New here? Subscribe to Hospitalogy today

Funny story – about 400 of you were chilling in purgatory over the past couple of weeks due to a small subscribing snafu on our end. Sorry about that! If you missed any of my recent posts, I’ve linked them below:

- Breaking down physician enablement care platforms (a deep dive on Privia, ApolloMed, agilon, and P3)

- The current state of hospitals (deep dive into hospitals’ Q1 financials and current trends affecting health systems)

Today we’re covering Advocate’s $27 billion merger with Atrium, Optum’s strategy with SCA, and Envision Healthcare’s recent woes.

Let’s get after it!

HEALTH SYSTEMS

Advocate Aurora merges with Atrium to create $27 billion Health System

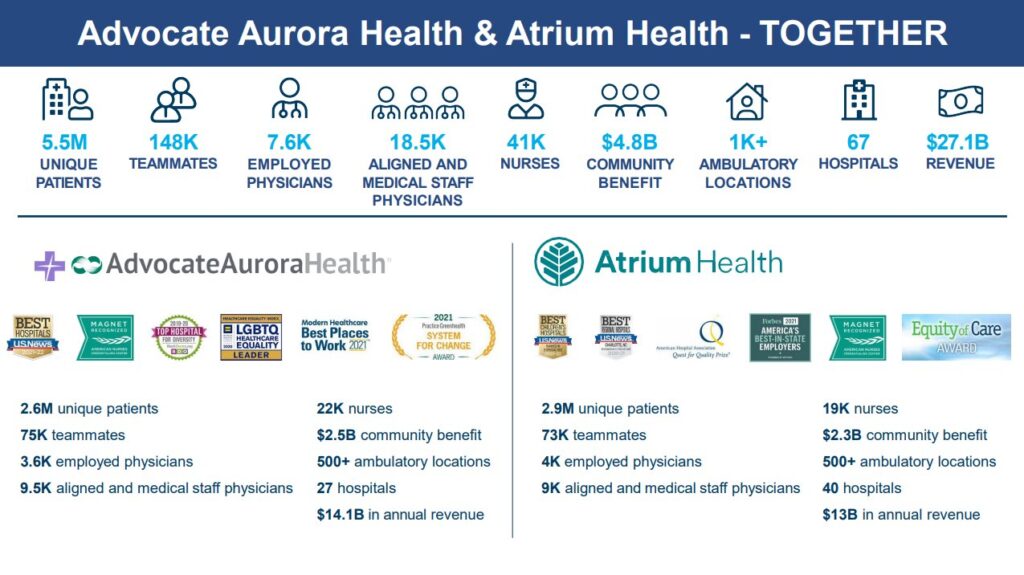

Advocate Aurora Health is merging with Atrium Health to create a $27 billion health system which will operate under a new name: Advocate Health.

The new system’s combined revenues puts it on par with that of Ascension & Providence at about $27 BILLION – good enough for the 6th largest health system in the U.S. Revenue numbers as of full-year 2021.

Advocate’s new footprint will include:

- 67 hospitals

- 1,000 sites of care

- 7,600 physicians

- 150k employees

- 5.5 million patients

- 2.2 million lives through 15 ACOs and 60 value-based contracts (whatever that means)

- $5 million in annual community benefit

- Operations across Illinois, Wisconsin, North Carolina, South Carolina, Georgia, and Alabama

Madden’s Musing.

The announcement creates one of the largest health system mergers since Providence / St. Joe’s & then CommonSpirit 5-6 years ago. It’s also right on the heels of the Intermountain-SCL merger, who consolidated in similar fashion into a $14 billion system across non-overlapping geographies. In late 2020, Atrium Health merged with Wake Forest Baptist Health into an $11.5 billion system. There’s absolutely no way that integration is done yet – right?

Here’s an interesting little tidbit – according to the press release, Advocate Health will be structured as a joint operating company (JOC). Instead of just contributing assets in a specific area, though, the two systems appear to be layering the JOC on top of 100% of their combined footprint. Which makes me wonder why they went the JOC route.

My guess is that the structure makes it easier to unravel if things go south since existing assets will remain in each of the health systems’ respective states.

