24 October 2022 | FinTech

Build Back Better

By Alex Johnson

3 Fintech News Stories

#1: I’ll Take One of Each of Yours

What happened?

Chase introduced a new product feature that might sound familiar to those in the neobank space:

The bank is debuting this feature — which accelerates payments including payroll, tax refunds, pensions and government benefits by up to two days — for customers of its Secure Banking product, starting this week, according to Ryan MacDonald, head of growth financial products for Chase.

Secure Banking … has no minimum balance requirement and costs $4.95 a month. The service, which is targeted to households that earn around $55,000 or less a year, has about 1.4 million users, MacDonald said. Most customers have direct deposit and will automatically begin receiving early payments, he added.

So what?

This quote from Ryan MacDonald is just great:

The fintechs are doing a good job of entering the space and trying to disrupt by offering services … Customers didn’t even think about early access to payment before some of these players came in. As we evaluated it, we think that there’s a real need for certain customers to have this.

Reminds me of this exchange from the movie The Italian Job (the remake), when the thieves are all discussing what they are going to spend their cuts on and the last guy (who is planning to rob all of his compatriots) glibly says “I liked what you said. I’ll take one of each of yours.”

I also think it’s interesting that Chase is building feature parity with the neobanks for its Secure Banking product, but it’s not showing any desire to get to pricing parity. $4.95 per month is a hell of a lot more than free.

#2: Aggregating the Aggregators

What happened?

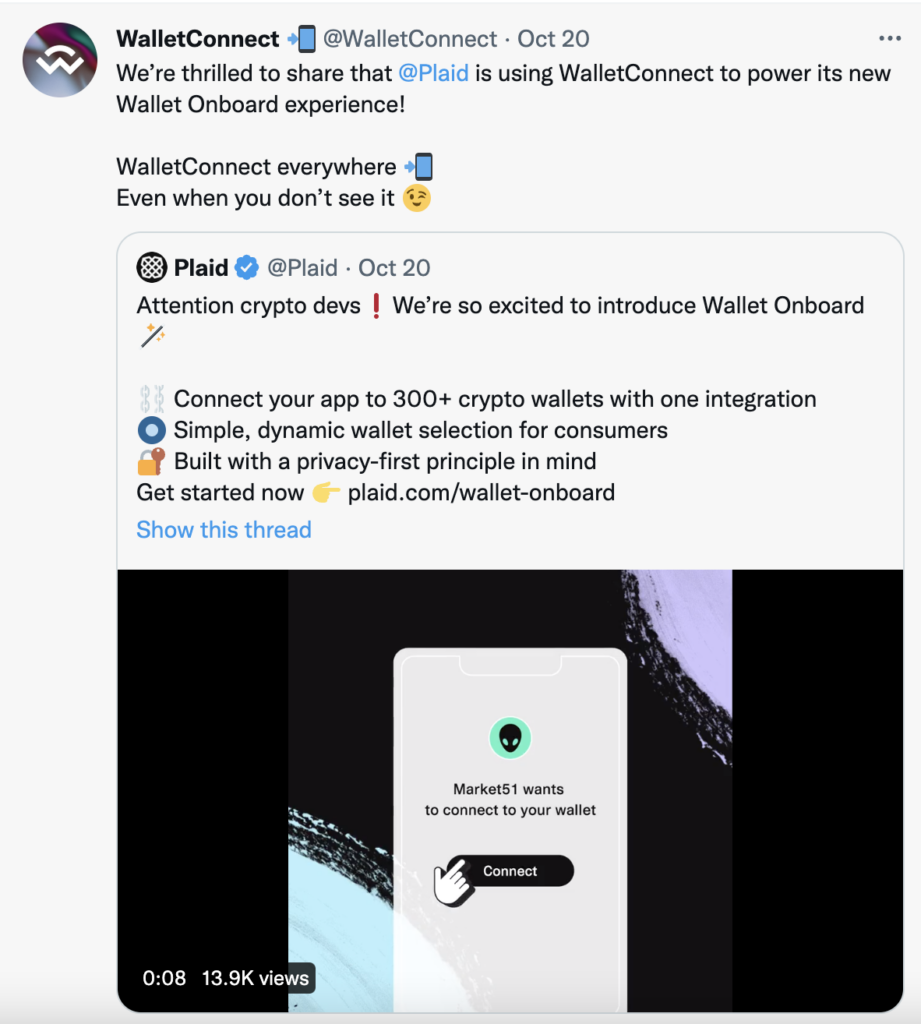

Plaid introduced a new product:

