Good morning,

Hospitalogy just crossed 7,000 subscribers so you know what that means!!

Absolutely nothing, fam. We stay on that grind to provide you with the best possible healthcare content I can muster.

Just kidding – I appreciate each and every one of you as always. Next stop – 10k.

Join 7,000+ smart, thoughtful healthcare folks and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!

Care Platforms in Q2 – agilon, Privia, and ApolloMed

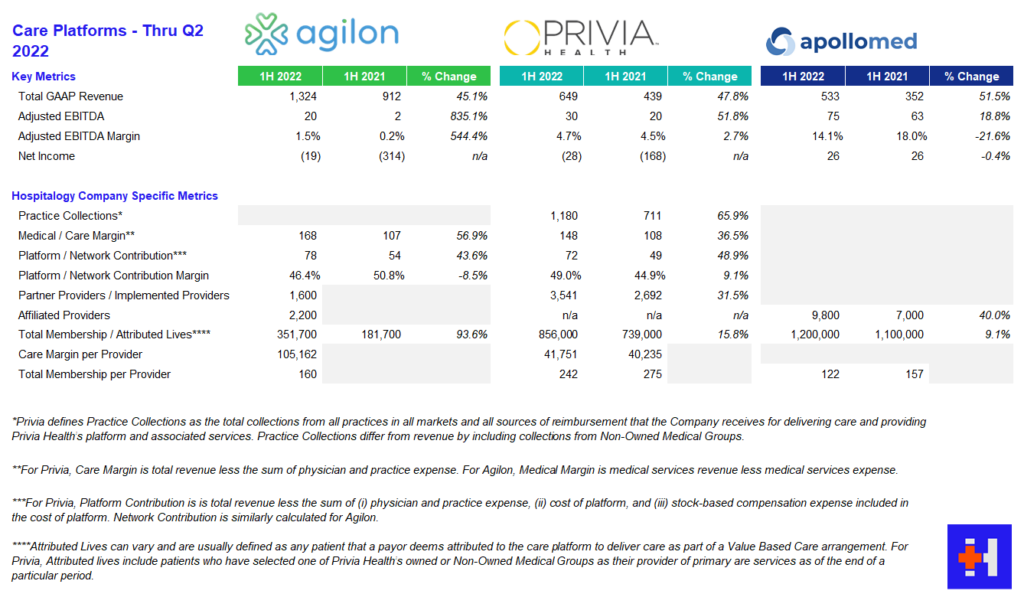

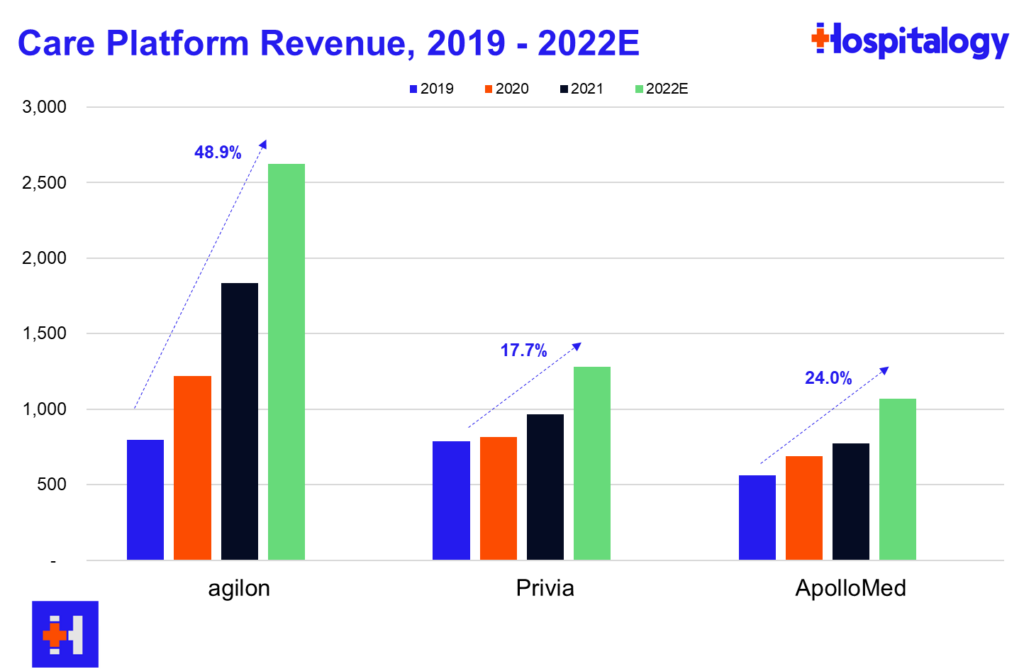

You all know that I love diving into the care platforms, particularly the affiliate based models (agilon, Privia, ApolloMed). Here’s what you need to know about what they have going on thru the first half of the year:

agilon: AGL reported strong growth across membership, revenue, and adjusted EBITDA stemming from better than expected membership numbers in year 1 geographies. To date, agilon operates in 16 markets with 2,200 affiliated providers. As far as same-store markets are concerned, agilon experienced a favorable PMPM boost of $136, a 26% increase year over year from $108. agilon attributes the boost to its care model and its ability to engage with high-risk seniors. On the direct contracting side, AGL management noted strong growth and margin expansion and included that the model is nice for its primary care physicians since they can maintain a single full-risk model across all of their Medicare patients. For 2023, agilon is focused on onboarding for its 7 new physician partners to establish a smooth transition to its platform. Management is also prioritizing payor contracts with health systems. As is similar to Privia and ApolloMed, the pipeline for new physician partners is strong and will continue to be as physicians seek these platforms for independence and their ability to focus on patient care. agilon has already signed a few providers for 2024 onboarding and continues to be a strong value prop for primary care physicians.

Some other interesting tidbits from the AGL call:

- 25% of its membership, or 90k members, are direct contracting members. On average, AGL partner physicians have 400 members across DCE and MA. AGL has generated over $500 million in DCE revenue over the first half of the year, which comprises almost 40% of its revenue if my math checks out.

