13 May 2022 | FinTech

Fintech That Makes an Impact

By Alex Johnson

When I announced that my newsletter had been acquired by Workweek, I wrote:

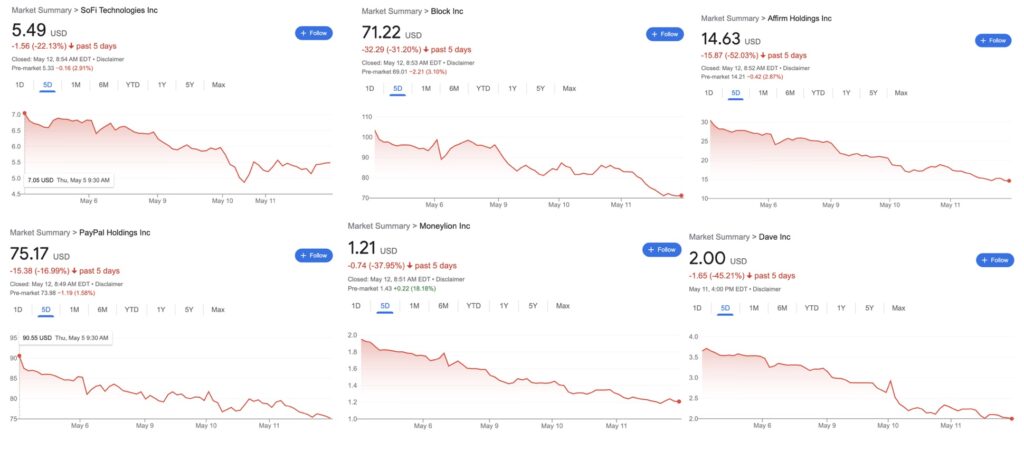

Since I wrote that, we’ve seen an acceleration of the slide in public fintech stock prices that is, even for a natural skeptic like myself, a bit surprising:

We’ve also seen a corresponding cooling in VC funding for private fintech companies, as reported by CB Insights:

Global fintech funding clocked in at $28.8B in Q1’22, down 18% quarter-over-quarter (QoQ) — the largest percentage drop in quarterly funding since 2018.

And then, of course, there’s crypto, which is … uhm … not going great right now:

Bitcoin fell below $26,000 for the first time in 16 months, amid a broader sell-off in cryptocurrencies that erased more than $200 billion from the entire market in a single day.

Also weighing on traders’ minds is the downfall of embattled stablecoin protocol Terra. TerraUSD, or UST, is supposed to mirror the value of the dollar. But it plummeted to less than 30 cents Wednesday, shaking investors’ confidence in the so-called decentralized finance space.

Why does all of this matter?

Because it confirms something that I think many of us in the fintech space have been quietly feeling for years now — we’ve been squandering our opportunity.

We took our eye off the ball. We became obsessed with minting unicorns and participating in the Miami vs. San Francisco debate and pouring absurd amounts of money into the one-click checkout space and trying to make the argument that Ponzi schemes are a legitimate way to overcome the cold start problem.

Meanwhile, according to a recent poll of working Americans:

- A quarter of respondents report having zero savings set aside for unexpected expenses.

- A third of respondents reported feeling somewhat or very uncomfortable about their ability to pay for a $400 emergency expense, and nearly one in ten said they would not be able to afford it at all.

- A third of respondents said they could cover roughly a month or less of expenses if they lost their income.

And, again, this poll was of Americans who are currently employed. For the roughly 6 million Americans who are unemployed, we can safely assume the situation is much worse.

Which brings us back to the question I asked in my tweet — how do we keep our eye on the ball? How do we ensure that fintech innovation stays firmly anchored on making a majority of people’s lives better?

If you’re a fintech founder or operator, the answer is relatively obvious — pick an important problem and build!

