This week in healthcare: Teladoc loses $6.6 billion in Q1 and the broader health tech implications, why I’m watching staffing agencies this week, Carbon Health and HCA continue to snatch up urgent cares, SSM Health creates an integrated care network with St. Louis University, Nutex completes its merger with Clinigence, Accolade’s woes, and executive moves

New here? Subscribe to Hospitalogy today

VIRTUAL CARE

Teladoc Plummets after Livongo Impairment

Last week, Teladoc posted the worst quarter that might ever happen for a digital health company. But let’s back up for a second.

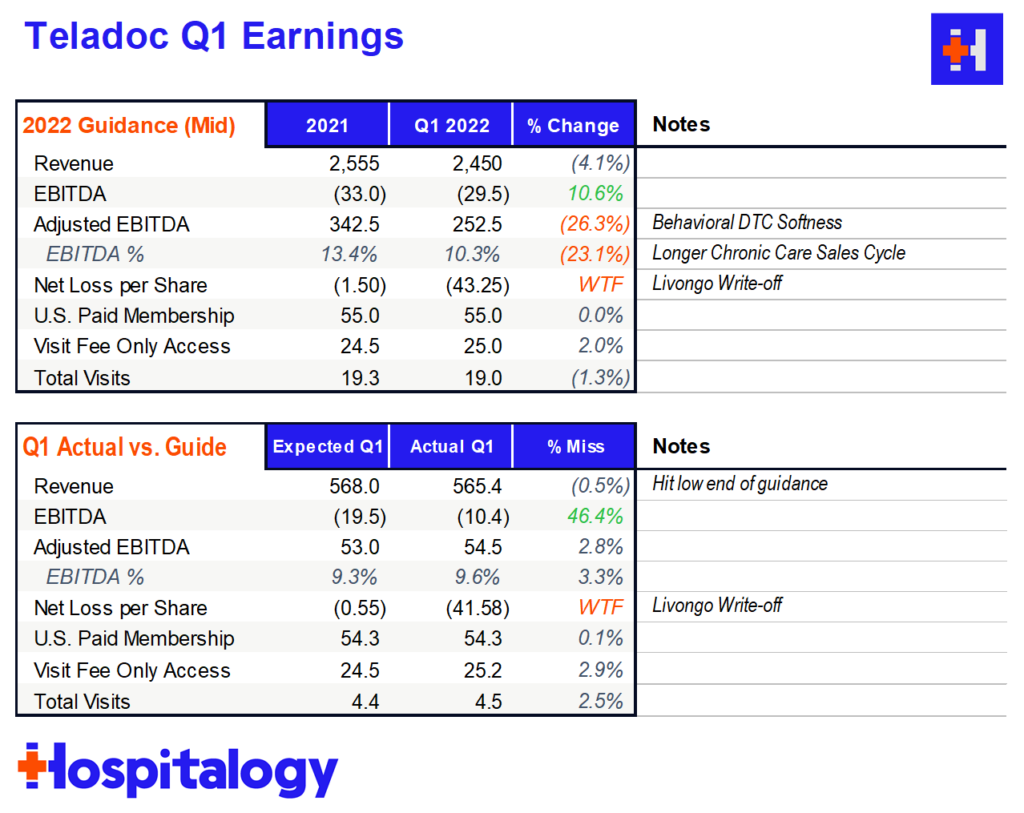

In its 10-K filing for 2021 back in February, Teladoc warned that if its stock continued to slide, it would be forced by auditors to recognize a goodwill impairment charge (AKA, an accounting term to basically say they overpaid on an acquisition) related to its $18.5 billion acquisition of Livongo. In that filing, Teladoc represented that the firm expected to recognize between about $800 million and $4 billion for that impairment charge.

- The good news is that the impairment charge is non-cash. Teladoc financed most of the acquisition with stock.

- The REALLY BAD news is that the recognized impairment charge came in at $6.6 billion. Which translates to a loss of ($41.11) per share for the quarter. Analysts trying to pull together comparable public multiples for the virtual care space are now cringing.

Based on the reported loss, Teladoc plummeted to $33 / share, sitting just $5 above its 2015 IPO price of $28, rebounding slightly Monday to $36. For those keeping score, Teladoc hit an all-time high in February 2021 at $294.54 and has since dropped almost 90% in a year.

Here’s what else interested me from the earnings report.

The Good: Teladoc’s core business, ironically enough, is plodding along just fine. The telehealth platform experienced 35% growth in visits and 25% topline growth. In Q1, Teladoc actually met guidance on EBITDA and revenue.

