Join 9,600+ smart, thoughtful healthcare folks and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!

Cano Health Catches a Bid

Cano Health is the latest name to get thrown into the acquisition ring. Rumors are swirling around the risk-based care MA clinic operator. Among the potential suitors are at least CVS, which just bought Signify Health for $8B, and Humana, which has a right of first refusal for any sale of Cano over a certain ownership threshold.

Madden’s Musing: Cano spiked 30+% on the acquisition rumors to around a $3.3B enterprise value and I feel like a broken record writing about these takeovers being perfect targets for payors.

- Background: the MA player SPAC’d at a $4.4B valuation in early 2021 amongst the value-based care and ‘Rona trade. Then, in March 2022, activist investor group Third Point bought 6.4% of the company and allegedly pushed Cano to consider a sale which ultimately didn’t materialize. In July, Humana was briefly rumored to be holding acquisition talks with Cano, which again, ultimately didn’t materialize.

So now here we are again with some more substantial weight to the discussions, considering that the Wall Street Journal reported on the news after previously scooping the Signify talks. Cano would be an attractive strategic asset for any payor – particularly CVS – as these giants continue to build out clinical assets and vertically integrate. The MA player provides for 282,000 members across 143 clinics located mainly in Florida but also in Texas, Nevada, and a few other states.

For 2022, Cano guided for revenues just south of $3B, a medical cost ratio in the high 70%’s, total membership around 300k, and 184+ opened medical centers. All of that acquired growth and continued capex comes with a cost, though – similarly to One Medical, Cano needs capital. I’m expecting to see a sale here and likely a substantial premium, but the valuation window for primary care assets is closing as most other names have been bid up as a result of the flurry of activity.

Resources:

- Activist investor group pushes Cano Health to explore a sale – Reuters

- Cano Health reportedly exploring a sale – Reuters

CommonSpirit posts FYE 2022 Results

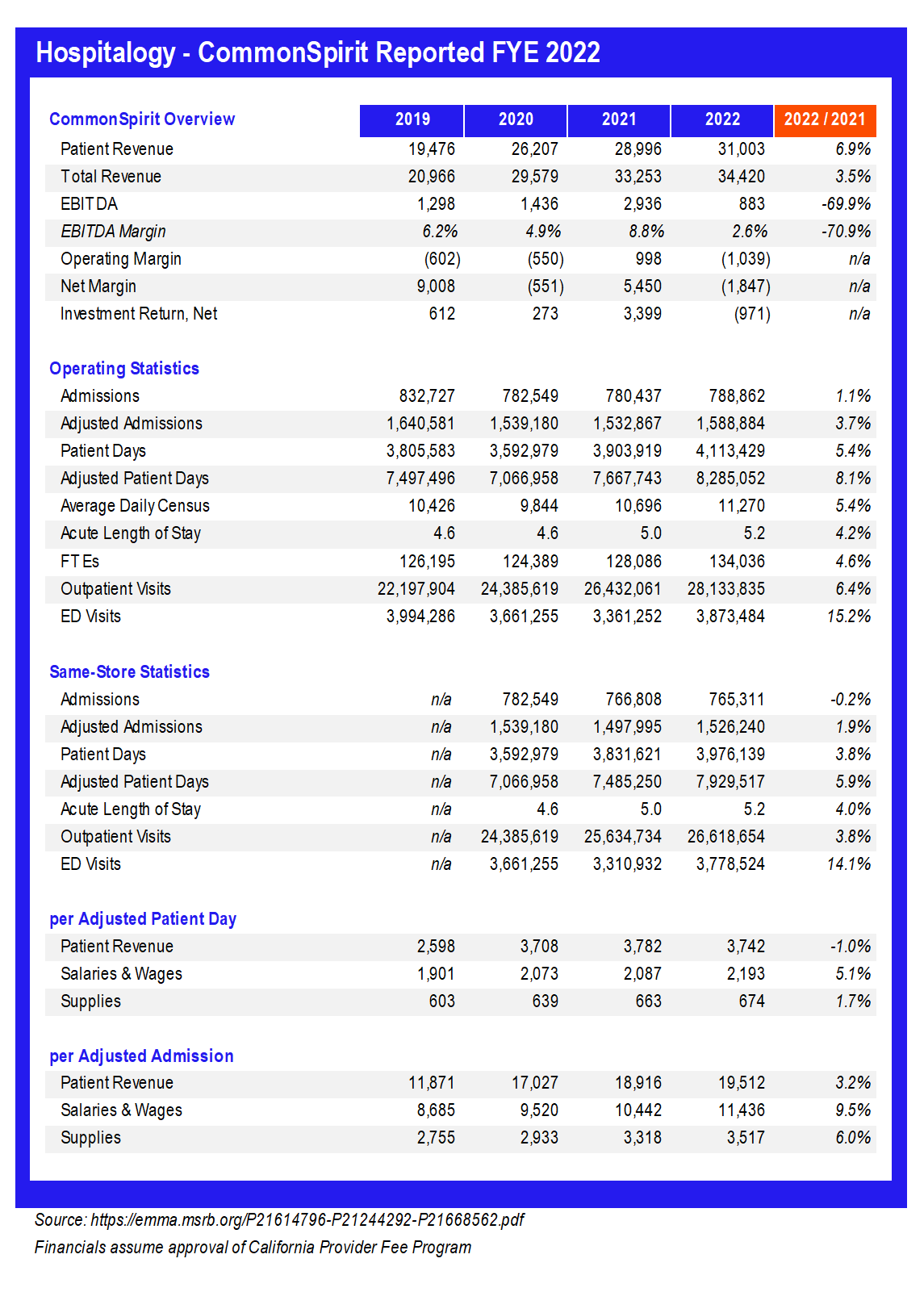

CommonSpirit Health, the largest nonprofit health system in the U.S. after its merger with Dignity Health 4-5 years ago, posted its full year 2022 (fiscal year end June 30) financial results this week.

Madden’s Musing: In summary, CommonSpirit faced similar issues to Ascension (which lost $1.8B – I covered that last week) and hospitals in general. Revenue gains on the topline were more than offset by expense inflation. Salaries & wages and supplies grew 9.5% and 6.0% per adjusted admission respectively while same-store admissions stagnated. It’s pretty amazing to see length of stay jump across the board even at these gigantic health systems. The widespread trend signals higher patient acuity and more observation days stemming from a lack of post-acute discharge support, one of many factors I noted in last week’s deep dive on hospitals.

Of course, investment losses didn’t help CommonSpirit, but given the sheer size of this organization and its pretty favorable payor mix, the health system will be just fine. In fact, Fitch even upgraded some of its debt recently, expecting the org to trend back to an 8% EBITDA margin over time by 2025. CommonSpirit operates among a number of diverse, growing markets which alleviates a lot of concern when it comes to factors affecting smaller hospitals and health systems. It’s nice to be big.

Resources:

- I can’t link to the earnings directly or Google will yell at me, so here’s a HCD article with a link to the PDF: Article Link

- Fitch Ratings upgrade

Market Movers

Business and Strategy:

- ApolloMed acquired All American Medical Group, a 250-physician practice and For Your Benefit, a licensed health plan, for an undisclosed sum. The acquisition will bring ApolloMed’s total membership to 30k+ in the Bay Area and allow the care platform to take on more risk through 250 additional physician partners. The deal will close by Q1 2023. Coincidentally, ApolloMed also picked up some analyst coverage from William Blair. Finally!

- Moody’s downgraded KKR-backed Envision Healthcare to its lowest junk rating, or C, this week. Factors included its ongoing spat (and out of network status) with United, No Surprises Act implementation, lower ER volumes, labor challenges, and social risk stemming from the negative publicity it received from pursuing an aggressive out of network billing practice in order to gouge patients and insurers. No love lost for Envision here.

- Axios reported (paywall) that PE firm Webster is planning to sell its ophthalmology portfolio company Retina Consultants of America in 2023 after forming the company in March 2020. That’s an…extremely short hold. Notable.

- MercyOne, the once-JOA now owned by Trinity, is pursuing a strategic partnership with Genesis Health, the details of which sounds eerily similar to a merger. If it looks like a duck…

- Babylon’s stock is under $1.00 and as such, out of compliance with the New York Stock Exchange. It’s implementing a reverse share split in the neighborhood of 15-to-25 to one in what is almost assuredly going to begin a death spiral for the publicly traded risk and telehealth provider. Babylon is down 90% in the past year and shockingly, more pain may still come to pass.

- Amazon is parting ways with the two founders of PillPack, which was acquired by Amazon back in 2018.

- Oak Street Health launched a 12-month Nurse Practitioner fellowship for adult primary care in collaboration with the Michigan school of Nursing. The NP model is growing increasingly prevalent in urgent caref and primary care settings and will fill a major shortage gap in primary care during the coming decade.

