Want to get these in your inbox to never miss an edition? Subscribe to Hospitalogy today!

CVS Launches Another Virtual Primary Care Platform

Announced this week, CVS is rolling out a new virtual primary care service for its Aetna members, which follows the trend of other major insurer players in offering new virtual care capabilities.

“CVS Health Virtual Primary Care will give members access to primary care, on-demand care, chronic condition management, and mental health services virtually, with the option of being seen in-person when needed at an in-network provider, including MinuteClinic. The virtual primary care provider can also help members identify appropriate in-network specialists and other in-network health service providers, if necessary.”

United and Anthem (ahem…I meant Elevance) also have launched virtual care offerings for their members, with Cigna & Humana quickly to follow, assuredly, with their clinical assets (MDLive, etc).

Madden’s Musing: Based on the reading in the release, this announcement seems to fit as a complementary piece to CVS’ partnership with Teladoc – which was announced last August and whose relationship extends all the way back to 2018 with its MinuteClinic partnership.

The announcement leaves me wondering…is CVS still looking to acquire an asset in this space like they mentioned at their investor day? If so, now seems like the perfect time to do it with digital health and market valuations at short-term lows. CVS is looking to continue to build out network offerings on the back of its acquisition of Aetna in 2018

The virtual care space is getting crowded as Walmart & MeMD just rebranded to Walmart Health Virtual Care and Amazon Care expands nationwide.

Resources:

- CVS Health unveils new virtual primary care platform

- UnitedHealthcare launches a new virtual-first health plan

- Anthem rolling out virtual primary care to plans in 11 states

- Cigna expands access to virtual care services available through MDLive

Talkspace Attracts Buyout Offer

An Axios Pro report (paywall) this week disclosed that Mindpath Health, a private equity backed outpatient mental health platform, approached Talkspace with a rumored $500 million take-private offer, although that price was subject to debate.

Of course, Talkspace spiked 40% initially on the news given that the firm seems to be eliciting takeover offers. The rumored $500m price tag translates to just over a 4x multiple on trailing revenues, while Talkspace trades at 0.3x trailing revenues today and a nearly-negative enterprise value of around $35 million. So, for all you savvy healthcare analysts out there, the purchase price would have represented a hefty premium to EV and a 128% premium to Talkspace’s market cap this Friday.

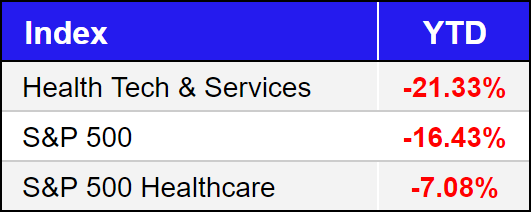

Madden’s Musing: Honestly I’m less interested in Talkspace specifically and more interested in these take-private offers. I think there are a lot of attractive assets out there in the public markets that could be strategically acquired soon. The market has obliterated valuations, especially in health tech, since last year. We’ve already seen an activist campaign in Cano Health. Who’s next?

My speculative names to watch:

- Talkspace (obviously)

- Risk-based facility MA players: Cano, CareMax

- Telehealth players: Teladoc, AmWell

- One of the insur-techs (Bright is likely)

Who do you think might go private? It’s a fun thought exercise on who can unlock value in the private markets through these struggling assets currently being heavily discounted in the public markets.

Resources:

Medtronic and DaVita launch a new Kidney Care Medical Device Company

Healthcare giants Medtronic and DaVita are teaming up to launch a new kidney-focused medical device company. Based on the press release comments, NewCo will focus on developing new types of kidney failure therapies as well as work on new home-based products.

Medtronic is contributing its renal-related assets to the JV including its current product portfolio and all of its R&D. The press release makes no note of DaVita’s contribution, leading me to believe that the firm forked up cash to create equal equity stakes in the new JV. Finally, NewCo will be operated as a separate company – independent operations from either parent organization.

Madden’s Musing: I mean, these are two powerhouses teaming up, so this news is pretty notable. This JV is the biggest kidney care news in a minute after the $2.4 billion value-based kidney merger between Fresenius, InterWell, and Cricket Health was announced a couple of months ago. Also, don’t forget about the Strive partnership with Bon Secours.

As CMS experiments with alternative payment models in the kidney space, I have to wonder if this partnership was somewhat of a defensive play to combat the Outset Medical’s of the world and its Tablo Hemodialysis product. Regardless, the kidney care space has seen a fair bit of activity over the past several months from major players involved in the space. Stay tuned.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Resources:

- DaVita – Medtronic press release

- Fresenius – InterWell – Cricket merger announcement

- Strive – Bon Secours partnership announcement

Market Movers

Top 3: GoHealth, AmWell, Talkspace

Bottom 3: Augmedix, Oscar, Cano

Big gains for most health tech & services this firms this week as the market rallied after 7 straight down weeks. SPACs and IPOs are at an all-time low. For the first time in 2 years, no SPAC or IPO took place last week. Makes me wonder when the market will stabilize enough to see some more public action in the healthcare sector.

Babylon and Bright Health announced a partnership this week, expanding Babylon’s access to 19,000 more Medicare members. Under the agreement, Babylon using Neue Health to access direct contracting members.

Trinity Health’s home health segment acquired Above & Beyond Home Health & Hospice. The article linked here from Hospice News does a great job of going into the recent M&A activity in the space from major players.

In a move that surprises nobody, Walmart and CVS have halted filling prescriptions for controlled substances by Cerebral and Done. They’re not about to be on the hook for another opioid settlement.

A key Senate group is looking to potentially relax or axe altogether the in-person requirement for virtual mental health services. This change would mean that seniors would not have to see an in-person provider every 6 months to continue online therapy. While this policy change seems like a no-brainer, it’s VERY notable that Congress is making moves to address telehealth regulations.

UPMC released its Q1 financial results – the Pennsylvania giant reported $50 million in operating margin and experienced similar struggles to other operators in expense inflation from labor and supplies.

Physician compensation trends from MGMA note that compensation is on the rise again in 2022, confirming the trend of outpatient utilization returning to normal and growing from here (assuming no more shutdowns).

Miscellaneous Maddenings

- Some guy threw ice cream at the Mona Lisa! What the hell. I mean I always thought the painting was overrated but this is just over the top.

- Good news – the recent monkeypox outbreak will likely NOT turn into a pandemic. I’m good for just one pandemic in my lifetime. What do yall think?

- The Iowa women’s golf state championship had a ridiculous pin location on…the 18th hole!! The average score was a QUAD bogey. Reporters on the scene witnessed multiple 10 putts. 10. Putts.

Hospitalogy Top Reads

- Nikhil wrote another banger about health tech startups, overpromising, and trying to understand how much is too much when getting started.

- This was a good look into Maryland’s all-payer program and how the structure has resulted in a lot of positive outcomes by shifting away from fee-for-service arrangements.

- I enjoyed this inside look at the BHSH merger (Beaumont and Spectrum Health) and the FTC’s involvement. It’s fascinating the steps that the two players took to make sure the merger made it to the finish line. I have GOT to get my hands on Beaumont’s legal bill over the past few years.

- This was a great, long read from Robert Pearl and Brian Wayling in HBR on how they believe the telehealth era is JUST getting started.

- As the Obamacare subsidies in the American Rescue Plan are set to expire, it’s estimated that healthcare spending could drop by as much as $11.4 billion. Which makes me wonder – is it worth it to continue offering these subsidies? Could money be better spent in the HC system elsewhere?

Want to get these in your inbox to never miss an edition? Subscribe to Hospitalogy today!