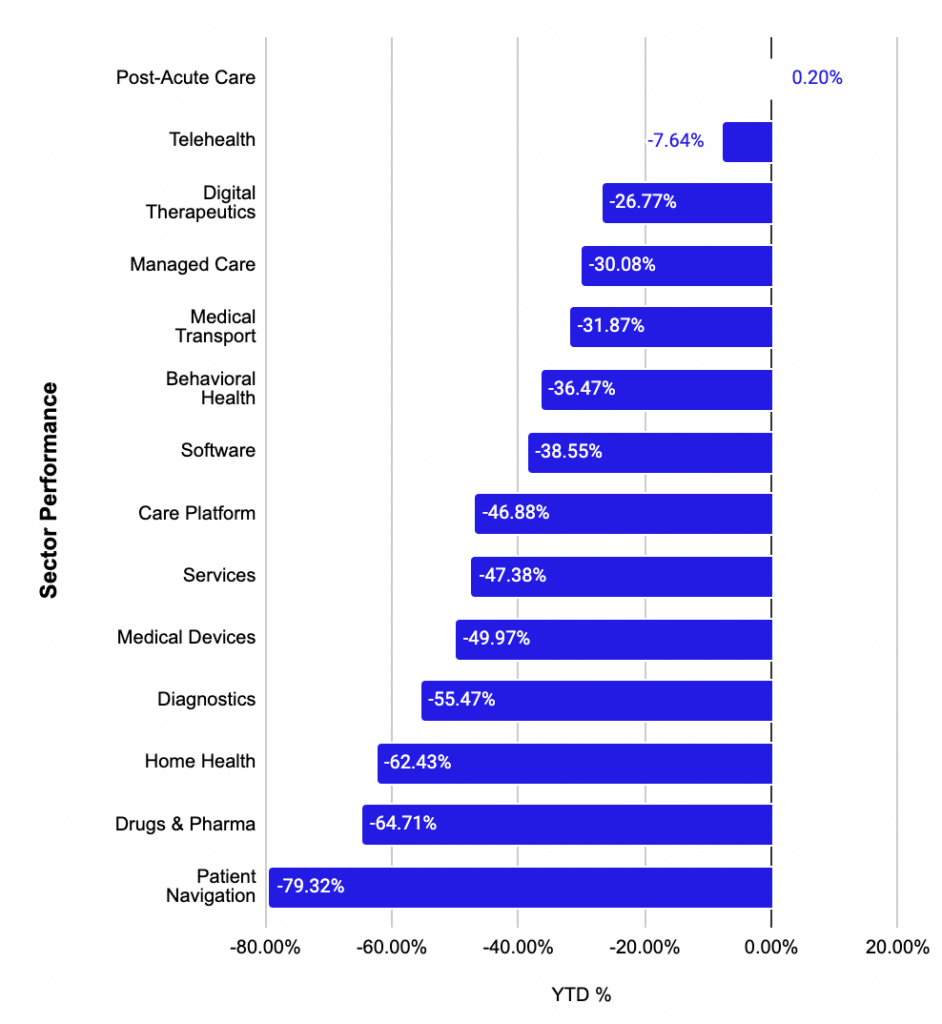

Today, we’re taking a deep dive together into how publicly traded healthcare and digital health stocks performed during 2021.

Out of the 41 companies tracked in the Health Tech and Services Index, only 3 finished in the green on the year. Today, I’m taking a look at the 10 worst performers and how these operators got to this point. While there’s plenty of blame to go around related to investigations, too-lofty expectations, and lack of execution, a lot of the underperformance stems from macro conditions and ‘Rona.

In order from worst-best, these were the 10 worst performing health tech and services stocks in 2021:

- SOC Telemed

- Bright Health Group

- UpHealth

- SmileDirectClub

- InnovAge Holdings

- Talkspace

- Oscar Health

- Clover

- AmWell

- ATI Physical Therapy

Let’s get into it, and of course, none of this is investment advice.

