Welcome back to another edition of Hospitalogy! This week I’m excited to say that there are over 5,000 …erm… Hospitalogists…who read my breakdowns on the business of healthcare!

If you want to join 5,200+ smart, thoughtful healthcare folks and get deep insights into what’s going on in the business world of healthcare, you can join us by subscribing here!

Also, if you missed my first half 2022 healthcare recap, you can find that essay here, where I broke down the top 20 healthcare business stories from the first half of 2022.

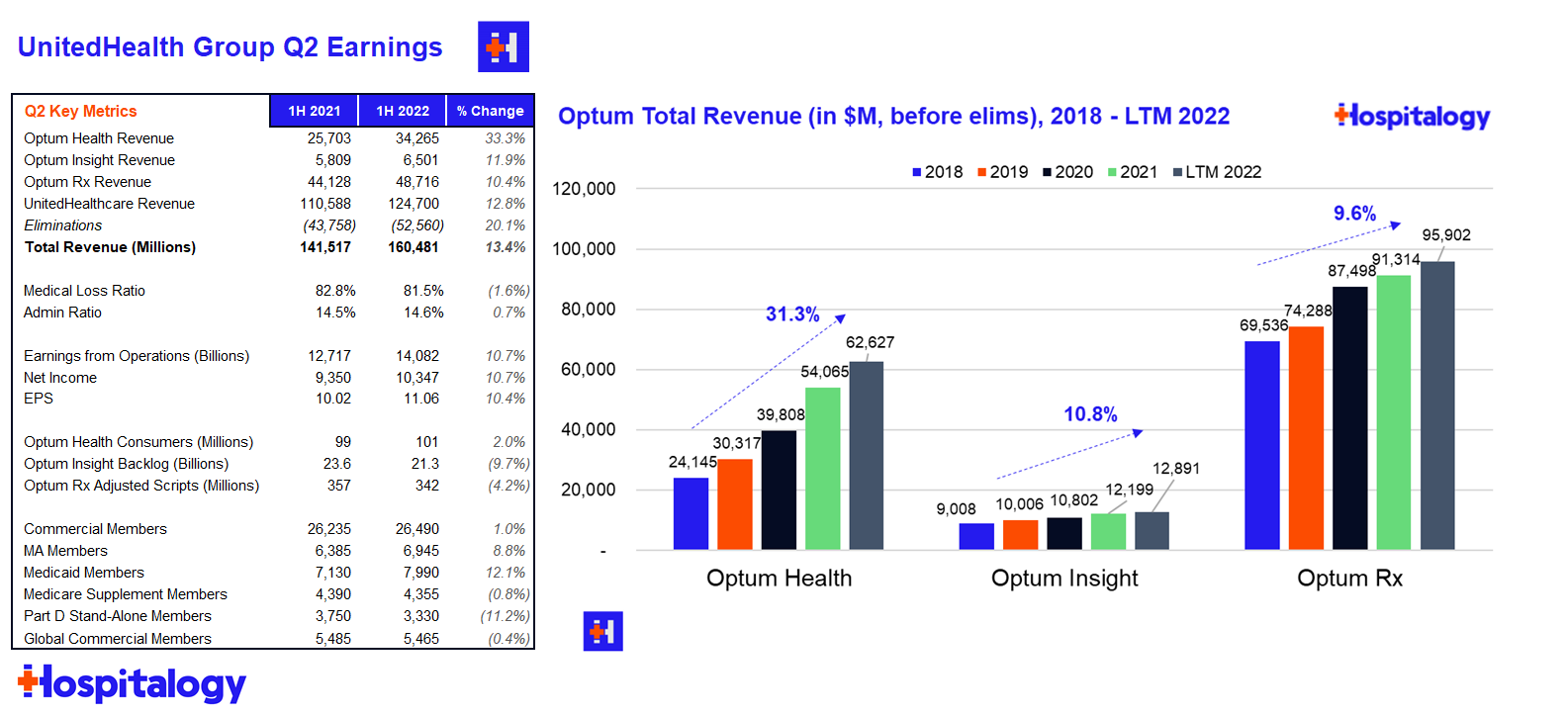

UnitedHealth Group’s Q2 Earnings Analysis

Everyone’s favorite diversified healthcare behemoth UnitedHealth Group reported Q2 earnings on Friday. Surprise surprise, UNH jumped around 5% as its unstoppable train running through the heart of our healthcare system continues to chug along.

