02 June 2022 | FinTech

Infrastructure Inception

By Alex Johnson

This essay is about Keith Baldwin, a 44-year-old surgeon who lives outside New Bedford, Mass. This essay is about how Dr. Baldwin lost more than 90% of the $177,000 that he had saved over the past decade. This essay is about the house that Dr. Baldwin was planning to buy with that money. And this essay is about Dr. Baldwin’s children, whose college funds he is now frantically saving money for because, in his words, “I don’t want to punish our kids for the mistake I made.”

However, before we can tell Dr. Baldwin’s story, we need to take a few steps back.

What? → How? → When?

One challenge in building financial products is striking a balance between the elemental nature of the product being built and the natural desire to imbue that product with as much competitive differentiation as possible.

Think of it in terms of levels.

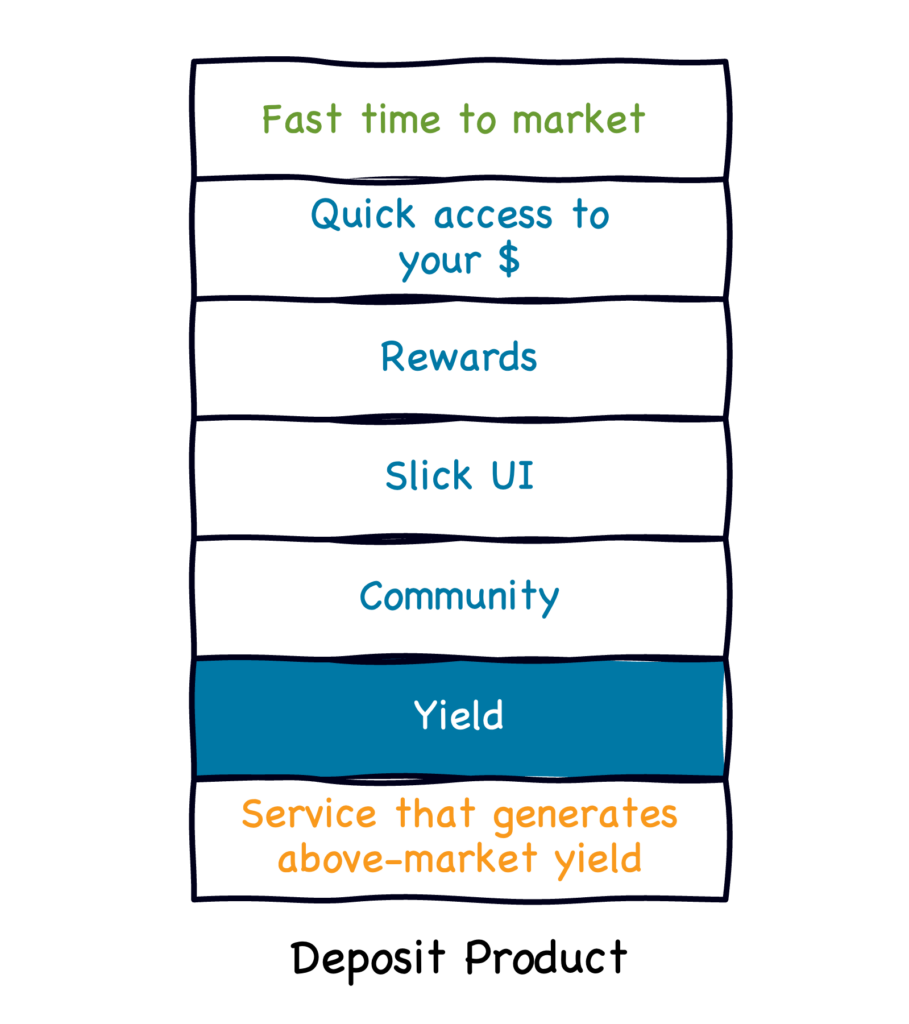

At a foundational level, most financial products within the same product category look about the same. There’s a good reason for this. Product categories tend to revolve around a single ‘job to be done’. In deposits, the job is giving customers a safe and accessible place to keep their money. In investing, it’s generating a risk-adjusted yield. In lending, it’s providing upfront capital to facilitate the acquisition of a good or service.