- When discussing utilization, AGL management noted that acute (hospital) utilization is below 2019 baselines but is getting offset by outpatient volumes, confirming the trends happening in healthcare as the shift to outpatient continues.

- agilon touched on its partnership strategy with health systems (it recently partnered with MaineHealth) including the changing mindset within those organizations that primary care could shift from a subsidy model to an integrated economically sustainable model. AGL noted they’re holding ‘robust’ conversations with potential health system partners, but these conversations take longer since health systems move notoriously slowly.

- Medicare sequestration will have a 2% knock on PMPM reimbursement in the back half of the year.

- AGL noted that its ability to take risk on PPO products gives it a competitive advantage and is a key differentiator.

- “The inflection in demand we are seeing reflects macro drivers, namely payer demands for value and the growing senior population and the level of success that our partners are seeing on the platform.” – Steven Cell, CEO, Agilon

- “We’ve never had groups signed up this early. When we talk about an inflection in demand, when we talk about group’s understanding the value that they have and what they can achieve through a partnership with Agilon, that’s accelerating this. And so the 2 that we’ve signed last year at this point, we had 0 and every year prior to that, we’ve had 0. So these will have 16-, 18-month implementations, which should give us just a tremendous leap forward. And — the rest of the funnel for 2024 looks extremely strong, basically at every step down on that process from qualifying all the way down to signing letters of intent, like we talked about.” – Steven Cell, CEO, Agilon

Privia: PRVA continues to execute on its strategy, notching wins in increased implemented providers on its platform and raising its guidance across revenue and profitability. Privia continues to shine as a care platform, touting strong provider retention and a strong pipeline to enter new markets. Interestingly, Privia management noted a big tailwind in CMS’ plans to prioritize the Medicare Shared Savings Program (MSSP), using the program as the basis for ‘growth and care transformation.’ PRVA saw 31.5% growth in implemented providers and 15.8% growth in total membership.