The Bad: Teladoc experienced softness in its chronic care division based on longer sales cycles with clients and pipeline developments taking much longer to unwind.

- Translation – employers are mulling their options when it comes to remote patient monitoring and chronic care management offerings. Smaller digital health players are crowding the space and also offering point-solutions (from Teladoc’s perspective), which is drawing attention away from Teladoc products. Teladoc management continues to insist that the firm’s entire integrated product offering helps it to retain a moat over competitors and that in the long run, they’ll win out.

The Worst: Besides the Livongo write-off, I found CEOs Jason Gorevic’s comments about the direct-to-consumer mental health market VERY interesting. With the emergence of well-capitalized startups like Cerebral, Lyra, Talkspace, Ginger, and probably hundreds of smaller firms, competition is rampant in the space. As a result, Teladoc’s cost to acquire customers – especially in paid search and online ads – skyrocketed 20%. Here’s what Gorevic had to say:

Over the past several weeks, we’ve seen lower-than-expected yield on marketing spend for BetterHelp, which is a reversal of the trends we experienced exiting 2021 and in the early part of 2022.

One example of this is paid search advertising, where we’ve seen a notable increase in rates for keywords associated with online therapy. We believe the biggest driver of this dynamic is smaller private competitors pursuing what we think are low- or no-return customer acquisition strategies in an attempt to establish market share. Some of those same providers are also exploiting the temporary suspension of certain regulations associated with the national health emergency concerning the prescription of controlled substances.

We believe these strategies are unsustainable in the long term. This dynamic is likely to persist at least throughout the remainder of this year, however, resulting in growth and margin contribution from BetterHelp that is below our expectation in February.

Gorevic went on to say that Teladoc expects the trend to continue at least throughout the rest of the year.

Madden’s Musing.

The direct-to-consumer virtual mental health market is a zero-sum game, and I’m of the opinion that only a few larger players will be able to withstand the current gauntlet facing the segment. The more I read about DTC mental health, the more I either hear about (1) Cerebral’s irresponsible hyper growth and ‘pill-mill’ policies, or (2) Talkspace’s current failures in the DTC market and their frantic attempts to pivot to B2B. FYI, Talkspace, a pure-play virtual mental health provider, is down 85% all time.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Here’s the thing with DTC mental health. I love the level of access any consumer has to jump on to any platform and see licensed personnel for mental health purposes. There’s a clear need for this. But the economics of the business model are unfavorable given the level of competition. It’s why you’re seeing multiple large players – like Teladoc and Talkspace – struggle. There’s just a funny feeling for me that things won’t end well for everyone here. You have a number of well-capitalized players competing with you to acquire customers that likely won’t even stick with you for that long. I have to imagine that a multitude of these companies will artificially inflate numbers through paid acquisition, cash will run out, and they’ll crash and burn. Do I want that to happen? No. I just think it will. I never want to see companies fail, if their mission is aimed at improving healthcare.

I can’t imagine that lawmakers will just sit back, read about Cerebral’s prescribing practices, and let that continue unregulated beyond the public health emergency. Maybe I’m wrong, because lawmakers can be idiots when it comes to public health policy. Don’t forget that the PHE suspended the Ryan Haight Act, which requires an in-person medical evaluation within a DEA facility at least every 24 months for any providers prescribing controlled substances. In fact, are there any consumer protections in place at all right now?

If Cerebral can make it through the unending string of bad press, I could see the firm becoming a dominant player in the landscape. For now, you all should be keeping track of what’s going on.

Final point. If Cerebral DOES crash and burn, there needs to be a reckoning for investors and executives pushing hyper scale and sacrificing plenty of morals for the sole sake of growth. Can you imagine being pregnant and hearing your company announce they’re removing your benefits?

I’d love to hear any and all thoughts from my readers on the DTC mental health market, as I’ve already engaged in thoughtful discussion with a few folks. Have you used these services? Which ones? Have they pushed pills on you? What was your overall experience?

Wild times.

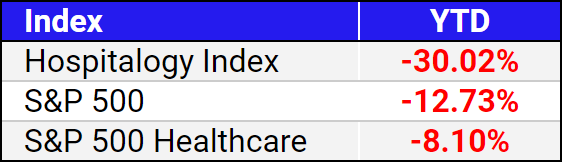

Teladoc and Accolade (more on that below) sell-offs beg the question as two of the more successful companies in digital health – is a reckoning coming for private valuations?

- Bigger question for Teladoc – based on this quarter, will we see some activist investor activity in Teladoc? Buy-out offers?

