02 October 2022 | FinTech

A Small Step in the Right Direction

By Alex Johnson

3 Fintech News Stories

#1: Good Timing

What happened?

Yet more product innovation in the business banking and corporate spend management space:

Rho announced Prime Treasury, a tailored treasury management offering built into Rho’s automated finance platform. Prime Treasury, a new, registered investment advisor subsidiary of Rho, will help growth-stage, US-based businesses protect their capital against inflation through strategic investment in government and corporate securities offerings.

So what?

Traditional banks and large corporations have known about the magic of treasury management for a while now, but a lot of private companies and startups are just starting to see the light (see Robinhood’s Q2 earnings for an example). Given that it seems unlikely that the Chairman of the Federal Reserve is going to knock it off anytime soon, I’d expect more private companies and startups to invest significantly in treasury management in the next 12-18 months.

Rho’s new Prime Treasury service is built on top of a very well-timed acquisition that Rho made back in February of this year, as Everett Cook (CEO of Rho) told me:

Last year, we recognized early signs that pointed to the likelihood of interest rates rising. For the first time in years, companies would have to have a cash management strategy that matches the sophistication of their spend management. For our customers’ sake, we wanted to get ahead of this.

Around that time, we were introduced to the team at Interprime, a YC-backed company that had built a phenomenal treasury management product. The two sides recognized immediate synergies; Interprime mentioned their customers frequently expressed interest in an all-in-one finance suite, and we knew that Rho customers would want more advanced cash management in the future.

In February, Interprime formally joined Rho, and we started building what ultimately became Prime Treasury.

#2: What’s Elite Got To Do With It?

What happened?

MoneyLion was sued by the CFPB:

the Consumer Financial Protection Bureau (CFPB) sued MoneyLion Technologies, an online lender, and 38 of its subsidiaries, for imposing illegal and excessive charges on servicemembers and their dependents. The CFPB alleges that MoneyLion violated the Military Lending Act by charging more than the legally allowable 36% rate cap on loans to servicemembers and their dependents, through a combination of stated interest rates and monthly membership fees. The CFPB also alleges MoneyLion required customers to join a membership program to access certain “low-APR” loans, and then did not allow them to cancel their memberships until their loans were paid.

So what?

Jason Mikula has a great write-up on the details of the CFPB’s lawsuit, so I won’t focus on the details here. If you’ve been paying attention to MoneyLion at all over the last few years, this news won’t be surprising to you (MoneyLion is dealing with regulatory scrutiny on quite a few different fronts at the moment).