Since antitrust is top of mind, systems are opting to merge with other systems outside of their primary geographical footprints, while still giving them access to scale in order to deal with the labor and inflationary pressures of today.

Be on the lookout for a deep dive coming NEXT week on the health system merger landscape, a macro view of what’s going on for hospitals in the currently challenging operating environment, and more pertinent thoughts on the Advocate-Atrium merger.

Resources:

- Here’s the press release announcement

- In an unusual move, the FTC likely to examine insurer overlap

OPTUM’S TAKEOVER

SCA quietly rebrands to SCA Health

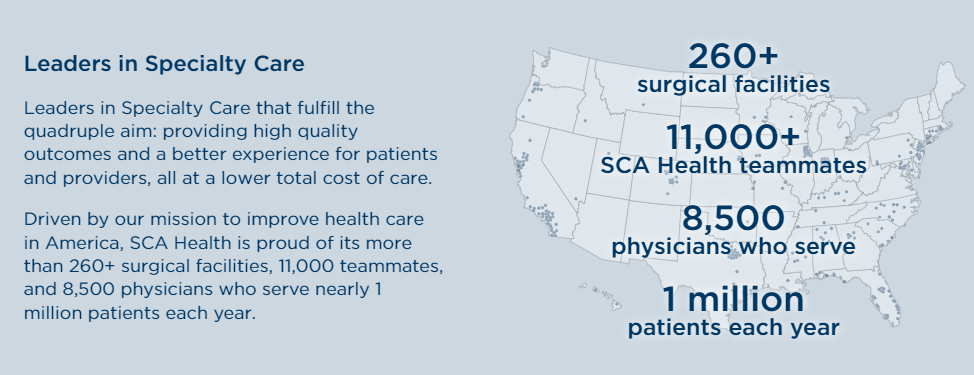

With little fanfare, UnitedHealthcare’s Optum appears to have rebranded Surgical Care Affiliates into SCA Health. Under the new slick angular logo and rebranding that everyone seems to be copying, Optum’s strategy is now pretty clear for SCA – create a physician enablement platform to allow specialists in particular to transition to risk-based arrangements.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

They’ll achieve this goal by aligning with health systems, local market health plans, and the practices themselves through the new SCA platform – a “physician-led, MSO-model of practice management that restores physician agency by aligning incentives to support growth and transition to value.”

Sounds familiar, doesn’t it? It’s a very similar strategy as the care platforms I covered just last week. Except their footprint is already scaled for success:

Madden’s Musing.

Keep in mind that Optum purchased SCA back in 2017 for around $2.3 billion, and it looks like SCA is slated to grow like crazy given the platform creation and focus on physician enablement. I mean, who can step up to challenge this? Seriously.

Every time I think some org has a leg up on Optum in some aspect…they stay ahead of the game. They’re so far ahead of everyone else, it’s truly unreal. Creating a physician enablement platform focused on specialists and ASC revenue streams creates a ton of value for Optum/UHC. Not to mention that CMMI is trying to find ways to grow specialty providers’ role in value-based care arrangements.

ASCs are essentially untapped when it comes to risk-based relationships, and specialists control a large portion of the healthcare dollar.

We’ll all be submitting our collective resumes to United anyday now.

ENVISION

What’s up with Envision?

After going private in 2018 for $9.9 billion, Envision Healthcare seems to be in dire straits. I mean, let’s just consider some recent history for the physician staffing and ambulatory firm:

In late 2020, Congress signed the No Surprises Act into law (which, side note, is currently being challenged and will probably need to be modified). I’m speculating here, but this bill likely had an outsized effect on Envision’s pricing strategy. Under the NSA, any surprise bill under dispute went into arbitration. The arbiter was then directed under the No Surprises to declare the regional in-network reimbursement rate for that procedure as the set payment rate for the bill. This probably hurt Envision pretty badly – insurers now had incentive to negotiate Envision’s likely much higher rates down, which I imagine killed the physician services firm

In April, Standard & Poor’s downgraded Envision’s debt, saying that they expected Envision’s cash and liquidity position to “meaningfully deteriorate” over the next 12 months and that Envision’s liquidity was “less than adequate.” Envision also told its lenders in April that it was delaying its financial disclosures, likely due to payor and accrual issues. Remind anyone of Adeptus??

