01 September 2022 | FinTech

The CFPB’s Capraesque Obsession with Relationship Banking

By Alex Johnson

Our story starts in Great Falls, Montana. And like most stories originating from Great Falls, this one is confusing and a bit depressing.

(Editor’s note – I hate Great Falls with a passion that, I admit, isn’t entirely rational. If you’re not from Montana, you won’t understand. Just go with me on this.)

At a public town hall in Great Falls in June, the Director of the CFPB (Rohit Chopra) announced that the agency was going to fight like hell to preserve what he called ‘relationship banking’:

relationship banking is a model used to serve families, businesses, and communities as individuals, with an emphasis on providing customized help, rather than assembly-line style service. At this point in the United States, relationship banking is geared toward high net-worth individuals who typically enjoy a wide range of banking services, often through local, regional, and national private wealth managers. For most households and small businesses, this kind of relationship banking is becoming harder to find.

At the Consumer Financial Protection Bureau and at federal banking agencies, we are taking a number of steps to help revitalize relationship banking, especially in rural communities.

The Director contrasted relationship banking with ‘transactional banking’ and ‘algorithmic banking’:

Then there’s transactional banking, which relies on highly standardized or mechanized products and processes. Typically, transactional banking is governed by terms and regulations imposed by the financial company on the consumer without flexibility or negotiation. When a customer has a problem, they typically cannot go to the individual that originally signed them up for the product. Transactional banking typically involves significant scale. In other words, big operations with lots of customers. Many of the big banks that took over smaller banks in the past several decades have versions of this business model.

And, third, more recently, many financial institutions and tech companies are shifting toward what I call algorithmic banking, which relies on using vast quantities of data about an individual through tracking and surveillance to make predictions about their behavior and banking habits. Advanced computational models make determinations about what products will be offered to you and whether you will be approved. I expect that we will see more and more of this type of banking as Big Tech conglomerates enter financial services.

And he argued that relationship banking is critical to serving rural communities:

Consolidation and new banking models happened at relatively the same time that many rural communities lost access to local banks. When farmers and ranchers started to capture smaller and smaller shares of the food dollar, family farms started to scrape for every penny, and populations started to decline, the big banks saw less of an incentive to have a brick-and-mortar presence in small towns.

When the banks shuttered, nothing replaced them. Instead, we see “banking deserts,” communities lacking access to in-person banking facilities. There are large swaths of areas with no bank branches all over the United States because of bank consolidations but 65 percent of existing banking deserts and 81 percent of potential banking deserts are located in rural areas.

Phew! There’s a lot to unpack here, but I think it’s that we do so because this isn’t just rhetoric. The CFPB is actively working to improve big banks’ customer service (which bank lobbying groups are very unhappy about) and address the challenges of rural banking.

Let’s lay out a few assumptions that the CFPB seems to be operating on and then examine the veracity of those assumptions.

Assumption #1: Consumers would choose community banks and relationship banking if only they had access to them.

Community banking advocates like to use stats like these, which Director Chopra used to lead off his public comments in Great Falls:

In 1984, the United States had nearly 18,000 banking institutions. Last year, that number declined to fewer than 5,000. What was once a decentralized consumer finance landscape, primarily populated by local financial institutions, is now dominated by large banks that have gobbled up many of those small players.

They argue this consolidation leads to bad customer service and bad banking. Again, here’s Director Chopra:

When Main Street banks pack up and leave town, and when issues are instead funneled through national call centers, there is a loss of local, on-the-ground knowledge that is the basis of good customer service, and good banking.

My Take:

This is a peculiar way to frame market consolidation, isn’t it? It removes all agency from consumers and treats consolidation and the progression from relationship banking to transactional banking to algorithmic banking as some regrettable fait accompli.

Here’s the reality – transactional banking (as practiced by the national and super-regional banks) became the dominant form of banking in the U.S. because consumers preferred it to relationship banking (as practiced by community banks). Algorithmic banking (as practiced by direct, digital-only banks and fintech companies) is starting to displace transactional banking because, again, consumers prefer it.

And, by the way, as banking continues to evolve, consumers still seem reasonably satisfied when it comes to customer service:

Although direct banks have always been prized for their easy-to-access, self-service nature, customer service (via phone and online chat/email) is a key driver of customer satisfaction. Among checking and savings customers, 59% say they have never had a problem or complaint with their direct bank. Among customers who experienced a problem/complaint in the past 12 months, 83% say it was convenient to reach customer service and 88% say their most recent problem was resolved.

