Join 11,000+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!

Sanford-Fairview Merger would create 58-hospital system in Midwest

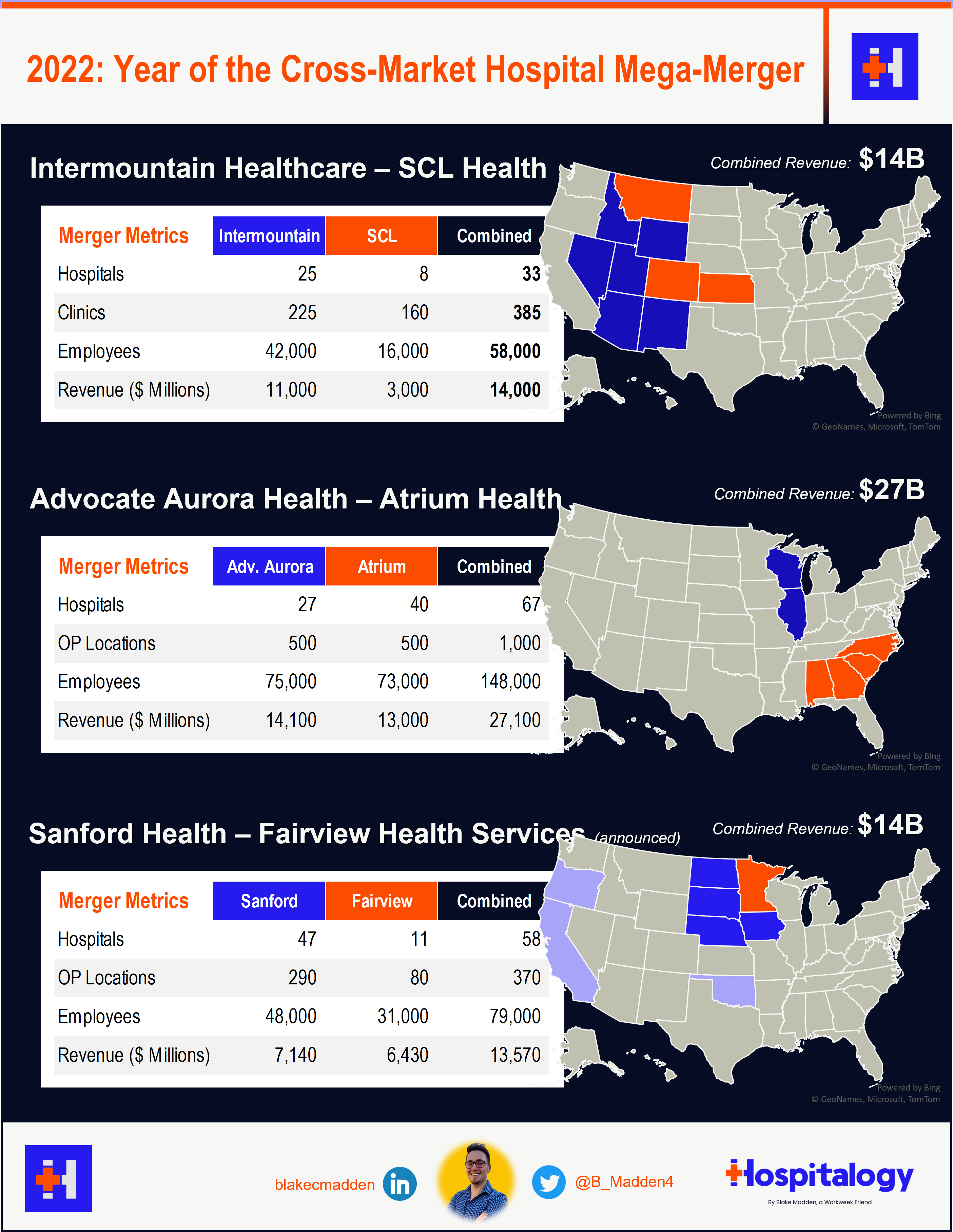

Announced this week, Sanford Health is planning to merge with Minnesota-based Fairview Health Services in what would create a $14B, 58-hospital merger.

Madden’s Musing: Get used to these types of cross-market mergers. The FTC is cracking down on ‘horizontal’ or ‘market dominating’ M&A, but it’s much harder for the Commission to challenge cross-market mergers given current precedent. As we saw with the canceled HCA-Steward deal in Utah and RWJBarnabas deal in New Jersey, mergers to control a market and thus demand higher rates from insurers aren’t gonna fly anymore.

Instead, the Intermountain/SCL, Advocate/Atrium (approved this week), and now Sanford/Fairfax (still pending) mergers will provide other value-adds, including population health management, shared staffing resources, better purchasing power on the supplies side, and casting a wider venture capital net to incubate startups of strategic priority to their hospitals. That being said, a rate lift play on fee-for-service reimbursement isn’t out of the question, as early studies have indicated that cross-market mergers might still result in higher prices given that there still exists some overlap with common insurer customer bases.

