For my fellow Dallasites, you might be under water in more than one way this week. Apparently Dallas just received 20% of its average annual rainfall – in one day – after a 65 day drought.

It’s as if the great state of Texas had decided to store all the water and dump it on us all at once!

Join 7,500+ smart, thoughtful healthcare folks and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!

Bidding war for Signify Health Escalates

So I’m sitting on my couch getting ready to watch the pilot of House of the Dragon when a headline catches my eye.

I’d mentioned a couple of weeks ago that home health analytics & enablement platform Signify Health is up for sale and had bidders including CVS.

Welp, hot off its acquisition of One Medical, Amazon seems to be among the bidders for Signify as well. The sale process has turned into quite the auction. According to rumors, bidders for the platform include at minimum CVS, Amazon, Options Health Care, and United – the last of which we know has offered $30 / share, an $8 billion + valuation and a ludicrous 2022E multiple above 9x (Are we in a recession or not?). New Mountain Capital owns over 50% of SGFY.

Madden’s Musing: CVS must be incredibly frustrated with its M&A strategy right now. Any deal it tries to strike gets caught up in a bidding war or gets out of its control quickly while other publicly traded acquisition targets get bid up quickly. I have to think that management commentary about “actively seeking” a primary care platform deal in 2022 ultimately led to what we’re seeing today.

Along with the CVS perspective, the Amazon healthcare strategy developing here is one to watch.

Amazon seems to have conducted some major internal analysis around the aging in place trend (AKA, home care for seniors) and wants a piece of the pie. Its current footprint to leverage a senior care strategy would include One Medical (Iora), Alexa Together, Pharmacy / Pillpack at-home delivery, and Signify Health.

If Amazon manages to buy the 10,000 clinician workforce that Signify has to offer, I have to think that another home health asset is in play for the Big Tech retail giant to enable at-home care delivery. The interest in Signify leads me to believe that Iora was a bigger piece of the One Medical acquisition than I initially thought.

Final note – even if things don’t work out perfectly for Amazon on the delivery and platform front, Amazon can still leverage these assets to work with healthcare clients on its fast-growing AWS segment (which might be an underrated aspect of the play). Demand for cloud services in healthcare will only continue to grow from here.

Who do you think wins the bid? My money’s on United.

Resources:

- Amazon among bidders for Signify Health (WSJ)

- UnitedHealth, Amazon Are Among Bidders for Signify (BBG)

- (Non-paywall) CVS, Amazon, UnitedHealth are among bidders for Signify, Bloomberg reports (HCD)

Nonprofit Health Systems in Q2

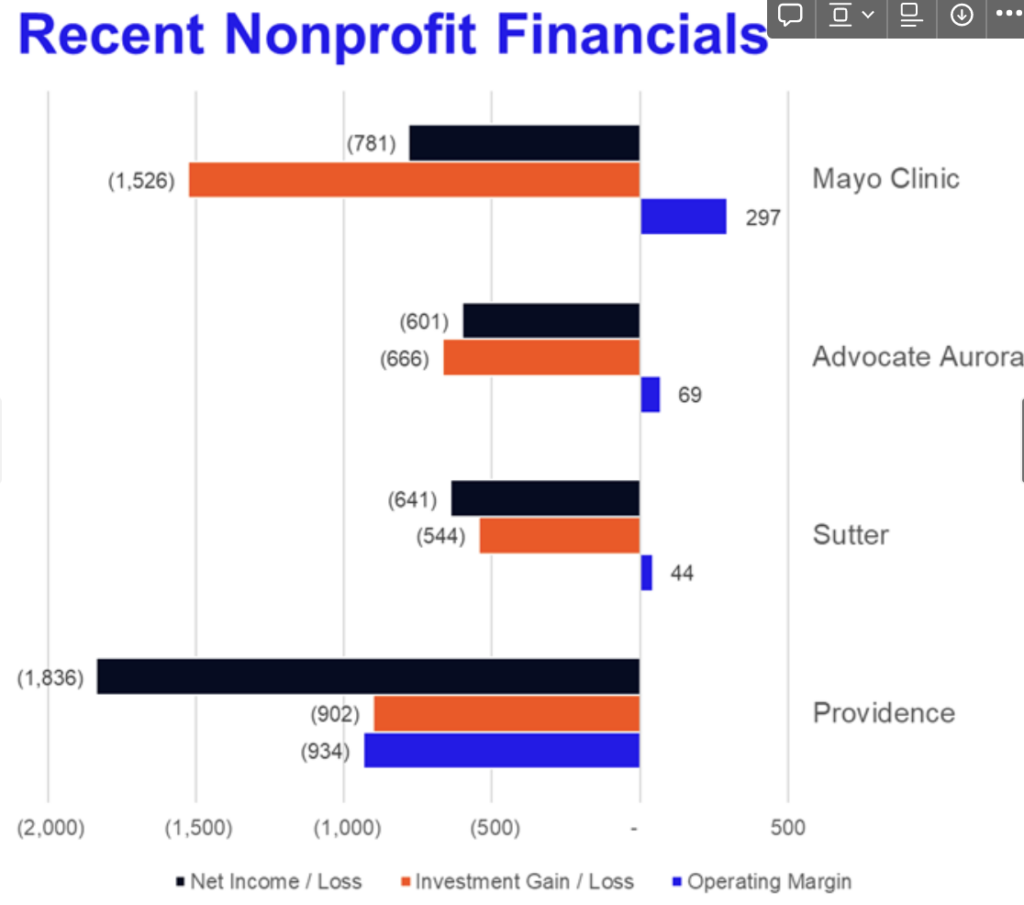

Fitch downgraded nonprofit hospitals to neutral this week after calling their situation ‘deteriorating.’ Although I’ve covered before the factors hitting hospitals hard that Fitch cited for its downgrade (labor, general economic pressures, investment losses), what I found interesting was Fitch’s expected timing of the deteriorating operations and subsequent recovery.

