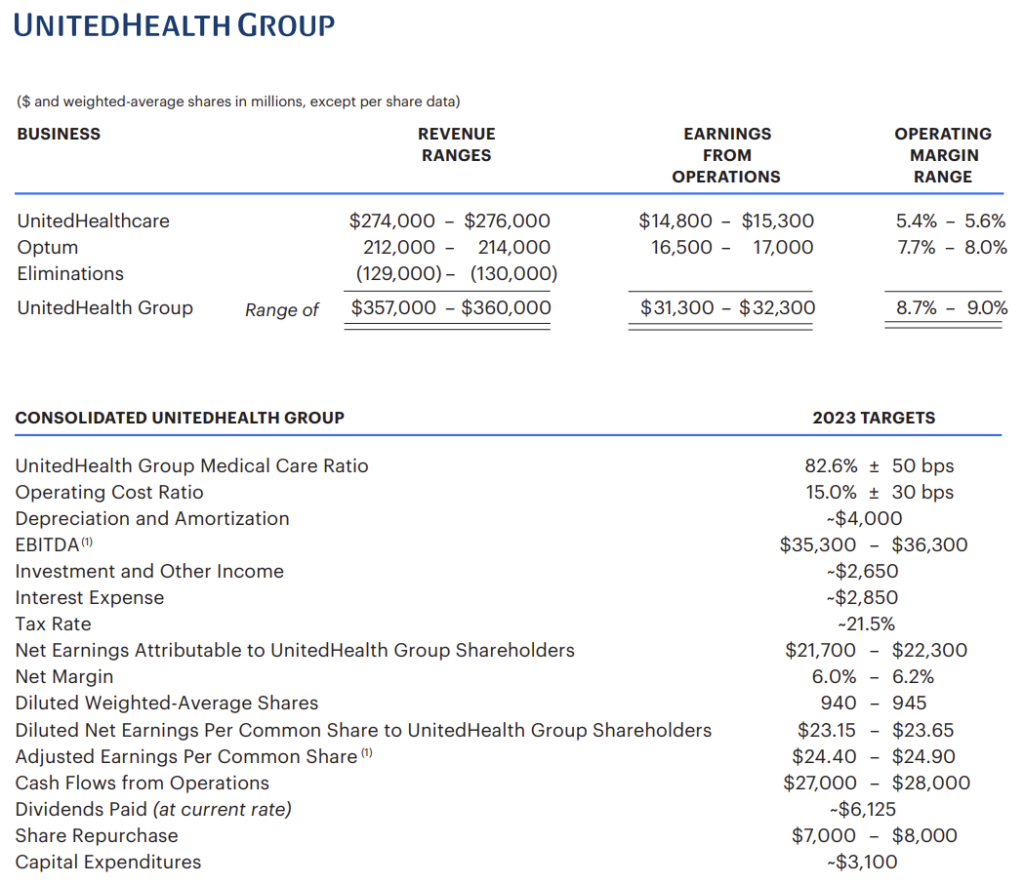

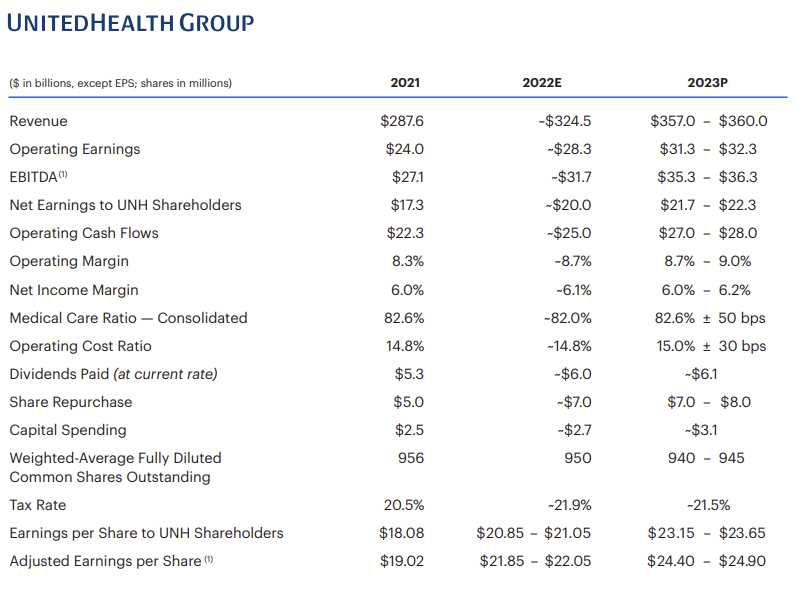

Financial and Operating Guidance for 2023

After intercompany eliminations, UHG expects Optum to hit $182.9B in revenue in 2022, growing around 12% to ~$213B in 2023 altogether. Overall, UHG will see revenues between an eye-watering $357B – $360B in 2023, representing ~10% year-over-year growth (again, after eliminations). The earnings per share guidance was lower than expected, but analysts believe that 2023 guidance in general may be conservative and depends on factors like whether patients will present with more complex cases and seek deferred care, or if the flu is higher intensity than normal, or whether the Change Healthcare integration is a flop:

Broader healthcare implications for 2023

There were a few interesting trends that UHG execs noted during the investor conference, outlined below for you guys:

- Consumerization of healthcare, meeting the patient where they are (AKA, Walmart, virtually, etc.) and having a ‘laser focus on the consumer’

- Continuing to shift site of care to lower-cost settings (ASC outpatient, at-home, virtual)

- Integrating care delivery across behavioral, home, virtual, in-person, and medical benefits – AKA, a payvidor as we all so fondly like to say = more touch points with patients

- Simplifying administrative complexities (prior auth automation, patient payments, utilization management, patient portals, EMRs)

- Removing friction from both a provider standpoint (accelerating payments, enhancing cash flow, reducing admin complexity) and consumer/patient standpoint (Optum Financial, price transparency, point of sale, moving toward a true consumer healthcare marketplace)

- Moving into commercial risk – a key trend moving forward – and generally transitioning providers to value-based care arrangements

- Advancing health equity – a nice corporate buzzword but widely varies in practice

United’s strategic acquisitions in 2022

UnitedHealth Group spent over $20B in acquisitions during 2022, most of which were instrumental in the vision that the management team laid out above:

