28 July 2022 | FinTech

An Apple Bank Account?

By Alex Johnson

Benedict Evans asked:

Simon Taylor suggested:

And so, I shall oblige (recognizing that I’m far from the first person to write about this and fully planning to build on many of these smart people’s thoughts).

And in typical Fintech Takes’ fashion, I shall answer this question with a bunch more questions.

What financial products and services does Apple offer today?

We should start here, because Apple already offers a myriad of financial products and services that will likely be the building blocks for any future offerings.

Here are the main ones:

Apple Wallet – an app that stores credit and debit cards, loyalty and reward cards, drivers’ licenses and state IDs, employee and student IDs, event tickets, transit passes and plane tickets, and keys.

Apple Pay – a digital payments service that facilitates contactless in-person payments and one-click digital payments (online and in-app) as well as other transactions involving credentials stored in the Apple Wallet.

Apple Card – a credit card with cashback rewards that incentivize Apple purchases and contactless purchases, family-sharing features, and a financial health-focused UX.

Apple Cash – a checking account and digital debit card, which facilitates in-person and digital payments, P2P payments, disbursement of Apple Card cashback rewards, and banking for kids.

Apple Pay Later (new) – a merchant-agnostic pay-in-4 BNPL service (comparable to Klarna), with no fees or interest, available for qualified customers using Apple Pay to make purchases online or in apps.

Apple Pay Monthly Installments (new) – a point-of-sale lending service (comparable to Affirm), with interest rates determined by the merchant and the customer’s risk profile. Currently offered for Apple products only, as an alternative payment option for Apple Card customers.

Apple Tap-to-Pay on iPhone (new) – A contactless payment acceptance capability, requiring only an iPhone (no additional hardware), compatible with any contactless debit or credit card, iPhone, Apple Watch, or other smartphone with NFC contactless payment functionality.

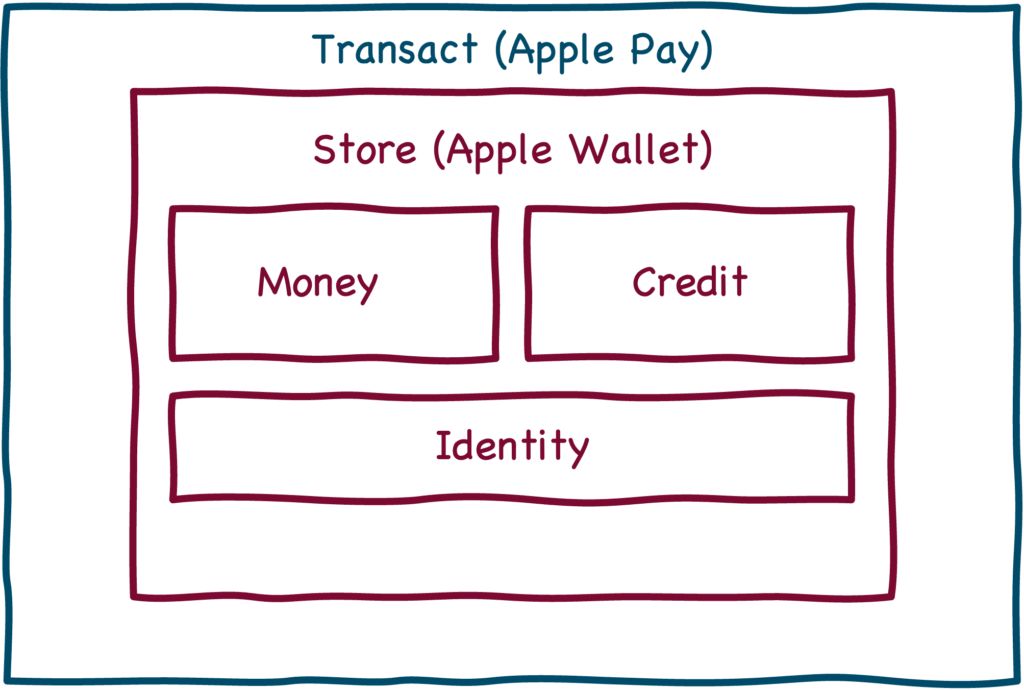

If we boil that down a bit, the essential design of Apple’s financial services offerings can be thought of as a container (Apple Wallet) that stores money (Apple Cash), credit (Apple Card, Apple Pay Later, Apple Pay Monthly Installments), and identity (government-issued IDs and other credentials) and wraps them with a transaction layer (Apple Pay) that can securely interact with a variety of other Apple components and third-party systems.

