Happy Tuesday,

I was blown away by the reaction to my Twitter thread on the Mark Cuban Cost Plus Drugs Company. That’s probably the most viral I’ve been…ever.

Also, this is amazing:

On to this week’s healthcare news!

Join 12,000+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!

Amwell in talks to acquire Talkspace for $1.50/share

Amwell (not Awell) is potentially buying Talkspace for $1.50 / share, or $200M – an ~85% discount to Talkspace’s SPAC go-public price of $1.4B. Talkspace’s share price rose from $0.60 to $0.81 after the news dropped, so if you think this is legit, go make some arbitrage happen (not investment advice)! The acquisition talks are in “advanced” stages.

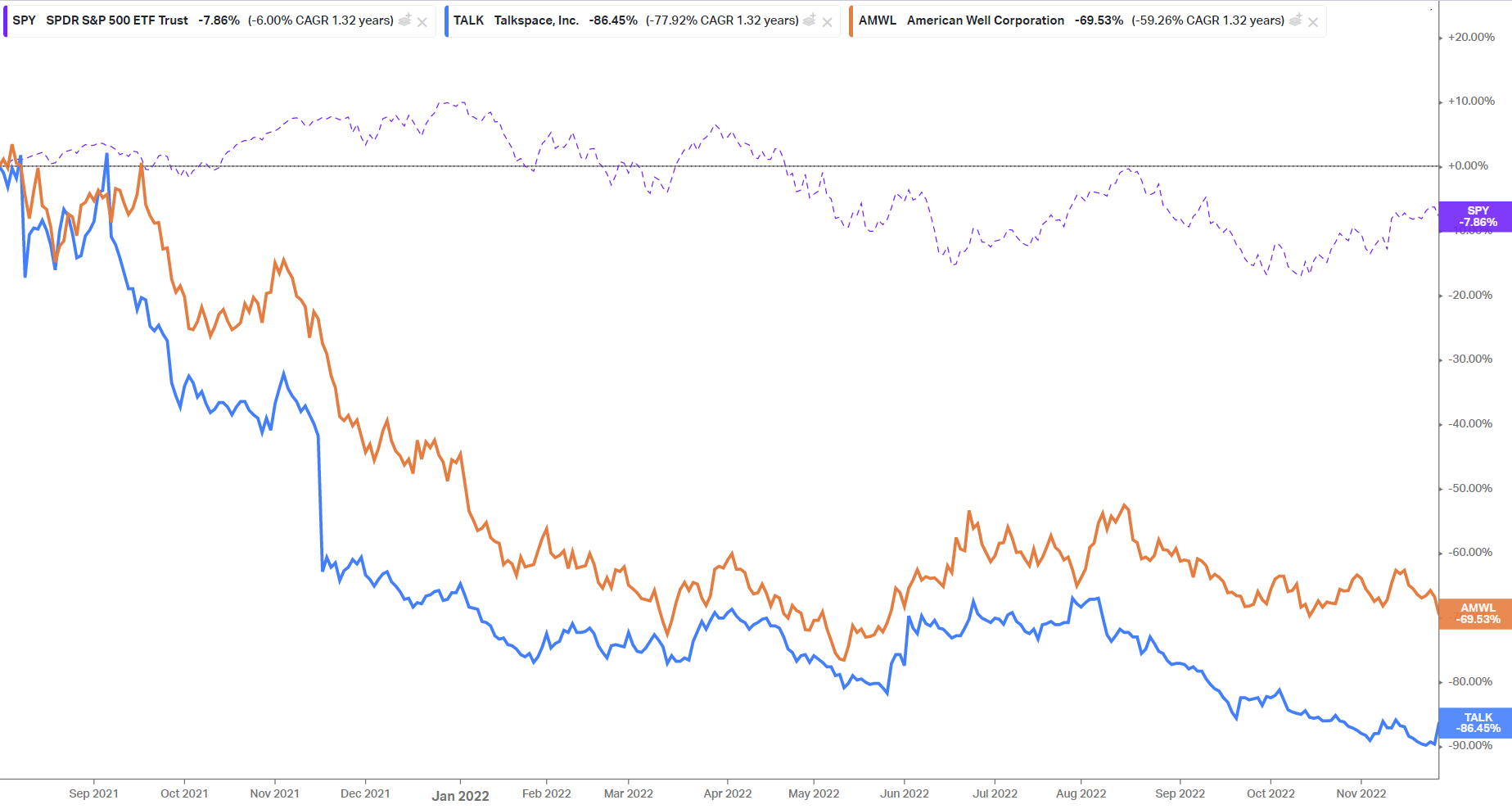

Context: Talkspace went public during the SPAC wave over the summer of 2021, merging with Hudson Executive Investment Corp and handing over $250M in growth capital to the virtual mental health provider. Since its public debut, Talkspace’s chart has unfortunately declined down and to the right, losing 86% of its value. Over that timeframe, Talkspace also missed on multiple operating metrics it had promised in its SPAC presentation.

For instance, In its SPAC presentation, Talkspace expected:

- $125m in net revenue for 2021

- $205m in net revenue for 2022

- 64% gross margins

- 46k consumer subscriptions

In reality, Talkspace reported significantly lower results for 2021:

- $114m in net revenue for 2021

- NO guidance for 2022

- 59% gross margins

- 24k active consumer subscriptions

In Q3, Talkspace reported a further-deteriorated gross margin of 49.4%, an 11% decline from YTD 2021.

