Today’s essay dives deep into the Amazon-One Medical acquisition. I have a lot of thoughts, analysis, fun predictions, and open ended questions for you guys to explore!

Healthcare is insane, isn’t it?

Join 5,700+ smart, thoughtful healthcare folks and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!

Amazon and One Medical: Key Takeaways and Thesis

Although the acquisition of One Medical is the largest, splashiest entrance into tech-enabled healthcare services companies by Big Tech, it’s a drop in the bucket compared to the larger primary care market. Anyone who thinks that Big Tech is anywhere close to disrupting healthcare is out of their mind.

Amazon has yet to define a clear strategy in healthcare and instead has a number of discombobulated (I just really wanted to use that word) assets that haven’t made any sort of real impact.

Buying One Medical, the O.G. tech enabled primary care platform, is an attempt to capitalize on the growing consumerization trend in healthcare. One Medical has always targeted higher income clientele and you can see this strategy based on where One Medical facilities choose to locate.

With the transaction, Amazon gets access to 8,000 clinicians, a 180+ clinic footprint, custom-built EMR, 8,500 employer relationships, 16+ health system partnerships, and a tap into the growing senior market with Iora Health.

Amazon will find a way to pivot healthcare – a traditional cost center – into a cash-flowing profit center by leveraging One Medical, existing Amazon Care assets, and future healthcare related acquisitions.

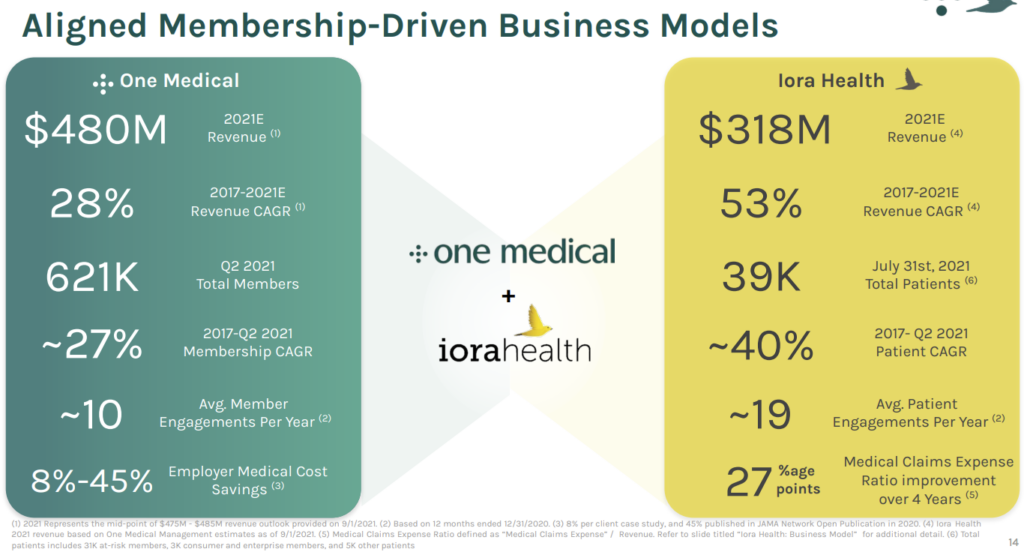

Iora, One Medical’s value-based care segment focused on the Medicare Advantage and Direct Contracting beneficiaries, is a wedge into the fast growing senior care market as Boomers age into Medicare and Medicare Advantage. Questions remain as to whether or not Amazon wants to fully dive into Iora’s segment.

Finally, the transaction has huge implications for investment into primary care. Big tech involvement creates another exit option and the One Medical transaction provides immediate credibility and a fantastic comp (~3.6x forward revenue) for tech-enabled clinical assets as the macro environment sours.