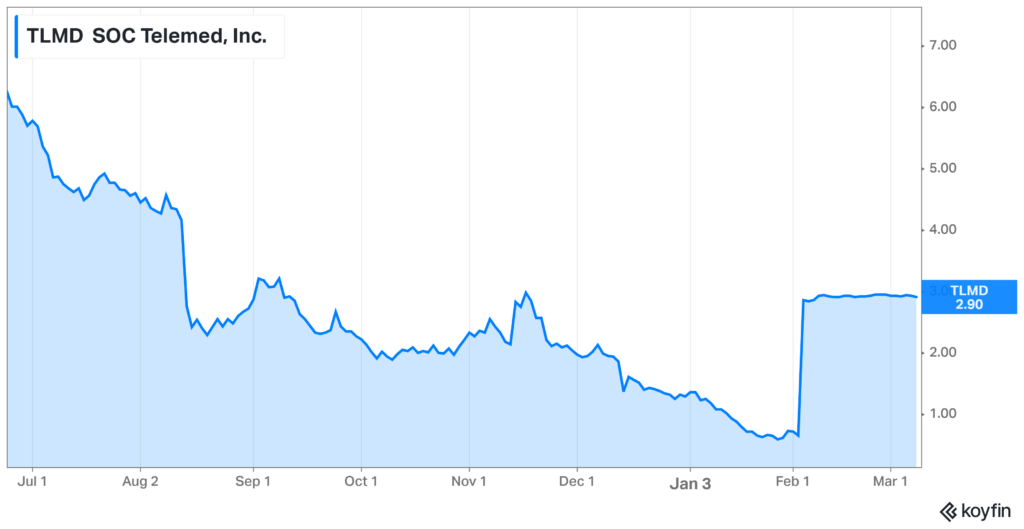

SOC Telemed (-83.7%)

Telehealth pure-play SOC Telemed never surpassed its SPAC share price of $10.00 after going public in late 2020. At that point, the ‘Pandemic Trade’ had mostly come to a close as evidenced by Teladoc and Zoom’s struggling performance post-Q1 2021.

Oddly, SOC Telemed was unable to weather the COVID variant storm despite obvious telehealth tailwinds during ‘Rona. As a result, its stock price gapped down substantially in August 2021 after reporting poor Q2 results and guidance.

Despite announcing multiple strategic partnerships (UnityPoint, physician groups), and the acquisition of Access Physicians valued at $194 million, SOC made the decision to once again go private. On Feb 3, 2022, Patient Square Capital announced the acquisition of SOC for $3.00 a share, or just north of a $300 million enterprise value.

- So what’s the signal there? Just 1 year after acquiring Access Physicians for around $200 million, and 1.5 years after going public at a $720 enterprise value, SOC Telemed truly believed the best way to maximize shareholder value at that point was to sell out like a whipped dog after a 60% decline.

Bright Health Group (-80.9%)

Where to even begin with Bright? The insur-tech unicorn IPO’d on June 15, 2021 and raised $924 million in that trading debut, valuing Bright at $11 billion and makin git the largest digital health IPO ever.

- Bright probably should have waited a bit longer on the IPO and struggled to get under its feet operationally. While the firm promised its investors scale and growth into new markets through acquiring members and providers, the firm couldn’t manage that massive growth given its existing infrastructure.

It gets worse. The insur-tech dropped to all-time lows after reporting jaw-dropping Q4 2021 losses of $-800 million resulting from inefficient claims processing from the rapid influx of new members. Just a month earlier during investor presentations, Bright had touted 2022 expectations of $6.4 billion in revenue and manageable losses of $-450 million. Despite higher growth guidance of $7 billion for 2022, Bright now expects a wider loss of $-650 million stemming from the operational struggles during the first quarter.

My thoughts: Personally, I’m pulling for Bright to turn things around. Lots of folks are expecting Bright to sell out and get taken private by Cigna after the insurance titan dropped a cash lifeline to Bright late last year, so this year is likely Bright’s last chance to prove it can tighten up operations.