Resources

- Teladoc Q1 earnings announcement and call transcript

- Cerebral’s CMO defends company’s prescribing practices

STAFFING AGENCIES

Why I’m watching staffing agencies this week

One man’s margin compression is another man’s margin opportunity. At least, that’s how the dynamic goes between health systems, healthcare operators, and staffing agencies. On Thursday, I’ll be breaking down hospital operators’ Q1 and current dynamics affecting organizations – be on the lookout for that edition!

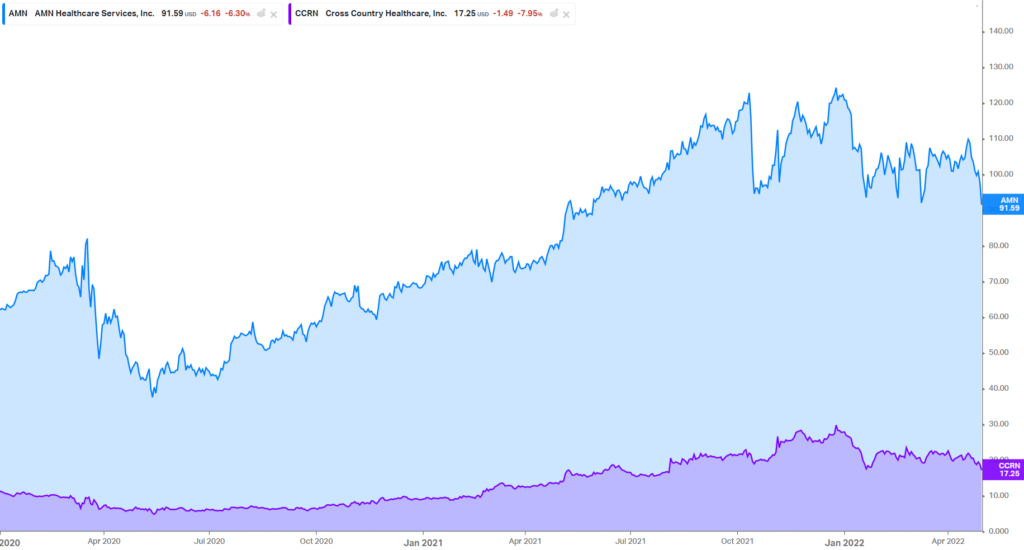

Of late, staffing agencies like AMN Healthcare and Cross Country Healthcare are selling off based on comments from hospital operators that they expect inflated travel nurse staffing agency rates to steadily come down, starting as soon as this month as these contracts get re-negotiated.

After an incredibly impressive run and elevated revenue & profits growth for both of these players, lots of folks are expecting these names to fizzle out over the next couple of years. In fact, analysts are expecting a decline in sales in 2023 and 2024 after 1.5 years of elevated staffing rates.

The thesis is simple: local nurses are taking local travel nursing contracts. Once these contracts get re-negotiated (they’re usually on a 12-13 week cycle, which means they’re re-negotiating now) and there are fewer contract opportunities, these local nurses will return to local positions – albeit at higher wage rates. Still a net positive for health systems but a BIG negative for staffing agencies. We’ll see how CCRN and AMN earnings go on 5/4 and 5/5!

M&A

Clinigence and Nutex Health complete merger

We finally have a new player to add to the Hospitalogy Health Tech & Services Index, albeit a small one. Clinigence Holdings – a primary care tech platform that enables population health, is merging with Nutex Health, an independent operator of…micro hospitals and hospital outpatient departments. The combined co, called Nutex, will trade under the ticker NUTX.

- Footprint: Nutex has a 19 facility footprint and partners with physicians, who appear to hold minority interests in the hospitals the firm operates. The thinking here is that the physician-owned micro hospitals can continue to expand their footprint and use Clinigence’s expertise to manage risk-bearing contracts

Madden’s Musing.

There’s a lot of digital health noise out there right now, and it’s hard to know who the sophisticated operators are as opposed to the ones floundering around on the ocean floor. As a result, they’re unfortunately getting valued and lumped together. Over time, the best operators will differentiate themselves. Maybe Nutex is one of those!

Resources

- Link to press release

- Link to company 10-K SEC filing

Market Movers

Big Winners: Pear Therapeutics (+8%), Augmedix (+7%), ATI Physical Therapy (+5%)

Big Losers: Accolade (-44%), Teladoc (-40%), Community Health Systems (-20%). Interesting little tidbit – as of this writing, Doximity is now valued higher than Teladoc.

SSM Health partnered with St. Louis University to form a regional integrated healthcare delivery network. That network will carry some serious weight behind it – more than 1,200 physicians and clinicians across a number of hospitals, including expanded clinical trials research and other strategic initiatives including what I imagine will result in more robust population health management.