Of course, beyond this Sanford-Fairview news brings with it the typical questions:

- Will this deal actually cross the finish line? Sanford tried to merge with Fairview back in 2013, UnityPoint in 2019, and then Intermountain in 2020, all to no avail.

- Assuming the deal goes through, how will prices change in the affected areas? According to ModernHealthcare, “Sanford Health’s commercial prices in South Dakota were 191% of Medicare in 2020, below the state average of 218%.” while Fairview’s Minnesota operations were “263% of Medicare rates for the same services, below the state average of 297%, in 2020.” So…both systems hold reimbursement below state average according to the RAND study.

- How else will Sanford/Fairview and other cross-market mergers affect regional pay for nurses and clinicians?

Bottom line: 2022 was a year of suffering for hospitals and it doesn’t surprise me one bit to see large health systems get creative with deals.

Amazon launches new Virtual Care Platform Amazon Clinic

In case you missed it: Amazon Clinic has officially launched. Given its list of treatable conditions, Clinic is a direct competitor to rival the likes of Hims and Ro. It treats conditions like acne, ED, male hair loss, and other ailments with a nice combination of low-acuity but high drug volume.

- On Thursday, I wrote about what you need to know about the latest healthcare offering from Amazon. Read it here!

Heritage Provider Network nears an $8B – $10B deal

Massive provider group Heritage Provider Network (HPN) is rumored to be near a deal to sell to a consortium of PE players brought together by the Carlyle Group, a private equity firm whose portfolio includes One Medical.

Details: The price tag, according to the article, will likely end up between $8B – $10B. HPN is an asset not too different from Summit given that it’s made up of several physician practices and operates a large urgent care footprint in the California (with some footprint in NY, AZ) area. It’s a solid cash-flow generator, producing around $600M annually.

Per the website, HPN has a huge footprint comprised of 3,700 physicians, 10,000 specialists, and 1,700 affiliated facilities (note: affiliated, not necessarily owned).

Madden’s Musing: Assuming the deal goes through, the size would create one of this year’s largest leveraged buyouts coming hot on the trail of the Walgreens/VillageMD/Cigna(Evernorth) $9B deal for Summit.

- Bigger picture: Huge, independent provider groups continue to sell to financial (PE) and strategic (Optum, hospitals) players as retiring MDs look to cash out and healthcare service providers see choppy waters ahead in 2023.

Resources:

- October 2021: Heritage Provider Network weighs $9B+ sale (Bloomberg)

- May 2022: HPN rumored to starts its sale process (Axios Pro)

- November 2022: The Carlyle Group rumored to put together an offer for HPN in the $8B – $10B valuation range. (Reuters)

- Heritage Provider Network home page (Read more)

Market Movers

Partnerships and Strategy Updates:

- Remember when I touched on General Catalyst’s partnership strategy with health systems? Well, the VC firm has added 10 more health system partners this week. General Catalyst is paving the way here in what could create a ton of value for VC firm, startup, and health system as they work together on strategic priorities. (Read more)

- Morgan Health snagged Cheryl Pegus from Walmart Health this week. (Read more)

- After just a year at the helm, Chris Gerard will leave Amedisys. (Read more)

- This was a nice overview of Elevance’s Carelon M&A strategy as insurers stay aggressive with acquisitions. (Read more)

- Humana/Welsh Carson backed CenterWell is planning to open 30-35 senior clinics in 2023. (Read more)

Finance and M&A Updates:

- Speaking of hospital mergers, Excela Heatlh and Butler Health intend to merge into a 5-hospital system in PA, with more than $1B in revenue and creating the 3rd largest health system in the state (gold stars if you know the first two). (Read more)

- Gundersen Health System and Bellin Health are planning to merge in what would create a $2.4B, 11-hospital system in the Midwest in Wisconsin, Michigan, Minnesota, and Iowa. Man, I already need to update that chart…(Read more)

- Fitch downgraded TeamHealth’s debt this week after an expected 30% drop in EBITDA stemming from soft ER volumes and lack of ability to price gouge patients. (Read more)

- Moody’s downgraded 45-hospital Prime Healthcare’s debt this week as well. Really NOT a good time to be a heavily levered health system as Prime’s debt/EBITDA is 6.1x, up from the high 3x’s just 12 months ago! (Read more)

- Surgery Partners priced a secondary stock offering with the intent to raise $575M priced at $24.50 / share. (Read more) Privia Health did the same, pricing shares at $23.50. (Read more) Finally, Oak Street Health secured $300M more in financing from Hercules Capital and SVB. (Read more)

- Centene divested its Magellan Specialty Health segment to Evolent for $750M in aggregate proceeds. (Read more)

- Merck will buy cancer drug developer Imago BioSciences for $1.35B. (Read more)

- Singing River Health System is up for sale in Jackson County, MS. I’ll see you guys at the KHN article in ~2-3 years on how a PE firm bought it and gutted it. (Read more)

- A quick slew of health system financial updates:

- Intermountain’s revenue hit $10.2B for the first 9 months of the year after its acquisition of SCL Health. (Read more)

- Mayo Clinic’s revenues bumped up to $4.1B while operating incomes dropped to $157M on the back of a $1.2B investment decline through Sep. 30. (Read more)