Transaction Deal Terms

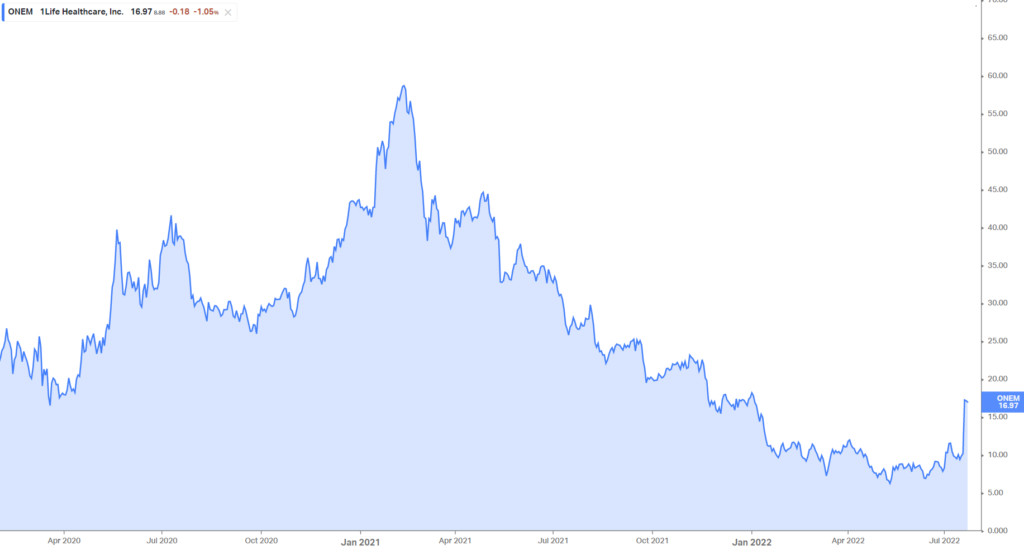

Announced on July 21, 2022, Amazon is acquiring One Medical, a tech-enabled primary care platform, for $18 / share. The all-cash offer amounted to a 77% premium to the previous day’s closing price of just over $10.

Year to date, the transaction price amounts to just a 2.4% premium. Yeesh.

Founded in San Francisco in 2007, One Medical originally began as a cash-pay subscription model. Each member paid an annual subscription fee to access primary care services. One Medical found early success by targeting higher-end clientele, even at one point being labeled the ‘Starbucks’ of primary care and selling its services to large employers like Google (who now apparently comprises 10% of One Medical’s total revenue).

Tom Lee, One Medical’s founder, wanted to completely transform the healthcare delivery experience for patients. One Medical did so by offering a differentiated primary care product that now includes 24/7 access to virtual care services (One Medical Now), chronic care management (One Medical Healthy Heart & others), timely access to in-office primary care and specialty care coordination, behavioral healthcare (One Medical Healthy Mind), and even at-home care (One Medical At-Home).

The model was successful enough to draw venture funding from major sourced like the Carlyle Group and Alphabet. One Medical reached a $1.5 billion valuation and had raised $400 million.

In January 2020, One Medical closed a successful IPO, raising another $245 million at a $1.7 billion valuation.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

One Medical peaked during Covid, right around when other ‘Rona trades (like Teladoc) ran out of steam in Q1 2021. As One Medical’s original growth engine stalled, the firm looked to acquisitions to find its next avenue and acquired Iora Health, a value-based care player, in September 2021.

From Q1 2021 to today, we saw a steady decline of most digital health assets (even the good ones). One Medical hit an intraday all-time low of $5.94 in April 2022 and was subsequently bought out for $18/share in July.

I imagine the talks with bankers began close to that point in April.

What Amazon is getting in One Medical

As far as tech-enables primary care goes, One Medical operates one of the best platforms for digital health and patient experience out there and is one of the OG pioneers when it comes to digital health.