None of this is a conspiracy. It’s just capitalism.

Assumption #2: Relationship banking is fairer than transactional and algorithmic banking.

Here’s Director Chopra again:

business models that privilege automation at the expense of high-quality human interactions don’t always deliver the best outcomes for consumers. Nor do they always fix the problems from the past. For example, while we know that human discretion without appropriate guardrails presents a risk of discrimination, automated systems present their own dangers too, as algorithmic bias can also unfairly distort outcomes.

My Take:

Saying that “human discretion without appropriate guardrails presents a risk of discrimination” is quite an understatement. That’s like saying, “closing one’s eyes while driving without appropriate guardrails presents a risk of crashing.”

It’s not a risk. It’s a certainty.

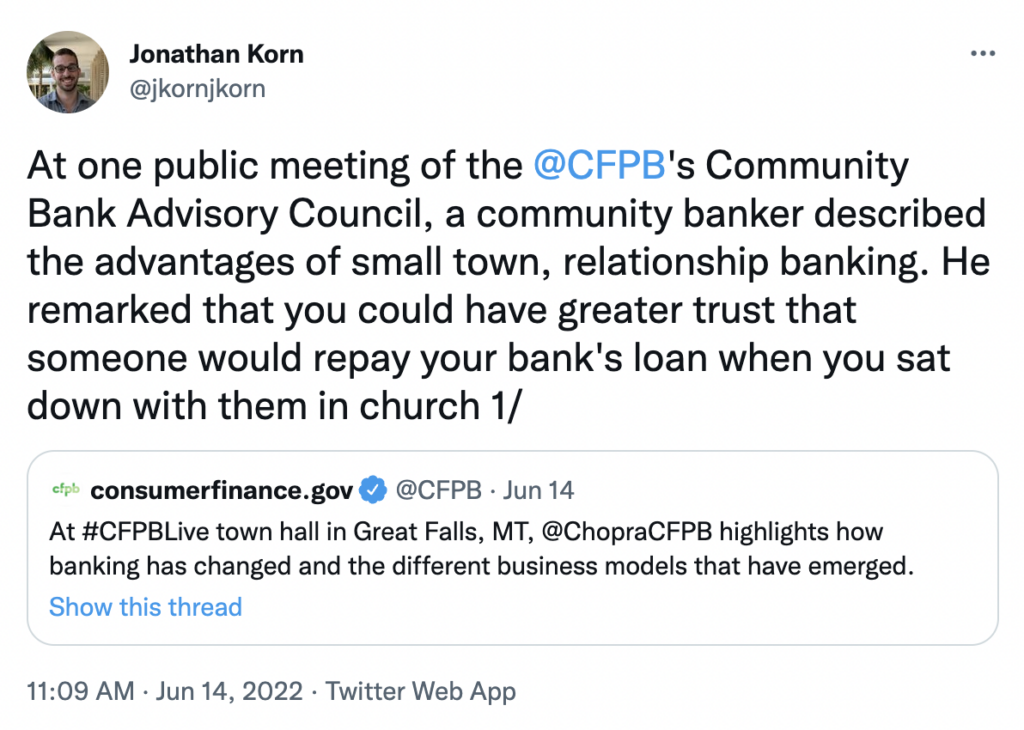

We know that when you put lending decisions fully into the hands of humans, discrimination will happen. This anecdote from a CFPB Community Bank Advisory Council meeting illustrates just how easy it is for relationship banking to crash into this particular wall:

Automation – enabled by credit scores, underwriting algorithms, and decision engines – reduces the likelihood of discrimination by reducing the surface area of human judgment in the loan underwriting process. It has made lending vastly fairer over the last 40 years or so.

For a recent example, let’s look at the Paycheck Protection Program:

Racial Bias in the financial system is nothing new, but the way it has played out across the $806 billion Paycheck Protection Program as it relates to the Black-owned businesses is beyond alarming. Researchers from New York University’s Stern School of Business found that Black-owned businesses were 12.1 percentage points more likely to obtain their PPP loan from a fintech lender than a traditional bank.