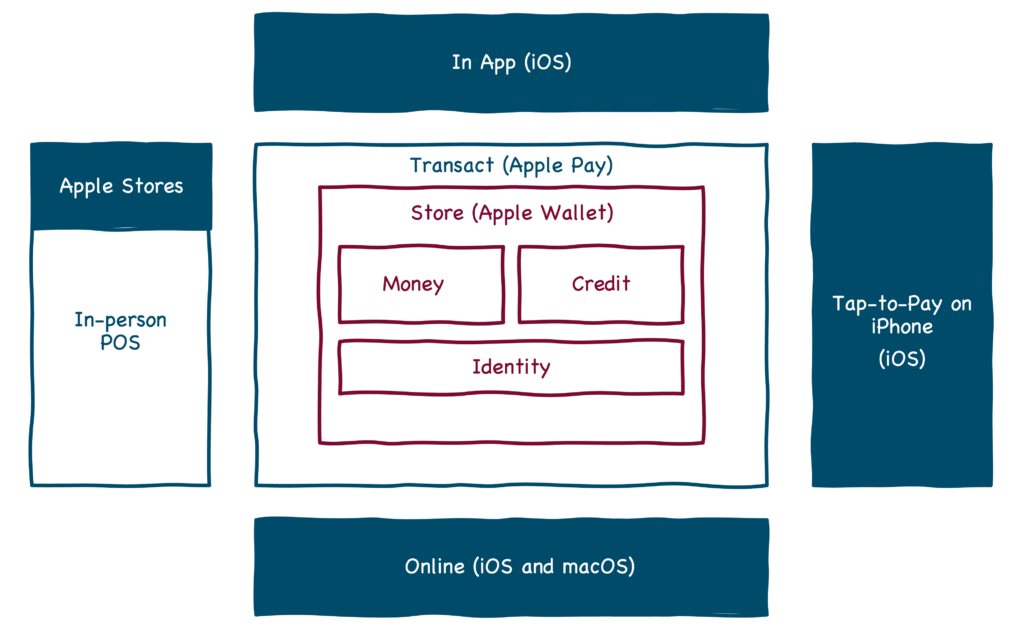

The transaction layer – Apple Pay – primarily interacts with other systems and components via near-field communication (NFC) and QR codes and barcodes (depending on the level of security required), although we can also consider the physical Apple credit card (made from titanium!) to be a part of this layer as well, facilitating transactions via an embedded chip and magnetic stripe when contactless payment acceptance isn’t available.

Apple Pay predominately runs on top of external networks like Visa and Mastercard, although it theoretically has the capability of conducting closed-loop transactions when the software on the other side of the transaction is also provided by Apple.

Provisioning of credentials (money, credit, identity) within the Apple Wallet is accomplished through integrations that Apple builds with external partners (banks, government agencies, etc.), wherein Apple takes responsibility for the user experience and the partner manages the back-end risk and compliance. In cases where Apple is providing the credential directly (Apple Card, for example) the sign up and provisioning process can be greatly streamlined for the end user.

Finally, it is important to note that all the components in Apple’s financial services ‘stack’ are composable, which is to say that they can be combined in a variety of different ways by Apple’s software developers. Take, for example, the Apple Card’s use of the Apple Cash account for the disbursing of customers’ daily cashback rewards. This composability can be made available to third-party iOS developers as well – picture a neobank leveraging the government-issued IDs in Apple Wallet for KYC – however, Apple doesn’t exactly have a great track record when it comes to empowering iOS developers, so it’s not clear to me how many of these financial services capabilities will ultimately be made available.

So, how might Apple build out its portfolio of financial products and services? What would it need to add in order to offer an ‘Apple bank account’ that is comparable to those offered by leading banks and neobanks today?

To answer these questions, it’s important to first point out that Apple has some competitive advantages.

What competitive advantages does Apple have in financial services?

Apple is obviously great at designing and building products that are a joy to use (typically more so on the hardware side than the software side, although I must say that the software that it wrapped around the Apple Card is as good as any I’ve seen in fintech). It has ample cash on hand to invest in new products and services. And it has an enormous base of existing customers and developers.

Its most important and unique advantage, however, is the control that it has over the integration of its financial products and services.