One month later in May, Envision got in a spat with its lender after Envision moved most of its more profitable AmSurg division AWAY from its current lender in order to borrow more $$$ to repurchase its debt and lower its overall indebtedness. Bottom line – Envision’s existing lenders kinda got screwed, and they’re not happy about it, even considering litigation.

Finally, this week, Envision decided to sue UnitedHealth in Florida, calling it an ‘evil empire’ in the lawsuit’s language and accusing the payor of underpaying its contracted reimbursement rates. Honestly, this is probably true. If I were United, I wouldn’t want to pay costly ER bills at contracted rates. I would push the provider out of network like they did and just wait for the arbiter to decide in my favor – at the median in-network rate as designated by the No Surprises Act lol. Yet another example of good intentioned policy set by Capitol Hill but utterly abused by the healthcare industry.

Madden’s Musing.

All of this to say that it looks like Envisions physician staffing division is hanging on by a thread and the writing on the wall – at least right now – is signaling bad things for the huge physician group.

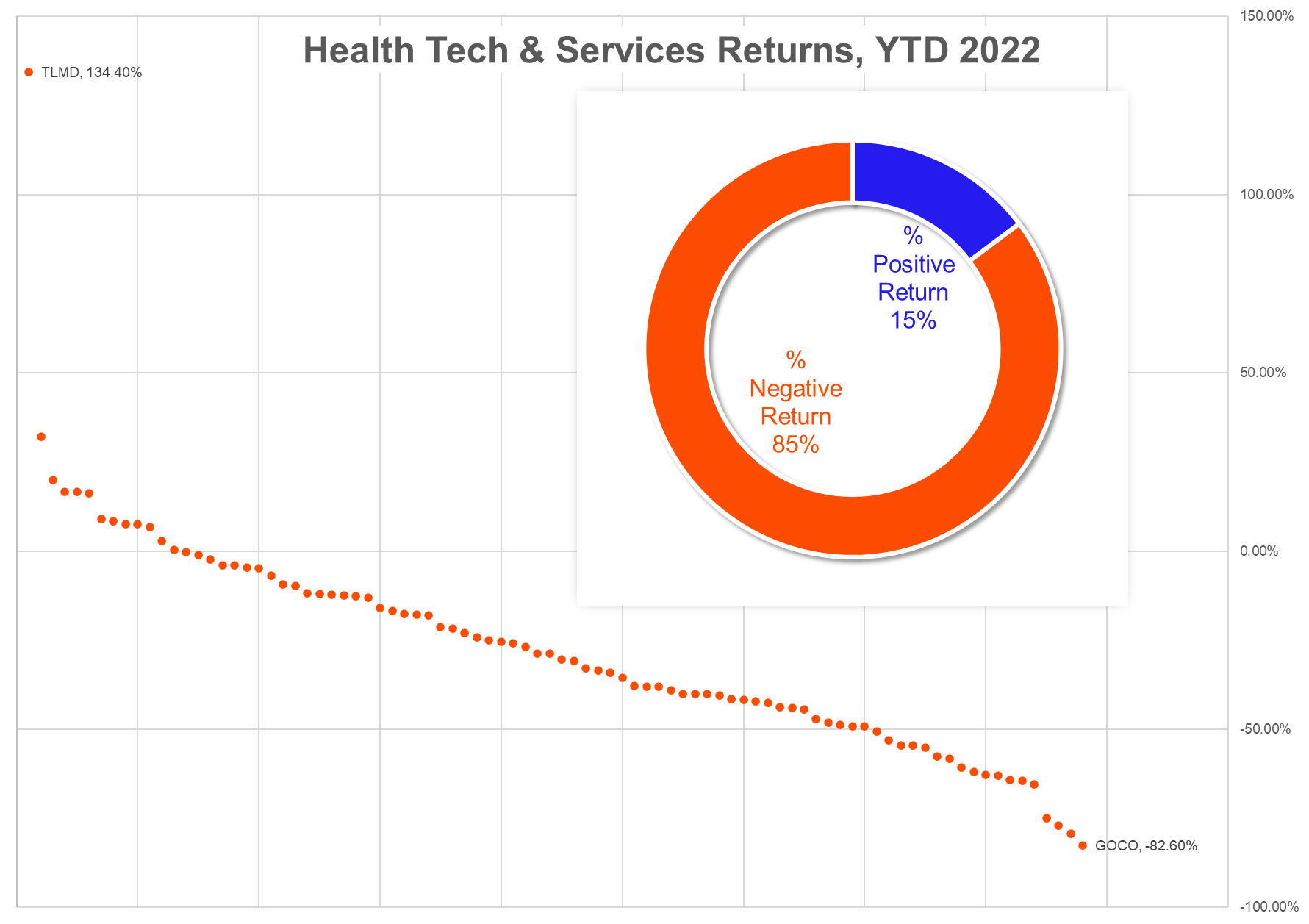

Market Movers.