The NYU researchers discovered that when small banks incorporated automation into handing out loans, the technology “more than doubled small banks’ propensity to lend to Black-owned businesses.” They also found smaller banks were much less likely to lend to Black-owned firms, while the Top-4 banks exhibited little to no disparity after including controls.

Part of the ongoing lending discrepancy which has made fintechs a better bet for Black-owned businesses could be their systems rely on “simple automation” in which computers merely verified if a loan recipient’s driver’s license was fraudulent or not. In stark contrast, small banks may have relied on humans to verify each recipient’s driver’s license as part of the identification verifying process, and people’s personal prejudices against people of color could have crept into the overall decision making.

This isn’t to say that lending is perfectly fair today. It’s not. We have a long way to go, and concerns about the fairness of black box algorithms and machine learning models are certainly warranted.

That said, no one should be pining for a return to the days of fully manual loan underwriting.

Assumption #3: Community banks and bank branches are critical for solving banking deserts.

The CFPB is very concerned about banking deserts and their impact on rural communities:

The CFPB highlighted the growing number of banking deserts in the U.S., areas defined by the Federal Reserve Bank of St. Louis as census tracts in which the central point has no branches within a 10-mile radius.

“The Federal Reserve has identified more than 2,100 existing and potential banking deserts across the country with more than 1,500 located in rural areas,” the CFPB wrote.

Rural areas are 10 times more likely to be in a banking desert than urban tracts, the CFPB found.

The CFPB believes that community banks and their small-town bank branches play a pivotal role in preventing bank deserts from forming:

The CFPB also highlighted the presence community banks and credit unions have in rural areas as larger institutions leave.

“Community banks are three times more likely to locate their offices in a non-metro area, and community banks hold the majority of banking deposits in U.S. rural and micropolitan counties,” the report noted.

The CFPB report cited an FDIC study that found, in 2012, almost one out of every five U.S. counties had no other physical banking offices except those operated by community banks.

Especially given that rural communities tend to trail urban and suburban communities in broadband internet access:

The disparity between rural and urban Americans regarding the frequency in which they visit bank branches may be attributed to lower rates of high-speed internet access in rural communities, the CFPB said.

While the rise of digital banking has helped some consumers cut back on the need for in-person visits to the branch, the CFPB said a lack of broadband access in some rural communities is a major limiting factor.

My Take:

Given that:

A.) most consumers prefer to interact with their financial services providers digitally,

B.) accessing financial services through the internet affords consumers infinitely more choices,

C.) the rural/urban divide on broadband internet access is relatively small (81% of rural households compared to 86% of urban households) and likely to continue shrinking, and

D.) even in rural communities that still have bank branches, the distance that rural consumers need to travel to get to the nearest branch is much greater than the distance required of urban consumers,

isn’t more investment in rural internet access a better policy prescription for banking deserts than the artificial preservation of the Bailey Building and Loan?

Assumption #4: Tech companies and other non-banks are bad for community banks and bad for relationship banking.

Director Chopra’s remarks in Great Falls strangely absent any direct mention of fintech. However, he did mention tech companies as a key part of the algorithmic banking wave that is sweeping the country:

many financial institutions and tech companies are shifting toward what I call algorithmic banking, which relies on using vast quantities of data about an individual through tracking and surveillance to make predictions about their behavior and banking habits.

Sounds sinister! And very much in opposition to the community-centric, relationship-focused banking that the CFPB wants to see a return to.

My Take:

Two things here.

First, if you want to stem the tide of consolidation and stop community banks from getting gobbled up, tech companies and other non-banks are your best friend! Banking-as-a-Service (BaaS) – in which licensed banks rent out their charters and other services to non-bank companies – is an enormously profitable business for community banks and is, for many, one of the last remaining levers they have to drive growth and avoid becoming an acquisition target.

Second, I think there is a solid argument that fintech and non-banks are actually helping drive a renaissance for relationship banking. Take, for example, the emergence of fintech for agriculture, including the creation of neobanks for specific agriculture sub-verticals like dairy farming. These fintech companies serve many of the same customer segments that community banks have traditionally served but without the same geographic constraints.

The CFPB should be a fan of tech companies getting into banking!

Assumption #5: Relationship banks don’t screw over customers.