Madden’s Musing: All that being said, Talkspace isn’t worth zero in spite of its cash burn. As SteadyMD CEO Guy Friedman pointed out, Talkspace holds valuable B2B contracts with employers and payors – 86 million eligible B2B lives, a 52% increase year-over-year – in addition to around 18,000 active direct-to-consumer (DTC) members – a 36% decline year-over-year. As Zach Miller, author of the Post-Op pointed out in a reply, Amwell seems to think that it can unlock some of that engagement on the B2B side and perhaps offer it to employers alongside SilverCloud Health, a virtual behavioral health platform it acquired back in August 2021. The potential move is perplexing analysts, though, who seem to think that the better direction for Amwell would be to focus on profitability and priorite Converge growth, its recent made-from-scratch telehealth platform. Remember – Amwell hasn’t done too hot in the public markets either.

Big picture: Given Talkspace’s materially declining DTC business and the fact that it allegedly rejected acquisition offers from Mindpath in May 2022 and Amwell itself as recently as June, is the writing on the wall for the state of the private mental health space? There are multiple unicorns (at least, as of their last funding rounds) operating in the same space as Talkspace, which is a scaled mental health pure-play cutting marketing spend and consequently seeing DTC growth dry up. DTC mental health is more sensitive to market and economic downturns, so I have to wonder whether we’re going to see things crumble here once cash dries up. That being said, there is SO much demand. As is a consultant’s favorite saying, “time will tell.” If you have any thoughts around the mental health space I’d love to hear them!

