Liquidity on the Back End, Fragmentation on the Front End

In my first essay on this subject, I wrote that the mortgage servicing process is “the biggest missed opportunity in financial services”.

Why?

Because I had recently gone through the home buying experience and I couldn’t believe how absurd it was. Here’s my description of the experience, from the customer’s POV:

You close on your mortgage and buy the house of your dreams. Your lender tells you that in the next month or two you’ll find out the name of the company that you will be making payments to for the next 30 years.

You’ll find out when they send you a letter in the mail! So make sure to watch out for generic, plain-looking letters from companies you’ve never heard of. One of them is your new mortgage servicer telling you where to send your payments.

In that letter is a set of instructions for creating an account and setting up your payments. It will require you to wade through the oldest still-functioning websites in the financial services industry and tussle with mobile apps that Apple and Google, in good conscience, never should have allowed into their app stores. You may even need to send a fax.

Once all of this is set up, guess what? Your mortgage servicer can change at any time! You just get another generic letter mailed to you informing you that the MSR associated with your loan has been sold and then yet another letter introducing you to your new servicer with instructions for how you can *easily* set up your new account and schedule your payments.

Crazy, right? However, what’s critical to understand is that it’s also not an accident that the modern mortgage servicing experience works the way that it does. It’s not the result of some random mutation of the financial services industry. Rather, it’s the direct result of decades of intentional design decisions made by the primary stakeholders in the U.S. mortgage industry.

Let’s run through the history real quick, because it’s important to understand:

- The overarching policy goal that has guided the development of the American mortgage is simple — maximize home ownership. Stretching all the way back to Thomas Jefferson, home ownership has been seen as a critical attribute in the makeup of a flourishing society. In pursuit of this goal, the U.S. government introduced two big innovations …

- First, in the wake of the Great Depression, the U.S. government bought up a bunch of defaulted mortgages and converted them from variable, short-term interest-only loans into (roughly speaking) the product that we are familiar with today — fixed-rate, 20-year, fully-amortizing mortgages. This was a big deal. The structure of American mortgages is unique in the world. It is an incredibly customer-friendly design for a loan product, which brings us to the second innovation …

- While long-term, fixed-rate, fully-amortizing mortgages are great for consumers, they’re terrible for lenders. And so the government created Fannie Mae. Its purpose was to buy mortgages from lenders and sell them to investors in the secondary mortgage market, thereby injecting liquidity back into lenders and allowing them to redeploy that capital as new mortgage loans.

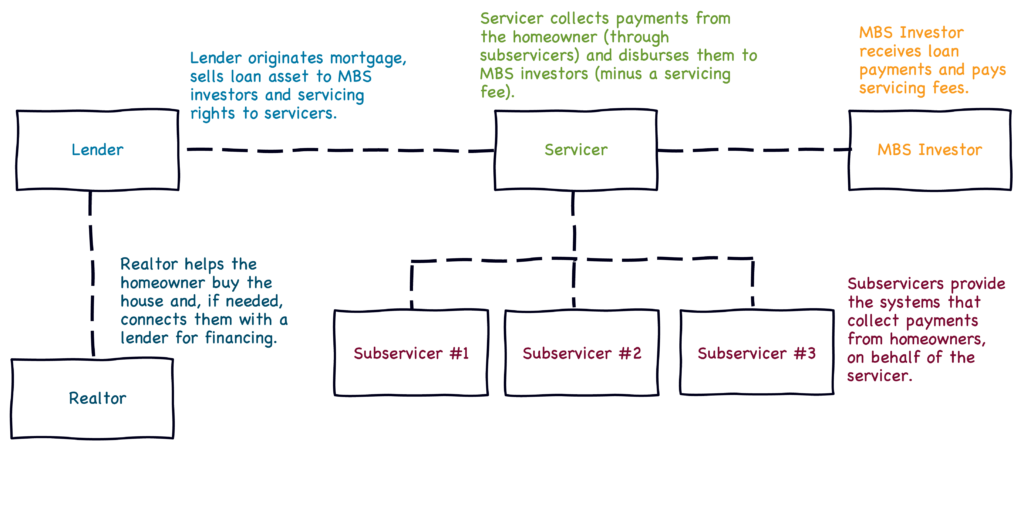

These two innovations produced the mortgage industry that we have today — a highly liquid market, populated by a number of different, hyper-specialized participants — realtors, bank and non-bank lenders, mortgage-backed securities (MBS) investors, mortgage servicers, and subservicers. It looks and works something like this:

The experience of acquiring and managing a mortgage feels fragmented and chaotic to U.S. consumers because it was designed that way. The U.S. mortgage industry was designed to optimize liquidity by bringing as many different participants into the market as possible because that was the only way for policymakers to achieve their end goal — maximum home ownership.

Thomas Jefferson simply never foresaw the mess he’d be creating for homeowners.

How Could We Improve the Mortgage Servicing Experience?

Now that we have a firmer grasp on why the mortgage servicing experience is the way that it is, we can ask the important question — how do we make it better?

There are several avenues for making improvements to the experience:

- Retain the servicing rights. When lenders sell mortgage loans, they typically are selling two different things — the loan asset itself (this gets bought, packaged, and resold as an MBS) and the right to collect payments for those loans in exchange for a fee (the MSR). Lenders typically don’t have the capital to hang on to the assets themselves (mortgage lending, at scale, is incredibly capital intensive), but they could hang on to the servicing rights and create a slightly less fragmented experience for the end customer. A few large and forward-thinking mortgage lenders, like Rocket Mortgage, are already doing this.

- Modernize mortgage servicing software. The software that facilitates payments on the $12 trillion worth of mortgage debt outstanding in the U.S. today is old, like frighteningly, operating-on-green-screens-that-were-all-the-rage-in-the-1960s old. An obvious answer to making the mortgage servicing experience better is to build better, more modern mortgage servicing software. There are a number of fintech startups working on this.

Both approaches have their merits and can help push us in the right direction, but neither approach is a slam dunk.

There’s a reason that most lenders don’t like to do mortgage servicing themselves. It’s incredibly complex, highly regulated, and has a very low fault tolerance. It often involves dealing with customers that are in difficult financial situations. It’s an obvious task to outsource.

Join Fintech Takes, Your One-Stop-Shop for Navigating the Fintech Universe.

Over 36,000 professionals get free emails every Monday & Thursday with highly-informed, easy-to-read analysis & insights.

No spam. Unsubscribe any time.

And building better mortgage servicing software runs up against similar challenges; the fintech founders that I have spoken with who have gone down this path have reported that it was much harder to build a compliant, highly scalable servicing system than they had thought and, once the system was built, competing head to head with incumbent subservicers and servicing software providers made competing with banks and core banking vendors look easy by comparison.

More fundamentally, my hangup with these approaches is that, even if they were wildly successful, they would only lead to incremental improvements in the homeowners’ experience … and that’s not good enough for me.

Mortgage servicing has always been seen as a back office cost center; a set of functions that needed to be streamlined as much as possible and then left alone. In order to truly transform the homeownership experience, we need to flip the mortgage servicing business model on its head and get market stakeholders to see servicing for what it actually is – the mother of all customer engagement opportunities.

The Home Ownership Engagement Opportunity … And Challenge

It’s not difficult to imagine what a more valuable home ownership experience, built on top of the mortgage servicing process, might theoretically look like. The average length of a mortgage loan in the U.S. — after you factor in home sales, refinances, early loan payoffs, and foreclosures — is roughly 7 years. 7 years of consumers logging into your platform to pay their bill (60% of mortgage holders log in to their servicing platform at least once every 90 days, according to Haven). 7 years to engage with consumers and uncover opportunities to help them better manage the most valuable and yet annoying-to-maintain financial asset that they will ever own. 7 years to cross-sell those consumers solutions, everything from home equity loans to insurance to bill negotiation services.