The competitive differentiation for financial products usually comes from all the bells and whistles that get layered on top of that foundation. These can be superficial (like a slick UI) or more utility-driven (2-day early access to direct deposits), but generally they are all stacked on top of a relatively stable (and, quite frankly, boring) base layer.

But, of course, this can be quite frustrating to product developers who want to maximize the value and differentiation of their products and frequently chafe at the constraints imposed by those foundational levels.

One way around this frustration is to enable those product developers to move as fast as possible. A prominent fintech VC once told me that, by far, the most important thing he looks for in fintech companies is the speed at which they ship code. The idea is that product velocity compounds and, thus, the ability to consistently ship code fast creates a widening competitive advantage over time (even if the foundation of the product remains relatively unchanged). This is well known in the world of SaaS, but is still under appreciated as a source of value in financial services.

Ramp — the corporate credit card provider currently valued at a staggering $8.1 billion — provides a good example.

On its face, a fintech company offering a corporate credit card isn’t the most exciting opportunity. However, the value of fintech companies like Ramp (from their investors’ perspective) isn’t in the total size of the market they are going after, but rather in the relative difference in product velocity between the fintech companies and the incumbent banks they are trying to disrupt. In other words, Ramp’s value is derived, primarily, from the fact that it ships software at a much faster pace than American Express.

Here’s Ramp’s primary investor, who has placed an astonishing amount of faith and capital in it, explaining the investment decision to Packy McCormick:

Keith Rabois, the Founders Fund partner who’s led or invested in every Ramp round over the past three years, told me, “Ramp’s product velocity is absolutely unprecedented in my 21 years working with technology businesses.”

A useful framework for thinking about product velocity is What?→How?→When?

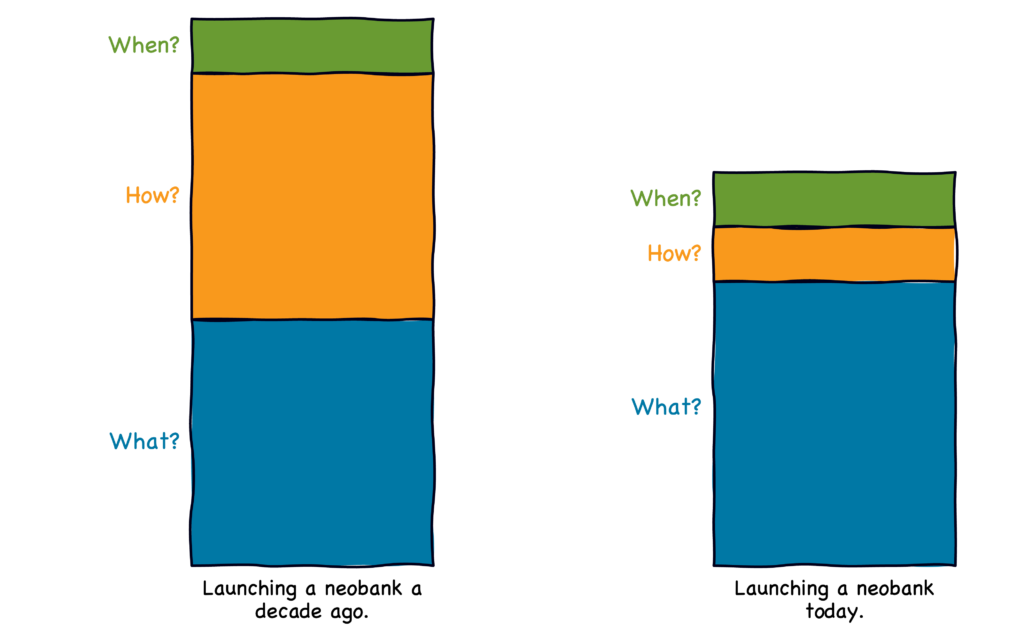

The idea is to compress the time between designing a new product or product feature (What?) and the moment it is released to the market (When?) by introducing as much efficiency into the process of building and testing that product or product feature (How?) as possible.