Big Winners: The Pennant Group (+37%), Nutex Health (+26%), One Medical (+19%)

Big Losers: GoodRx (-24%), Pear Therapeutics (-13%), Warby Parker (-19%)

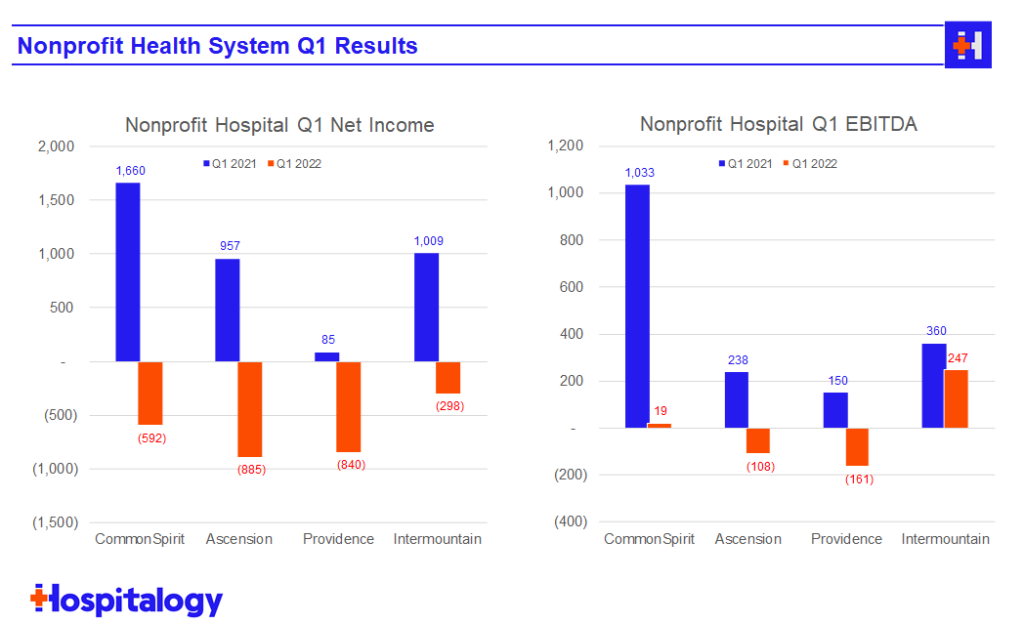

Nonprofit Financials: Of the NFP health systems that have released Q1 financial disclosures on EMMA, none reported a net profit. Only CommonSpirit and Intermountain eked out positive EBITDA margins for the quarter. The poor financial performance is due primarily to two factors, which I’ve touched on before:

- Horrible investment returns from NFP portfolios (given the market selloff in Q1 and beyond); and

- Contract labor usage // wage inflation // supplies inflation.

Oscar Health announced this week that the insur-tech is pulling out of two markets (Arkansas and Colorado).

Humana and Welsh Carson-backed CenterWell health announced an expansion of their senior primary care joint venture. Under the arrangement, they’ll plan to develop 100 more clinics between 2023 and 2025 and invest $1.2 billion in the de-novo’s. The added developments would make Humana the largest senior-focused primary care provider in the country!!

Amazon-backed tech-enabled care platform Crossover Health announced its intention to expand into Seattle and Austin this week.