Just stop and picture what a company like Amazon would do with an asset like that.

The challenge isn’t imagining such an experience. The challenge is bringing it to life.

Why?

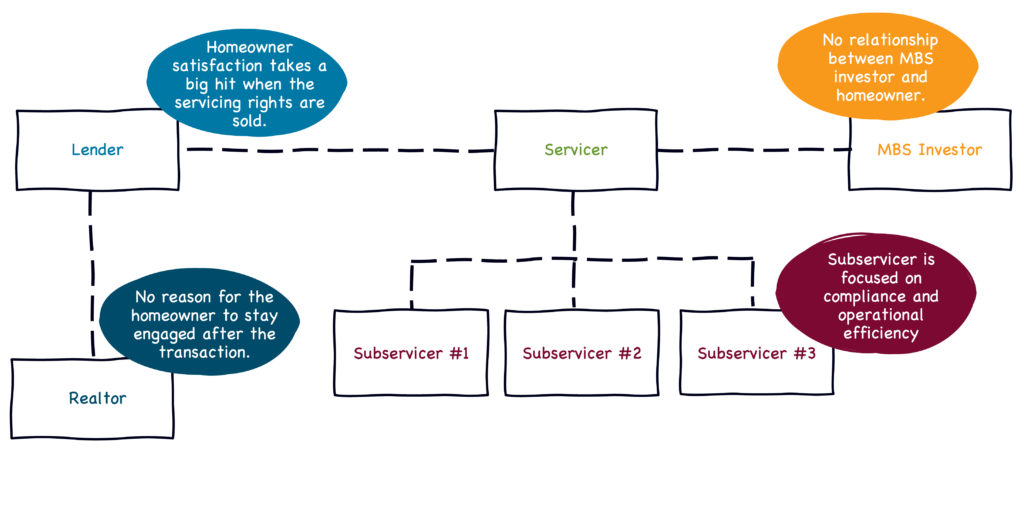

It comes back to the fragmented nature of the mortgage industry. That fragmentation serves a purpose — creating an efficient and highly liquid market — but it also warps the incentives between most market participants and the homeowner to create a long-term, highly-engaged relationship:

There just aren’t a lot of good options:

- MBS investors are an obvious no. They don’t have a relationship with the homeowners whose mortgages they’ve invested in.

- Lenders are a good option … if they hang on to the servicing rights. Most don’t, however, which breaks the relationship with the homeowners.

- Realtors would ideally like to maintain some type of relationship, but there’s really no incentive for the homeowner (at least until they are ready to buy a new home).

- Subservicers are the most obvious candidate. They are providing the payment systems that homeowners are interacting with to pay their mortgages. The problem is that subservicers care, first and foremost, about operational efficiency. Subservicing is a low margin business. In order to make money at it, you have to do it efficiently at a massive scale. Consequently, there is very little appetite among subservicers to invest in any technology or business initiative that doesn’t improve scalability or efficiency. Or, as a former executive at one of the largest mortgage subservicers in the country told me, “any project that wasn’t about cutting costs was a no go.”

There’s really only one option; one stakeholder that has the incentive to transform the home ownership experience and the position in the ecosystem to implement that transformation — the holder of the MSR asset – the servicers.

The Key to Unlocking a Better Home Ownership Experience

Let’s answer some questions about MSRs and servicers.

Q: First of all, what are MSRs and who invests in them?

A: Mortgage servicing rights, or MSRs, are the contractual right to collect monthly payments from homeowners, hold that money until it is due to investors and insurers, and finally disburse the funds and collect servicing fees.

Servicers – which I am defining in this essay as any company that owns MSRs – raise hundreds of millions from LPs and deploy funds by purchasing MSRs in the open market, hoping to extract 8 – 9% unlevered yield on these assets. And if you crank up the leverage, even modest improvements in asset value can have a substantial impact on return on equity.

Q: Why are they valuable?