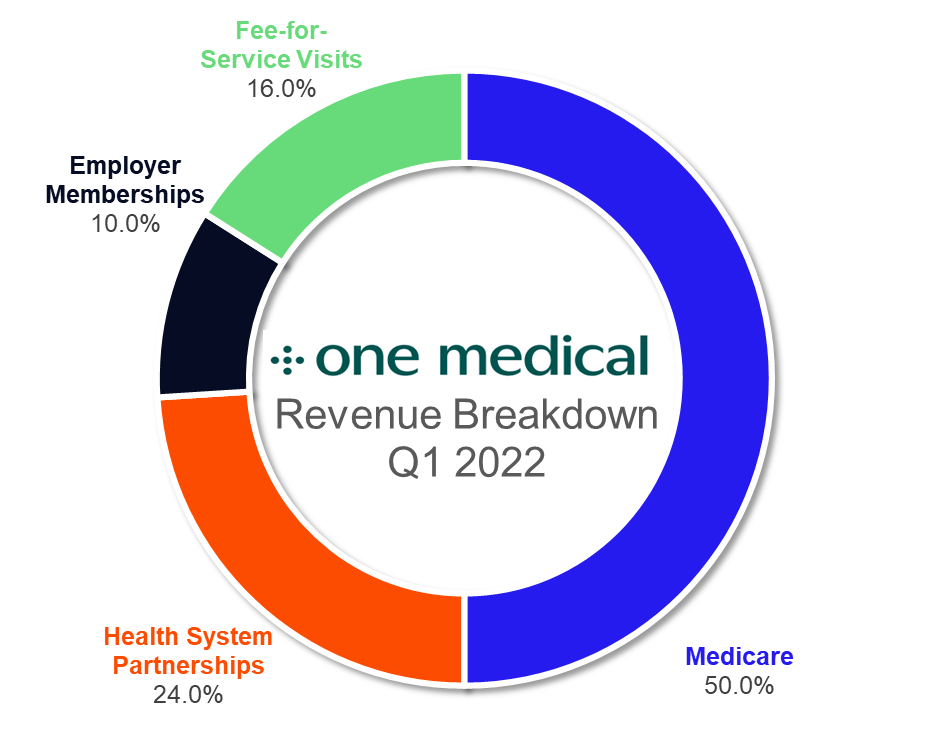

Since its early days as a subscription based model, One Medical has evolved to encompass not only its business with enterprise customers and consumers but also its fee-for-service partnerships with health systems and most recently, its Medicare book of business with Iora.

In fact, One Medical has pretty diverse revenue streams as far as primary care platforms are concerned:

One Medical generates its revenue through three primary segments:

Health System Partnerships & Fee-for-Service: One Medical holds at least 16 partnerships with some of the best run health system players including the following:

- Emory Healthcare Network – Atlanta

- Ascension Seton – Austin

- Mass General Brigham – Boston

- Advocate Aurora (and now Atrium) Health Care – Chicago and likely Milwaukee next

- HartFord HealthCare – Hartford, Connecticut

- The Ohio State University & Wexner Medical Center – Columbus

- MedStar Health – Washington DC

- Baylor Scott & White – Dallas Fort Worth (Dallas!!!)

- Houston Methodist – Houston

- Providence – Los Angeles, Orange County, Portland,

- Mount Sinai – New York

- Dignity Health (AKA, CommonSpirit) – Phoenix

- Duke Health – Raleigh

- UC San Diego Health Physician Network (a clinically integrated network) – San Diego

- Swedish Health – Seattle

- UCSF Health – San Francisco

The firm clinically and digitally integrates with these players and benefits from higher fee for service rates for services rendered while the health system benefits from the primary care integration and downstream referrals to specialists and other care provision. In most health system and certain health network or employer relationships, One Medical charges fee-for-service rates based on contractual arrangements.