Today, we’re bringing this technology and experience to web3 through Wallet Onboard, a safe and easy way for developers to onboard their consumers through a seamless wallet-linking experience. Wallet Onboard allows developers to enable connectivity to more than 300 self-custody crypto wallets through a single integration.

So what?

What’s interesting is that Plaid didn’t build this by going out and building integrations with every single Web3 wallet out there. It used an existing aggregator – WalletHub:

Plaid spent the first chunk of its existence doing a lot of hard work to spin up a multi-sided network – going out and scrapping screens, building integrations, signing up fintech customers, and getting consumers accustomed to the experience of aggregation.

Now it is reaping the benefits of having an established, multi-sided network up and running.

Reminds me a bit of Visa, Mastercard, and Square. Merchants under a certain size just aren’t worth the card networks’ attention, but the networks certainly benefit when some other company goes out and does something clever to aggregate volume and bring it back to them.

It’s interesting to see Plaid starting to assume this position within the open finance world.

#3: Build Back Better

What happened?

Current cut out a middleman and got closer to the bare metal:

Current … announced it has successfully migrated to the Visa DPS Forward platform with a seamless migration of over four million accounts. DPS Forward is a digital issuer processing platform built with REST APIs and designed to integrate with modern, digital banking cores to create unique card programs and payment solutions. This innovative integration allows for a deeper partnership between Visa, the world leader in digital payments, and Current that will enable the introduction of new financial products to all members on Current.

The migration was completed on Current’s proprietary core banking technology platform, which allowed for full control during the live payment network cutovers. Through close cooperation with Visa, the new features DPS Forward offers became immediately available to all Current members without issuing new payment mechanisms.

So what?

Current has long touted the benefits of building its own core banking system.

Well, here’s a tangible example.

Moving off of Galileo, which it had been working with to issue and process debit cards, and working directly with Visa on issuing and processing is a big change. Current’s executives argue that it will allow the company to be more nimble in deploying new products and features moving forward (like a combined debit and credit card?)

I would argue that a more immediate and perhaps more important benefit is the cost savings and improved unit economics that it will realize by cutting out Galileo.

I wrote recently about the problematic nature of equity-focused consumer fintech products like Income Share Agreements and Home Equity Investments. These products reduce short-term costs for customers in exchange for the possibility of significant upside for the product providers down the road.

Well, fintech infrastructure is similar. Companies that build their products using the slick no-code tools and elegant APIs that today’s infrastructure providers offer are making a trade (whether they realize it or not). They are gaining low initial capital expenditures and quick speed to market in exchange for ongoing transactional costs, which will scale perfectly with them as they grow … forever.

Unless, that is, they bite the bullet and do what Current just did.

2 Fintech Content Recommendations

#1: Fintech Reckoning (by Francisco Javier Arceo, Chaos Engineering) 📚

I’m a little late in recommending this piece by Francisco, but I wanted to make sure I did so in case you somehow missed it.

It’s excellent.

I especially loved: 1.) his pinpointing Visa’s failed acquisition of Plaid as a major inflection point in recent fintech history (I very much agree), 2.) his argument that now is the best time to start a lending business (yes! Lending is a learning business! This is a great time to learn!), and 3.) the hand-drawn graphics (they are glorious … don’t listen to Shevlin!)

#2: Ron Shevlin Snarks Up the Cake: Apple Checking, Super Apps and Teen Spirit (Matt Janiga & Reggie Young, Fintech Layer Cake) 🎧

My favorite new fintech podcast + my favorite fintech analyst = an easy recommendation.

1 Question to Ponder

We’ll keep it light this week because I know everyone is busy.

Should Money2020 have changed its name to Money2030 two years ago? And is it now too late for them to change their name?

If you have thoughts on this very important question, sound off on Twitter or LinkedIn.