This quote, from Director Chopra’s remarks, is quite something:

Relationship banks do not create fake accounts or pass the buck when customers face problems. A key element of relationship banking is one where banks respond to customers with clear answers, can translate into better banking for individuals but also for the banks. When banks put effort into service, responsiveness and customer care, problems get solved and customers get the products that best match their needs.

Translation: small banks don’t screw over their customers.

My Take:

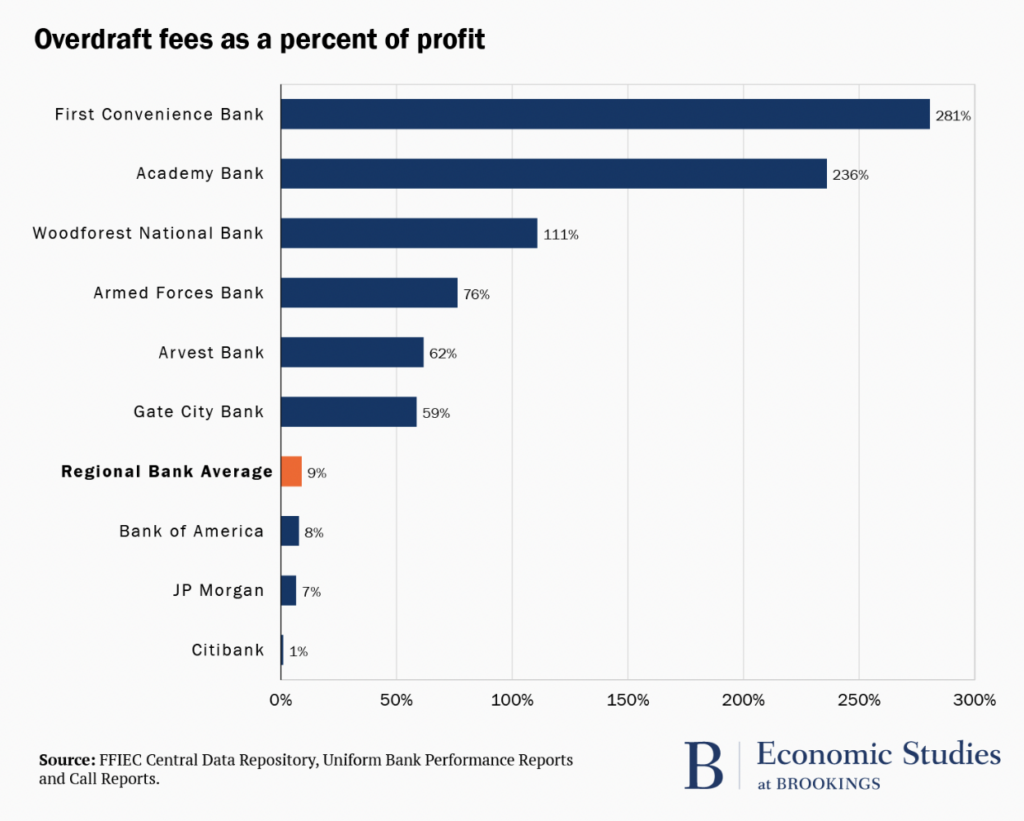

For six banks, overdraft revenues accounted for more than half their net income. Three had overdraft revenues greater than total net income (meaning they lost money on every other aspect of their business). First National Bank of Texas (doing business as First Convenience Bank) made over $100 million in overdraft fees yet posted an annual profit of just $36 million in 2020. Academy Bank and Woodforest National banks likewise made more money on overdraft revenues than profits in 2020. All three were entirely reliant on overdraft fees for any profit in 2019 as well. This is not a one-year blip; it is their business model. Armed Forces Bank, Arvest Bank, and Gate City Bank all rely on overdraft fees for more than half their profit.

There is no corner of the financial services industry where you will not find some bad actors. Suggesting otherwise is just silly.

Let This One Go

Despite what the entirety of this essay up to this point might suggest, I generally like the CFPB!

Financial services is one of those industries where information asymmetry tends to benefit suppliers over consumers. So I like that there is a regulatory agency focused on leveling the playing field. And I don’t mind that they occasionally hurt banks and fintech companies’ feelings with a strongly worded press release.

That said, this iteration of the CFPB does have a few policy positions that seem more philosophical than fact-based, and this weird, Capraesque obsession with relationship banking is definitely one.

It would be nice if they let this one go.