Consumers choose BNPL, in large part, because it’s easy. It’s embedded right in the checkout page. The reason that BNPL providers like Affirm and Klarna have spent the last decade frantically building as many merchant integrations as they can is because they understand this – merchant integrations, once you have them, are a huge competitive moat. It’s the reason why banks will never be able to beat the BNPL providers at their own game. They don’t have the merchant partnerships and they’re not well equipped to catch up.

Apple doesn’t have to worry about that. It doesn’t need to integrate into each individual checkout page because it already controls the operating systems through which many of those checkout pages are accessed. It can preempt every other payment option with its own options (Apple Pay, Apple Card, Apple Pay Later) whenever it wants.

This integration advantage extends everywhere you look – in mobile apps (obviously), online (through both iOS and macOS), and in the company’s new Tap-to-Pay on iPhone capability.

The only vector in which this advantage is muted is in-person point-of-sale systems, where Apple Pay is forced to compete on a somewhat level playing field with all other contactless payment options that a consumer might consider using while checking out in a store.

Unless, of course, that store is an Apple Store.

Apple Stores – of which there are more than 500 globally and more than 250 in the U.S. – have not yet been leveraged by the company as a part of its financial services strategy, but there’s no reason that they couldn’t be, and they would provide it with an important competitive advantage over almost all fintech companies and neobanks.

What financial products and services could Apple offer tomorrow?

What could Apple do with these competitive advantages and with the financial services ‘building blocks’ that it already has assembled?

I’ll try to confine my ideas to ones that fit within the general scope of what Apple does today – providing hardware and software ‘hubs’ that consumers interact with multiple times per day. This will exclude interesting, but highly unlikely possibilities like an Apple Mortgage or an Apple business bank account.

[deep breath] OK, here we go …

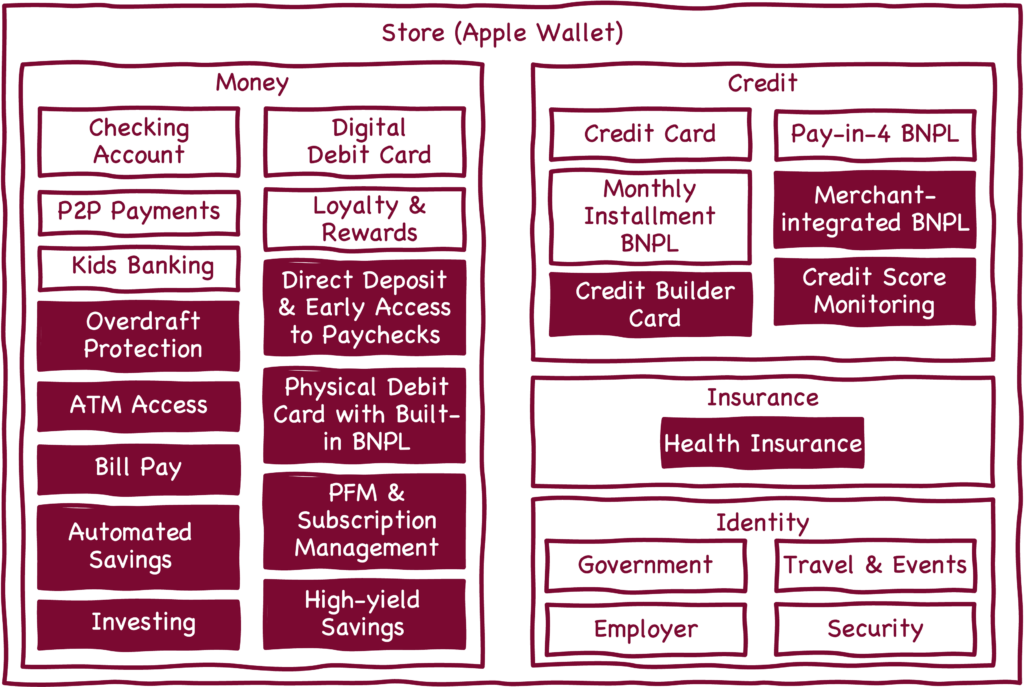

- A more robust checking account than what Apple Cash currently provides, featuring the ability for direct deposits and two-day early access to paychecks.

- An improved debit card, featuring a physical card (Apple Cash is digital-only right now) with embedded BNPL functionality, allowing customers to spread the costs of larger purchases out with no interest or fees (similar to what Klarna and Affirm are working on).