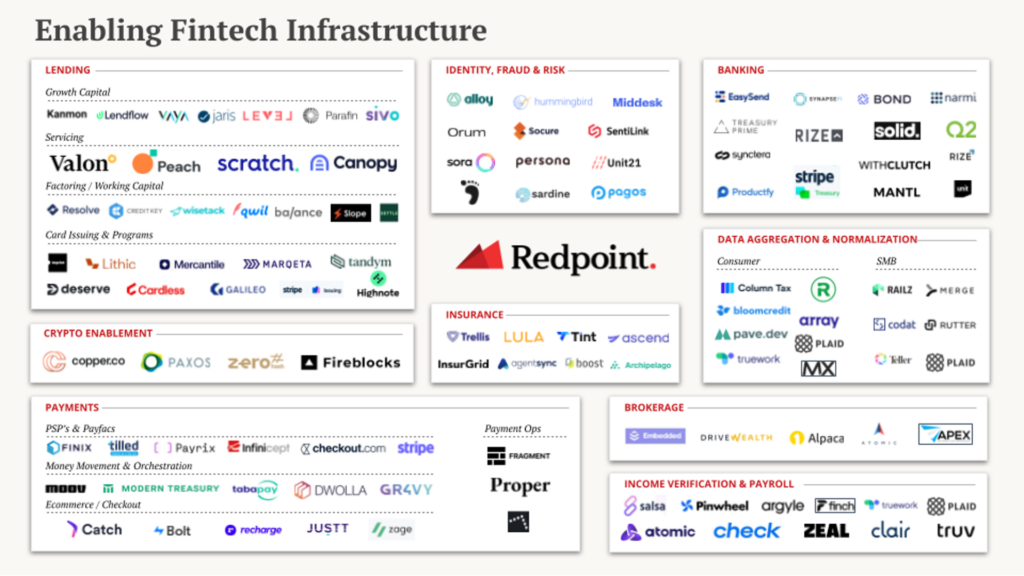

The great thing for fintech companies building today is that they have access to an ever-growing array of product development infrastructure — designed with the express purpose of eliminating as much of the How? as possible — that their predecessors would have killed for.

Neobanks provide a good example.

It took Simple, one of the OG neobanks, three years and millions of dollars to get their product to market. Today, a deposit-focused neobank product (with many more bells and whistles) could be designed and launched in a few weeks for less than $100,000.

This is, I think, generally a good thing for the industry. Accelerating the pace of innovation delivers more choices for consumers and puts pressure on every company in the market to keep up.

However, it also introduces a couple of risks.

First, when you move faster you increase the odds of making mistakes. The recent history of fintech is littered with examples of consumer-facing companies speeding through the product development process (with the help of copious fintech infrastructure) only to realize, after getting to market, that they may have made some less-than-optimal decisions along the way. One common example — neobanks running into scaling and compliance issues with their partner banks.

These mistakes are usually fairly minor and, while annoying for all involved, don’t typically derail the fintech company or introduce catastrophic outcomes for the end customers.

But there’s a second, more pernicious risk that I’m starting to see crop up.

Infrastructure Inception

Remember when I said that the elemental nature of financial product categories introduces constraints that sometimes chafe fintech product developers?

It’s important to understand why that is.

Great product developers empathize deeply with their target customers. They feel their customers’ pain and they develop an almost pathological dislike of the incumbent products and systems that they perceive to be causing it.

Here’s a hypothetical example.

Let’s say you’re building a deposit product for young, lower-income consumers who are living paycheck to paycheck and struggling to save. You are frustrated, on your customers’ behalf, that rising inflation is further straining their cashflow while the big banks are refusing to pay more than 0.06% APY on savings. How is your customer supposed to ever accumulate any wealth? Why, you wonder, can’t your startup offer a deposit product with a substantially higher interest rate? After all, your company is significantly more operationally efficient than the big banks are? Why can’t you pass those cost savings along to your customers in the form of a higher interest rate? Why can’t the financial industry move away from using all these middlemen and focus on delivering the maximum value directly to the end customer?