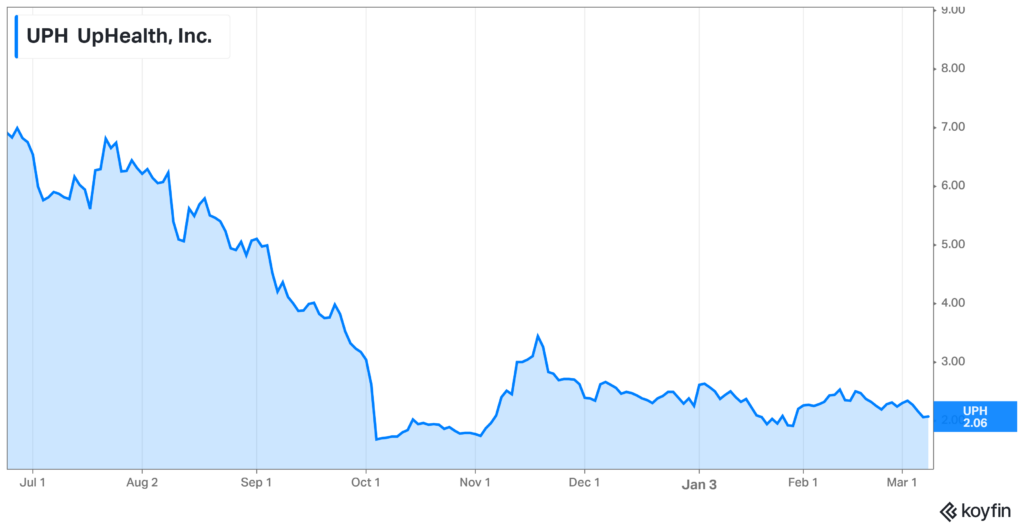

UpHealth (-80.7%)

UpHealth merged with Cloudbreak Health in late November 2020 to form a $1.4 billion virtual care company, and that’s about the only good news the company has generated since. UpHealth combines a virtual care platform with various healthcare services and has made significant moves to expand internationally, including the opening of virtual clinics in the Congo and India and supporting existing operations there with its tech platform.

- The virtual care firm gapped down ridiculously after announcing a $40 million equity raise in October 2021 and never really recovered. Part of the problem here is its business model is pretty confusing to understand, and honestly, I wouldn’t be surprised if this operation were to fall apart pretty quickly at some point. If someone from UpHealth wants to walk me through their model, I’d love to learn more about it, but right now I simply can’t grasp the model while looking through the investor presentation and website. Can’t argue with the stock price performance, either.

SmileDirectClub (-80.3%)

Despite SmileDirectClub’s hype as a meme stock along with Clover (more on that below) during 2021, the DTC dental provider couldn’t take advantage of the hype, dropping over 80% on the year.

In 2021, SDC expanded its oral products globally to retail stores in Canada, Mexico, France, and more, but couldn’t overcome massive short sellers, general unprofitability, and growing competition from other DTC whitening suppliers. Let’s not forget about the shooting incident, either. But you can’t really blame SDC for that.

- Finally, SDC’s CFO resigned in late 2021 which is really never a good thing. Shortly afterward, SDC announced a performance improvement plan to cut costs by shutting down a ton of international operations and cut other costs to focus on core markets and profitability.

- SDC’s Q4 report was sobering – revenue and margins decreased across the board, and macro headwinds related to supply chain and consumer spending hamstrung SDC’s ability to generate revenues.

InnovAge Holdings (-79.3%)

When a regulatory authority announces its intention to investigate your core market and the source of an extremely large proportion of your overall revenue, things tend to go south rather quickly.

That’s exactly what happened to InnovAge in 2021 after CMS decided to audit its PACE programs in Colorado.

- InnovAge immediately withdrew guidance (duh) and shares plummeted pretty quickly after the initial announcement

That’s exactly what happened to InnovAge in 2021 after CMS decided to audit its PACE programs in Colorado. InnovAge immediately withdrew guidance (duh) and shares plummeted pretty quickly after the initial announcement.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Of all the companies listed here, InnovAge probably has the best chance to turn things around. There are a lot of tailwinds and support for the PACE program. Given the amount of growth and attention on the post-acute arena, InnovAge is one I’ll be watching!

