Want to get these in your inbox to never miss an edition? Subscribe to Hospitalogy today!

Enhabit Goes Public

After announcing spin-off plans in January, Encompass’ home health arm, Enhabit Home Health & Hospice, successfully debuted on the public markets this week under the ticker ‘EHAB.’

About Enhabit: The home health and hospice operator holds a nationwide footprint and generated just north of $1.1B in revenue as of CY 2021. Enhabit is solidly profitable as well, operating at around a 17% EBITDA margin, or $184M on 200,000 admissions.

As part of the spin-off announcement, Encompass issued guidance for Enhabit for full-year 2022. Financials are expected to decrease slightly, with a revenue midpoint of $1.1B and EBITDA midpoint of $175M. Some of this is likely related to corporate overhead allocations while the rest is attributable to the headwinds I’ll mention below. Its hospice segment comprises about 19% of total revenue with an ADC of around 3,800.

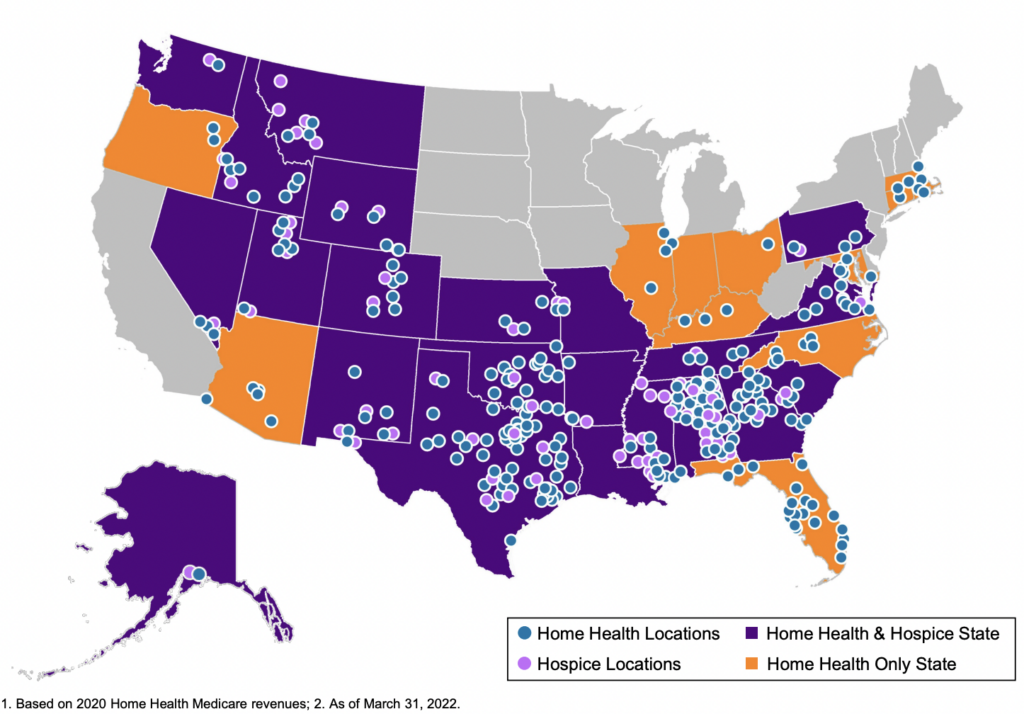

Enhabit is the 4th largest home health player and the 12th largest hospice player sitting alongside the likes of other national operators like Amedisys, LHC Group, AccentCare, and Kindred. The operator boasts 351 HH&H locations across 34 states with 10k employees.

Madden’s Musing: Although home health – and post acute in general – is poised for growth given the aging Medicare population and continued shift to the home, Enhabit and other home health orgs are facing major short-term headwinds, including staffing woes and reimbursement hits from CMS given that 80% of its book of business is Medicare. Here’s an interesting tidbit on Enhabit’s home health → hospice pipeline:

“Many home health patients will ultimately require hospice services. By offering hospice services in many markets where we operate our home health business, we minimize disruption and gaps in care to patients who transition to hospice. We believe this co-location strategy between our home health and hospice businesses creates a growth opportunity for our hospice business, especially in geographies where we operate home health but not hospice.” Enhabit 8-K filing

One of the major reasons why Encompass decided to spin Enhabit off seemed to be related to Encompass’ desire to fully focus on the IRF biz while Enhabit could do the same for home health.

Enhabit still has a major opportunity ahead of it both from a consolidation standpoint (home health is STILL highly fragmented along with a growing need for hospice) and a value-based care standpoint (payors are incentivizing shifts to value-based models).

Since Enhabit operates at a lower cost per visit than Amedisys and LHC Group as of CY 2021 and holds solid readmission percentages, the firm believes it’s in good shape to serve the Medicare Advantage population as it continues to grow to above 50% by 2030.