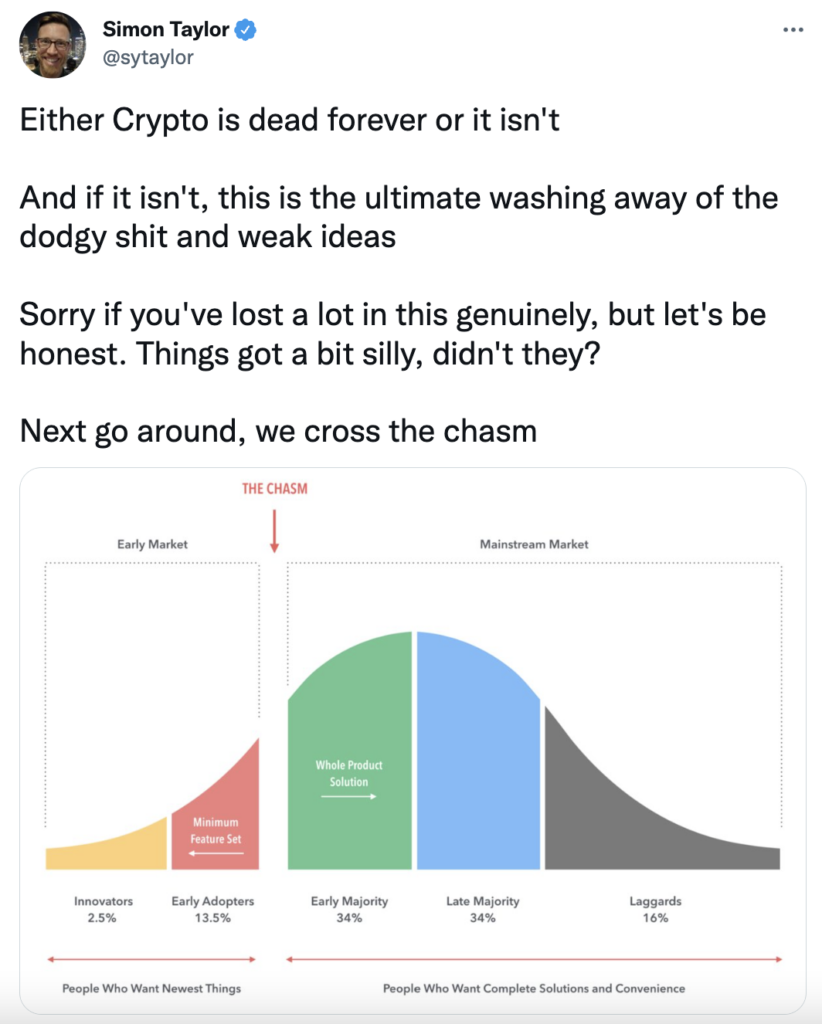

Given the massive market correction that we’re going through right now, building fintech products is likely to be a little less glamorous and lucrative than it has been recently. This is a good thing! As my friend and fellow fintech newsletter writer Simon Taylor pointed out, moments like these are healthy for the ecosystem because all of the folks looking for an easy buck get washed out:

If you’re a fintech analyst, journalist, or content creator, the answer to the question — how do we help? — is a bit harder to answer.

For me, the answer is to focus on analyzing and writing about the most impactful trends and companies in fintech. From my same Twitter thread:

This is harder than you’d think. Even coldly rational analysts like myself can get sucked into the hype machine and get distracted by well-funded shiny fintech objects.

So, to help balance things out, I will periodically use this newsletter to spotlight specific companies that are flying a bit under the radar because they are quietly focused on building impactful solutions to important problems.

If you’d ever like to suggest an impactful fintech company for me to look at, please feel free to ping me on Twitter or LinkedIn or just reply to one of my emails.

This first cohort of companies was sourced from suggestions to my recent Twitter thread. They are organized, loosely, into categories, with some quick commentary from me on what they’re doing and why it matters.

Saving & Debt Management

What they’re doing: Helping consumers get out of debt faster by aggregating account information and providing personalized recommendations and goals for consumers to eliminate debt and rewarding them when they do so.

My take: Debbie isn’t live yet, so I’ll reserve judgement on the product. However, the mission is great. Approximately 80% of American households have at least some debt and providing tailored advice on how to get out from under that debt is very much needed. Debbie’s business model appears to be built around partnerships with financial institutions, which can introduce some tricky incentive issues. I’ll be curious to see how those are addressed.

What they’re doing: Allowing consumers to shop for big-ticket items that they want to purchase and then build a personalized savings plan to facilitate the purchase of those items without taking on debt.

