23 May 2022 | FinTech

Fintech Companies Got Stimulus Checks Too

By Alex Johnson

3 Fintech News Stories

#1: How Much BaaS Is Too Much BaaS?

What happened?

Unit, the banking-as-a-service (BaaS) provider, raised more money:

Unit, a banking-as-a-service startup, has closed on a $100 million Series C round of funding led by Insight Partners.

Existing backers Accel, Better Tomorrow Ventures and Flourish Ventures also participated in the financing, which values the company at $1.2 billion. The raise follows a $51 million Series B financing that was announced last June, and brings its total equity raised since inception to nearly $170 million.

So what?

With Y Combinator advising its portfolio companies to “plan for the worst” in the newly-arrived bear market, it’s a bit of a surprise to me when any fintech company successfully raises a new, later-stage round.

That surprise is magnified when the company raising the round is a BaaS platform provider.

Now, I like everything that I’ve seen and heard about Unit. They seem to run a tight ship and their marketing is *chef’s kiss*.

However, as I’ve written about before, I do wonder how many BaaS platforms the market really needs. It feels like we already have too many neobanks and the larger neobanks have all acquired (or will eventually acquire) their own bank charters. If you are super bullish on embedded finance, you could argue that the need for BaaS platforms is still massive, but I’m not sure how bullish I am.

Plus, isn’t Column basically Unit, but if it had its own chartered bank?

#2: Fintech Companies Got Stimulus Checks Too

What happened?

Klarna needs money, badly:

The Sweden-based payments company is aiming to raise up to $1 billion from new and existing investors in a deal that could value it in the low $30-billion-range after the money is injected, the people said. That would represent a roughly 30% drop from the previous round.

So what?

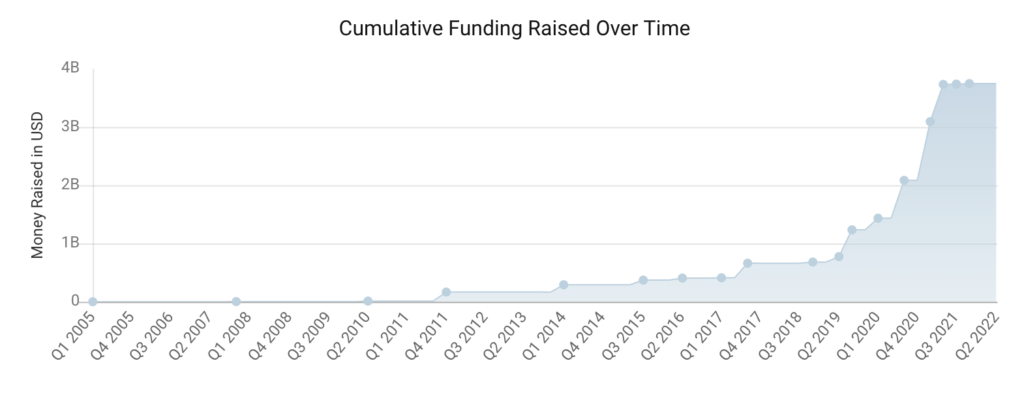

I (and I’m guessing others) tend to forget that Klarna isn’t a new company. It was founded in 2005! For most of its existence, Klarna has been a boring little European payments company. It wasn’t until BNPL became A THING — around the same time that we saw a pandemic-fueled surge in e-commerce — that Klarna was able to get significant traction with investors. I mean, look at this fundraising chart from Crunchbase:

We talk a lot about the impact that COVID stimulus checks had on consumers and their spending and saving behaviors over the last couple of years.

Perhaps we should be talking about the money raised by fintech companies between 2019 and 2021 in similar terms. Klarna received a few MASSIVE stimulus checks during the pandemic. Here’s what they did with it:

BNPL giant Klarna has reported soaring operating losses of $748 million for the full year 2021, driven by expansion to fresh markets and the challenges of underwriting a massive inflow of new customers.

The company … saw losses grow by 408% compared to $150 million reported in the year prior.

#3: Tax Filing: The Next Neobank Feature

What happened?

Column Tax, a fintech infrastructure company, raised money:

Tax software company Column Tax, which provides an API that enables mobile banking and fintech companies to offer tax products to their users, announced today that it has raised a $21.7 million series A. The round was led by Bain Capital Ventures with participation from Felicis and Not Boring, as well as existing investors Core Innovation Capital and South Park Commons.

So what?

Here’s a pattern that plays itself out over and over:

- A neobank develops a cool feature that differentiates it from the competition.

- Fintech infrastructure companies appear and offer that feature (as an API) to every other neobank.

- That feature becomes table stakes for all neobanks.

In this case:

- Cash App acquired Credit Karma’s tax preparation business and launched its own tax filing feature.

- Column Tax (and a few other players) emerged, offering Embedded-Tax-Filing-as-a-Service (ETFaaS).

- Fintech Takes Prediction — tax filing becomes the next table stakes neobank feature.

2 Things to Read and/or Listen To

#1: The Three Body Problem (by Frank Rotman) 📚

Frank doesn’t publish long-form content often, so when he does it’s best to pay close attention. This presentation outlines Frank’s thoughts on the evolving VC ecosystem, with a focus on the four “points of stability” that he sees all VC firms moving towards (if they want to survive): Scale, Non-consensus Alpha, Late-stage Generalist, and Solo Capitalist. If you want to understand the unseen forces shaping investment in fintech companies, read this.

#2: Fintech Recap: The Key Factors Impacting Lending in 2022 (by Jason Mikula and Alex Johnson) 🎧

This is a special bonus edition of Jason and I’s monthly podcast, Fintech Recap. It was recorded live at Empire Startups’ New York Fintech Week.

In the podcast, Jason and I delve into all of the big trends that we see impacting lending in the coming year, including macroeconomic conditions like inflation and rising interest rates, BNPL, and some important changes coming to the credit bureaus.

1 Question to Ponder

Block just made BNPL (powered by Afterpay) available for Square merchants to offer, in the U.S. and Australia. Will BNPL in the Square/Cash App ecosystem see significant traction or did Block miss its window?

DM me on Twitter or LinkedIn if you have any thoughts on this question.