- Access to ATMs, which could be accomplished by refunding all ATM fees and/or putting ATMs in Apple Stores (am I the only one who wants to see what an Apple-designed ATM would look like?)

- Small-dollar paycheck advance or overdraft protection, likely fee free (Apple could afford it) and contingent on having the customer’s direct deposit.

- Personal financial management functionality built into the Wallet app (spend categorization, budgeting, goal setting, etc.) Subscription management would be a particularly valuable service given the number of subscriptions Apple already handles for consumers and the fact the current subscription management experience in iOS is clunky and unintuitive.

- Bill pay that is integrated through the app store, allowing (or requiring?) any biller that has an iOS app to enable third-party bill payment through Apple.

- A high-yield savings account (these are going to start getting popular again in the rising rate environment) with automated savings functionality (transfers, roundups, etc.) to help customers set aside more money.

- Investment capabilities, likely skewed more towards the Wealthfront/Betterment end of the spectrum rather than the Robinhood/Public end.

- A credit builder card (similar to Chime and Varo) that dynamically sets aside an ‘escrow’ amount in your checking account as you spend, making repayment at the end of the month easy and highly likely.

- Credit score monitoring and financial product rating/shopping. Apple does a tiny bit of this today (if you are declined for an Apple Card), but it could do a lot more, all the way up to a full-blown Credit Karma replacement (with integrated third-party products from non-competitive categories that aren’t pay-to-play).

- Merchant-integrated BNPL, allowing app developers to pass discounts and incentives through financing to the end customer.

- Health insurance, with discounted rates for Apple Watch and Apple Fitness+ users.

OK! I think we captured the scope of what Apple could realistically do.

In order to narrow in on what Apple will do, it’s necessary to look at what consumers want when it comes to Apple offering financial products and services.

Would consumers be interested in more financial services from Apple?

There are two ways we can look at this.

First, let’s look at how Apple’s current tentpole financial products – Apple Pay and Apple Card – are performing.

According to consumer survey research conducted by Ron Shevlin at Cornerstone Advisors, it’s not going great.

Apple Card has stalled out:

After seeing a doubling of Apple Card holders in 2020, growth in 2021 slowed to a crawl. Cornerstone found that the number of consumers with an Apple Card grew from 6.4 million at the beginning of 2021 to just 6.7 million at the start of 2022.

And Apple Pay is struggling to gain a foothold in P2P payments:

According to a Q1 2022 study from Cornerstone Advisors, roughly half (52%) of consumers with a smartphone and a checking account make mobile person-to-person (P2P) payments. Three-quarters of those consumers use PayPal, 43% use Cash App, and just 26% use Apple Pay.

And is having even less success breaking into in-store retail commerce (according to PYMNTS):

Seven years after the launch of Apple Pay, PYMNTS analysis shows that 94 percent of U.S. consumers who could use Apple Pay to check out in the physical store still don’t, and that statistic has held steady since its launch. According to our analysis, Apple Pay accounts for roughly 2% of overall retail sales in the U.S., even though there are more people than ever with iPhones capable of using Apple Pay and more stores than ever that accept it.

The second way we can attack this question is to look at how interested consumers would be in acquiring new financial products from Apple, if Apple were to offer them.