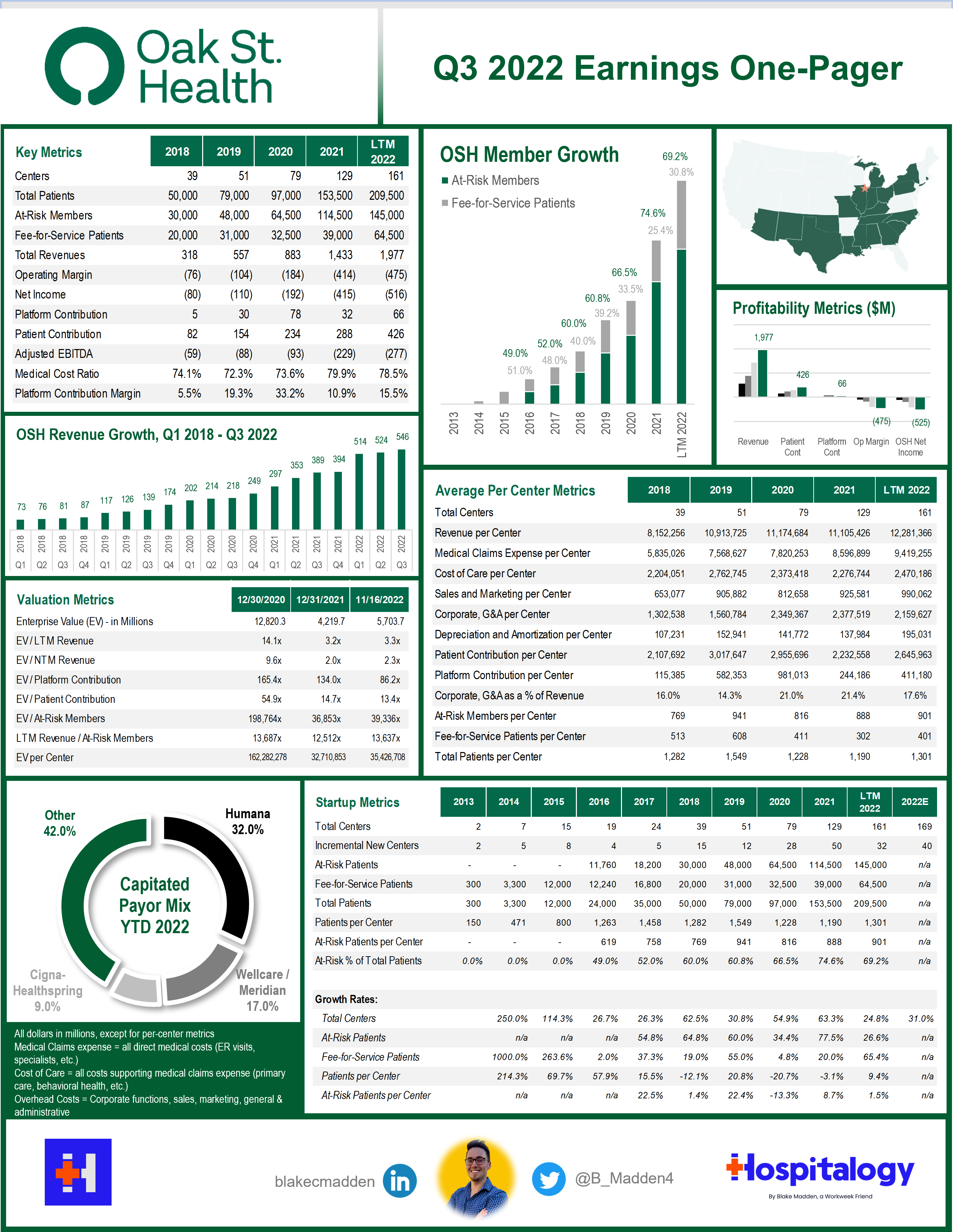

One-Pager: Oak Street Health’s Q3

You guys liked my Privia one-pager so I figured I’d drop a one-pager on everyone’s favorite value-based care darling, Oak Street Health! Slowly churning these out but they’re fun to do:

P.S. if you subscribe your whole team to Hospitalogy I’ll send you the Excel (half joking)

Market Movers

Partnerships and Strategy Updates:

- BrightSpring Health Services, a home health and home care company, withdrew its $750M IPO plans. (Read more)

- ChenMed is entering the Indianapolis market. (Read more)

- Providence closed 27 urgent care clinics in Southern California citing the usual 2022 taglines – labor shortages, inflation, and increased competition. (Read more)

- Perry County Memorial Hospital affiliated with Deaconness Health System in Indiana effective Jan. 1. (Read more)

- Siemens Healthineers and Atrium Health entered into a multi-year partnership focused on workforce development and investment in underserved areas. As part of the deal, Atrium will commit to purchasing $140M in imaging and other equipment. (Read more)

- AdventHealth apparently beat out Novant Health and Mission Health (HCA) to build a 67-hospital facility in western North Carolina, winning the CON approval. (Read more)