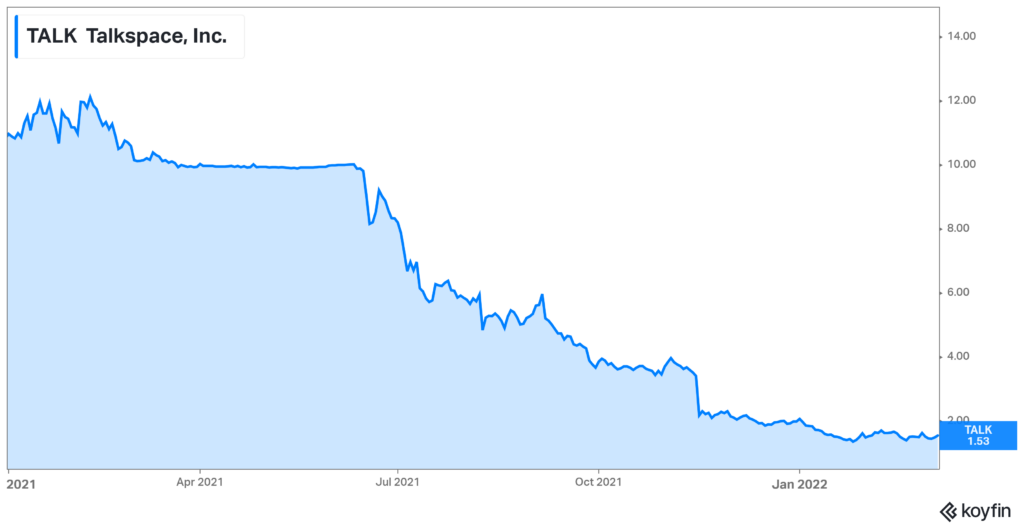

Talkspace (-78.6%)

Talkspace is the CLASSIC example of lofty investor and management expectations screwing over retail investors. After SPACing in June 2021, Talkspace boasted a huge total addressable market through both consumer and business-to-business segments.

In their SPAC presentation, Talkspace expected:

- $125m in net revenue for 2021

- $205m in net revenue for 2022

- 64% gross margins

- 46k consumer subscriptions

In actuality, Talkspace reported:

- $114m in net revenue for 2021

- NO guidance for 2022

- 59% gross margins

- 24k active consumer subscriptions

Although I love the business model and Talkspace’s ability to reach consumers for mental health needs, their financial and operating execution – along with misleading investors related to forward-looking guidance – disappointed me thoroughly. I’m expecting Talkspace to be bought out for pennies.

The DTC mental health is an incredibly tough market to be in right now (hence Talkspace’s attempt to pivot to B2B). Customer acquisition costs are out of control, increasing by 20%!! Plus, there’s a ton of scrutiny given Cerebral’s shenanigans. Lots of well-capitalized players trying to scale as quickly as possible.

Oscar Health (-77.4%)

Once the darling of Google and other large venture capital wings, Oscar IPO’d at around a $8 billion valuation and sits south of a $1.5 billion enterprise value as of this writing.

What went wrong: Really, Oscar probably went public too soon more than anything. The firm is definitely still in growth mode, and patients love the Oscar insurance product.

Oscar has announced some pretty material partnerships, including one with HCA in Texas and various Colorado health systems including plenty of other markets. I would argue that despite the steep decline in valuation, Oscar’s investment thesis is still intact. If any insur-tech firm breaks through and takes on the incumbents, it’s going to take quite a while.

In 2022, especially given the market blowout, Oscar is focusing on cash flows and profits, trying to reach operating profitability by 2023. So far, the insur-tech has exited 2 markets and I’m sure more operating changes will continue to meet that very lofty 2023 goal.

Clover (-76.6%)

Clover went public via a Chamath & Social Capital SPAC to much fanfare in January 2021 at a valuation of $3.7 billion. Similarly to Oscar, Clover boasted a ‘tech enabled’ managed care platform to provider better care at lower costs to Medicare Advantage and direct contracting (now ACO REACH).

At the time of announcement, Chamath & Clover management issued some lofty guidance for 2022 and beyond, even issuing a ‘2025E’ multiple for revenue, which is just absurd and should have been an immediate red flag.

Despite its emergence as a meme stock during the Gamestop and AMC hysteria (which was an incredible time, by the way), Clover tanked over the course of 2021. It’s easy to see why when you compare expectations to reality:

At SPAC launch, Clover expected the following for 2021:

- 73k MA members in 2021

- 89% MLR

- 200k members under Medicare’s direct contracting program

Clover released the following disappointments during its 2021 earnings announcement:

- 68k MA members

- 106% MLR (this is an absolutely massive miss)

- 165k aligned direct contracting members…expected for 2022!!

Takeaway: Not even the power of memes can make up for poor operating performance.