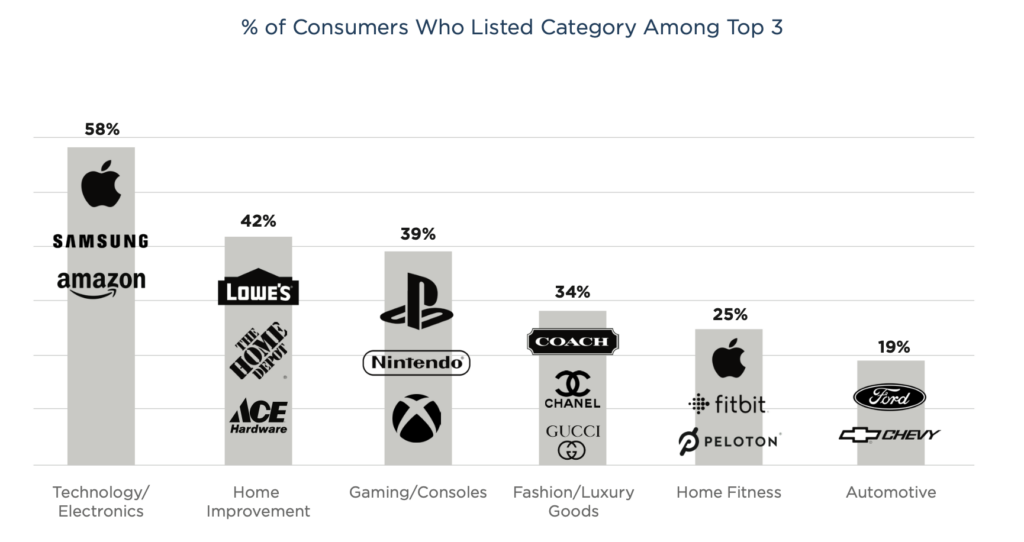

Again, we will turn to Ron and Cornerstone Advisors for help. In a recent research report on embedded finance, Cornerstone surveyed consumers about their use of and interest in embedded financial products and services from their favorite non-finance brands. In the survey, Cornerstone asked consumers to identify their favorite categories of products. Technology was the category that consumers reported liking the most, across generations, with Apple enjoying the strongest brand affinity:

Operating on the assumption that non-finance companies that consumers like and interact with frequently will be in the best position to offer financial products, Cornerstone asked consumers who are engaged with the various product categories about their interest in acquiring financial products from the companies in those categories, if they were offered.

Specifically, in the technology category, Cornerstone asked consumers about the following two products:

- A checking account that allowed you to deposit money, cash checks, withdraw money from ATMs, and earn rewards.

- A savings account that automatically sets aside small amounts of money for you to help save for large purchases.

62% of technology fans said that they would be interested in such a checking account if it was offered by a technology company that they liked. For the savings account, 59% said they would be interested.

(Side note – as it relates to the Apple health insurance idea I tossed out before, this Cornerstone survey found that 68% of home fitness enthusiasts would be interested in “health insurance with rates based on your personal fitness habits, directly within their mobile app”. Apple was the most popular company in the home fitness brand category. Do with this information what you will.)

Taking all of this into consideration, there are a couple of conclusions I would draw:

- Consumers are open to using financial products and services from Apple. Apple hasn’t been super successful with Apple Pay and Apple Card, but honestly, I don’t read too much into that data. P2P payments is a very competitive category, as is credit cards. And in-store mobile payments just hasn’t taken off in the U.S. yet. That’s not a failure you can hang on Apple. What these products have demonstrated is that Apple customers are open to the idea of using Apple financial services.

- An Apple bank account has potential. Apple Cash isn’t a full-fledged deposit product, but according to the Cornerstone survey Apple customers would be interested in a more robust deposit product offering.

- Apple, like every non-finance brand, faces some challenges. Consumers have a lot of options today. And not all of them trust big tech companies. According to the Cornerstone survey, among consumers that said they wouldn’t be interested in a financial product from a non-finance company that they like, 77% said they wouldn’t trust getting a financial product from the company and 71% said they prefer to shop around and compare different financial products before they buy one.

And this brings us back to the first part of Mr. Evans’ question.

What would an Apple bank account look like?

Assuming Apple chooses to build a more fully-featured bank account on top of its existing Apple Cash product, it would likely utilize a combined checking & high-yield savings structure, with automated savings capabilities that can intelligently shuttle money back and forth. It would have a physical debit card (odds are it would be the best designed, most premium feeling debit card on the market) with virtual one-time and subscription token capabilities and built-in BNPL financing for larger purchases. It would allow for direct deposit, and it would provide two-day early access to customers’ paychecks. It would refund 100% of out-of-network ATM fees and it would have a limited amount of PFM functionality (modeled after the Apple Card UI). I do not think that it would feature any overdraft protection or paycheck advance services (that’s not Apple’s target market) and I doubt that it would include any investing capabilities (feels like a bridge too far for Apple right now).

Now, let’s tackle the second part of Mr. Evans’ question – how might the rails work?

To understand how Apple might approach building new financial services products, we first need to understand what Apple’s strategic goal is.

Why is Apple offering financial services?

The old answer to this question, pre-2020, was simple – Apple wants to offer financial services to its customers in order to make the overall value of owning Apple hardware and transacting in the iOS ecosystem incrementally more valuable.

Put simply, even a tiny improvement in customer retention is worth investing in if retaining those customers leads to more sales of $1,000 hardware at a 45% gross margin.

And this retention-focused strategy informed how Apple built out its financial products and services.

