Big news on the Hospitalogy front – we’re closing in on 10k subscribers, a number that’s pretty insane to think about.

I’m thankful for each and every one of you and hope you keep finding the content valuable enough to share with colleagues and friends.

Onward!

Join 9,996+ thoughtful healthcare professionals and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!

OneOncology Dives Head First into Value-Based Specialty Care

OneOncology is going full risk-on! On Monday, October 3rd, the oncology practice care platform announced that all 14 of its practices applied to participate in the new CMMI Enhanced Oncology Model (EOM). EOM is a 5-year voluntary alternative payment model that will start next year on July 1. Under the model, OneOncology will take on 2-sided risk (AKA, can lose money to the downside) for episodes of care that involve chemo administration to patients with common cancer types.

Madden’s Musing: OneOncology is a significant player in the cancer care space with an expansive footprint – 850+ providers, 175+ sites of care, and 485k+ patients (backed by General Atlantic and partnered with Flatiron Health in 2018). There’s a ton of momentum in oncology care between EOM and Biden’s Cancer Moonshot program. But the biggest part of this news to me is the fact that specialty care is the next frontier for value-based care. In my mind, this is a significant jump into risk-based payments for specialists, an untapped – and huge – market.

Just look at what Optum is doing – it quietly rebranded Surgical Care Affiliates, its specialty care segment, into SCA Health to ‘support growth into many aspects of specialty care’ like transitioning specialist practices to primary care and even pursuing risk-based contracting in the ASC setting. Meanwhile, UnitedHealth execs are touting the growth of value-based care arrangements in Optum. Optum leads the way and everyone else follows.

Resources:

- OneOncology press release

- Surgical Care Affiliates rebrands to SCA Health

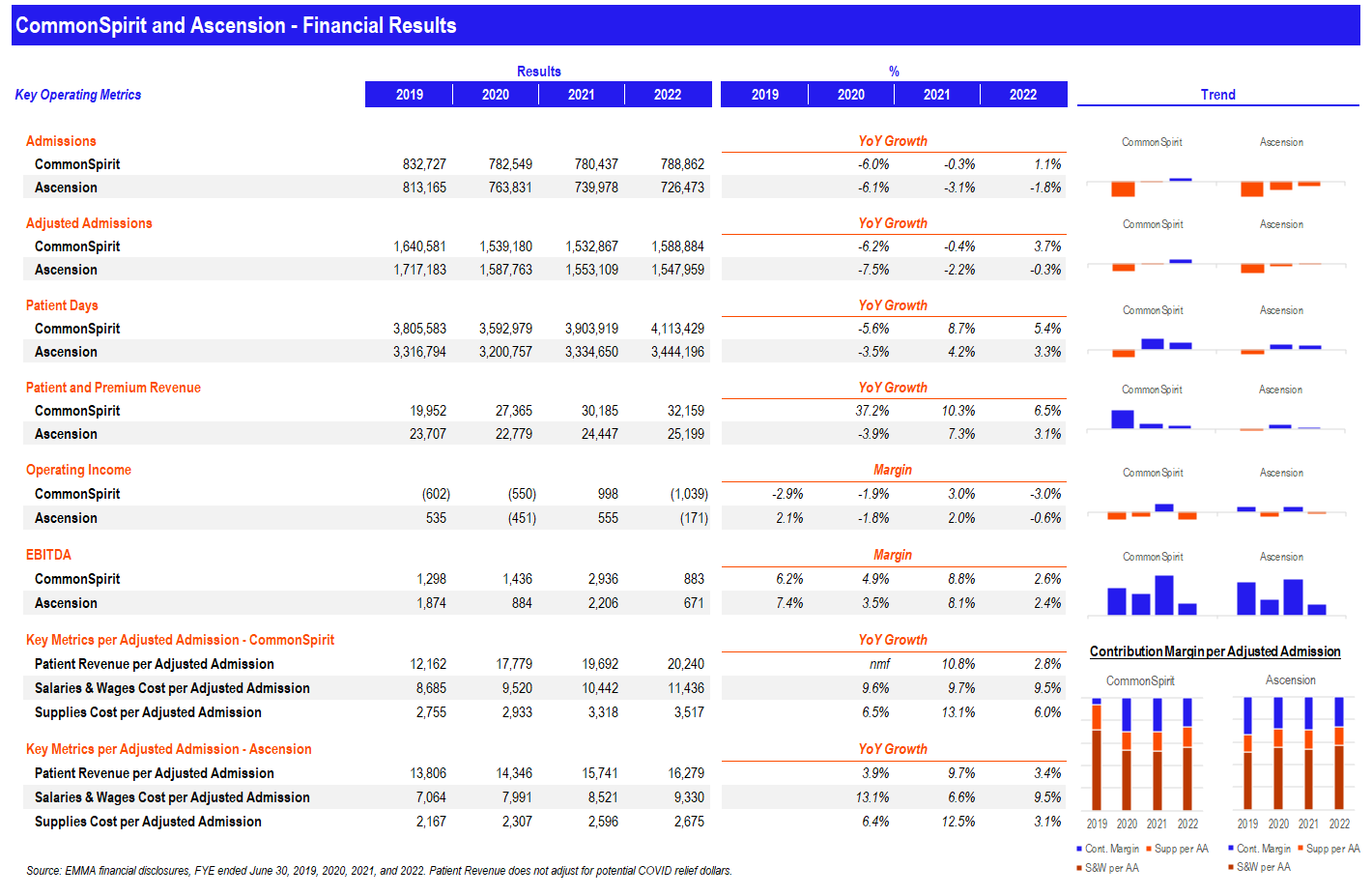

Analysis: CommonSpirit and Ascension Full-Year 2022 Performance

Since both Ascension and CommonSpirit dropped their full-year financial disclosures in mid-September, here’s a picture comparing key financial and operating metrics across both organizations. If there’s anything you guys would like for me to dive into in particular, I’m all ears.

Insurers expand MA plans for 2023

The biggest managed care players all have announced their Medicare Advantage plans for 2023:

- UnitedHealthcare is expanding into 314 new counties

- Humana is expanding into 260 new counties

- Wellcare (Centene) is expanding into 209 new counties

- Elevance is expanding into 145 new counties

- Aetna is expanding into 141 new counties

- Cigna is expanding into 106 new counties

- Clover is expanding into 13 new counties

- Alignment is expanding into 14 new counties

Along with all the expansion announcements above during enrollment, MA premiums are set to decrease on average by 8% in 2023.

Market Movers

Business and Strategy:

- Rock Health’s Q3 digital health funding report noted a significant, expected slowdown in activity. Q3 is the “lowest quarter by dollars raised in digital health since Q4 2019.”

- Allina Health partnered with Medline to provide an extensive portfolio of lab stuff across Allina’s 15 health system labs.

- Layoffs are rampant across healthcare and they’re not just occurring in digital health. 25 hospitals and health systems have announced job cuts in 2022.

- Truepill conducted a fourth round of layoffs, affecting 65% of its remaining staff. Sheeeesh. Ironically it’s possible that some of its struggles are related to Cerebral’s shutdown since Truepill was Cerebral’s preferred pharmacy partner.

- Independence Blue Cross sold a minority stake in Tandigm Health to Penn Medicine. Penn and Independence will partner by using Tandigm as the primary care platform of choice moving forward. Tandigm was founded in 2014 and serves the 5 Philadelphia counties through 400+ primary care physicians.

- Walmart is partnering with Kindbody to offer fertility treatment as an employee benefit.

- Cigna is launching a care platform called Pathwell which seems to be a suite of products offered by Evernorth to help providers manage high-cost patients (with rare and complex diseases).

- Novant Health bought a minority stake in MA plan HealthTeam Advantage, currently majority-owned by Cone Health, solidifying the joint venture.

- McKesson extended its pharmacy distribution agreement with CVS thru June 2027.

- In a blow to Cerner, Memorial Hermann switched to Epic.

- The Kaufman Hall September hospital flash report noted a mild recovery in hospital ops thru August.

Regulations and Rates:

- UnitedHealth finalized its purchase of Change Healthcare.

- The next challenge of the No Surprises Act is coming from Texas – who’s surprised? HA! Anyway, the Texas Medical Association is taking issue with the arbitration process despite the latest language pulling out the arbitration guidance related to referencing the median in-network rate.

Other:

- Physician burnout has reached distressing levels according to a Mayo Clinic survey. Almost 63% of physicians had some manifestation of burnout in 2021. The NY Times also did a write-up related to the concerning trend.

- An Alzheimer’s drug from Japanese drugmaker Eisai reduced cognitive decline by 27% after 18 months in a phase 3 clinical trial that has yet to be peer reviewed.

- UMass Chan Medical School launched a COPD study and program in collaboration with digital health firm Wellinks called Healthy at Home.

Miscellaneous Maddenings

- If any health tech or healthcare companies want to name me CMO (aka, Chief Metaverse Officer), I’m available. Just sayin’.

- Texas had a great bounce back performance against West Virginia, and shockingly, ESPN’s FPI has the ‘Horns favored in the remainder of their games, something I’m all too familiar with as a Texas fan that has next to no chance of happening. If anyone’s headed to the Texas-Ou game, hit me up – we can grab a Fletcher’s corn dog.

- Kim K has been fined $1.3M by the SEC for shilling crypto sh*t coins thru paid ads. How do you just forget to disclose that you were paid $250k to promote something? Get outta here with that!

Hospitalogy Top Reads

- The WSJ published yet another Cerebral piece littered with operational deficiencies that utterly failed one of its patients, an underage teen who ended up committing suicide. Still waiting for accountability from the venture scene on this one for pushing and incentivizing growth at all costs – even suicide.

- James Leckie penned a nice piece on safety net providers and an overview of care for the uninsured and underinsured populations.

That’s it for this week. Join 9,996+ thoughtful healthcare professionals and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!