Other notable tidbits:

- Privia thinks it’s uniquely positioned to continue to capitalize on CMS’ investment into the MSSP program as it operates one of the largest, most successful ACOs in the country.

- Privia continues to see a solid pipeline of providers to add to its platform given its value prop (similarly to other care platforms, it seems to be an easy sell for physicians, at least for now).

- Main drivers of growth for Privia continue to be (1) transitioning physician partners downstream to take on more risk (management noted a lot of TAM left here as the transition is slow) and (2) entering new markets.

- As far as utilization trends, Privia echoed similar sentiment to agilon – outpatient and ambulatory volumes are strong, but inpatient utilization is highly variable and hard to predict. The biggest unknown for PRVA’s model would likely be inpatient utilization in the back half of the year.

- Geographically, Privia operates in 8 states and has “42 more to go” if that gives you an idea of its growth ambitions. Privia is uniquely positioned to benefit from both fee for service arrangements (higher utilization) and risk-based arrangements (MSSP & MA growth, about 30% of total revenue)

- Similarly to agilon, Privia sees major potential and appears to be in talks with health systems about partnerships and enabling risk in those arrangements. On top of health system conversations, Privia has seen initial success and appears to be chugging along just fine in its 3 markets (Texas, Montana, and California, most notably)

- One of the more interesting analyst questions revolved around Privia’s moat (AKA, ability to retain its physician practices) and if there were any existential risk involved from someone coming in and outbidding Privia for its existing partners. Privia management noted that its doctors are ‘vehemently independent,’ it has enough practices not to worry about concentration risk with any single group, physicians at Privia-affiliated practices are making more comp, attrition is at all-time low’s, and it’s not going to worry about M&A buying out its groups or chase anyone coming in with a big checkbook.

- “…over half our additions come from doctors referring colleagues to Privia. And I mean, if you think about it, and somebody asked the question in the last quarter about how does — how the inflation factors, is it kind of different? Will it — what do you think from a driving business perspective? And anytime there’s, I guess, tough things going on in the economy, people are looking for partners and solutions to help, and we believe that. I mean we saw it through COVID, and we believe that’s going to continue to play out in the next few years as we — as the economy kind of gets back on its feet.” – Shawn Morris, CEO, Privia Health

- “The one thing I would say is our criteria, as we’ve been very clear, to take on more risk is always to ensure that at a minimum we’re not economically and from an EBITDA standpoint worse off. And ideally we’re doing it to enhance the level of EBITDA and earnings and shared savings. So that’s a fundamental criteria. We’re not going to do it just to recognize top line practice collections or revenue. We’ll do it when it makes sense and when we think it’s a good financial decision for our physicians as well as the payers in Privia.” – Parth Mehrotra, President & COO, Privia Health

ApolloMed: AMEH saw strong growth in capitated revenues, increasing 57% year over year. ApolloMed management noted higher expenses on both the medical expense side given a return to pre-COVID utilization, something that both HCA and Tenet noted in their earnings calls as well – a return to normal. G&A costs rose as well as ApolloMed continues to invest in geographic expansion and an increase in stock based comp. Management continues to execute and pursue strategies to enable independent physicians throughout its geographic footprint and noted the benefit of its recent acquisition of Orma Health.

- AMEH continues to fly under the radar as its business model chugs along and it actually walks the talk in transforming primary care and risk-based relationships in reaching and caring for underserved communities. It serves 1.2 million members, about half of which in capitated arrangements, and has massive staying power in its core regions stemming from longstanding relationships. The mind-blowing thing to me is that ApolloMed has no analyst coverage despite its fascinating and compelling, economically sustainable business model in an area with fast-growing secular tailwinds.

- “ApolloMed has a long history of operating successfully and profitably in our core regions, and we believe we can replicate our success in other local communities across the country by partnering with like-minded physicians. We remain incredibly excited and energized in our mission to enable providers to excel in value-based care and deliver higher quality outcomes to their communities.” Brandon Sim, CEO, ApolloMed

Note that I would include P3 Health Partners here, but it looks like they’ve decided not to report earnings so far in 2022 (It’s August btw). Hmm.