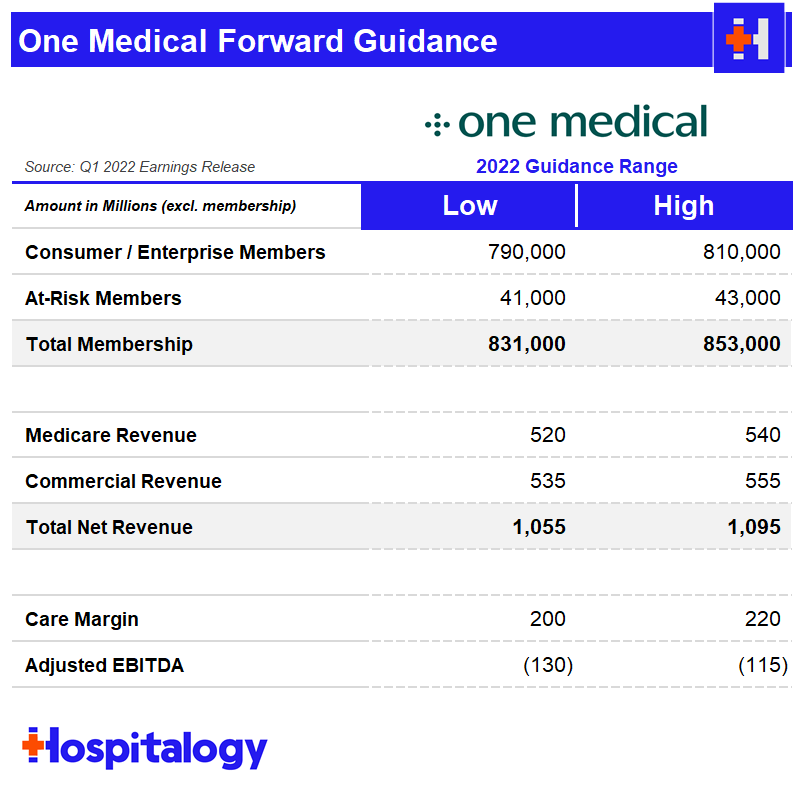

Enterprise and Consumer Revenue: Its original bread and butter, One Medical receives membership revenue from consumers and depending on the employer/enterprise contract, either a per-member-per-month fee from employers or annual membership fees charged to enterprise clients. One Medical’s book of business is over 8,500 enterprise customers and the firm guided to total membership of around 800,000 members by year-end.

Medicare Revenue: This is mostly Iora-generated revenue through capitated Medicare Advantage and Direct Contracting – AKA, all risk-based contracting targeting senior populations. One Medical also generates a small portion of fee-for-service Medicare revenue. For 2022, One Medical expected Iora to generate $530 million in Medicare revenue on a membership base of 42,000 beneficiaries between MA and DCE.

Financially speaking, Amazon is getting a clinical asset expected to generate just under $1.1 billion in revenue. After the Iora acquisition, One Medical isn’t currently profitable and really hasn’t been…ever:

Financials aside, One Medical is one of the best when it comes to outcomes data and consumer experience, two key factors that I’m sure played a role in Amazon’s due diligence.

The firm retains 9 out of every 10 consumer members, 90% of its enterprise contract values, and 8 out of 10 at-risk members. The membership growth numbers speak for themselves, growing over 300% during a five year period from December 2016 to December 2021. People like getting care at One Medical.

On the employers and payor side of things, according to investor decks and case studies, the One Medical model saves 8% per client on average on healthcare costs despite more patient touch points, and reduces ER costs by 33%.

In addition to the One Medical experience, existing partnerships and agreements with employers, One Medical has some other assets that piqued Amazon’s interest:

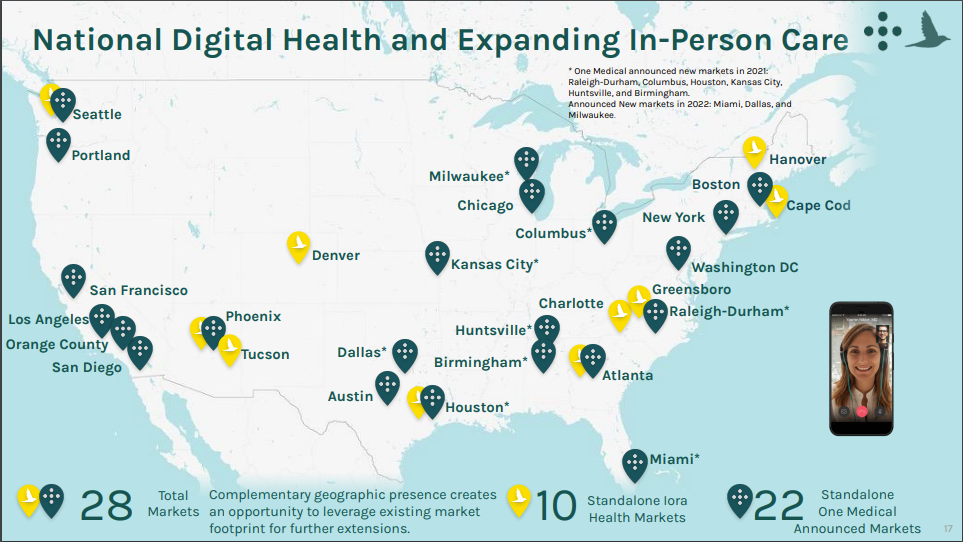

Geographic Footprint: One Medical holds a presence in 25 major markets, soon to be 29 after expanding into Dallas, Miami, Milwaukee, and Connecticut. It operates around 180+ clinics in those markets.

Source: One Medical-Iora Health investor presentation

Clinical Employee Base: One Medical has an employee base of at least 8,000 clinicians. One Medical continues to hire well and the firm attributes this success to its clinical model that prevents burnout. Although it’s not clear how many primary care physicians vs. APPs (NPs and PAs) One Medical employs, the expansion gives Amazon immediate access to clinical scale.