Major highlights from the earnings report and subsequent call:

Financials: UnitedHealthcare (insurance) revenue totaled $62.1B before elims and a 81.5 MLR for Q2. Optum’s (services) revenue totaled $45.1B before elims and revenue per consumer jumped 30% as it continues to tout its growth in value-based care arrangements.

Acquisitions: UNH spent $7.2B on net acquisitions in the first half of the year – I’m not sure if that includes the LHC acquisition but I would assume so. United spent $6 billion on acquisitions in the second quarter, which is what the entire firm spent annually each of the last 5 years. It’s clear that UNH is acquiring healthcare assets opportunistically as compelling valuations present themselves.

Utilization trends: Interesting tidbit for what we might see volume-wise on the hospital side – UNH noted that Covid-related inpatient admissions in Q2 dropped to 1/3 the volume of that seen during the Q1 Omicron wave. United management also noted lower pediatric and ER usage as compared to historical norms, but heightened utilization for senior preventative services (more wellness visits, specifically called out colonoscopies). Finally, United mentioned strong growth in its SCA segment as outpatient surgeries continue to see strong growth.

Other Tidbits: Optum’s financial team (I guess it makes sense they’d have a payments or fintech team) has been piloting a consumer benefits card, which it expects to roll out to all members starting in 2023. As a savvy PR move and great benefit politics aside, United is planning to offer insulin and a few other notable drugs at no out of pocket cost to its members in 2023 as well.

Madden’s Musing

United management seemed to dodge a pointed question about inflation and premium expectations for 2023, stating that some big ways to stave off inflation might stem from virtual care, more digital engagement, and heightened consumer choice.

The comments about utilization lead me to believe that hospitals will report patient volumes back on track with expectations in Q2, but there’s always the next variant to cause chaos, burnout, and destruction of patient census for more profitable elective procedures.

“It’s really around virtual care and around emergency department use. We’ve seen, obviously, virtual care increase and emergency department use go down.

As I think in the particular, again, back to that concept of consumer and choice, it’s around product design, Bind being our best example when we can put that consumer in the driver’s seat where they can choose site of service and optimize both their cost and quality, they do. And when you couple that with a high-performing network, obviously, you get the benefit both of the unit cost as well as that consumer choice. So those are the greatest examples that I can see really emerging in this environment.” – Brian Thompson, UNH Q2 2022 earnings call

Resources:

- Link to UnitedHealth Group Q2 earnings release

- Related: Nisarg Patel wrote a solid overview of UnitedHealth’s operating playbook, taking a dive into each of its segments and the economics at play given its vertical integration

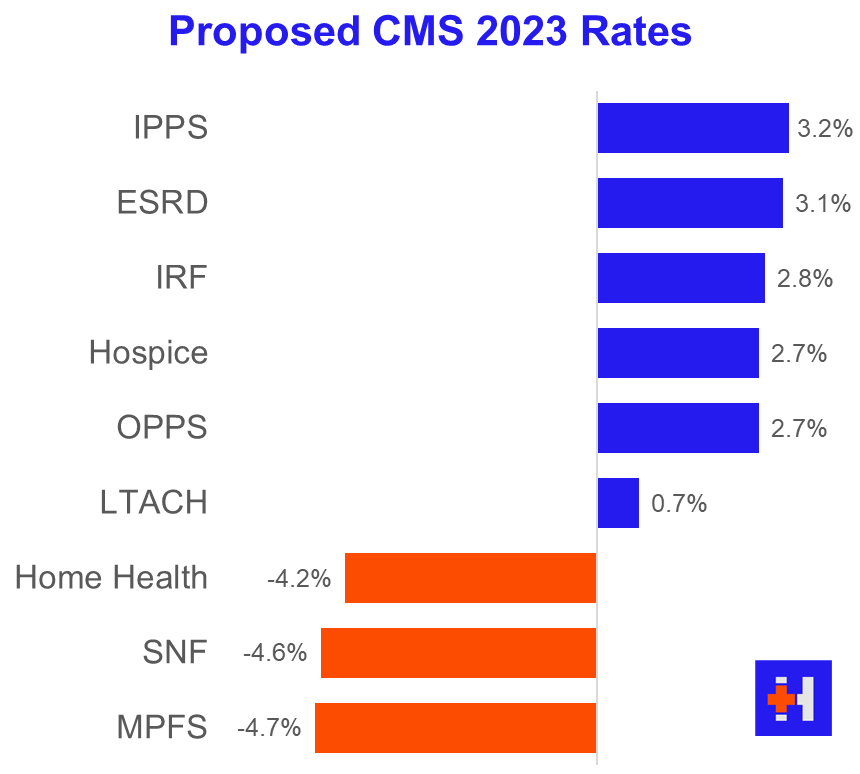

Hospitals Outraged over CMS’ Paltry Outpatient Pay Bump

CMS dropped the OPPS (hospital outpatient and ambulatory surgery center) proposed rule Friday chock full of interesting updates & implications for provider organizations. If I had to characterize it one way it’d be…year of the Rural Hospital.