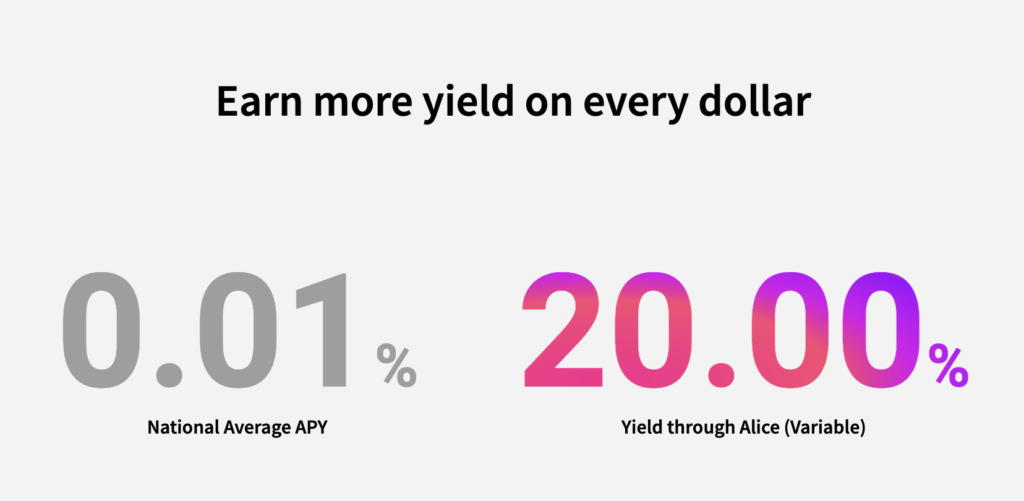

Then you hear about a new infrastructure provider that offers a service that can return 15% APY interest (30x higher than a traditional bank can offer!) on your customers’ deposits, with no gimmicky lockup periods or caps on balances. The service is available right now and can be easily integrated via an SDK.

You think to yourself, ‘that sounds like EXACTLY what my customers need!’ And yeah, you know that using this product will take you down a slightly different development path than some of your competitors; it’ll introduce a few new wrinkles that will need to be ironed out, but that’s a feature not a bug! After all, you’re trying to solve your customers’ problems and maximize your competitive differentiation. Why wouldn’t you build your entire product around this new yield-generating protocol?

