Welcome back to this week’s Hospitalogy news round up. Today we’re discussing the take-private trend along with recent Supreme Court cases on PBMs, abortion, Disproportionate share payments, and more.

Want to get these in your inbox to never miss an edition? Subscribe to Hospitalogy today!

TPG takes Convey Health Solutions private

TPG Capital, a major private equity player, announced its intention to take Convey Health Solutions private at $10.50 per share. The value amounted to $1.1 billion, a 143% premium to Convey’s last close, and about a 100% premium to Convey’s VWAP, or volume-weighted average price per share as of a recent date to the transaction announcement. TPG previously invested in Convey, took them public at $14 per share and now is taking them private again at $10.50.

Madden’s Musing: As with a lot of other healthcare assets, private investors believe that more value is to be had in the private markets by scaling the business further privately and then selling it to a strategic buyer or other financial backer. My prediction is that Convey – and SOC Telemed prior – will be the first of at least a handful of public to private transactions coming in 2H 2022.

SCOTUS has a day

Although we’re all aware of the big SCOTUS place that took place last week, I wanted to highlight a bunch of different healthcare-specific cases that have pretty interesting implications within their various sub-industries.

Abortion

The Case: Mississippi wrote a law criminalizing abortion after 15 weeks in direct contradiction to the legal precedent set by Roe. Jackson Women’s Health sued the state as a result.

The Decision: SCOTUS overturns Roe v. Wade, ending the constitutional right to abortion and leaving the decision up to the states in lieu of federal codified law.

Madden’s Musing: I’ll be covering this – along with all of the implications for women, businesses, clinicians, and more, on Thursday.

PBMs

The Case: If a PBM has the ability to lower drug prices, does it have a fiduciary duty under ERISA to do so? (Keep in mind that PBMs benefit from higher drug prices by scraping a piece of the drug price for their own benefit in the form of a rebate)

The Decision: SCOTUS decided NOT to take up a lawsuit related to whether PBMs had a fiduciary duty to provide lower drug prices under the Employee Retirement Income Security Act (ERISA).

Madden’s Musing: “Your silence is deafening” – me to SCOTUS on PBMs. PBMs exist in this insane space where everyone knows they suck, yet they’re untouchable. Plz, FTC, do something.

340B – Outpatient Drug Program

The Case: The 340B program allows certain eligible and critical access hospitals access to outpatient drugs at favorable rates they can make a decent amount of $$ on. Big Pharma hates it, hospitals love it, Feds are trying to fix it. Previously, HHS changed the reimbursement formula for hospitals from cost-plus-6% to average sales price-less 22.5%. Hospitals argued that HHS broke statutes when doing so, saying that certain protocol needed to be followed first.

The Decision: On the 15th, SCOTUS decided that HHS broke the law when it changed the payment formula for hospitals to get reimbursed on drugs from cost-plus-6% to average sales price-less 22.5%. SCOTUS said that in order for HHS to have authority to make that change, the regulatory body would first have to conduct a drug cost survey at the targeted hospitals.

Madden’s Musing: I covered this last week but wanted to include it along with the other court decisions. The 340B Program now accounts for 15% of all pharmaceutical sales in what will continue to be a hot battleground between hospitals, big pharma, and the government.

Disproportionate Share Payments

The Case: Disproportionate share payments are extra payments that CMS makes to hospitals that serve a ‘disproportionate share’ (ha, get it?) of low-income patients. I’ll spare you the highly fascinating details, but the hospital in this case was arguing that HHS was underpaying their DSH payments

The Decision: SCOTUS decided that HHS’ DSH payments were ultimately consistent with the written statute and adequately accounted for the hospital’s entire low-income patient population.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Madden’s Musing: Not gonna lie, this case is highly confusing, and what’s even more confusing is trying to understand what the heck is going on with hospital supplemental payments. Even the dang Supreme Court was confused about the statute’s language if it gives you any indication as to why healthcare is sometimes really stupid when it comes to highly technical, nuanced subjects like DSH. Still, DSH revenue represents a significant chunk of change for hospitals and health systems.