- The Oncology Institute expanded into Miami-Dade County. (Read more)

- UnitedHealthcare and AARP are partnering to improve access to hearing aids. AARP members can now purchase prescription and OTC hearing aids through UnitedHealthcare Hearing. (Read more)

- Palm Medical Centers, one of the largest independent primary care groups in Florida, expanded into Hernando County and now operates 26 clinic locations. (Read more)

Finance and M&A Updates:

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

- The Sanford-Fairview health system merger is in jeopardy and will be subject to pretty strict review given Sanford’s failed merger history and community concern. (Read more)

- Bankrupt hospital operator Pipeline Health is selling 2 hospitals to Resilience Healthcare and Ramoco Healthcare Holdings for $92 million. Pipeline had previously acquired the hospitals from Tenet back in 2019 for $70 million. (Read more)

- Audax Private Equity acquired Medi-Weightloss – an operator of 100 physician-supervised weight-loss and wellness clinics – on November 28. (Read more

- Quorum Health, the once-public hospital operator, is selling 5 hospitals and a SNF in the Southern Illinois area to American Healthcare Systems. (Read more)

- UPMC reported $18.9B in total revenue and $18.7B in total expenses. For you math whizzes out there, that’s a $200M operating margin, down from $800M the year prior. Health systems do be struggling financially to end the year. (Read more)

- Quest Diagnostics acquired Summa Health’s outsourced lab functions, LabCare Plus, previously announced in October. (Read more)

Digital Health and Startup Updates:

- Excelsior Integrated Medical Group and Rendr merged to form an integrated multi-specialty medical group focused on serving the Asian community in New York – 200k members and 100+ medical sites backed by Ascend Capital Partners and Kain Capital. (Read more)

- Google Health is entering into a collaboration with RadNet and RadNet’s subsidiary Aidence to license Google Health’s AI research model for lung nodule malignancy prediction on CT imaging. (Read more)

- CardieX acquired Blumio, a developer of cardiovascular sensor algorithms and data analytics tools. (Read more)

- This was a nice read from Caraway’s CEO Lori Evans Bernstein on the vast need for more women’s health services. (Read more)

Policy and Payment Updates:

- The No Surprises Act has led to thousands more disputes than the government expected. Who’s surprised? Ha! (Read more)

- 3.4 million people have signed up for ACA plans, a 17% increase. (Read more)

- Advocacy groups are asking the FTC to investigate group purchasing organizations (GPOs) and their potential role in supply chain shortages for drugs and supplies. (Read more)

Costs, Data, and Other Updates:

- Here’s a cool resource from KFF on hospital adjusted expenses per inpatient day, sorted by ownership type. (Read more)

- Apparently Cerebral is counter? suing former CEO Kyle Robertson to recoup loaned funds in the amount of $50M…ugly ugly (Read more)

Miscellaneous Maddenings

- So my wife Emily and I were out shopping this Saturday for my father-in-law’s birthday that day. We’d decided on getting him a gray UT (Texas, the real UT, that is) sweatshirt from Rally House. A family was in line in front of us and seemed to be returning? Buying? a consortium of gifts. The father apparently felt bad that they were taking so long that he offered to pay for our sweatshirt just like that! It was unbelievably generous. Anyway, now my father in law is expecting two gifts since we got that one for free.

- We attempted to make a new pie for Thanksgiving – a snickerdoodle pie – and managed to successfully do so on our third attempt. Note to self and a general rule of thumb: You can never buy too many pie crusts.

Hospitalogy Top Reads

- This was a nice overview of healthcare M&A activity in Q3. (Read more)

- WSJ published a PBM article discussing how Humira, one of the most expensive drugs on the market, will continue to flourish in sales despite its patent expiring given name brand recognition and the state of the biosimilars market. WSJ paywall – (Read more)

- Mark Cuban’s next target: work like Civica Rx to identify generic drug shortages for hospitals. (Read more)

- Nature published a paper on neurons that have been developed and apparently can restore walking after paralysis! (Read more)

Join 12,000+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!