A: MSRs generate revenue for servicers in a few different ways. Servicing fees are the big one. Servicers are paid a per-payment fee for collecting, holding, and disbursing mortgage payments. While they are holding the mortgage payment funds in escrow, servicers can also collect interest on those deposits. And because servicers own the relationship with the homeowner (and, in fact, are the only ones in the real estate market that have long-term relationships with homeowners), they can also generate revenue by cross-selling them additional products or services.

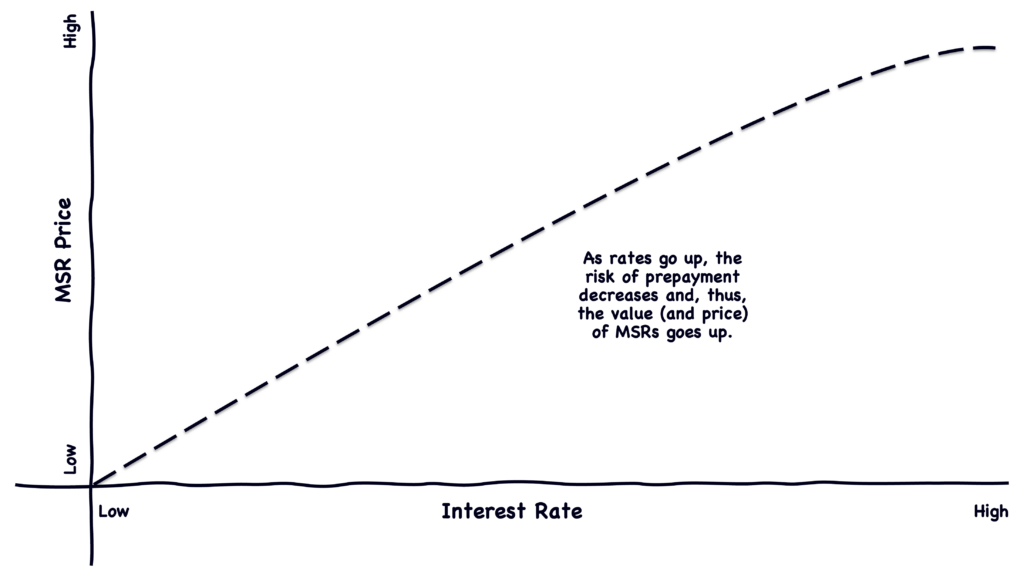

Q: How does the value of MSRs change in different macroeconomic conditions?

A: The big factor that impacts the value of MSRs is prepayment risk, which is the risk that a homeowner pays off their mortgage earlier than expected, thus cutting short the servicer’s window for earning revenue from the asset. Prepayment risk is highest in low-rate environments because mortgage homeowners are most likely to refinance their loans (and thus pay off their original loans) when interest rates are low or falling. Conversely, when rates are rising, prepayment risk decreases and the value (and price) of MSRs surge.

Editor’s note – the above explanation of factors that impact the value of MSRs is a massive oversimplification and ignores several important nuances in regards to retention, cross-sell, and negative convexity. If you would like to dive into these nuances in depth, let me know and I will put you in touch with the experts.

Q: Why are servicers well positioned to transform the home ownership experience?

A: A few reasons:

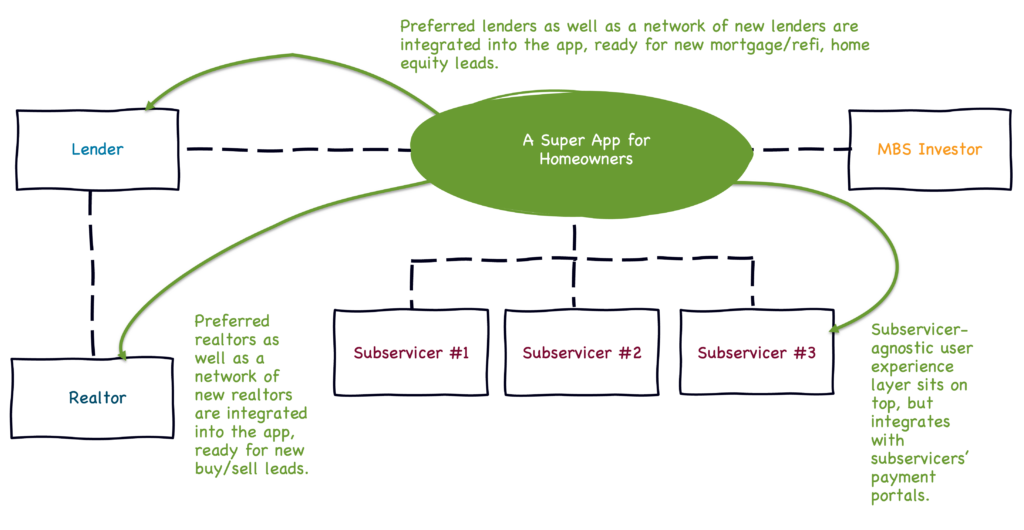

- They are, ultimately, responsible for homeowners’ mortgage servicing experiences. While the subservicer payment system is what the homeowner typically interacts with (and frequently complains about), the servicer is the one that picks the subservicer(s). They own the experience layer.

- They need to retain homeowners as long as possible. The longer that the homeowner sticks with their loan, the more money that the servicer makes. This gives servicers a unique incentive to care about the quality of the homeowner’s servicing experience and it’s why servicers typically like to stay subservicer agnostic — they want the flexibility to work with the subservicers that deliver the best combination of cost and value.

- They have the ability to cross-sell homeowners additional products and services. In addition to the yield generated by the MSR asset itself, servicers can generate revenue by cross selling additional products and services to the homeowners (and collecting lead generation fees from the companies whose products and services they sold). The key for the servicer is making sure that these cross-sell efforts are highly relevant and valuable to the homeowner. Servicers don’t want to annoy the homeowner and thereby introduce retention or portfolio risk. Fortunately, servicers have access to a wealth of proprietary data on their homeowners (household balance sheet, payment history, cost of insurance, etc.) because they sit directly within the flow of funds. This data could, if utilized properly, facilitate tailored and highly engaging cross-sell strategies.

- They need a competitive advantage in acquiring MSR portfolios. In today’s rising rate environment, MSRs are trading at record multiples, forcing servicers to look for solutions to increase yield and ensure they can bid competitively for the asset. MSRs have historically traded as an esoteric financial asset by mortgage bond geeks, but the current environment is forcing servicers to incorporate the relationship value of the assets they acquire into how they bid and price. The current environment is also forcing servicers to find creative ways (i.e. something other than paying the highest price) of enticing lenders to want to work with them on MSR sales. If a servicer created an engaging homeownership experience, one with built-in hooks for cross-sell, they could provide lenders with a mechanism to maintain their relationships with homeowners after the transaction and better position themselves for follow up sales opportunities. This ongoing access for the lender could differentiate the servicer from their competitors and give lenders a compelling reason to work with them.

So, the question is what would a radically better home ownership experience, enabled by servicers, actually look like?

A Super App for Homeowners

Put yourself in the shoes of a new homeowner, who just bought their dream property.

Now, imagine this:

- Having acquired a mortgage and closed on your house, you log in to your personalized home ownership app to set up auto pay for your mortgage. The whole process is smooth, seamless, and takes you about 15 seconds. Along the way, the app gives you a sense of your home’s future, setting you up with an analysis of how you’re building equity, credit, and net worth as you pay your mortgage, with changes proactively monitored over time.

- You return to the home page of the home ownership app. It has a dashboard that is already pulling in everything you need to know about not only your home and your mortgage, but also your overall finances (credit, accounts, net worth).