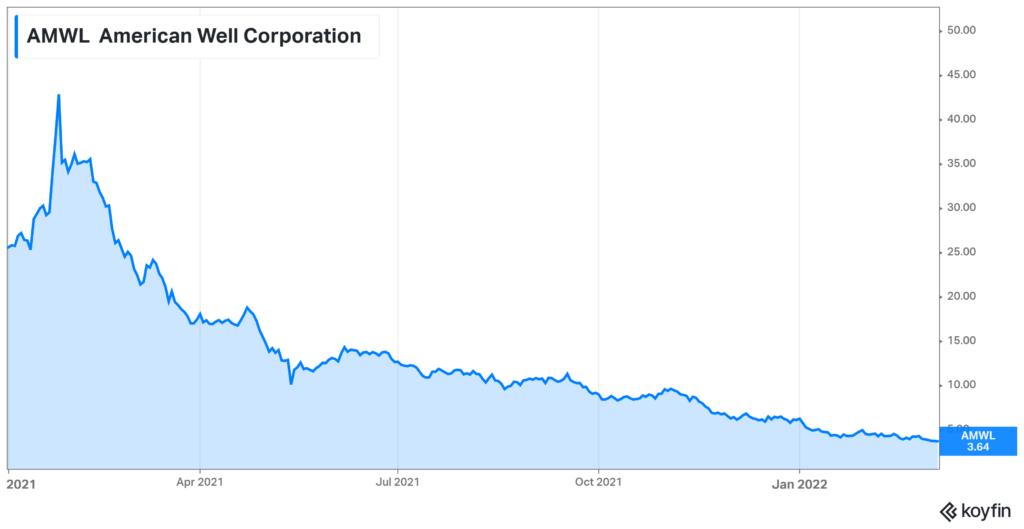

Amwell (-76.2%)

American Well, now known as Amwell, was one of the first health tech IPOs in the Health Tech Index, debuting in September 2020 as a pure-play telehealth provider. Prior, Amwell operated as a private company since 2006, just a few years after then-close peer (maybe not anymore) Teladoc was founded.

The telehealth operator raised $742 million in its IPO. Flush with cash and massive COVID tailwinds, Amwell had a seemingly massive runway ahead of itself.

- You can imagine that it was pretty perplexing to investors then, when Amwell decided to raise AGAIN in a secondary offering just FOUR months after raising a huge pot of cash.

- Couple this announcement with the general sentiment that the ‘Rona trade (AKA, Zoom, Teladoc, Peloton) was running out of steam, and you get the stock results shown in the chart above.

I’m of the mindset that Amwell is still a solid business, but the overall thinking toward telehealth these days is generally that it’s a commodity and easily replacable.

To combat that notion and create a bit of a moat for itself, Amwell **acquired** SilverCloud Heath (behavioral virtual care platform) and Conversa Health (remote patient monitoring for hospitals) for north of $300 million.

Still, the stock performance continues to fizzle out and it’s not like Amwell has done anything to wow investors over the following quarters. Another example of a decent business with a valuation that preceded actual results.

In 2022, we’re getting to the point to where there is some serious value to be had in the telehealth names. I wouldn’t be surprised to see some take-privates or strategic acquisitions at these levels.

ATI Physical Therapy (-66.1%)

Also SPAC’ing during June 2021 (that was a busy month for me), private-equity backed pure play physical therapy operator ATI Physical Therapy went public at a $2.5 billion valuation.

To bury the lede here, that was extremely short lived.

On ATI’s FIRST earnings report as a publicly traded company, the firm completely revised its guidance way lower, citing COVID pressures and staffing issues. To put it more plainly from my perspective, ATI shat the bed and failed to listen to its staff, resulting in a mass exodus of therapists. What happens when you lose staff? Patient visit volumes suffer, you can’t expand into new sites of service, and your margin craters.

- 2 months later, ATI lost its CEO.

- 2 months after that, ATI released Q3 earnings and revised its guidance even LOWER.

For full-year 2021, ATIP lost 66% in share value (essentially trading as a penny stock), is way behind on hiring staff, can’t find a CEO, and lost $782 million due to goodwill impairment charges on assets.

- From the outside looking in, it really seems as if ATI investors were just looking for a quick exit via the public markets. I’m shocked by how fast these events unfolded. I mean, the speed of decline here is borderline fraudulent, COVID aside.

In 2022, ATI has leveled out and is more or less running around breakeven profitability.

Lessons learned from bad operators

Although I’m incredibly bullish on healthcare investments, digital transformation of healthcare, and value-based care, we also need to be realistic on timelines required to build out the infrastructure to allow these companies to succeed. And that, in my mind, is a decade-or-more-long process.

With the washout happening in valuations in 2022, I’m hoping that the washout will let the truly good operators thrive and stand out from the rest – something that has yet to happen in the digital health world.

Who will differentiate themselves from the health tech pack?

Time will tell.