Custom EHR: While I’m not sure how big of a deal One Medical’s custom EHR is (given that Iora also has an EHR and so does Amazon Care), it’s still likely a strategically useful asset and can be leveraged in some way.

TL;DR: Amazon chose a ‘Buy’ strategy. My guess is that they wanted to roll out a clinical footprint for Amazon Care much faster than they could initially with Crossover Health (which was expected to start with 20 medical clinics), and buying One Medical supercharged that expansion, including access to 8,000 clinical staff.

Okay, One Medical sounds pretty great…Why’d they sell?

It all boils down to one word in healthcare…Money.

Given the current macro environment, One Medical saw its share price plummeting and its cash pile falling. Investors started to note some concern over One Medical’s growth and cash spend given that value-based care models and growing facility footprints require significant capital outlays.

On top of capital and investment needs, One Medical was likely getting close to having to write down some portion of the Iora acquisition. The deal – an all-stock transaction – closed for $1.4 billion. One Medical had to be getting dangerously close with how low its stock dropped in April.

Likely having to raise capital in THIS economy within the next 12 months + potentially having a huge write-down…it could’ve gotten ugly. Obviously my speculation here could be wrong, but just some data points.

Amazon’s Current Healthcare Footprint

Okay, so we’ve covered One Medical’s operating model and footprint! What about Amazon? Amazon has been all over the place in healthcare. If I had to describe its strategy using one word I’d say…disjointed.

Here’s a quick timeline to get you caught up to speed:

2018:

- January: Amazon, Berkshire, and JP Morgan launch Haven, a joint venture aimed to improve employee access to healthcare and lower costs. Lotsa fanfare on this one as is the case with most things Big Tech and Healthcare.

- June: Amazon buys PillPack for $753 million

2019:

- September: Amazon launches Amazon Care, initially a virtual-first program for employees.

- October: Amazon acquires health API startup Health Navigator.

- November: After some intial operational challenges, Amazon rebrands PillPack into ‘PillPack by Amazon Pharmacy’.

2020:

- Haven shuts down operations after reports indicated that the three companies at the helm weren’t working in tandem and resources were better purposed elsewhere.

- Amazon also launches its wearable, Halo.

- November: Amazon officially launches Amazon Pharmacy.

2021:

- February: Amazon expands Amazon Care and nabs Hilton, others as a client as well as its existing Whole Foods employee base.

- March: Amazon expands its partnership with Crossover to five more states – Texas, Arizona, Kentucky, Michigan, and California.

- July: Amazon launches AWS for Health, including cloud services for services and biotech firms.

- October: Amazon pilots ambient documentation with Alexa into a few hospitals.

- December: Amazon launches Alexa Together, which is a subscription service that enables caregives to provide remote support to elderly folk through Alexa (fall detection, 24/7 emergency assistance, etc).

2022:

- February: Amazon rolls out Amazon Care nationwide.

- July: Amazon partners with the Fred Hutchison Cancer Research Center on phase 1 trials for certain cancer vaccines.

- July: Amazon acquires One Medical for $3.9B in an all-cash deal.

So none of Amazon’s initial forays into healthcare have made a material impact on incumbent players…yet. Or even within Amazon’s organization. Which is one of my broader points about the One Medical acquisition.

I distinctly remember seeing Kroger, CVS, Walgreens, etc. stock drop like 10% in the public markets after the media reported that Amazon was entering pharmacy, or buying Whole Foods, or whatever. And yes, I get that. It’s scary when a large player tries to compete with one of your business segments.

But Amazon hasn’t really done…anything material in healthcare.

Which is why I’m skeptical about One Medical and all of the claims about integrating with Prime, taking over healthcare, etc. It’s all codswallop. For now.

That being said, if Amazon REALLY wants to make a push in healthcare, it could potentially make a sizable dent in UnitedHealth’s Ferrari. So now we’ll get into the ‘thought experiment’ part of my analysis, which should be a good time.

My Predictions and Thoughts on Amazon’s Healthcare Strategy

Listen, making predictions are fun. And being wrong is fun. Because I get to learn!

So I’m gonna lay out some potential strategies Amazon might explore now that One Medical is under its belt. You can roast me in the comments as always.

Even though the primary play (in my mind) is to boost Amazon Care’s physical footprint and capitalize on employer relationships in a step-wise fashion, there are other strategies Amazon COULD pursue if it decides to make healthcare a core initiative to devote significant resources.