- CommonSpirit lost $397M, noting a 43% decrease in contract labor from peak in March. (Read more)

- Providence has lost $1.1B through Q3 2022 not including investment losses of $1.4B. (Read more)

- Health system days cash on hand is dropping significantly, but apparently you can’t talk about things like this or people will think you’re disseminating misinformation about how well off health systems actually are. (Read more). IYKYK (Read more) (Read more)

Digital Health and Startup Updates:

- Navvis and Esse Health merged to create Surround Care, a population health organization serving more than 4M patients across 9 markets and employing 1,200 people with 4,600 affiliated physicians. (Read more)

- Amazon launched an AWS Healthcare Accelerator cohort aimed at workforce development in healthcare companies. (Read more)

- Included Health is launching a new hybrid care product with a navigation component to boot. Remember that Included is the new company name for the merger between Doctor on Demand and Grand Rounds – which previously held plans to go public. (Read more)

- DispatchHealth raised $330M in a mixed debt/equity offering. The equity offering was led by Optum while the debt offering was led by Silicon Valley Bank. Lots of big names in this one! (Read more)

- Here’s an interesting little startup – Interstate Health Systems launched with an oversubscribed seed round to open up services companies along…the U.S. interstate system, aimed at serving the more than 3.5 million truck drivers and rural population. (Read more)

- Bicycle Health provided a strategic update related to its milestones in 2022 including footprint and patient enrollment growth. (Read more)

- Google launched a slew of things this week during HLTH: health data accelerator programs, (Read more) a digital health platform with Highmark Health thru the My Highmark app (Read more) and a partnership with Epic. (Read more)

- HC9 Ventures closed an $83M fund to start investing in healthcare software and services startups at early stage companies. (Read more)

- Twilio launched Segment for healthcare. (Read more)

- Instacart created a food-as-medicine program. (Read more)

- Verily and ResMed launched a sleep platform, Primasun. (Read more)

Policy and Payment Updates:

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

- Democrats are calling for more consumer protections for Medicare Advantage – what’s new? Main grievances aired included ‘false and misleading marketing’ and ‘fraudulent sales practices’ – something that CMS is actively working to address by restricting TV ads and scrutinizing broker deals. (Read more)

- There are rumors swirling around the DEA easing telehealth prescribing rules permanently. Right now, providers can subscribe controlled substances via telehealth as a result of the public health emergency. But once the PHE runs out, things return to normal. I’m thinking lawmakers make changes to telehealth sooner rather than later.

- On the note about health system finances, I expect to see both physicians and hospitals get some form of relief in the government year-end spending package. Likely will see some relief at the state level for hospitals too, for better or worse.

Costs, Data, and Other Updates:

- American lifetime healthcare expenses may top $700K. (Read more)

- There’s still a huge af Adderrall shortage affecting millions of patients. Addy prescriptions rose 10% since 2021 and increased by 15% for people aged 22-44 between 2020 and 2021. Hmm. I wonder what’s spurring that? Perhaps reckless prescribing by virtual providers? (Read more)

- Civica Rx is partnering with California to produce low-cost insulin – at no more than $30 per vial. (Read more)

- Optum is adding more biosimilars to its formulary to combat the high costs of drugs like AbbVie’s Humira. Specialty drugs represent 2% of total prescriptions but 50% of total cost!! (Read more)

- Nurses are getting paid this year: Maine hospital nurses will see a 10-11% increase over the next 3 years while Kaiser prevented a 22,000 clinician-strong strike with a 4-year, 22.5% increase. Am I talking sports contracts or nursing salaries here?? You’ll never know.

- The city of Toledo bought up its residents’ medical debts, paying $800,000 in Covid dollars to eliminate $160M – $200M in medical debt. Heck yeah. (Read more)

Miscellaneous Maddenings

- Elizabeth Holmes was sentenced to 11 years in prison. Gotta be one of the more punitive white collar crimes in a minute. Her kids will be 11 and 12 when she gets out. (Read more)

- I was quoted in two articles this week (Business Insider and MedCity News) related to Amazon Clinic’s launch! Super cool experience.

- Pretty crazy news as Disney brought Bob Iger back after a VERY short stint by Bob Chapek at the helm. Disney was up on the news today. (Read more)

Hospitalogy Top Reads

- This NPR article was a great overview of recent CMS audits of Medicare Advantage plans and why the program’s risk adjustment mechanism is so controversial. (Read more)

- Alongside the MA audit piece comes a nicely written ProPublica investigation into UnitedHealth Group’s acquisition of Change Healthcare and how UNH can leverage the data along with some details on how the antitrust court case transpired (which is now getting appealed by the gov’t) (Read more)

- Behind the GoodRx-Express Scripts partnership and how PBMs make money on discount cards. (Read more)

- Here’s a good write-up on the dynamics evolving between payors and providers as contract negotiation disputes grow more public and heated in nature. (Read more)

- Betty Chang wrote a wonderful piece on the Family Tech space and an almost exhaustive list of companies operating in the arena. Fantastic write-up. (Read more)

Join 11,000+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!