30 May 2022 | FinTech

Reputational Risk

By Alex Johnson

3 Fintech News Stories

#1: Reputational Risk

What happened?

Adventure Now, Pay Later (or, more accurately, BNPL for guns) is apparently a thing:

If you visit the website for gun manufacturer Daniel Defense, the first thing you’ll see is a pop-up message offering condolences to the victims of a gunman who killed 21 people at a school in Uvalde, Texas. Of those killed, 19 were children. “We are deeply saddened by the tragic events in Texas this week,” it reads. “It is our understanding that the firearm used in the attack was manufactured by Daniel Defense. We will cooperate with all federal, state and local law enforcement authorities in their investigations. We will keep the families of the victims and the entire Uvalde community in our thoughts and prayers.”

If you scroll down and click on a panel promoting a financing option from the company, you’ll get a different message: “Enter to win $15K when you buy now, pay later with Credova,” with an explanation of how to enroll in the sweepstakes in three easy steps.

The partnership with Credova, a Bozeman, Mon.-based consumer finance company that offers installment plans on firearms and goods tied to outdoor activities, is illustrative of how far-reaching so-called “buy now, pay later” programs have become in retail sales. Credova says it did not finance the purchase by the killer in Uvalde. Daniel declined to comment.

So what?

I wrote recently about why certain customer segments are underbanked. Some customer segments aren’t legally allowed to be served by banks. Some customer segments are difficult for banks to make money from. And some customer segments are reputationally risky.

Reputational risk, which banks are required to actively monitor and mitigate, is tricky to define. At the most basic level, reputational risk is the risk that people will be mad at you (the bank) based on the divergence between what you believe is morally right (and therefore OK to support with your products and services) and what society at large believes is morally right.

The challenge, of course, is that what people think is morally right is always changing. Examples abound — cannabis, gambling, sex work — of industries that society has changed (or is changing) its moral opinion on.

In the case of firearms, most banks and BNPL companies steer clear. And given the continued irresponsibility of the gun industry — see the details of this recently settled lawsuit for one example — I’d personally like to see it become even more reputationally risky for companies like Sezzle, Credova, and Cornerstone Bank in North Dakota (the bank partner behind Credova) to serve this industry.

#2: Pebble for Your Thoughts?

What happened?

Pebble, a DeFi-based neobank, came out of stealth and announced a seed round:

The company, a participant in Y Combinator’s Winter 2022 cohort, came out of stealth and announced its $6.2 million seed round today. Investors in the round include Y Combinator, LightShed Ventures, Eniac Ventures, Global Founders Capital, Montage Ventures and Soma Capital, as well as angel investors Odell Beckham Jr., musician Matthew Bellamy, Quantstamp CEO Richard Ma and others.

So what?

If the name Pebble sounds familiar, congrats! You spend way too much time enjoying fintech Twitter drama (as I do). Eco, a company that has been offering a product very similar to the one Pebble just announced, accused Pebble of plagiarizing its product via “copy-and-pasting, immaturity, lying, and espionage.”