Here are some thoughts:

Employer Relationships → Commercial Disruption?

Amazon stans and visionaries everywhere may remember Amazon’s infamous motto: “Your margin is my opportunity.”

So uhh, where’s the high margin stuff in healthcare?

The commercial employer market. We’ve all seen the charts: “commercial plans pay 250% of Medicare” you know the one.

So maybe there’s a perfect storm scenario where Amazon leverages One Medical’s employer relationships and health system partnerships, makes some acquisitions needed for an insurance-like product, and offers a compelling insurance product to employers.

Stated another way: Amazon could eventually try to cut out health insurance companies almost entirely from the employer market and contract directly with employers along with health system partners.

It’s a pipedream, I know.

After having some conversations with some folks, it probably isn’t even worth it as a business venture to pursue. There’s infinitely more nuance than I could even hope to consider as a poor non-operating former healthcare consultant. A guy can dream for the ultimate disruption though…sigh.

It’s probably more likely that Amazon becomes some sort of benefits broker or platform with One Medical and Amazon Care to boot.

The Perfect Storm Scenario: Healthcare Integration with Prime?

Imagine this. Amazon has something in the neighborhood of 145 million Amazon Prime subscribers.

What if they packaged One Medical and Amazon Care with Prime, integrated the data with Halo, then Whole Foods sent you automatic food delivery based on your readings?!

Yeah I’m gonna be honest, that kind of sounds like fairy land. I would love for Prime to be transformed into an insurance-type product where I could add on One Medical, but there’s no way the clinical footprint has NEAR enough capacity to handle that level of demand. There’s not really any sort of feasible play involving Prime.

Amazon would have to get serious real quick on healthcare to support that level of patient census.

Time for some more realistic thoughts/predictions:

Leaning into Iora Health to Unlock Senior & Medicare Market

Given Iora’s foothold into the senior care market through Medicare Advantage and Direct Contracting (along with multiple payors to boot), Amazon could continue to build out Iora’s care capabilities – say, integrate Alexa Together with Iora’s at-home care model, or find other cool ways for Amazon’s existing tech and infrastructure to supplement risk-based models to find ways to actually transform care delivery.

If Amazon were to go this route, I wouldn’t be surprised to see it continue to purchase clinical assets including a home-based provider like Amedisys, Aveanna, Enhabit, or others. Lots of possibilities here but also lots of execution risk and not really Amazon’s cup of tea given its origins far, far away from value-based care.

Source: One Medical acquisition of Iora Health investor presentation

Synergizing with Whole Foods?

Although I personally would never go seek care inside a grocery store (or a HealthHUB for that matter, don’t @ me CVS I’m sorry), I’ve seen several mention Amazon’s potential synergy here with co-locating One Medical’s within Whole Foods since they target similar demographics.

Based on a high level overview of One Medical and a (old) layout of Whole Foods national locations, you can see that they tend to locate in similar, higher end urban areas:

I could see Amazon run a pilot program with locating One Medical clinics inside of Whole Foods just to see how things shake out. I mean, it makes enough sense.

The strategy would also dive into the whole ‘food as medicine’ argument and lean into One Medical and Amazon’s vision of maximizing consumer experience and value.

Next Logical Step = Diagnostic Testing and Pharmacy

The best synergy here exists between Amazon Care, Amazon Pharmacy, One Medical, and at-home diagnostic testing. One of the more interesting takes I saw consisted of Amazon making a play to create & facilitate its own narrow network PBM through combining One Medical with Amazon Pharmacy, PillPack, and a PBM acquisition to create the network in a high volume, low margin arena. Narrow network theory aside, other logical next steps include Amazon Pharmacy integration with One Medical, at-home lab test delivery, and other similar step-wise synergies that make sense given Amazon’s logistical prowess.

Implications for the future of Primary Care

Even if Amazon chooses to do nothing with One Medical for the rest of its existence, the transaction still matters for the future of primary care for at least a couple of reasons.

It solidifies that hybrid care is the future: If it wasn’t apparent before, it’s now more obvious than ever that a hybrid approach to care is the future of primary care. You can’t do everything virtually. It’s impossible. But virtual services to supplement an in-person facility footprint is a great model. It appears as if Amazon has nailed its primary care model between Amazon Care and now One Medical. That being said, I wouldn’t be surprised if a player like Teladoc, offering only virtual solutions for the time being, targeted a facility/physical footprint to create a robust primary care platform like that of One Medical’s.