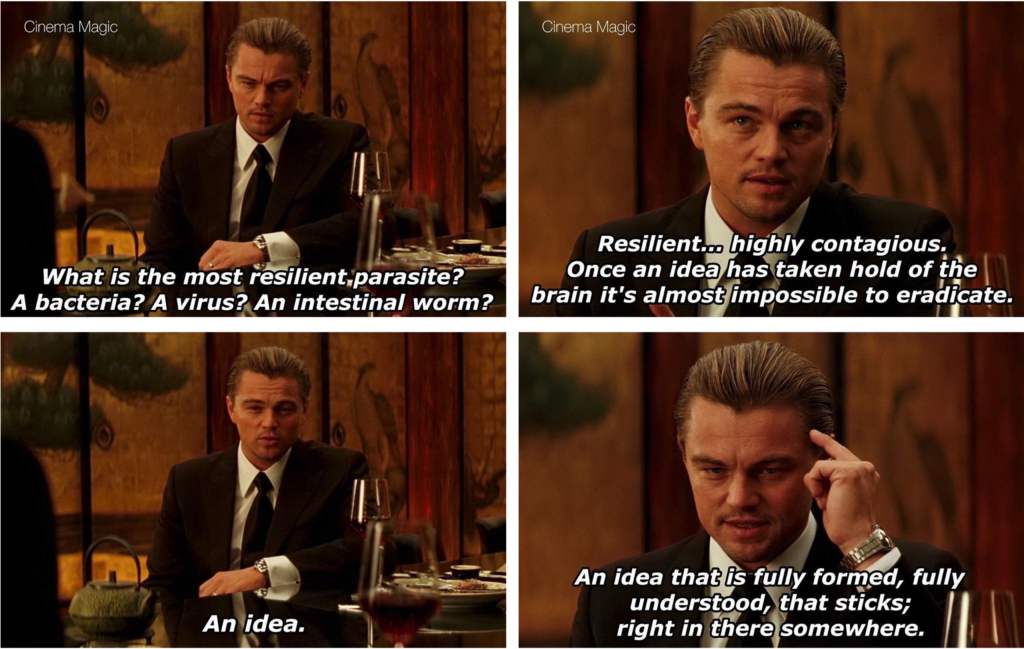

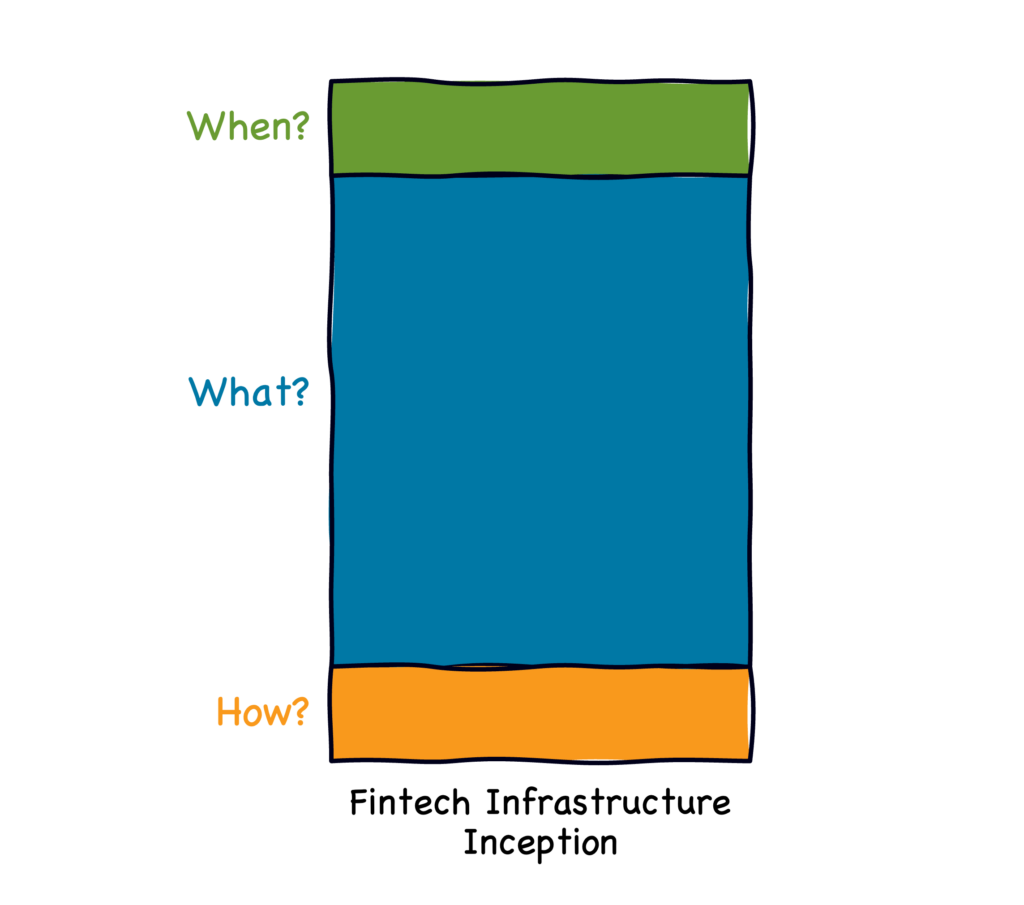

I call this infrastructure inception.

A simple idea about what some new piece of fintech infrastructure can do becomes lodged so deeply in the brain of a product developer that it comes to define for them, at a foundational level, what the product should be.

In other words, the How? moves down the stack and pre-empts the What?

This is really important because that idea can fundamentally reshape the way in which a product developer views not only their product, but the entire category in which that product sits.

Returning to the earlier hypothetical, a product developer that realizes that they can provide substantially higher interest rates for their customers’ deposits by cutting out those pesky financial services middlemen using a new yield-generating protocol might come to see generating yield as the most foundationally-important characteristic for all deposit products.