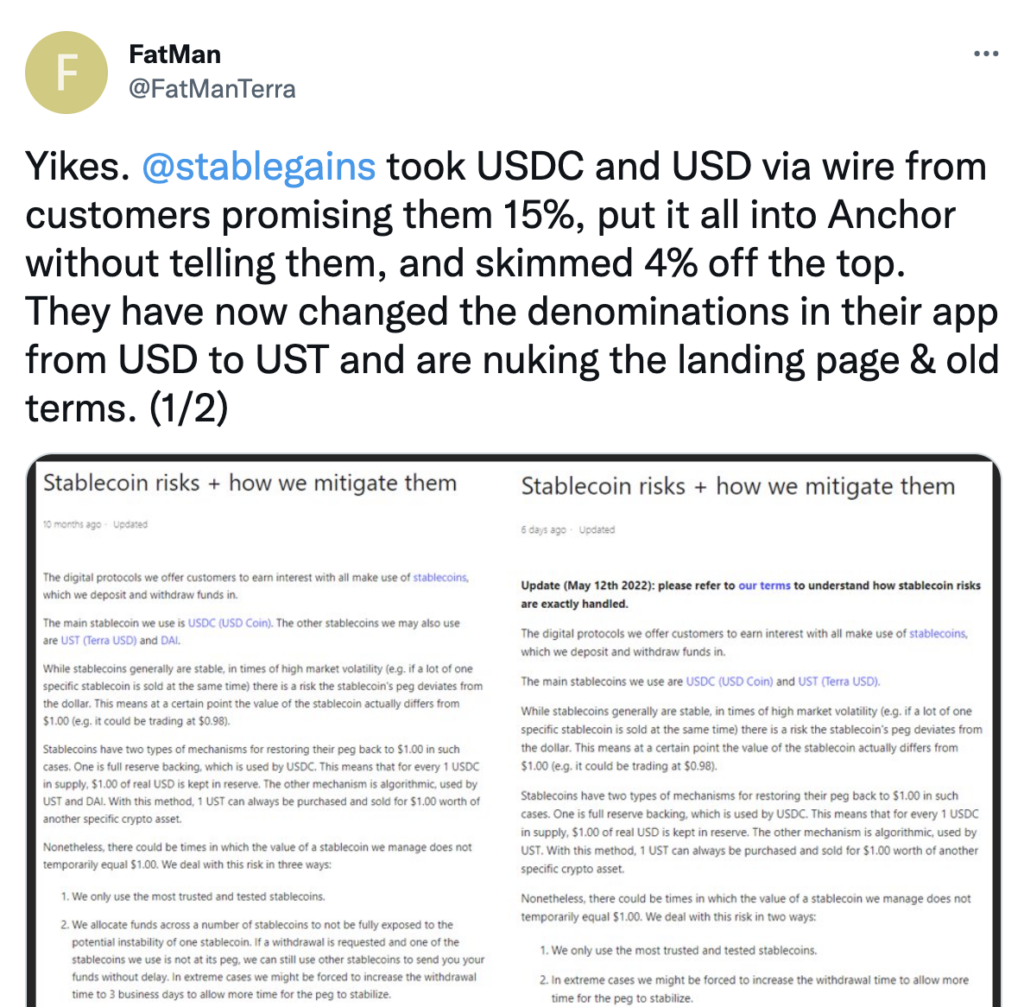

I won’t attempt to judge the merits of Eco’s accusation here. All I’ll say is that I find it a bit weird to see two companies fighting over the ownership of an idea for a stablecoin-powered deposit product while we are all still standing in front of the smoldering wreckage that is Terra and Anchor:

#3: Wait! Come back!

What happened?

Robinhood is planning to release a web3 wallet:

Robinhood is taking the plunge in the nascent world of web3, announcing a new wallet application that allows customers to access non-fungible token markets, decentralized exchanges and swap tokens.

The new wallet will be a standalone application from Robinhood’s existing stock and crypto platform and function similarly to other non-custodial wallets like MetaMask, the US brokerage announced at crypto conference Permissionless on Tuesday. Still, Robinhood is hoping that the sleek and intuitive design of its new app will make engaging with web3 destinations less cumbersome for newbies. The firm plans to fully roll-out the product to its entire user base by the end of the year.

So what?

Robinhood’s business model is, essentially, transforming customer engagement in speculative financial services activities into revenue. Succeeding with this business model requires that Robinhood always be the app where people are going to engage in these super fun financial activities.

The problem is, since the great Dogecoin party of Q2 2021, Robinhood hasn’t hosted a lot of fun parties. Meme stocks fizzled out and crypto currency trading on centralized exchanges slowly became the boring, semi-responsible older sibling to NFT investing and yield farming.

Robinhood launching a web3 wallet to take on Metamask, well after Coinbase and a whole host of smaller, UX-focused companies like Rainbow, feels a bit like the high school student who briefly enjoyed a brief surge in popularity and is now chasing frantically after the cool kids.

2 Things To Read And/Or Listen To

#1: Fintech Web3 Wallets (by Simon Taylor, Fintech Brain Food) 📚

My viewpoint on Robinhood’s web3 wallet product is, admittedly, a bit cynical. For a more hopeful view on the opportunity for fintech (and big tech) in web3 wallets, I’d recommend reading Simon’s latest Fintech Brainfood newsletter. In it, he asks “What if web3 wallets are your new home on the internet? Your digital backpack to access applications, your personal balance sheet, and buy a coffee becomes a critical piece of your digital life. The new players who get to own this space become not only the banks of the internet but the next big tech players aggregating data on behalf of users and managing services. This is a generational opportunity.”

#2: Time to Money as a Competitive Advantage (by Ayokunle Omojola) 📚

This is a wonderful essay. Ayo helped build Cash App and he draws on that experience to discuss the value of speeding up time to money for lower income consumers, “if you’re rich this doesn’t matter. If you live paycheck to paycheck, time to money matters a lot. Living paycheck to paycheck means you likely have a liquidity problem that can quickly turn into a solvency problem.”

In the essay, Ayo discusses two areas where time to money remains unsolved in the U.S. — real-time tax withholding and real-time paychecks. He makes a particularly compelling case for the value of real-time paychecks and spells out (in really helpful detail) how this service could be enabled by a combination of capabilities provided by banks/neobanks, payroll API companies, and payroll providers.

1 Question To Ponder

Given that Varo’s decision to get a bank charter is looking like a strategic mistake and that later-stage fintech companies have much less access to venture capital today than they did 12 months ago, how many fintech companies will we see obtain bank charters over the next 5 years?

DM me on Twitter or LinkedIn if you have any thoughts on this question.