- Molina, Centene, and UnitedHealthcare were the big winners in the Nebraska Medicaid contract

- 9 months since launch, Mark Cuban is expecting his Cost Plus Drugs pharmacy to be profitable in 2023. Cuban said that the company already has over a million customers and a 10% week over week growth rate, which makes me wonder how this model, which seems pretty easy to replicate, hadn’t been done at this level of success before. Was it the personal branding and marketing touch with the Mark Cuban name that did it? Either way, I constantly see patients saving tons of money at MCCPD versus pharmacy formulary prices for various drugs.

- Encompass Healthcare announced plans to build a 50-bed inpatient rehab facility in The Villages, Florida.

- BCBS of Massachusetts will offer both Carbon Health and Firefly Health in most of its commercial plans in 2023, two hybrid primary care platforms and what I imagine to be a nice win for both digital health organizations. BCBS Vermont similarly

- Mass General Brigham has agreed on a plan with the Mass. Health Policy Commission to reduce state spending by $128 million over a number of initiatives, including..going in network with more commercial payors?

Regulations and Rates:

- CMS released information on nursing home and SNF ownership today. Check it out here.

- The DEA is investigating virtual mental health company Done for its online prescribing practices of controlled substances. In other news, I just saw a Tik Tok ad for Done. Real talk, these other, lower profile companies deserve just as much scrutiny and discussion as the chronically-dunked-upon Cerebral.

- We finally received some more information on the United-Change court ruling (I covered last week). TL;DR, the judge thought that the DOJ failed to prove that UNH’s acquisition of Change would create antitrust issues or that UNH would misuse the Change data, calling these DOJ assertions ‘speculation’ and not based on real world evidence. The judge seemed to be particularly swayed by UNH exec arguments that being caught sharing sensitive data would cause immense, irreparable financial and reputational harm to United.

Other:

- Pre-clinical, gene editing biotech firm Prime Medicine filed for an IPO this week. BOLD. I like it.

Miscellaneous Maddenings

- 2 astronomy related things since I’m ever-fascinated by space: NASA is flying a spacecraft into an asteroid, testing out a planetary defense method should a collision-course asteroid ever pose a threat to Earth. And tonight, get your binoculars out – Jupiter is going to be the closest in proximity to Earth in our lifetimes (until 2129), bright enough to see its bands in colorful detail. I’m gonna be up tonight looking at it for sure! I also just realized that both of the tweets I linked came from the same person, so I’ll probably follow astro_jaz right after writing this.

- As a Longhorn Loyalist carrying the burden of being a lifelong friend to a Tech fan, we went to the Texas – Texas Tech game in Lubbock over the weekend and let me tell you. There’s nothing like witnessing an entire stadium composed of 68,000 fans of the opposing team rushing the field after your team collapsed and gave up a two-touchdown lead in the second half only to tie it up in the last 21 seconds to go into OT, only to inevitably fumble on the first play of the first possession of OT, to lose on a walk-off field goal. If you’re a Texas fan, you understand this pain. It is truly unique to us. And maybe Nebraska. And the Cowboys. 2 of those I’m a fan of. Anyway, I’m still all-in on Sark and you should be too!

Hospitalogy Top Reads

- For the operators out there, the CareOps + Awell team and HTN in collaboration with a few others published an in-depth survey on what practices and tools care provider organizations (virtual, traditional or hybrid) are leveraging to build, operate and optimize software-powered care flows that drive outcomes improvements for patients and efficiencies in care delivery.

- I say it all the time: I’m not an operator and am low-key glad I’m not (lol). But for the operators, the CareOps team is hosting an interesting panel to dive deeper into the results of the survey tomorrow (9/28). Here’s the link to sign up.

- The New York Times dropped two articles on hospital billing and patient practices this week. One report dove into Providence’s billing tactics including McKinsey’s involvement with extracting dollars from patients who were otherwise eligible for charity care. The other essay discussed Bon Secours Mercy Health and using the 340B program to its advantage by funneling drug purchases through a safety net hospital in a low-income area while also allegedly cutting inpatient services at that same hospital, leading to access issues for patients in the community.

- McKinsey (lol) had a nice 5-part ‘Gathering Storm’ series on the current headwinds and challenges facing our broader healthcare system, and the change needed (necessitated) in the coming years.

- Rick Goddard from Lumeris published a fantastic look at the current vertical integration trends in healthcare among major incumbents, including how hilariously behind a player like Amazon is when compared to United, CVS, or regional health systems.

- ICYMI: I published an essay on why the traditional hospital that relies on acute care is dying, including the factors affecting hospital operations in 2022. This week I’ll dive into what the health system of the future will look like and some fun guesses on some innovations there!

Join 9,600+ smart, thoughtful healthcare folks and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!