If you’re reading this from HLTH, I have major FOMO.

Writing from rainy, 40-degree Dallas, your resident Hospitalogist.

Onto this week’s news!

Join 11,000+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!

Insurtechs ditch Medicare Advantage as Incumbents lean in

After snatching up Medicare Advantage (MA) members earlier this year and making a market share play against incumbent insurers like Cigna and Humana, Bright Health and Oscar are now doing a complete 180 and exiting almost all MA markets.

- Bright is leaving its Florida MA market behind, once a major bullish thesis for the insurtech and its last operational holdout outside of Texas and California. For those following along at home, this announcement is the third contraction of its business model. Hopefully the realigned focus will help Bright succeed with more narrow, services-focused growth goals, but they have major questions to answer from investors.

- Oscar is almost entirely exiting the MA market to focus on its ACA – individual exchange markets. It’s a big move toward trynna get to operating profitability by 2024. Ambitious, but possible.

- Meanwhile, although Clover is expanding its MA reach, the meme-sure-tech company is scaling back its ACO REACH expansion efforts – again, once thought of as a big bull thesis for the company. Hmm.

- Finally, oddly enough, Texas regulators asked Friday Health Plans to exit the state’s ACA market, citing operational challenges and rising costs (shout out inflation), which could cause the private insurtech to cut a rumored 80% of its workforce for 2023. Friday intends to re-enter Texas, its largest ACA market by far, in 2024. Yikes.

On the other hand, incumbent insurers are having no issues in the MA space, touting the program as major avenues of growth for their organizations.

I’ve noted this before, but here are the announced expansions for 2023:

- UnitedHealthcare is expanding into 314 new counties

- Humana is expanding into 260 new counties

- Wellcare (Centene) is expanding into 209 new counties

- Elevance is expanding into 145 new counties

- Aetna is expanding into 141 new counties

- Cigna is expanding into 106 new counties

- Alignment is expanding into 14 new counties

- Clover is expanding into 13 new counties

Long story short, it seems as if the insurtechs are grasping at straws in 2022 and entering 2023. I covered insurtech challenges pretty extensively here and they have a long way to go in improving the patient and health insurance experience while not burning inordinate amounts of capital.

Veterans Day and Supporting Stop Soldier Suicide

In support of Veterans Day, I wanted to give a quick shout out to an organization brought onto me by a Hospitalogy reader and friend. Stop Soldier Suicide (SSS) is the only national nonprofit focused solely on reducing the military suicide rate. SSS’s goal is to reduce military and veteran suicide rates by 40% no later than 2030. In 2021 alone, SSS saved almost 150 lives, the equivalent of an entire U.S. infantry company.

Here’s a word from SSS’s Chief Growth Officer Tina Starkey on what SSS is all about and how you can help them out this Veterans Day:

The numbers are staggering: As of September 2022, veterans are 57 percent more likely to die by suicide than members of the general population. And, since 2001, we’ve lost more than 125,000 veterans by their own hands.

These families of military suicide loss are brothers, sisters, spouses, and parents, like Gay and Kevin Murga, who lost their only son, Austin, in Sept 2020 at the age of 26. At Stop Soldier Suicide we’re on a mission to ensure future military families don’t suffer the grief and loss that comes with veteran suicide.

Our goal is to reduce veteran suicide by 40 percent by the year 2030. We believe our technology innovation, Black Box Project, will uncover never before known insights about how those we’ve lost to suicide spent their final days, hours, and minutes. These insights will be used to redefine signals of risks, advance methods of outreach and care, and ultimately significantly reduce service member and veteran suicide.

To learn more about our mission, and Black Box Project, visit StopSoldierSuicide.org/BlackBoxProject

If you or a veteran or service member you know is struggling, please call us 24/7 at 844-889-5610 or visit StopSoldierSuicide.org/get-help

Resources:

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Nomi Health’s game-changing Fintech Launch

Nomi Health, an organization focused on providing direct healthcare and cutting out all middlemen possible (No Middlemen Health, get it HA!) launched a fascinating new fintech payment management product this week aimed at supporting providers and organizations. Called Connect, the platform supports and pays providers in real-time while also integrating every step of the billing process between patient, provider, and buyer.

Madden’s Musing: Following in the footsteps of Cedar and OODA Health (acquired by Cedar for $425M) but more ambitious in scope with its emphasis on direct healthcare (cutting out embedded payor payment workflows, etc.), Nomi is making a game-changing play here, which is kind of sad considering this product and products like Connect are the way that healthcare revenue cycle management SHOULD be. It’s build different for a few key reasons:

- Health plans and third party administrators can administer claims much faster with less friction (no fax machine?)

- Patients know what the heck they’re paying for and aren’t getting lab bills or anesthesia bills in the mail 2 months after the procedure or scan

- Providers will love it because it vastly improves their cash flow. In fact, providers would likely accept lower reimbursement rates if it meant cash faster in the door rather than wasting hours tracking down and disputing claims

This is a notable move from Nomi Health and I’ll be interested to see how the Connect platform plays out. They’re a name to keep an eye on. Like Mark Cuban’s Cost Plus Drugs, Nomi seems to be making a play for a simplified healthcare system – one rebuilt with trust. “The launch of the fintech platform is the next step in Nomi Health’s years-long mission to create easier access to lower-cost, high quality care by rebuilding how care is paid for and delivered.” (insert side-eyes emoji here).