Resources:

BCBSA Settles Antitrust Lawsuit for $2.7B

A decade long legal battle accusing the Blue Cross Blue Shield Association of anticompetitive behavior (paywall – WSJ) (non-paywall – Beckers) has come to a close. BCBS settled the lawsuit for $2.67 billion. The lawsuit had alleged that BCBS acts like a cartel and purposefully retains geographic exclusivity (AKA, prevents competition among members) to collude on pricing to the detriment of providers.

BCBS, of course, denied the allegations. The final settlement requires some concessions to existing BCBS rules and would let employers choose another Blue plan to compete against its current Blue insurance bid, but ultimately geographic exclusivity stays the same. Sick. Employers like Home Depot complained about the settlement, saying it doesn’t do enough to spark competition. Elevance’s portion of the settlement totals $594 million since it operates Blues plans in 14 states.

Also, have I mentioned that lawyers stay winning in healthcare? As part of the settlement, they’ll get $627 million and another $41 million to boot in covering 10 years of legal fees. Can you imagine? Nuts.

Tik Tok’s Takeover?

“I’ll take news I didn’t expect to hear for $200, Alex” (RIP legend).

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

What is…Tik Tok buys a health system? ByteDance, the owner and operator of Tik Tok and valued privately around $300 billion, just bought AmCare Healthcare (paywall – Bloomberg), a Chinese health system that specializes in women and children’s hospitals. According to Bloomberg, ByteDance bought Amcare’s footprint for $1.5 billion in Freedom dollars.

It’s a pretty wild step for a social media company. Prior to the announcement, ByteDance’s only real foray into healthcare (that I’m aware of) was some sort of scheduling app for clinics and hospitals. So jumping right in to facilities seems…odd…and…forced.

I’m not too well versed on health data practices but I would prefer for ByteDance NOT to own mine. It also doesn’t seem likely that ByteDance would independently pursue M&A in a low margin, highly capital intensive, low IRR business like healthcare facilities.

Side note – can you imagine the outrage if Meta tried to buy a health system?

Market Movers

Amazon Care is prepping a partnership with mental health firm Headspace Health as Amazon continues to build out its healthcare footprint. Keep in mind that Ginger merged with Headspace in a deal valued privately at $3B to create the new mental health conglomerate now known as Headspace Health with both direct to consumer and B2B segments.

- In adding Headspace to its roster, it looks like Amazon is continuing to build out a suite of hybrid care products to sell to employers. Amazon is definitely the most active of the Big Tech players when it comes to healthcare and it seems as if they’re not done here – talk on the street is that Amazon is looking to acquire a third-party administrator.

Speaking of Amazon, according to Bloomberg, CVS tried to buy One Medical (paywall – Bloomberg) before Amazon and had an offer at $18 per share. CVS wasn’t comfortable with the pacing of the deal and seemed to drop out for that reason. I’ll be diving deeper into the nuts and bolts of the deal which has some fascinating valuation and deal aspects. You can get ahead if you want by reading the filing here.

According to reports, primary care platform ChenMed is exploring a possible sale of its joint venture with Humana, JenCare. The JV operates in 5 states and cares for about 50,000 patients. ChenMed is seeking around $4 billion for its JenCare spinoff, or about 3x its revenue. Humana currently owns 35% of the joint venture. Now I have to speculate…Might ChenMed be spinning off its JV ops with Humana to ultimately sell to CVS? The M&A crystal ball game is fun.

HCA partnered with Johnson & Johnson on initiatives to improve patient outcomes and health equity.

Outset Medical was awarded a contract with the VA to sell its Tablo Hemodialysis System (medical device for dialysis treatment) into the VA’s 106 hospitals. Quite the comeback after the FDA had paused shipments for OM earlier this year. 35,000 vets are on dialysis.

Deerfield Management, an activist group with lots of healthcare plays, invested $110 million into the Oncology Group, a value-based care practice focused on…oncology. The Oncology Group also reported Q2 earnings.