Here’s the stuff you need to know:

Base Rate: CMS proposed a 2.7% overall bump to OPPS payments.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Rural Hospitals: CMS wants to bolster the struggling rural hospital. According to the AHA, about a third of rural hospitals operate on negative margins so…they’re not doing too hot with record closures. It makes sense that CMS would want to boost reimbursement to maintain and incentivize access for rural areas. CMS wants to further develop the new rural emergency hospital designation (REH) with the goal of converting rural and critical access hospitals to the new designation with the following notable changes:

- Boost OPPS reimbursement by OPPS-rates-plus-5%

- Provide an extra monthly facility payment to REHs

- Loosen Stark (referral) law regulations around physicians’ ability to have ownership stakes in REHs and certain physician compensation arrangements surrounding REHs

340B Program: Although CMS had planned to propose payment changes to 340B drug reimbursement, the recent SCOTUS decision (which I covered here) hamstrings CMS into maintaining the current reimbursement model of average drug sales price plus-6%.

Remote Behavioral Health: CMS is proposing to allow hospital outpatient departments (HOPDs) to bill Medicare for remote behavioral health visits, a move meant to address and expand access to mental health services. If finalized, the move would allow virtual/remote mental health for Medicare beneficiaries to be covered as an outpatient service. The move would appear to codify a provision already in place from the public health emergency related to remote behavioral care.

Madden’s Musing

The rural hospital changes – particularly around Stark law provisions and physician ownership in rural settings – are the most interesting piece of the proposed changes.

I feel like this is a big deal that not many people are talking about right now? For the most part, the ACA’s passage outlawed physician owned hospitals. This change and added exemption to Stark could actually be a pretty compelling way to incentivize physicians to work in rural areas. I’ll be interested to see the downstream effects of this considering Stark protections are in place for a very good reason.

On the other side of the equation, the AHA is none too happy with the payment updates (of course – a lobbying org is gonna fight for every nickel and dime they can), even though CMS hasn’t really done ANY provider org favors this year.

Meanwhile, physicians are just asking for any sort of help. It pays to be big.

The common theme for 2022 is inflation and staffing woes stemming from ‘Rona. Since CMS is using cost data from 2021 and 2019 and all changes to payment policies are budget neutral, we’re in for a doozy of a 2023.

I feel like a broken record saying that over and over, but margin pressures will be pervasive throughout all services verticals as provider orgs get financially squeezed from both sides.

Final tidbit: I do find the remote behavioral health proposal intriguing. I would assume that if finalized, hospitals and HOPDs would enjoy higher reimbursement rates for virtual mental health services. This change may mean that we could see some M&A activity in the space or behavioral health being incentivized as an added ancillary at hospital-owned clinics.

Resources:

- CMS fact sheet

- AHA response to the OPPS ruling

- HFMA write-up of the OPPS ruling

- BH Business write-up of the OPPS behavioral proposed provision

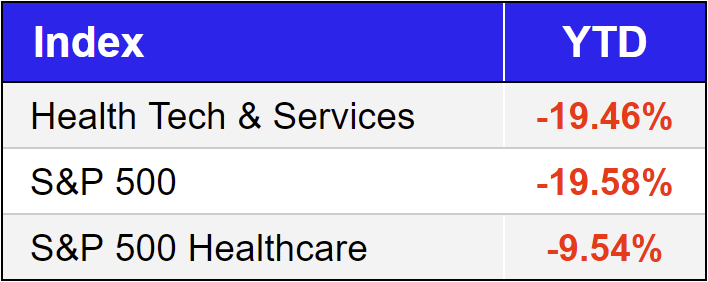

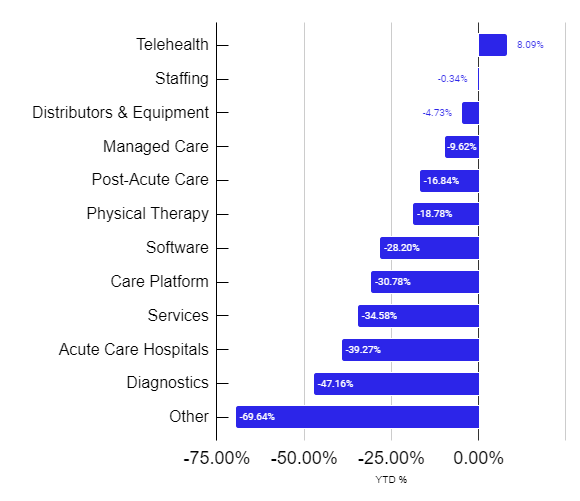

Market Movers

Dispatch Health is partnering with rural health system Marshfield Clinic to create a hospital-at-home program. The partnership will deploy Dispatch’s model across Marshfield’s 11-hospital footprint across Wisconsin and Michigan. At this point, HaH has massive traction and likely isn’t going anywhere, even after the waiver expires. Still don’t believe me? Mass General Brigham is ramping up its HaH program too.

Turquoise Health announced a partnership with Komodo Health to continue to build out transparency tools and leverage each others’ data to build out a compelling data platform. It’s a fascinating time for digital health firms focused on analytics to drive insights and associations with the ultimate goal of better patient care. Even more notable was that Komodo Health was expected to IPO this summer but that obviously has been put on hold given the macro environment unfolding!

TeamHealth is suing United claiming that UNH wrongly denied and underpaid TeamHealth for emergency services. Sounds oddly familiar…oh yeah – Envision is in litigation with United as well!

Encompass Healthcare announced plans to build a 40-bed IRF in Town and Country, MO alongside BJC HealthCare to be opened in 2024.

Molina acquisition

Centene’s Delaware subsidiary won the state’s Medicaid contract. The Medicaid giant also completed its divestiture of PantherRx

HHS approved Colorado’s public option plan under the Section 1332 State Innovation Waiver to create a state-run public health insurance plan. The plan will allow individuals on the exchange or companies with sub-100 employees to enroll.

Rock Health’s 1H 2022 digital health funding report showed a continued slowdown in funding this year compared to an explosive funding year in 2021. Jared broke down the trends further here.

Amazon is partnering with the Fred Hutchinson Cancer Center in Seattle to work on a clinical trial for a cancer vaccine, which appears to be a personalized vaccine for patients with skin and breast cancers.

New York-based Northwell Health invested $10 million into pediatric specialty mental health provider Brightline. Northwell also struck a deal with Google Cloud to partner on automating administrative workflows and identify patient risk factors.

New York state filed a False Claims lawsuit against Fresenius last week, alleging that the dialysis services giant performed thousands of medically unnecessary vascular procedures on ESRD patients.

Miscellaneous Maddenings

James Webb Telescope images are insane and it really just makes you realize how small we are in the grand scheme of things. Next time I have imposter syndrome I’ll try to remember this!

This perspective on venture capital funding from Pitchbook was interesting – across a number of notable datapoints, the article seems to indicate that VC is still doing just fine as far as historical investment activity is concerned.

I played in a family golf tournament this past weekend. The format – with 3 teams of 4 – was a shamble, taking the best 2 scores from each hole. Unfortunately I couldn’t overcome some food poisoning from the night before and we finished in second. I think the fam poisoned me on purpose! By the way, congrats to Cam Smith on winning the Open. What a round – 64. I just hope he doesn’t join LIV…

The S&P 500 is now more oversold than in 2008

Hospitalogy Top Reads

- Two great reads on price transparency: X=primary care wrote about price transparency in primary care specifically, how it affects patients and clinicians, and more on Turquoise Health. Then Nikhil dropped a sponsored post on Turquoise Health including his initial investment thesis and a dive into Turquoise’s opportunity (which I love as a way to structure an essay and one I try to emulate). Man, Turquoise has run a hell of a marketing campaign. Kudos, yall.

- This was an interesting read on a notable trend – PBMs are apparently creating group purchasing organizations, further entrenching itself into the drug & medical supply chain. GPOs seem to have grown in popularity lately, especially with hospital and other providers focused on procurement and their supply chains.

- Greycroft wrote a thought provoking article on whether care delivery models – ahem – provider organizations – should be venture backed. Based on what I’ve read and seen, I’d say…it depends.

Want to get these in your inbox to never miss an edition? Subscribe to Hospitalogy today!