- Over the next couple of months, you pop into the home ownership app periodically. Not because you’re worried about your payment, but more just to check in on the status of your house and your loan. While you’re there, you complete a short quiz about your top financial goals (pay down debt, build up savings, renovate the house, etc.). It also has some helpful, easy-to-consume educational resources that help answer questions you’ve always wondered about but have been too embarrassed to ask, like “what’s an escrow and why do I have one?”

- The next time that you log in, it’s because you’ve received a notification telling you that the app has identified a way for you to save more than $100 a month on your home insurance (which you literally hadn’t spared a single thought about since you got it). Your servicer uses your existing insurance data to bind your quote in a few taps, and your old insurance is automatically canceled.

- Over the next couple of years, your family grows and you decide to start thinking about either moving to a new home or upgrading your existing home. Luckily, the home ownership app had matched you with a realtor when it first learned this home might not be your forever home. Since then, the realtor has been proactively updating you about your local neighborhood and market dynamics via the home ownership app, so you already have a good sense of what your home is worth. You use the app to compare what the decision to move, upgrade, or sell would look like and you decide to start looking for another home. The app automatically pre-approves you for a new mortgage, and connects you with the realtor to start your home search.

I don’t know about you, but that sounds infinitely better and more useful than any of the mortgage servicing apps I’ve had to stomach using over the last ten years.

Here’s what it would look like, on the backend, to a servicer:

Ron Shevlin is fond of pointing out that the term “super app” is misunderstood and often applied incorrectly by tech and fintech companies that are really just trying to use a cooler-sounding name for the product bundles that they are already building.

A true super app meets the following requirements:

- It’s an enclosed experience. Super apps are appealing to customers because they represent a convenient place to conduct a wide range of related activities. A super app brings everything that a user might want to do within a single, enclosed environment.

- It’s an ecosystem. Despite being an enclosed environment, super apps aren’t closed environments. They’re ecosystems with capabilities from third-party partners woven throughout.

- It is comprised of many ‘mini programs’. The capabilities inside super apps — in an app like WeChat, these are things like ride hailing and travel booking — are built as ‘mini programs’, which you can think of as lightweight apps that run inside another app. They don’t need to be downloaded or upgraded through app stores. They make it possible for one app to perform the service of many apps.

The vision described above, of a new experience built for homeowners and provided by servicers, meets the requirements for a super app. It brings everything relating to home ownership and financing together into one environment. It aligns the interests of all stakeholders in the mortgage industry and allows them to participate in the home ownership experience as integrated partners. And it relies on pre-built widgets of functionality (mini programs) to engage, educate, and enroll homeowners in the products and services that will make their home ownership experience better.

Super apps haven’t, generally speaking, had a lot of success taking root in the U.S.

I feel like a super app for homeowners could.

About Fintech Takes’ Sponsored Deep Dives

Sponsored Deep Dives are essays sponsored by a very-carefully-curated list of companies (selected by me), in which I write about topics that are of mutual interest to me, the sponsoring company, and (most importantly) you, the audience. If you have any questions or feedback on these sponsored deep dives, please DM me on Twitter or LinkedIn.

Today’s Sponsored Deep Dive was brought to you by Haven.

A Little Bit About Haven

I got introduced to the folks at Haven more than a year ago, when I wrote my first essay on mortgage servicing and wondered why there weren’t any fintech companies building a customer engagement layer on top of the mortgage servicing process.

It turns out that there was, they were just building in stealth!

Founded in 2020, Haven is on a mission to make life simpler for homeowners. It is pioneering a new model of mortgage servicing – recasting servicers from mere payment collectors to the primary point of contact for a growing list of revenue opportunities across lending, insurance, and home services.

Since emerging from stealth, the team over at Haven (which is made up of early executives and engineers from Credit Karma, Plaid, Rocket Mortgage, Opendoor, and Optimal Blue), has seen impressive traction, having signed/integrated with several of the top 30 mortgage servicing companies in the U.S., touching 800,000 homeowners monthly.

If you’re curious to learn more, I’d encourage you to visit their website.