If you don’t care about making money in financial services, then you partner with the biggest and most well-resourced financial services companies and vendors to enable your product vision. You prioritize speed to market and keeping your expenses low and you punt on negotiating the most favorable revenue splits possible. You do not build anything in house or make any acquisitions. And you take on the absolute minimum credit, compliance, and reputational risk.

This is why Apple partnered with Visa and Mastercard (for Apple Pay and Apple Card), Goldman Sachs (for Apple Card), and Green Dot (for Apple Cash), among many others, to bring its existing financial products and services set to life.

Then, in June, it was reported that Apple was not going to be partnering with Goldman Sachs to originate its new pay-in-4 BNPL offering but would instead be creating a new subsidiary – Apple Financing LLC – to originate and fund the loans directly, thereby keeping the vast majority of the profits for itself.

I cannot stress enough how surprising this was. Even coming on the heels of reports that Apple was planning to bring more financial services functions in-house (I wrote about that here), I never thought that it would cut Goldman Sachs out and go acquire the necessary state lending licenses to originate its BNPL loans directly.

This would be like if you made a smoothie in a blender, poured the smoothie into a cup, and then reached back into the blender with your hand to try and scoop out a bit more at the very bottom … with the blades still attached and the blender still plugged in.

You’re making a mess and risking your fingertips in exchange for, you know, not that much more smoothie.

If Apple’s goal in offering financial services was still primarily retention, it would never do this. It also probably wouldn’t spend $100 million on a Canadian mobile payments company or $150 million on a UK open banking company.

Apple’s primary strategic goal for financial services is no longer retention.

Apple’s new goal is to make as much money as it can from financial services, and that goal has and will continue to influence the decisions that it makes for how it builds its financial products.

How will Apple build out its suite of financial services?

So, moving forward in financial services, how might the rails work?

Well, I think it’s safe to assume that Goldman Sachs is in some trouble. Apple clearly believes that it can originate and service loans without Goldman, as demonstrated by its decision to do Apple Pay Later on its own (it still works with Goldman for a small piece of Apple Pay Later, but that piece is negligible). Apple might not replace Goldman on the Apple Card anytime soon (I have no idea what that contract looks like), but it wouldn’t surprise me if that happens at some point down the road.

Visa and Mastercard are trickier. Given the control it has over both sides of most of the transactions happening through iOS, Apple could convert a lot of Apple Pay transactions to “on us”, meaning that they would stay within Apple’s walls and wouldn’t incur any network fees. However, the ubiquity of Apple Pay (in terms of both supporting all of their customers’ cards and being accepted everywhere) is a significant value. I’m not convinced that Apple is willing to walk away from the special deal that it negotiated with Visa and Mastercard when Apple Pay was originally set up (which was contingent on Apple agreeing to not create its own proprietary payments network). I’d bet against Apple shaking things up too much, although I’m sure it’ll continue to push on the card networks in ways that make the banks grumble.

Green Dot is the one I’m most intrigued by. Green Dot is the current bank partner for Apple Cash. If Apple decides to expand on its bank account product, it could choose to go in several different directions. It could expand its partnership with Green Dot. It could buy a bank or apply for a de novo bank charter, thereby allowing it to directly hold customer funds and realize 100% of the upside. Or it could partner with a smaller, less sophisticated bank, which would require Apple to do more of the heavy lifting on the infrastructure side but would give it greater leverage to negotiate a superior revenue split.

My bet is that Apple (eventually) goes with door number three – partnering with a smaller bank and capturing more of the financial upside. Doing the heavy lifting on the infrastructure side (essentially playing the role of a BaaS platform) wouldn’t be a problem given all of the infrastructure investments Apple is making as a part of project Breakout and partnering with a smaller bank wouldn’t foreclose the option of acquiring that bank (and its charter) at some point down the road.

I don’t think Apple would be quite daring enough to go for the bank charter immediately. Large public companies haven’t had a ton of luck acquiring charters historically (ask Walmart) and the Director of the CFPB is a particularly fierce critic of big tech. Indeed, Apple is already in the CFPB’s crosshairs over its entry into BNPL, as the Financial Times just reported:

The top US consumer finance regulator has warned that Big Tech’s entry into the buy now, pay later lending business risks undermining competition in the nascent sector and raises questions about the use of customer data. Among the issues the agency would consider was “whether it may actually reduce competition and innovation in the market”, Chopra said in an interview.

But then again, I might be wrong! Lately, it feels like every time I size up Apple’s financial services ambitions, I end up underestimating it.