HCA is purchasing another urgent care chain – this time, BetterMed in Richmond. BetterMed operates 12 urgent care centers throughout central Virginia and North Carolina. The announcement comes on the heels of HCA’s acquisition of Florida-based MD Now, a 59-center footprint. Between these splash plays into primary care and its acquisition of Brookdale’s home health segment, HCA continues to sprawl out its footprint.

Carbon Health acquired MedPost Urgent Care’s southern California footprint. The acquisition brings Carbon’s total managed clinics to 120, making Carbon one of the largest urgent care providers in the country and a major primary care presence. Carbon has been pretty dang active lately between urgent care acquisitions, partnering with Froedert Health in the Milwaukee area, successfully raising capital, and an interesting little relational arrangement with Hims & Hers. One of my favorite tech-enabled names to watch.

Women’s Health-focused startup Tia just notched another major health system partner under its belt. After raising about $132 million and announcing its first partnership with CommonSpirit Health, Tia announced a second partnership with UCSF Health in the Bay Area and will open at least 10 de-novo clinics in the area. Between Carbon and Tia, it goes to show that partnering with health systems is an extremely effective strategy – if you can get your foot in the door for those conversations.

- Also, don’t forget about Diana Health, a similarly-focused startup that raised $11 million in January 2022 and announced a small partnership with HCA. You just started and you have a partnership with HCA?? Sheesh.

Skylight Health announced a joint venture with Collaborative Health Systems, a subsidiary of Centene and a population health management service organization. Based on the press release, the two will co-develop a value-based care framework in large markets within Pennsylvania, Colorado, and Florida.

Accolade tanked 50% after posting Q1 earnings in what looks to be a very unforgiving market. Accolade lost its top customer – Comcast – to a competitor. To me, it points to a larger trend in digital health. VC dollars and investments are pouring in, tightening up competition across the board. I don’t envy these companies one bit right now. Shout out to Brian Dolan for the snag.

CommonSpirit’s new CEO is Wright Lassiter, former CEO of Henry Ford Health.

Teladoc got a new Chief Medical Officer – Vidya Raman-Tangella. Her tenure starts immediately for the telehealth giant and I’m sure she’ll have big ideas on how to best continue to integrate Livongo and package TDOC’s offerings. She has her work cut out for her.

ATI Physical Therapy finally found someone courageous enough to take the CEO position – Sharon Vitti. She’ll step in just 9 months after the company went public via SPAC. Over that timeframe, ATI has dropped 84%.

Other Q1 Earnings Releases:

- HCA Q1 earnings

- Tenet Q1 earnings

- UHS Q1 earnings

- CHS Q1 earnings

- Centene Q1 earnings

- Anthem Q1 earnings

- UnitedHealthcare Q1 earnings

- Humana Q1 earnings

- Molina Healthcare Q1 earnings

- Encompass Q1 earnings

- Amedisys Q1 earnings

- Mednax Q1 earnings

- Chemed Q1 earnings

- Labcorp Q1 earnings

- Medical Properties Trust Q1 earnings

- Option Health Care Q1 earnings

Madden’s Musings

- Apparently Kevin Na and Grayson Murray almost got into a fistfight on the PGA tour driving range. What a world.

- I went down a black hole on learning about black holes this week. Black holes are absolutely nuts yall. And, as luck would have it, it looks like scientists are about to make another major announcement about black holes on May 12!

- My Texas Longhorns just unveiled the design for our new basketball arena. Will we win more games? No? Will our arena look amazing? Yes.

- Jared Dashevsky, slayer of businesses, had a thought-provoking take on Levels in last week’s Huddle. Check out his Twitter thread here.

Hospitalogy Top Picks

- Buzzfeed published an article on Brightspring, a nursing home operator which had plans to go public after being purchased by PE sponsor KKR, but since ditched those plans. The article dives into purported detail on certain bad practices that the nursing group home giant neglected – reporting that KKR and Brightspring vehemently reject, I should say.

- KFF just published some new Medicare Spending Trends data.

- CVS, Walmart are delaying or not filling certain ADHD med prescriptions provided by telehealth operators. And to add to my above blurb on mental health, here’s another Cerebral whistleblower article here.

- More and more folks are thinking that the nation flips back to Republicans in 2022. Here’s a start on their healthcare plan if the nation flips back next election cycle.

- I enjoyed this summary of all the various ACO models and what’s working, what isn’t between the various initiatives. Also, the Commonwealth Fund provided a similarly great overview of all innovation models since the ACA was enacted – what worked, what didn’t and what’s working now.