Dialysis

The Case: centered on whether a health plan followed Medicare statute when it purposefully offered extremely low reimbursement rates for outpatient dialysis – AKA “Medicare shouldn’t pay for a service that this health plan should cover.” DaVita argued that the low rates effectively caused all providers to be out of network and alleged that the plan discriminated against chronic kidney disease patients

The Decision: SCOTUS decided that the plan didn’t discriminate against ESRD patients since it cut rates for all plan members…wtf? As a result, a private health insurance plan can cut or limit dialysis coverage uniformly… DaVita

Madden’s Musing: On the same week that CMS proposed a 3.1% lift to dialysis providers, DaVita dropped 11% after SCOTUS ruled against the dialysis maker. This ruling has implications beyond just dialysis. The precedent set here could trickle down to other benefits and services. At the end of the day, this decision does nothing good for chronic kidney disease patients across the country, a continual spurned group of individuals.

“It’s not like anyone is dying in the emergency room waiting for coverage. Medicare will pay,” said Jen Jordan, an attorney who specializes in Medicare Secondary Payer Act cases. “The only fear I would have is that plans may be more inclined to write more bare-bones benefits now that they know that the Supreme Court supports such an outcome.”

Sick!!

Resources:

- SCOTUS decision on abortion – nobody wins

- SCOTUS decision on Dialysis coverage limits – Health plan wins, DaVita loses

- SCOTUS decision on 340B cuts – Hospitals win

- SCOTUS decision on Medicare DSH payments – HHS wins

Want to get these in your inbox to never miss an edition? Subscribe to Hospitalogy today!

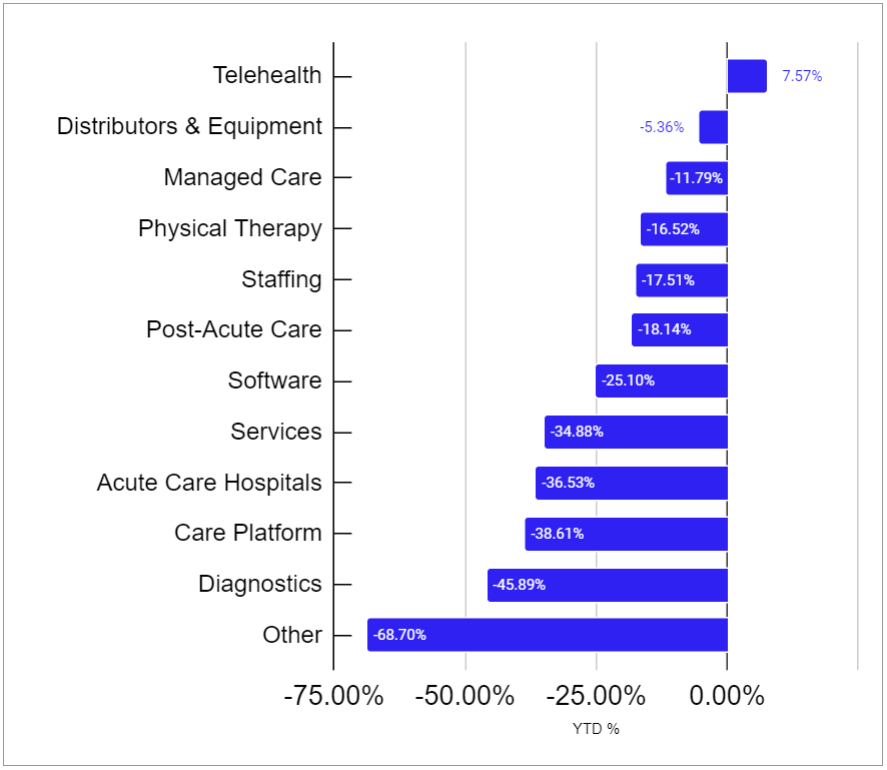

Market Movers

Colorado officially launched its first ever public option plan after getting approval from CMS last week. The plan will run on the state’s ACA exchanges and is aimed at lowering premiums and costs for the state.

In a move I predicted back in late April (I mean seriously yall, you’re getting this stuff for free!! lol), hospitals are calling Medicare’s proposed payment update of 3.2% ‘woefully inadequate.’ Cost inflation on expenses and payors playing hardball on increased commercial rate lifts are leaving hospitals in a tough spot from a margin perspective. It makes you wonder where they turn to from here as payors likely aren’t giving most operators enough of a lift to combat the CMS lift, labor shortage pressures, and general the inflationary environment. Dare I say, value-based care?

Optum launched a new lab-based benefit management tool aimed at reducing unnecessary testing. Kind of a quiet little announcement here, but this is something that could have an outsized effect on even routine testing for labs nationwide.