Refresh Mental Health:

Optum bought Refresh Mental Health, an outpatient provider of behavioral health services, for an undisclosed sum. According to Axios, Refresh, founded in 2017, “operates a network of more than 300 outpatient mental health, substance abuse and eating disorder centers spanning 37 states.”

Refresh was rumored to be generating $40 million in EBITDA and was owned by private equity firm Kelso, which bought the mental health co back in 2020 for $700 million. At the time, Refresh operated in 28 states and 200ish facilities. The acquisition aligns with UHG’s vision for integrated care delivery at Optum as does the LHC Group purchase mentioned next. Overall, Optum employs 4,500 mental health clinicians and served 42 million people.

LHC Group:

On March 29, UnitedHealthcare’s Optum announced its acquisition of LHC Group for $170/share. The transaction values LHC at about $6.4 billion including debt. Acquiring LHC Group allows UHG to catch up to Humana, who now owns all of Kindred, in the post-acute sphere and further bolsters Optum’s footprint in services adjacent to its main physician footprint along the care spectrum. It’ll also be a key touchpoint into value-based care arrangements with UHG’s HouseCalls program. I wrote about the acquisition on The Health Care Blog in a long-form essay back in April!

Change Healthcare:

Optum will finally get to integrate Change Healthcare into its OptumInsight (analytics, rev cycle, & data platform) arm, which did $12.2B in revenue in 2021 and ~$12.9B in the last twelve months ended June 30, 2022. Change Healthcare generated around $3.5B in revenue in its FYE March 2022 (seen above) but part of that will get divested as the judge ordered UHG to sell Change’s ClaimsXten biz to TPG Capital for around $2.2B. After the divestiture, Change Healthcare will contribute just under $1 billion in revenue to the unit but will assuredly have much more drastic downstream effects on the Optum business as a whole.