It will increase investment activity in primary care: Like I mentioned previously, the fact that Amazon just entered tech-enabled primary care services by buying its own platform for strategic use indicates that there are going to be some new players in town. New players (AKA, CVS, maybe Amazon continues to buy up assets, …Apple anyone? & Other payors) = new potential exit strategies for both venture capital and private equity alike. Because One Medical operates across all or most primary care segments (value-based care, direct primary care, fee-for-service partnerships, and employer contracts), startups raising in those spaces get more credibility to their business models and more eyes and attention focused their way. In a way, I could see this potential trend being the most positive externality from Amazon making the acquisition.

It could change the status quo of primary care delivery: Let’s say Amazon goes all-in on its healthcare strategy and continues to scale & open One Medicals, offering it to more and more employers. If Amazon does so successfully and maintains the same level of outcomes and patient satisfaction, you have to think this gives One Medical, and Amazon by extension, a competitive edge over every other traditional primary care player out there. Over time, the status quo of care in primary care would be forced to adapt to what Amazon and One Medical offer.

What happens to Iora and existing Amazon Primary Care relationships?

Source: One Medical acquisition of Iora Health investor presentation

Here’s one of the biggest question marks stemming from the acquisition: what happens to Iora?

I’ve touched on Amazon’s likely consumer and employer play with One Medical’s traditional book of business and its bread and butter.

But Iora was supposed to be this longstanding growth engine for legacy One Medical.

I see three potential scenarios and I’ll place a probability on each outcome as to the likelihood of that happening:

1) Amazon divests Iora: 70%. The value-based care space is a hot market right now for payors. I bet Amazon could spin off Iora prior to it being fully integrated and shop it to the managed care players. I’m not well versed enough to know who might ultimately buy Iora, but I’m willing to bet Amazon could at least make One Medical’s money (about $1.4 billion) back on the sale which would be just south of 3x Iora’s 2022 expected revenue.

2) Amazon integrates Iora: 15%. This would be the coolest option and the option I discussed above in Amazon’s potential strategy with Iora where it builds out care capabilities in the value-based care arena and taps the senior market for growth.

3) Amazon continues Iora integration into One Medical and lets it operate as – is: 15%. I could also see Amazon just not touching the segment and letting it grow to see what happens to it. I mean at the end of the day, Iora’s business footprint is really a rounding error for Amazon’s larger organization. Why not just take a flier on keeping Iora around to see what happens to value-based care?

Finally, others have pointed out that Amazon has existing primary care partnerships with Crossover Health and Teladoc. Honestly, Amazon should just acquire them all. And acquire Carbon while we’re at it. Why not throw a 4th EMR into the mix? In all seriousness, this Amazon acquisition raises just as many questions as answers.

Data Privacy and Antitrust Concerns

I’ve seen a lot of concern surrounding data privacy and the fact that a division within Amazon will have access to patient data on One Medical’s EMR.

Amazon has already been in healthcare for a number of years. If you’re concerned about Big Tech’s use of data in healthcare, the ship has sailed and everything transpiring is perfectly HIPAA compliant. Now obviously, if Amazon (or any firm for that matter) violates these rules and the strict internal provisions/safeguards they have in place, there are pretty material monetary and criminal consequences for the players involved.

Although Amy Klobuchar and countless others on social media are worried about Amazon’s use of healthcare data and antitrust concern, Amazon has been in healthcare for some time now and has access to a multitude of healthcare-related datasets:

- Amazon has had access to health data from the NHS since at least December 2019.

- Amazon’s AWS developed and commercialized a natural language processing software that can mine patient health records and be linked to certain medical ontologies since December 2019. It’s HIPAA compliant.

- In 2020, AWS partnered with health systems as a qualified business partner to datamine patient medical records for the purpose of developing innovations and solutions in the space.

- More recently, Amazon partnered with the Fred Hutchison Cancer Research Center on phase 1 trials for certain cancer vaccines: “Amazon is contributing scientific and machine learning expertise to a partnership with Fred Hutch to explore the development of a personalized treatment for certain forms of cancer,” the spokesperson told CNBC in a statement

Amazon also isn’t the only tech company engaged in working with health data. Remember Project Nightingale? In 2019, Google Cloud partnered with huge nonprofit health system Ascension as a business associate (compliant under HIPAA) to collect and process patient data for a similar purpose – gain insights on populations and improve experiences and patient outcomes.