Resources:

- Nomi Health Product launch press release (Read more)

- Nomi Health Connect Fintech Platform Demo (Watch)

Market Movers

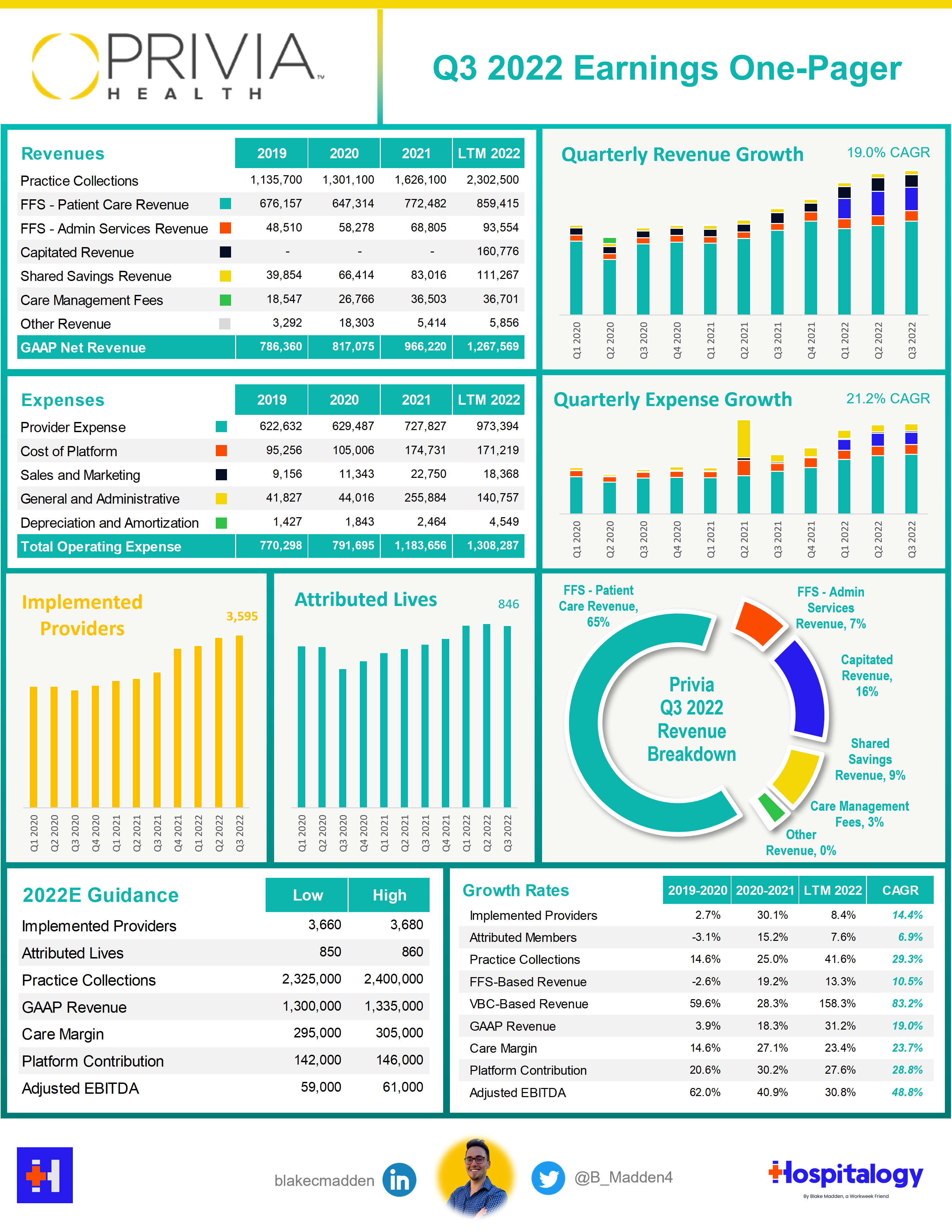

Here’s a one-pager on Privia’s Q3 earnings release:

Partnerships and Strategy Updates:

- This was a nice overview of Cigna’s recent behavioral health partnerships and strategy through its services subsidiary Evernorth, including partnering with the likes of Bicycle Health, Quit Genius, and Alma. Look for more activity to follow across the spectrum of care services as Cigna has been quite talkative about its desire to continue to follow in Optum’s footsteps. (Read more)

- Hims and Hers ChristianaCare (Read more) reminds me of Carbon Health deal in Cali (Read more)

- AdventHealth selected Monogram Health as its chronic kidney disease partner. (Read more)

- Aetna launched a primary care pilot with Crossover Health for Seattle employers and a fixed-fee payment model. (Read more)

- CenterWell, Humana’s services segment, is opening 3 senior primary care clinics in Louisville by mid-2023. (Read more)

- The VA is building a 58-bed hospital in Tulsa, Oklahoma by 2025. (Read more)