Piedmont Health tacked on 10 more urgent cares through its acquisition of SmartCare in the greater Atlanta area.

ScionHealth acquired Cornerstone, a specialty hospital operator based in Dallas, Texas (shout-out DFW). Don’t forget – Scion was spun off in late 2021 as a foster child of some of LifePoint’s hospitals combined with Kindred’s LTACHs. Interesting to see them making moves here!

Encompass is building a 60-bed IRF in Houston.

Earnings Drops:

- SmileDirectClub Q1 earnings

- Oscar Health Q1 earnings

- GoHealth Q1 earnings

- Health Catalyst Q1 earnings

- Cue Health Q1 earnings

- The Oncology Institute Q1 earnings

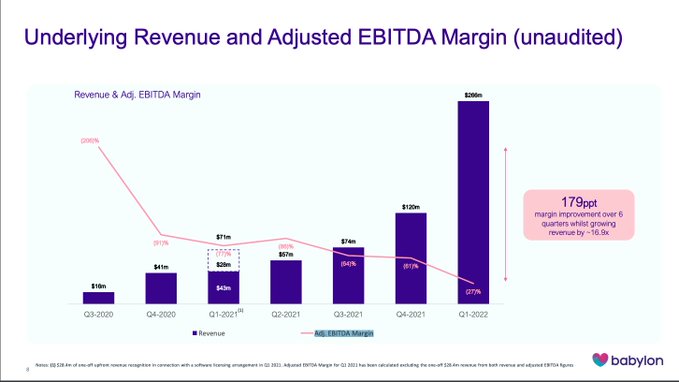

- Babylon Q1 earnings…and I had to drop in their chart crime here too. Hint: Look at the adjusted EBITDA line…

- UpHealth Q1 earnings

- Aveanna Healthcare Q1 earnings

- Sema4 Q1 earnings

- DocGo Q1 earnings

- Privia Health Q1 earnings

- The Pennant Group Q1 earnings

- CareMax Q1 earnings

- Convey Health Solutions Q1 earnings

- InnovAge Q1 earnings

- Warby Parker Q1 earnings

Miscellaneous Maddening’s

- I finally tried the Sonic ocean water hard seltzer after tracking it down for months. Overall, solid. 7.7/10. A bit more coconut-y than expected, but not a bad thing.

- So get this. I pull up to the #11 tee box at Rockwood in Fort Worth this past Saturday. The cart girl is over on the cart path about 200 yards down to the right of the fairway. I pull my 2 iron and hit one of my worst shots of the day, a low hook (my typical miss…I’m a lefty) going…right at the cart. Like, straight up a line drive going at Mach-2 and head-height. Luckily the killshot harmlessly clanged off the other side of the cart and into the fairway, but it got us thinking – did I owe buying a beer or something off of her at that point? Or was I just good to go? Ya know? It’s kind of a gray area, I feel. I was frozen in time for about 3 seconds watching the ball travel through the air.

- Jared had his own Jordan flu game this week – he got the ‘Rona over the weekend and still powered thru to publish the Healthcare Huddle send Sunday. Give him extra props for that.

- In case you missed it, the Event Horizon team published its image of Sagittarius A*, the supermassive black hole at the center of the Milky Way. According to the scientists, the upgraded ‘scope will begin a new era in space science to be able to study the properties of black holes. Nuts.

- What’s your fave healthcare book? I polled Twitter this week and got some great responses. If you have any to add, hit me with ‘em

Hospitalogy Top Picks

- Nikhil had yet another great article and prepper on how healthcare payments are structured presented through a sponsored post of Candid Health

- I enjoyed this breakdown from Next Ventures on Tech-enabled primary care and diving in to the investment opportunities there. Very similar thesis to my take on care platforms.

- Cerebral feels “picked on” as a result of recent slam pieces and a pending investigation. Woe is me.

- Chrissy Farr penned a great piece from the perspective of what it’s like to be a full-time telemedicine doctor.

Thanks for reading! Let me know what you thought of the write-up by DM’ing me on Twitter or shooting me an e-mail at [email protected]. Til next time!

New here? Subscribe to Hospitalogy today