My take: It’s basically Klarna (shopping, merchant-funded offers, assistance with financing, payments), but the financing that is provided comes from savings accrued by the consumer over time rather than through an installment loan up front. Inspirave is part of a new product category — Save Now, Buy Later (SNBL)!

What they’re doing: Helping consumers gain more control over their spending through the use of dynamically-created sub accounts and joint accounts with friends and family.

My take: I’ve always liked the idea of giving consumers more granular ‘places’ to keep their money, without requiring them to actually open multiple bank accounts. It’s the digital equivalent to the envelope budgeting method. HyperJar also enables Save Now, Buy Later through partnerships with specific merchants.

Niche Neobanks

What they’re doing: Building a digital bank for gig workers.

My take: This is becoming a popular niche, but I like how Moves is approaching it. Most gig workers aren’t exclusive to a single gig platform. They work across multiple accounts. Moves appears to be designed to simplify the management of cashflow coming in from a variety of different gig platforms, which could be a huge value add over a traditional checking account for this customer segment.

What they’re doing: Building financial tools — deposit accounts, debit cards, budgeting, etc. — for couples.

My take: The thing I like about multiplayer fintech, as a category, and specifically about Zeta, as a company, is the focus on using fintech to solve financial-adjacent problems. In the case Zeta, the core problem they appear focused on solving is helping couples fight less about money. That’s a very worthy goal.

Embedded Finance

What they’re doing: Creating a marketplace that connects produce sellers that have excess or imperfect produce that they need to quickly sell with interested buyers, with the overall goal of creating a more efficient market and eliminating food waste.

My take: Niall Haughey, author of the excellent Agri Fintech newsletter, pointed me to this one. As Niall explained in an early edition of his newsletter:

Not only do [food marketplaces] help producers access markets, but they help them digitise these records, creating a financial personality often presented with payment data.

Marketplaces are helping participants to manage the business but at the same time becoming a distribution point for the relevant financial services.

Full Harvest, by solving a market-making need for the produce industry, has created a new distribution channel for B2B payments and other financial products and services.

Fintech Infrastructure

What they’re doing: Enabling immigrants to be able to access credit by taking their established credit histories with them when they move to a new country.

My take: I’ve been a fan of Nova Credit for a while and was happy that someone suggested them on Twitter. Immigrants represent one of the most obviously attractive opportunities within the credit invisible population and Nova has done the hard work of integrating with credit bureaus around the world to facilitate the creation of ‘credit passports’ that immigrants can use when applying for credit with Nova-partnered lenders. Neat stuff.

What they’re doing: Automating the process of monitoring compliance and risk management controls and streamlining the remediation process for any regulatory breaches.

My take: The idea of replacing the highly manual and largely ineffective approach that banks use today to monitoring the effectiveness of their AML compliance controls with something more automated and intelligent is appealing, especially for BaaS banks working with multiple fintech partners. This is exactly the kind of boring, but critically important problem that fintech should be solving, especially when you consider that current AML compliance programs fail to stop 99% of financial crime.

What they’re doing: Streamlining the rental property inspection process by empowering tenants to do their own inspections, documented through the RentCheck app.

My take: The analogy in banking for this is self-service collections. Take a process that is annoying and inefficient for all parties involved and replace it with a digital-first experience that is controlled by the end customer/tenant rather than the lender/landlord. Win-win.

What they’re doing: Otomo looks like a complex product, but the pitch is simple — embeddable self-driving money.

My take: I have my concerns with self-driving money (documented here and here), but the idea of building it as an embeddable service is certainly intriguing. Otomo also appears to be trying to strike a good balance between automation and control, which is the central challenge when it comes to self-driving money. I also think I spy another instance of Save Now, Buy Later in there?

What they’re doing: Enabling financial advisors to help their clients make better house sale, purchase, and relocation decisions.

My take: This one feels timely given the amount of consumers in the U.S. who have relocated during the pandemic (speaking as a Montana resident, I can confirm that this trend is real). Providing personalized cost-of-living calculations and advice, on a property-by-property basis, could be a very useful new tool in financial advisors’ toolbox.