- Cigna’s MDLive is adding a chronic care management program to its 2023 virtual primary care offering. (Read more)

- VillageMD opened up a new Las Vegas clinic, with more to come. Really hogging the headlines these days! (Read more)

- HCA announced a large scale expansion of its Meditech EHR platform on November 8 and then experienced software complications at several hospital sites a day later. Par for the course when talking about EHRs! (Read more)

Finance and M&A Updates:

- Babylon announced a 1-for-25 reverse share split, which was the absolute max that shareholders approved at the meeting in September (sheesh). The reverse split will reduce total shares outstanding to 24.8 million from 620 million. So when you see Babylon trading at some much higher dollar figure on December 16, you’ll know what happened. (Read more)

- United Dental Corporation announced its move into the U.S. by acquiring 7 dental practices in 3 markets. (United Dental Corporation announced its move into the U.S. by acquiring 7 dental practices in 3 markets.)

- Elevance acquired specialty pharmacy BioPlus (Read more)

- Cigna’s minority investment in Summit amounted to around $2.5B and between 10%-15% total ownership stake. (Read more)

- Thomas Health will become fully affiliated with West Virginia University Health System by the end of the year. (Read more)

Digital Health and Startup Updates:

- Wheel made big headlines this week by announcing its intention to purchase GoodRx’s telehealth platform HeyDoctor for $19.5M. Looks like Wheel will service the back-end infrastructure while GoodRx will continue to offer the consumer facing product. GoodRx’s telehealth biz is on track to generate a bit over $20M in standalone revenue. (Read more)

- Northwell Health and Aegis Ventures launched a virtual menopause platform called Upliv with $8.4M in seed funding thru 2023. (Read more)

- Amazon made some headlines this week with its leaked Amazon Clinic video. It appears to be a direct-to-consumer offering aligning with its Pharmacy biz aimed at competing with Hims and Ro, but I could be misreading the offering. (Read more) Also, here was an interesting article on Amazon’s strategy with cost cutting – the fact that it continues to prioritize healthcare seems to signal how important the sector is for future growth initiatives internally. (Read more)

- Maven raised $90M in a Series E led by General Catalyst (with participation from CVS Ventures and Intermountain Ventures), bringing the women’s health and family planning provider’s total capital raise to $300M at a $1.35B valuation. (Read more) It raised a $110M Series D in August 2021 at a ‘$1B+’ valuation. (Read more)

- 25m Health celebrated its first year since launch in collaboration with Lifepoint Health, 25madison, and Apollo Global Management. Along with the announcement, it released its portfolio of incubated startups. (Read more)

- Sword Health launched Sword Move this week, a virtual MSK solution where users work with personal trainers and monitor patients remotely through tailored programs. (Read more)

- Komodo Health launched a partnership with Intercept Pharmaceuticals (Read more)

- Late-stage VC-backed valuations are compressing in Q3, according to Pitchbook. (Read more)

- 3 months after announcing a $10M extension to its Series C raise, pediatric mental health provider Brightline is unfortunately laying off 20% of its workforce. (Read more)

- Digital oncology platform Jasper Health partnered with Particle Health for its clinical interoperability needs. (Read more)

- Commure launched CommureOS, a new platform aimed at supporting organizational and care workflows at health systems and provider orgs. (Read more)

- PointClickCare is partnering with Pfizer to enable the exchange of real-world data on seniors and the post-acute market. (Read more)

Policy and Payment Updates:

- South Dakota voters approved a measure on election day to expand Medicaid, which would balloon the program to cover up to an additional 40k people. (Read more)

- Cerebral is likely headed for a legal battle with its former CEO Kyle Robertson. (Read more)

Costs, Data, and Other Random Updates:

- Orthopedists are leaving SSM Health and joining an independent MSO (Read more)

- 15% of U.S. hospitals have joined the White House climate pledge with the goal of slashing emissions by 50% by 2030 ultimately to hti net-zero emissions by 2050. (Read more)

- The flu continues to pick up. “The overall cumulative hospitalization rate is 5.0 per 100,000 — the highest it’s been this early in the season since the 2010-11 flu season.” (Read More)

- 21k Kaiser nurses are striking in Northern California, one of the largest private sector strikes in history. (Read more)

Miscellaneous Maddenings

- Texas I…have no words. I texted this same thing to some of my buddies, but I don’t think there’s a collective fandom

- So this was a hilarious, random story. I have a college buddy who lives in London who was talking about healthcare with another guy at a house party. My buddy brings up my name, says I write about healthcare. Turns out this dude follows me!! Guy from London – if you see this and this happened to you, please hit me up because this is hilarious to me.

- The collapse of FTX and the subsequent crypto fallout has been insane to witness. Here’s a great breakdown of what happened and why you should care!

- The way to pick up women? Show them your Costco membership.

Hospitalogy Top Reads

- The most and least expensive states for healthcare, per Advisory (Read more)

- Why value-based business models are core to 2022 investment activity (Read more)

- Cerebral’s latest hit piece is, once again, tough to read. (Read more) – Paywall

- VMG Health’s piece on nonprofit health system financials is worth the read. (Read more)

That’s it for this week! Join 11,000+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!