Based on the report, Fitch doesn’t expect nonprofit hospitals to experience the full impact of inflationary pressures and other headwinds until this time next year (AKA, August 2023). Pressures include elevated nursing salaries and continued shortages putting pressures on the amount of patients that hospitals can see, trends that they expect to continue well into 2023.

- “As a result, many NFP health providers will violate debt service coverage covenants in 2022. As to what that scenario means for hospitals in the coming months, “We may be in a period of elevated downgrades and Negative Outlook pressure for the rest of 2022 and into 2023,” said Holloran.”

Madden’s Musing: The largest nonprofit health systems in the U.S. are operating on razor-thin margins, the nursing staff situation nationwide is dire, and the days of relief dollars from the public health emergency are numbered. The number of headwinds facing hospitals makes me wonder what a sustainable operation looks like as the health system footprint evolves. It’s dang hard to run a hospital in 2022.

Resources:

- Fitch Ratings Revises U.S. NFP Hospitals Sector Outlook to ‘Deteriorating’ (Fitch)

Market Movers

Business and Strategy

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

- As a part of its earlier deal to purchase Houston-based multi-specialty physician group Kelsey-Seybold, UnitedHealth Group also bought Kelsey-Seybold’s MA plan – KS Plan Administrators – a 41,000 member plan with $147 million in member premiums, closing the deal this month. Another interesting tidbit from the article: UnitedHealth bought KS for $2 billion. KS was/is a gargantuan practice with 600+ physicians and every ancillary service line under the sun.

- GI Alliance, a private-equity backed roll-up in the gastroenterology space, is getting bought out by its physician owners, valuing the biz at $2.2B. Apollo helped the physicians buy out Waud Capital’s remaining minority stake and will hold a similar position in the GI practice.

- After announcing a deal to go public via a Chamath Palihapitiya SPAC earlier this year, digital therapeutics company Akili ($AKLI) debuted on the markets and raised $163 million in cash in the process to launch EndeavorRx, a prescription video game to treat ADHD in kids. Naturally, Akili dropped 49% today as there’s not the best appetite for a pre-revenue digital therapeutic right now. Pear Therapeutics (SPAC’d on 12/6/21) is down 82.3%.

- Virginia Mason and Confluence Health announced the formation of Madrona Health, a joint venture to expand its specialty pharmacy operation to more of the Pacific Northwest.

- Bright Health and other insur-techs are facing some capital crunches. It’s going to be interesting to see how the recent gone-public insurance companies like Bright, Clover, and Oscar navigate massive losses. Here’s a good look at Bright from Ari Gottlieb.

- Activist investor group Elliott Management disclosed a large stake in Cardinal Health and looks to be seeking some board seats.

- Incredible Health raised $80 million at a $1.65 billion valuation, joining a few other private and public names benefiting majorly from the nursing shortage trend while also providing real value to allocate nurse staffing at hospitals.

- P3 Health Partners is in danger of getting de-listed from the NASDAQ

- Kaiser Permanente is planning a $1.7 billion expansion to build out two existing hospitals and break ground on two medical office buildings

- ChristianaCare called off its deal with Prospect Medical Holdings to purchase Crozer Health, a multi-hospital system in the Pennsylvania area, citing economic conditions.

Regulations and Rates:

- The surprise billing final rule shifts some language around the arbitration process. The arbiter will now consider the median rate as a data point (rather than the right payment amount) along with the evidence presented on the provider side. Slight win for providers.

- North Carolina failed to pass Medicaid expansion after some concern from healthcare trade groups around that same expansion package loosening CON laws. Lose-lose – I wrote here why CON laws are outdated.

- A federal judge sided with the state of Georgia in its ongoing case about Medicaid work requirements. Basically Georgia’s argument was that CMS (under Trump) had approved Georgia’s waiver to install the program then rug-pulled the program (under Biden).

- The FDA announced this week that over-the-counter hearing aids will be available starting in October. Best Buy and other retail players are scrambling to buy the devices for OTC retail sales.

Other

- Aon is projecting a 6.5% increase in healthcare costs for employers in 2023.

- Fauci is stepping down in December in what had to be the most heavily politicized public health position ever.

Miscellaneous Maddenings

- So this tweet circulated this week about how there actually IS sound in space, and the sound is…creepy.

- The wife and I played a 6-hole pitch and putt this weekend (prior to the great flood of 2022). We walk up to hole 3 and Emily takes a swing and the ball rolls down the hill to 3 feet from the pin! While I’m celebrating the shot, Emily grimaces and says “I didn’t hit that very well. Let me try again.” I had to explain to her that in golf you don’t get to be very picky with situations like these and you had to take strokes of good fortune when you get ‘em! Anyway, she birdied and I hit my wedge completely over the green. Golf.

- Give some good thoughts to my buddy Travis. We were supposed to play golf on Saturday but he got appendicitis. He tells me that the good news is he’ll have a lot more space on his side to rotate through impact and should “gain 20 to 30 yards of distance off the tee” so I’ll keep you posted as to whether or not that’s true in the coming weeks. Anyway, he’s fine.

Hospitalogy Top Reads

- Nikhil wrote about investment opportunities and emerging markets in healthcare

- OMERs and Second Opinion rounded up a list of the most active early-stage investors in healthcare

- Next Ventures dove into its investment rationale for Trial Library, a startup focused on improving health equity in clinical trials.

Join 7,500+ smart, thoughtful healthcare folks and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!