Just a couple of weeks after announcing a partnership with Baylor Scott & White, Contessa Health moved down I-45 to partner with Memorial Hermann on hospital-at-home and to provide home-based care.

Drug distributor McKesson inked two notable deals this week. First up, McKesson announced plans to form an oncology joint venture with HCA Healthcare, combining HCA’s Sarah Cannon Research Institute with McKesson’s US Oncology Research segment. Next up, McKesson expanded its agreement with the Oncology Institute, a recently gone-public value-based care player in the oncology space, to continue to distribute pharmaceuticals through McKesson. Must’ve given ‘em a good deal on rebates!

Walgreens Health inked a partnership with Ohio’s Buckeye Health Plan to serve Medicaid patients in its Health Corner stores throughout the state. After the deal closes, Walgreens will expand its total number of patients served past 2 million folks. Pretty cool all around.

Speaking of Walgreens, the retail pharmacy giant and its 3-letter counterpart are looking to launch their own clinical trials operations.

Hue Health and Banner Health partnered to launch 39North, which is a new performance based primary care plan engined by Flume Health. Lots of big names here and an exciting cross-partnership that I wish I had mentioned and remembered when I wrote about the 9 recent digital health partnerships with health systems to watch!!

Home health operators tank the day after CMS drops its proposed rule expected to result in a 4.2% rate decrease in 2023. Amedisys (-10%), the Pennant Group (-11%), Aveanna (-17%) and Encompass (-4%) all suffered at the hands of daddy CMS.

Tenet’s USPI announced a joint venture with United Urology Group, a 140-physician group. Through the affiliation, USPI will buy into UUG’s ownership interests and operate within 22 ambulatory surgery centers throughout Maryland, Colorado, and Arizona. This is a nice development for Tenet – anytime you can partner with a highly specialized group to expand access to certain procedures, it’s a win. Also, this was a brief good overview of USPI’s recent activity in the ASC space from Beckers.

Telehealth advocates are looking to reform the physician licensing landscape, among other changes, post public health emergency. I’ll be interested to see what telehealth provisions stay and which regulations return, especially as looks like telehealth has found a great niche in the provision of virtual mental health.

Nomad Health raised $105 million to expand its staffing capabilities. I’m intrigued to see how Nomad pivots from taking advantage of massive travel nursing tailwinds into a more stable operation spanning a number of staffed positions for hospitals and other care providers. It’s clear that there is still a need for travel nursing and labor shortages, but is this a short term wave or the long-term future that hospitals need to prepare for? Adams Street Partners, Icon Ventures, and others argue that staffing agencies are here to stay. Another middleman, or an efficient solution?

California hospitals are stowing away billions for Seismic upgrades needed to combat earthquake risks in the state. What’s crazy is that 73 of the 93 hospitals in LA county aren’t yet upgraded to the guideline standards set out by the state. It’s still a ways away, but that’s a significant amount of capital needed to sink into real estate development with minimal ROI

Miscellaneous Maddenings

- Our grocery pickup forgot our order of flank steak. You can imagine my dismay when I opened the fridge and the 1 pound slab of meat was nowhere to be found. So I drove to the store to get the flank steak and they hooked me up with 0.2 extra lbs! Talk about a 20% arbitrage baby. Anyway, I got the flank steak on the grill but you guys let me know if you have any fire flank steak marinades.

- I know a few of you are keeping tabs on my golf game, so I’ll keep this going! I played in 102 degree heat with a buddy of mine this Saturday at the Texas Star and shot a smooth 76 with several missed birdie putts…still, anytime you can shoot a score lower than the temperature, I consider that a win. If you’re in Dallas and want to take me to all the nice courses, hit me up anytime (I’m really only half kidding but I’ll buy the beers)

- Check out this performance of a lifetime by an extra on Dr. Strange. Wonderful.

- Charli D’Amelio has been dethroned by a laid off factory worker.

Hospitalogy Top Reads

- Nikhil wrote a great article on the biggest perceived problems in US healthcare today.

- 7wire Ventures discussed how digital health can address health equity in the coming years. It’s a very robust deep dive into the drivers of health disparities and potential solutions to existing problems.

- This was a wild story: Weill Cornell says it unknowingly advised patients against birth plans for years (paywall – Crains)

- VMG Health took an interesting look at public market valuation trends in an attempt to isolate variables affecting valuation.

Want to get these in your inbox to never miss an edition? Subscribe to Hospitalogy today!