Tenet and Steward Health Care, two large for-profit health systems, are in litigation after Tenet sold 5 hospitals to Steward for $1.1B and apparently ended its IT & data services to those hospitals, something Steward isn’t OK with.

Humana acquired Inclusa, a Medicaid managed care organization focused on long-term care services in Wisconsin. The managed care behemoth also completed its sale of Kindred’s hospice segment to CD&R.

Intermountain CEO Marc Harrison is departing his role as CEO to work in venture capital in conjunction with General Catalyst. Keep in mind that General Catalyst just raised (paywall – Forbes) a $670 million fund and had a pre-existing partnership with Intermountain announced in May. As someone who thinks that Intermountain was doing things the right way as a health system, this will be interesting to watch.

According to reports, VBC player Babylon is considering a take-private transaction (paywall – Seeking Alpha). After some trading volatility, Babylon refuted the claims so I guess they’ll just continue to bleed cash to the dismay of shareholders. Kidding aside, Babylon is down 90+% since SPACing last year. Babylon also released its Q2 earnings

Rite Aid partnered with WellSpan Health in Central Pennsylvania to share data and insights and improve care coordination across a broader continuum of services.

Physician compensation saw increases across all specialties in 2022 for the first time in 11 years as things rebound from ‘Rona.

Just a day or two after Oscar management noted a strategic movement away from its +Oscar platform, Cigna and Oscar announced an expansion of the Cigna and +Oscar small business health insurance package to firms across the Philadelphia metro area starting in 2023.

Average nationwide travel nursing weekly pay increased 12% year over year in July, from $2,681 to $2,997 according to Beckers and Vivian Health.

Q2 Earnings Roundups continue!

- Oak Street Health Q2 earnings

- One Medical Q2 earnings (will be going deeper here on Thursday)

- CareMax Q2 earnings (crushed it)

- Cano Health Q2 earnings (looks like some trouble here as Cano may need to raise some capital in coming months)

- LifeStance Health Q2 earnings (I could see this being a takeover target)

- Bright Health Q2 earnings (it’s not looking good and seems as if Bright will need to ask for another lifeline from Cigna)

- Oscar Health Q2 earnings

- RadNet Q2 earnings

- Aveanna Healthcare Q2 earnings

- Cue Health Q2 earnings

- UpHealth Q2 earnings

- Sema4 Q2 earnings

- Pear Therapeutics Q2 earnings

- GoHealth Q2 earnings

- 23andMe Q2 earnings

- SmileDirectClub Q2 earnings

Miscellaneous Maddenings

- Will Zalatoris finally got his first win on the PGA tour in the FedEx playoffs and he had to earn every bit of it. Talk about a wild ride in the 3-hole playoff!

- So the wife and I were working on a small project this weekend – painting a tiny hallway in our house between the kitchen and laundry room near the back of the house. As we’re painting the ceiling white, I took a step backward and heard a ‘thud.’ It was the paint can. White paint was leaking all over the paint cloth, and it was our only can of paint for the project. By the time I’d picked the can back up, a third of the paint was on the cloth. So I did what any sensible man would do. I got on my hands and knees and started hand-scooping the paint back into the can. Maybe not the most efficient method, but hey, you gotta do what you gotta do. Emily just looked at me with a sense of bewilderment. Can’t blame her. Anyway, we had enough paint to finish the job so I chalk it up as a win.

- As it turns out my prediction was wrong – Texas is NOT ranked in the AP top 25 which likely means that we’re going to have a much better season than predicted eh?!?!!? Eh!!???

Hospitalogy Top Reads

- Oliver Wyman provided a solid overview of private market investment and deal-making in healthcare. General consensus seems to be that the number of deals are down, but total invested capital is elevated from 2021.

- Woodside Capital Partners is BACK with its incredible resource looking into the digital health and tech enabled services market comps as of Q2. Check it out here.

- This from STAT was a good look at ABA therapy, its vast variation, and the lack of oversight in the industry. With a wife in speech therapy, it hits close to home hearing her talk about ABA horror stories.

Join 7,000+ smart, thoughtful healthcare folks and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!