Google essentially had access to complete medical records as do several tech and data analytics firm at this point in the year 2022, I imagine.

But don’t take it from me: Brendan Keeler and resident expert on these sorts of things went much deeper on Amazon and data privacy / practices in healthcare and I highly suggest you give that a read if you’re worried about it. Check it out here.

As far as antitrust goes, I just have to say…you gotta be kidding me.

The primary care space is a hyper competitive market across direct, concierge, fee for service, and now risk based arrangements across physician practices, urgent care, retail health, care platforms, and even telehealth. One Medical itself has pegged its total addressable market as $870 billion across commercial primary care and Medicare (lol).

Given that metric and the calculated market size, One Medical is around 1/870, or 0.11% of the primary care market.

Of the markets that One Medical has entered, the company estimates the total commercially insured primary care market at $55 billion and Medicare at $220 billion.

With that math, One Medical’s total market share is…around 0.4%.

Good luck, Amy.

I would be truly, utterly shocked if Amazon failed to get this past regulatory review and it’s shameful that someone like Klobuchar would even bring something like this up when she literally has Optum, a $150 billion operation, sitting in her backyard (aka, Minnesota). The burden of proof is on the FTC

What about Culture?

As one of the biggest acquisitions Amazon has ever made, I couldn’t help but think about Amazon’s track record with its integration of Whole Foods.

I have to question whether a similar culture clash might occur with any sort of changes Amazon might make related to One Medical’s care model. Don’t forget that Amazon had lofty changes for Whole Foods – making high quality food affordable, etc. and most of this has (yet) to pan out.

I hope that Amazon – for the sake of patients and treatment of One Medical’s clinicians – has done proper due diligence on cultural fit between the two organizations. The culture clash between Whole Foods CEO (soon to be retired) John Mackey and Amazon leadership is well documented.

How will Amazon’s historically cutthroat, efficient culture affect One Medical?

- “Amazon’s culture is a tight one, characterized by structure and precision. Rooted firmly in the manufacturing industry, Amazon has defined processes to maximize its efficiency. Employees operate within a hierarchy and are well aware of the guidelines that dictate their behavior. According to Amazon’s leadership principles, leaders are instructed to hire and develop the best and insist on the highest standards.”

While One Medical and Amazon align on their desire to challenge the healthcare status quo and experiment with new product offerings, retaining employees and keeping clinicians happy – without burnout – should be top of mind for the new subsidiary of Amazon Care.

This is a key execution risk to this acquisition succeeding as clinician burnout is top of mind, especially in a fee for service setting that One Medical operates in.

One Medical distinctly points out in its SEC filings that its “culture, technology, team-based approach, and salaried provider model help address the fundamental issues driving physician burnout. Our culture allows us to attract and retain top board-certified physicians and premier team members…Our salary-based provider compensation model incentivizes delivery of the right care at the right time, without the adverse financial incentives that fee-for-service or compensation systems can have on clinical decision-making.”

One Medical keeps strict measures in place to make the platform a great place for clinical personnel to work. The firm historically limited visits and maintains a salary (NOT productivity) model for its providers.

“Furthermore, our strong mission-driven culture has enabled us to hire more primary care providers in Q1 than in any other quarter ever reported in the history of One Medical.” – Amir Rubin, Q1 2022 earnings call

I doubt Amazon would be dumb enough to mess with clinicians or thoughtful workflows that prevent burnout, but I’ve been wrong before!

Conclusion

This was a fun article to write and think critically about when it comes to the options for Amazon in healthcare, as it seems like there are limitless ways this could go. As with other takes I’ve read, there are plenty of open ended questions for Amazon’s healthcare team to dive into.

It all depends on how deep they want to go.

While I’m excited about Amazon’s potential for changing the status quo, we need to acknowledge that Amazon and other players are a LONG way off from doing anything material.

As an aside, I wish One Medical had been afforded the capital and valuation to go at the primary care market alone and continue to push forward as a standalone organization, but the macro environment shifted and alas, I can’t blame management for the buyout.

As with anything in healthcare, it’s going to take time.

Resources:

- Read Nikhil’s take on the One Medical acquisition here with some good thoughts

- Read Brendan’s take on Amazon and data practices in healthcare

- One Medical press release on the transaction

Join 5,700+ smart, thoughtful healthcare folks and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!