And that can cause significant problems, as Keith Baldwin recently discovered.

Anchor Protocol

As you might have guessed by this point, Dr. Baldwin lost the vast majority of his savings when the algorithmic stablecoin TerraUSD crashed and brought down Anchor Protocol, a yield-generating service built on top of Terra, with it:

Last year he [Keith Baldwin] took his savings and bought USD Coin, putting it in a crypto account that paid a 9% annual yield.

In April, he moved it into a pseudo-savings account powered by TerraUSD that offered 15%. More than 90% of his savings vanished in a few days when TerraUSD lost its peg to the dollar. Dr. Baldwin said he didn’t know that Stablegains, the startup that managed the account, was converting his USD Coin holdings into TerraUSD.

When Dr. Baldwin learned that TerraUSD’s troubles were threatening his nest egg, he scrambled to withdraw his funds from Stablegains. Hours ticked by as the site processed the transfer. By the time they landed at Dr. Baldwin’s newly created account at the Kraken crypto exchange, the coin was trading at just 14 cents.

I’m not going to spend any words trying to explain how TerraUSD and its sister token Luna worked, because it’s both incredibly complex and incredibly stupid at the same time (Patrick McKenzie already leapt on that grenade and wrote an excellent primer on stablecoins, which you should read).

The only bit that’s important to understand is that Terraform Labs (the creator of TerraUSD and Luna) created Anchor Protocol as a growth hacking tool to subsidize the purchase of TerraUSD. Any company that wanted to could integrate the Anchor Earn SDK and use it to convert their customers’ money into TerraUSD, collect the 19.5% APY yields offered as an incentive by Terraform Labs, and pass some or all of that yield back to their customers as ‘interest on their deposits’.

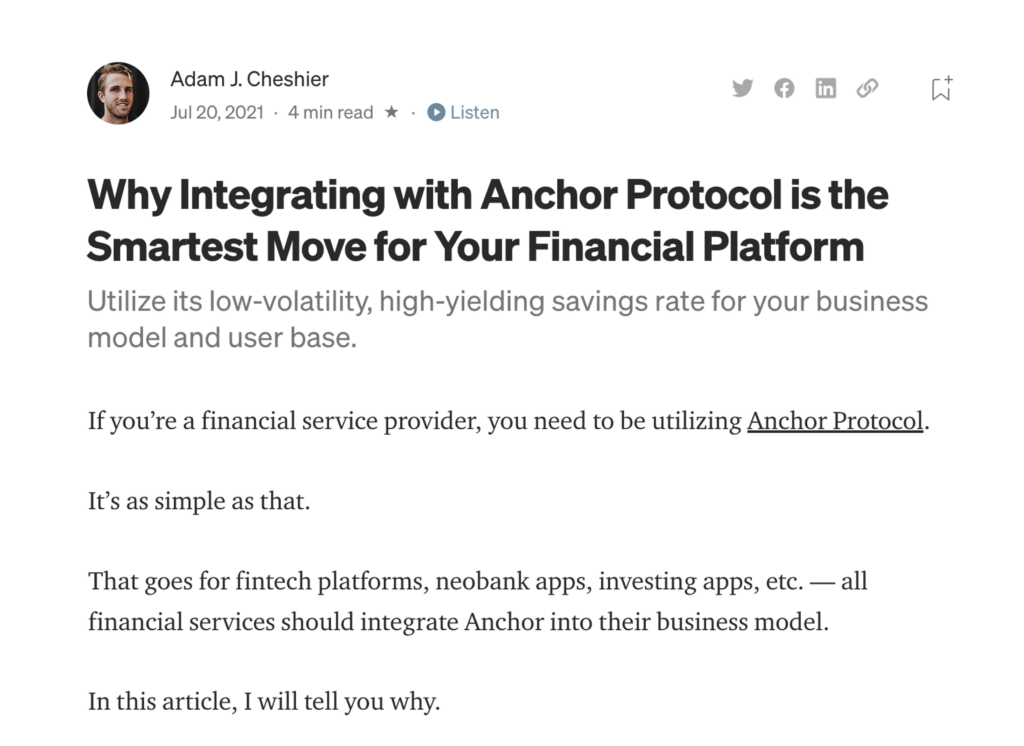

Anchor Protocol was presented to the fintech and DeFi companies as a new piece of infrastructure that could and should be incorporated into their consumer banking products.