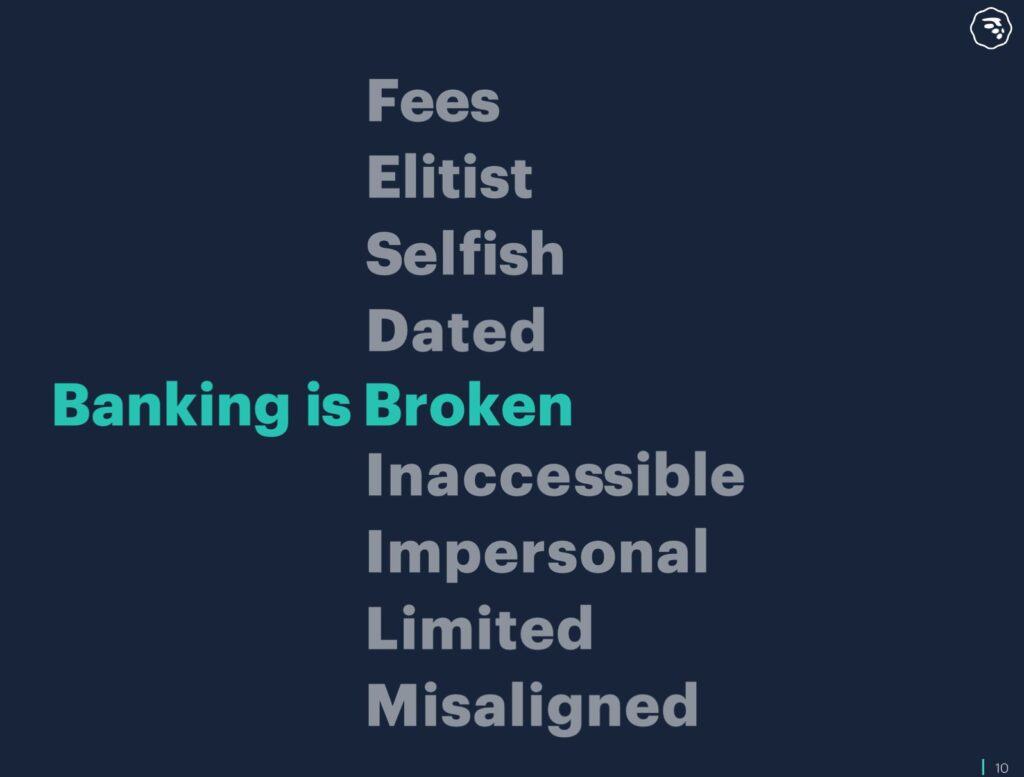

In the original deck that it created for investors, as it prepared to go public via a SPAC, MoneyLion included this slide:

“Banking is Elitist”

I’m not 100% sure what that statement is meant to convey, but I’d guess it’s something along the lines of ‘banks don’t have your best interests at heart because they are run by highly educated jerks who work in glass skyscrapers in Manhattan and are more interested in enriching themselves and their families at any cost than they are in helping you.’

That’s a wildly unfair generalization.

I mean let’s just say, hypothetically, that you live in New York and you have nearly two decades of experience working for large investment banks on Wall Street and you run a financial services company that acquired a different company that your spouse co-founded right after your own company finalized a deal to go public.

That might not sound great, but that’s no reason to assume your company is going to deceive and harm its customers, right?

#3: A Small Step In The Right Direction

What happened?

Juno, a web3 banking platform, raised an $18 million Series A and is launching a tokenized loyalty program:

Juno, a startup that provides checking accounts to crypto enthusiasts and allows them to take their paychecks in digital tokens, has raised a new funding round as it expands its offerings to include a tokenized loyalty program.

The one-and-a-half-year old startup has amassed over 75,000 customers in the U.S. who take their salaries (some in entirety, rest in portions) in crypto and invest consistently in digital assets each month.

Customers are able to spend their crypto or cash using the startup’s Mastercard-powered debit card, make bill payments and easily move funds to and from traditional banks if they so desire. Juno also offers direct onramps to customers from a checking account to layer 2 blockchains such as Polygon, Arbitrum, and Optimism for zero fees.

So what?

I wrote about Juno a while back, as a part of a larger shift towards what I call ‘hands-on-the-wheel money’, but that’s not what I want to emphasize today. Instead, I want to focus on this portion of the TechCrunch article:

Juno, which raised a $3 million seed funding last year, is now ready for a new offering: an optional loyalty program. The startup is introducing an ERC20 token, called JCOIN, which will be rewarded to customers, if they so choose, based on their usage. Remarkably, Juno co-founders, employees and investors are not taking any allocation in the tokens to avoid conflict of interest in a move that is in contrast with how a significant number of industry players operate.

“We feel distributing tokens to founders, investors and team members creates misaligned incentives. Being market participants with privileged information creates distrust with community in the long term,” said Deshpande.

“The exit path for our company’s success remains developing successful products, and the path for our investors and team remains an IPO,” he said.

This is great. Juno is trying to stay focused on long-term value creation and is keeping employees’ and investors’ financial incentives aligned with that objective.

No wonder a16z crypto isn’t involved in this one.

2 Fintech Content Recommendations

#1: The Fraud Bulletin (by Frank Abagnale) 📚

This week’s content recommendations are sourced from Alloy’s Client Conference, which I attended and spoke at last week.

First up is Frank Abagnale’s Fraud Bulletin.

Mr. Abagnale was the keynote speaker at Alloy’s conference, and he was excellent. Dude is 74 years old and hasn’t lost anything on his fastball. His presentation was deeply informative, as is the annual write-up on fraud trends that he creates and publishes for free. I read it on the plane ride back from Santa Monica, and I learned a ton!

#2: Operation Firewall (by Michal Lev-Ram) 🎧

Second, I would highly recommend Operation Firewall, a podcast created by Michal Lev-Ram, a journalist at Fortune.

The primary subject of the podcast – former Secret Service Special Agent Steve Ward – was a speaker at the Alloy conference (along with Michal Lev-Ram) and the story they shared is fascinating. In the early 2000s, law enforcement was focused on counterterrorism, not computer crimes. Then agent Ward meets Albert Gonzalez, a young hacker, who had been stealing money from ATMs using hacked debit card data, and everything changes.

Listen to this podcast.

1 Question to Ponder

Which banks will be the 5 biggest banks (by asset size) in the U.S. 30 years from now?

If you have thoughts on this question, hit me up on Twitter or LinkedIn.