Strategy with SCA:

With little fanfare this year, UnitedHealthcare’s Optum rebranded Surgical Care Affiliates into SCA Health. Under the new slick angular logo and rebranding that everyone seems to be copying, Optum’s strategy is now pretty clear for SCA – create a physician enablement platform to allow specialists in particular to transition to risk-based arrangements.

They’ll achieve this goal by aligning with health systems, local market health plans, and the practices themselves through the new SCA platform – a “physician-led, MSO-model of practice management that restores physician agency by aligning incentives to support growth and transition to value.”

Keep in mind that Optum purchased SCA back in 2017 for around $2.3 billion, and it looks like SCA is slated to grow even more given the platform creation and focus on physician enablement. Specialists control a large portion of the healthcare dollar and the ASC market will grow as more complex cases shift to the outpatient setting in areas like orthopedics and cardiac.

EMIS Group:

Optum acquired UK-based EMIS Group for $1.5 billion, about a 50% premium to EMIS’ closing price on Thursday. What the heck does EMIS do? The firm is a software-based health tech firm focused on integrating physicians, connecting PCPs with specialists to provide seamless care across sites of service. Looks like a pretty interesting strategic acquisition for Optum and add it to the laundry list of companies the services giant is snagging at supreme discounts.

Lab Benefit Management Tool Launched:

Optum launched a new lab-based benefit management tool aimed at reducing unnecessary testing. Kind of a quiet little announcement here, but this is something that could have an outsized effect on even routine testing for labs nationwide.

Physician Practice Platform Acquisitions:

- Kelsey-Seybold: Optum purchased Kelsey-Seybold (”KS”), a 500-physician, multispecialty practice with a huge footprint in the greater Houston area in April. Not only does KS provide Optum with yet another huge physician base in a large market, KS also runs its own ~40k member, 5-star MA plan – KelseyCare Advantage – and operates a consortium of ancillaries, including two ASC’s, one of which is among the largest operating ASC’s in Texas, 19 pharmacies, after-hours clinics (urgent care), radiation therapy & infusion centers, and imaging centers

- Atrius Health and Healthcare Associates of Texas: Keep in mind that in March 2021, Optum made a very similar acquisition in that of Atrius Health in Boston, a 715-physician, 30-clinic multispecialty group at the time. Finally, Optum bought Healthcare Associates of Texas – a 60+ clinician group – for a $300 million enterprise value and apparent 15x EBITDA multiple (in-line for a large physician org).

Key Quotes

“Really, as we think about the platform capabilities now between Optum and Change Healthcare, they’re massive. It brings us to a true multi-payer capability that allows us to connect to our retail and provider care networks to deliver payments more efficiently, more effectively and drive a lot more value for both providers and consumers in that value chain and for us to really be able to build experiences on top of all this infrastructure that’s been established over the course of the past 20 years or so.” – Kurt Adams, Optum Financial

“So as Optum starts to build a multi-payer marketplace environment, a lot of the work we’ll be doing this year is laying the ground for that, having a sophisticated financial service capability able to run through the back of that, recognizing that $1 and $5 spent in the U.S. is spent in health care, super important opportunity for us in terms of the consumer agenda as well. So those 2 areas, I’d say, Justin, and you heard some of the detail beneath that.” – Andrew Witty, CEO

“Thanks, John. And to your first question, so already underway. So pockets of commercial risk capitation already in the business. You heard from Tony Lin and Kelsey, several other areas of Optum Health, we already have that. I think in terms of pacing, I think this is something which we’d see accelerate over the next 3, 4, 5 years. It’s going to be very much a kind of geographic employer kind of mix.” – Andrew Witty, CEO

That’s it! Join 12,000+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!