It was presented as such an obviously great idea that you’d have to be a moron to not leverage it.

Seriously, look at this garbage:

Thankfully, Mr. Cheshier’s clumsy attempt at inception didn’t work with any of the traditional banks or large, established fintech companies.

However, the idea did take root in a generation of newer startups.

Who Did Anchor Drag Down?

There were more than 250,000 cryptocurrency addresses that had deposited TerraUSD to Anchor Protocol before TerraUSD crashed. The top 1,000 or so of those wallets owned more than 80% of the total supply of TerraUSD, which means that the remaining 249,000+ of those wallets likely weren’t owned by crypto whales, but rather by ordinary consumers like Dr. Baldwin who used consumer-facing DeFi ‘savings apps’ to invest in TerraUSD.

These are just a few of the DeFi ‘savings apps’ that were leveraging Anchor Protocol to generate yield:

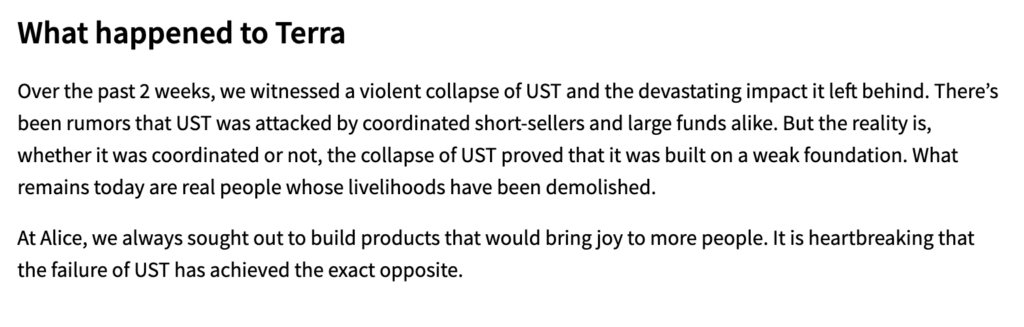

It’s worth noting that a few of these companies have been honest and contrite in dealing with their customers in the aftermath of the Terra collapse. Alice is a good example:

While others have been, allegedly, less forthright:

Stablegains customers are now alleging they were scammed – misled by marketing that suggested the company was better diversified, when in fact, it had deployed all investor funds in Anchor Protocol, the now-infamous savings app on Terra..

As the UST stablecoin collapsed last week, Stablegains said its 4,878 customers would likely lose most of the $47 million they had entrusted to the company.

In all cases, however, it turns out that building your consumer-facing deposit product around an asset that was, by its very nature, at high risk of suffering something called a death spiral was a really bad idea.

Where Do We Go From Here?

Honestly, I don’t know.

It’s concerning to me that Anchor Protocol got as much traction as it did. Enough to drive more than 250,000 crypto wallets to interact with it.

It’s concerning to me that the traction that Anchor Protocol saw was enabled by prominent accelerators like Y Combinator and investors like Sequoia, which each backed multiple of the DeFi ‘savings apps’ included on the wall of shame pictured above.

It’s concerning to me that this idea of ‘yield above all else’ has so deeply embedded itself in the fintech/DeFi industry’s collective brain that a consumer-facing financial services company that has raised nearly $100 million to create a unified product for spending, saving, and earning money feels comfortable arguing (even still, in the wake of the Terra collapse) that people don’t need FDIC insurance.

And it’s concerning to me that Chime can get in trouble for calling itself a bank, but it’s apparently fine for consumer-facing DeFi apps to toss around terms like ‘savings’ and ‘deposits’ on their websites and equate their not-in-any-way-a-legitimate-savings-account products with traditional bank savings accounts?

I don’t know how we, as an industry, start to address these concerns.

All I know is that Keith Baldwin deserves better.