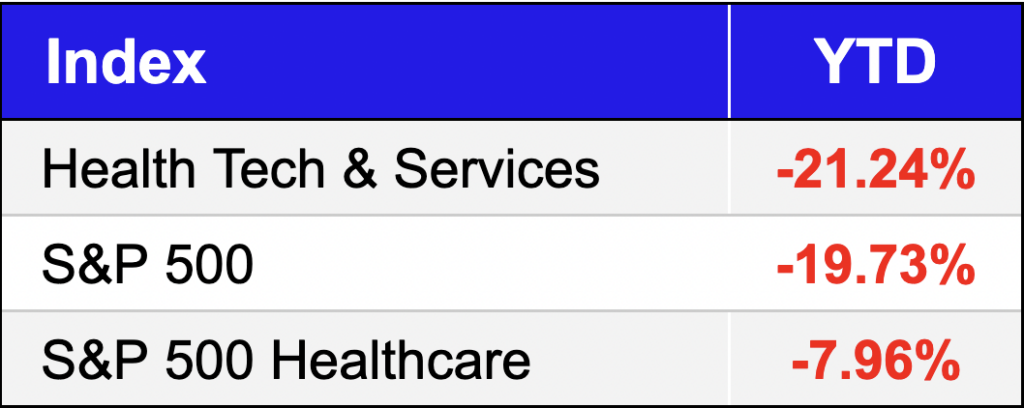

Final point – Timing for the spin-off wasn’t exactly ideal given what’s going on in the broader economy as well as the idiosyncratic struggles home health operators are facing. These issues are probably one of the major reasons why LHC decided to sell to Optum for 22x EBITDA back in late March. Really timing the top there!

Disclosure: I received Enhabit shares as part of the Encompass spin-off.

Resources:

- Here’s the Enhabit investor presentation

- Press release on completed spin-off

- Enhabit SEC filings – the recent 8-k is a great overview

- Encompass issued guidance for consolidated, IRF segment, and Enhabit

- CMS comes after home health

Want to get these in your inbox to never miss an edition? Subscribe to Hospitalogy today!

Turquoise Health partners with Ribbon

Price transparency digital health firm Turquoise Health announced a partnership with healthcare-focused API data platform Ribbon Health to integrate Turquoise’s price transparency data into Ribbon’s platform.

Through the partnership, Turquoise and Ribbon aim to continue to empower patients and consumers within the healthcare system. Imagine that you’re googling various in network providers and their prices for common procedures (including other pertinent information) pop up next to the practice. This use-case is just one example of what Ribbon, Turquoise, and others in the space hope to achieve.

Madden’s Musing: Price transparency in the midst of the increasing consumerization of healthcare is a great thing – don’t get me wrong. But from the conversations I’ve been having, we still have a decent ways to go for it to mean anything cost-wise within the broader healthcare system.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

How much will partnerships like these, and actually knowing the costs of things move the needle? With so many other factors to consider – doctor referrals, networks, and structure of health insurance – it’s hard to know. Despite the unclear effects of price transparency, I’m excited by the fact that we’re still in the early innings of data collection & insights driven by that data.

Regardless, Turquoise has a compelling market opportunity in front of itself, especially as payors begin to submit their pricing data after the very-under-the-radar CMS price transparency rule compelled them to do so on July 1.

Resources:

- Here’s the press release announcement

Market Movers

Hospital and behavioral health operator UHS cut guidance this week like we all expected even though they refused to do so in Q1 when the writing was on the wall. As a result, hospital operators fell in trading. HCA even dipped below 8x forward EBITDA, which is unheard of.

Layoffs continue to roll in at digital health startups – Ro just cut 18% of its workforce while Cue Health shed 10% of its staff. Probably could have retained some staff if they hadn’t bought that Super Bowl ad…I mean I should have logged into my computer at halftime and placed a short order right then and there. Finally, Circulo Health laid off a quarter of its workforce last week.

Accolade’s quarterly earnings report dropped this week. Despite a $300 million goodwill impairment charge related to its purchase of PlushCare and 2ndMD, Accolade actually beat on revenue and (adjusted) EBITDA, raising the lower end of revenue in its full-year guidance. The healthcare navigation firm jumped around 28% post-earnings – perhaps signaling a bottom? Accolade is expecting positive EBITDA and cash flow by calendar year 2024.

Acadia Healthcare announced the formation of a joint venture with Tufts Medicine to build a 144-bed behavioral health hospital located in Malden, Massachusetts. It’s Acadia’s 17th such JV and combined with Tufts will result in a $65 million investment into behavioral health in Boston.

Evolent Health acquired IPG, a leading technology and services company providing surgical management solutions for musculoskeletal conditions, from TPG Growth, the middle market and growth equity platform of alternative asset firm TPG, for $375 million with an additional earn-out provision of up to $87 million.

Alignment Healthcare announced plans to expand into two high-population states: Texas and Florida. With the move, albeit into extremely competitive marketplaces, Alignment expects its total reach to increase to 8.2 million Medicare beneficiaries. Although much more attention has focused on other higher profile insur-tech stocks, Alignment has been plodding along JUST fine on its own.

So this is pretty insane – Cardinal Health, Novant Health, and Magellan Rx are launching a long-range drone delivery service in North Carolina powered by Zipline, which appears to be organizing the logistical challenges of such an operation. Drone delivery pilots have been going on for a number of years.

Want to get these in your inbox to never miss an edition? Subscribe to Hospitalogy today!

Miscellaneous Maddenings

- After some debate and deliberation over the past few years of seltzer craze, I’m just gonna have to come out and say it – High Noons are the best seltzer brand, hands down.

- A 60-person brawl broke out on a cruise ship after an apparent threesome was uncovered by an unbeknownst partner. Wooooof.

- The latest Minions movie just surpassed $200M worldwide in what’s assuredly going to be a marketing campaign to study for the ages!!

Hospitalogy Top Reads

- Turquoise Health had / has a live blog going related to all of the payor price transparency tracking

- Paulius Mui, MD wrote an in-depth article on digital therapeutics in primary care and how their continued success need to be bolstered by PCP adoption.

- Marissa Moore and Second Opinion penned an article on the growing presence and opportunities available to new and old entrants alike in the lab & diagnostics industry.

Want to get these in your inbox to never miss an edition? Subscribe to Hospitalogy today!